2025-12-15 23:06

Judge rules USDA wrong on when compliance grace period ends States had also challenged USDA guidance on immigration-related SNAP restrictions USDA revised guidance last week Dec 15 (Reuters) - A federal judge on Monday ordered U.S. President Donald Trump's administration to extend a deadline for states to implement new immigration-related eligibility restrictions on food aid benefits, allowing them to avoid potentially severe financial penalties for failing to do so in time. U.S. District Judge Mustafa Kasubhai in Eugene, Oregon, at the behest of a group of Democratic-led states, issued an injunction requiring the U.S. Department of Agriculture to extend the expiration date of a grace period for the states to comply with the new restrictions on Supplemental Nutrition Assistance Program benefits from November 1 to April 9. Sign up here. The judge, who was appointed by Democratic President Joe Biden, said guidance USDA issued on October 31 concerning who is eligible for the SNAP benefits, or food stamps, contributed to "confusion" that impeded states' ability to implement the new restrictions. The guidance interpreted a provision in Trump's tax cuts and domestic policy law that restricts SNAP benefits to U.S. citizens and lawful permanent residents, also known as green card holders, aligning with the president's hardline immigration stance. GUIDANCE SPARKS LEGAL CHALLENGE Attorneys general from 21 states and the District of Columbia in a lawsuit filed last month had said the guidance unlawfully deemed permanent residents who were initially granted asylum or admitted as refugees to the United States as ineligible for SNAP benefits. USDA contended it never intended for its guidance to go beyond the new immigration-related eligibility restrictions set forth in the law, and a lawyer for the Justice Department on Monday said that reflected a "misunderstanding" by the states. USDA revised its guidance last week, which Kasubhai said corrected what he said had been a policy on ineligibility that was contrary to the One Big Beautiful Bill Act, which Trump signed into law in July. But USDA continued to stand firm on a related issue raised by the states, which administer the benefits on a day-to-day basis, of when a 120-day grace period for them to comply with the law's provisions was to expire, saying it ended November 1, the day after it issued the initial guidance. Kasubhai at the close of a nearly four-hour hearing agreed, saying USDA's position was unlawful, contrary to past practice, and would expose the states' budgets to irreparable harm if the grace period was not extended. "The inability to provide compliance in the time period in which they were forced to by virtue of the guidance contributed to an erosion of trust," Kasubhai said. (This story has been refiled to say Monday, not Tuesday, in paragraph 1) https://www.reuters.com/legal/government/usda-must-give-states-more-time-implement-new-food-aid-restrictions-judge-rules-2025-12-15/

2025-12-15 22:47

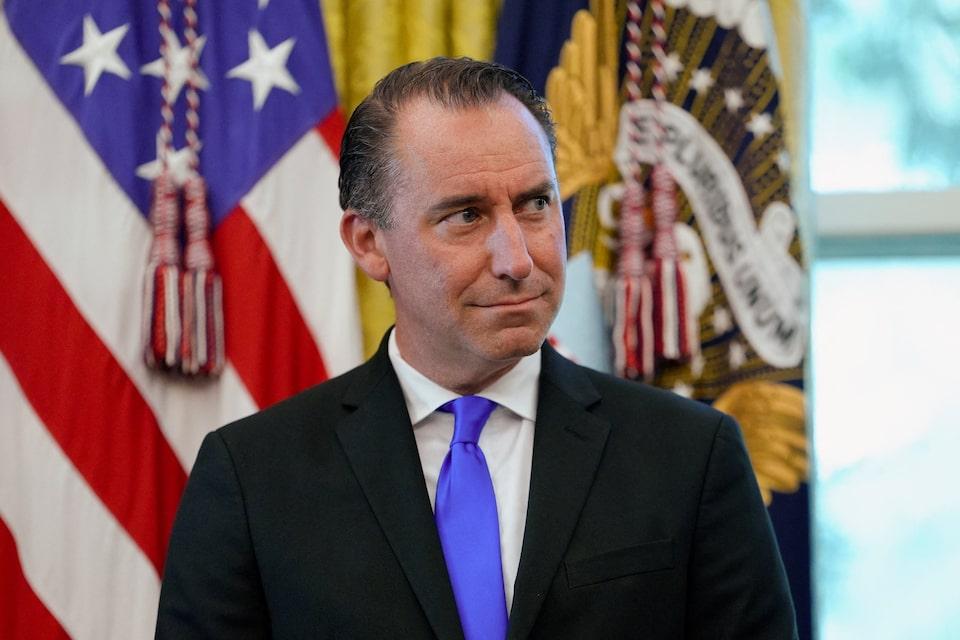

Dec 15 (Reuters) - The Trump administration plans more "historic deals" with the U.S. mining sector to boost production of critical minerals for the national defense and high-tech sectors, a senior official said on Monday. Earlier this year, the administration took equity stakes in MP Materials (MP.N) , opens new tab, Lithium Americas , opens new tab(LAC.TO) , opens new tab and Trilogy Metals (TMQ.TO) , opens new tab. The transactions were part of President Donald Trump's push to increase domestic production of lithium, rare earths and other minerals used for the national defense and rely less on China, which has used its minerals prowess as leverage in trade negotiations. Sign up here. "What we want to see is the ability for the U.S. to not be reliant on any adversary out there or any other foreign entity, that we control our own destiny when it comes to our supply chain and our critical minerals," Jarrod Agen, executive director of the White House's National Energy Dominance Council, said on Monday. "We've set a good pace so far, but this is just the first year." On Monday, Korea Zinc (010130.KS) , opens new tab said it would build the first U.S. minerals refinery in decades with Washington's financial support. "You're going to see throughout this administration historic deals when it comes to critical minerals, historic partnerships with the private sector, and then really a revitalization of mining in this country," Agen told a critical minerals conference hosted by the Center for Strategic and International Studies in Washington, D.C. The remarks were webcast. Agen, who previously held roles at defense contractor Lockheed Martin (LMT.N) , opens new tab, said Trump aims to "jumpstart" mining projects in Alaska and also in Arizona, where Rio Tinto (RIO.AX) , opens new tab and BHP (BHP.AX) , opens new tab aim to build one of the world's largest copper mines. https://www.reuters.com/world/asia-pacific/white-house-plans-more-historic-deals-with-mining-sector-official-says-2025-12-15/

2025-12-15 22:08

ORLANDO, Florida, Dec 15 (Reuters) - Caution weighed on Wall Street on Monday as investors awaited Tuesday's U.S. jobs report, while underlying selling pressure and uncertainty over who will be nominated to replace Federal Reserve Chair Jerome Powell eroded earlier gains in Treasuries. More on that below. In my chart-based column today, I look at how markets are shaping up as the last full trading week of the year gets underway. Worries over AI and long-term yields dominate the equity and bond landscape, while in FX, China's yuan goes from strength to strength. Sign up here. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Today's Talking Points * Belated U.S. payrolls release Official U.S. labor market figures for November will be released on Tuesday, later than scheduled due to the government shutdown, and coming less than a week after the Fed cut rates again but signaled it could be on hold for a while. As usual, attention will be focused on the two main numbers, but getting a clear read through the jobs market fog will not be easy. The unemployment rate continues to be distorted by unique labor demand and supply issues; and Fed Chair Jerome Powell said last week that average payrolls growth of around 40,000 a month could be overestimated by 60,000. That's to say, the economy may actually be shedding jobs outright. * China alarm bells still ringing The readout from China's latest monthly 'data dump' is pretty clear - the world's second-largest economy performed worse in November than expected, upping the ante on authorities to do more to boost domestic demand and growth. But does Beijing have the appetite? Last week's Central Economic Work Conference, a key gathering of the Communist Party to set the 2026 policy agenda, said the global environment is no longer "unfavorable" and indicated budget deficits next year will be kept at "necessary" levels, suggesting little desire for big stimulus. Economists warn more support will be needed. * Year ends with a central bank bang The final full trading week of the year will be a choppy one for FX, rates and bond traders, as five G10 central banks announce their last policy decisions of 2025 - the monetary authorities of Norway, Sweden, Britain, the euro zone and Japan. The Bank of England on Thursday and Bank of Japan on Friday could be the highlights. The BoE is set to cut rates by the narrowest of margins - a 5-4 vote, with Governor Andrew Bailey swinging the balance. The BOJ is set to raise rates, with all eyes on the signals Governor Kazuo Ueda sends for next year. Charting the last full market trading week of 2025 The final full trading week of 2025 is underway, but investors can't start winding down for the holiday season just yet, with artificial intelligence jitters and fiscal woes threatening to spoil the festive cheer. Wall Street, stung last week by gloomy warnings from tech giants Oracle (ORCL.N) , opens new tab and Broadcom (AVGO.O) , opens new tab, remains on edge about the profit-generating capabilities of AI. And even though the Federal Reserve cut interest rates last week and unveiled a program of large-scale T-bill purchases, long-term bond yields are rising and yield curves are steepening – both inside and outside the United States. Does that mean investors should give up hopes for a "Santa rally?" Below are five charts that should give investors a flavor of what this week may have in store. 1. 30-YEAR BOND YIELDS' RAPID RISE Yields on long-dated bonds around the world are popping higher. The 30-year U.S. yield last week reached 4.8670%, its highest since early September, as it broke convincingly above the 2025 average of 4.77%. Long bonds now have to contend with the prospect of having both a White House seeking to run the economy hot with loose fiscal policy and a dovish-leaning Fed. Rising long-term yields are not just a U.S. phenomenon. Japan, Britain and Australia have been in the spotlight recently too, with the 30-year German yield last week leaping to its highest point since 2011. 2. YIELD CURVES' STEEP CLIMB U.S. fiscal concerns and inflation fears – partly reflecting President Donald Trump's trade and tax policy as well as the politicization of the Fed – are resulting in steeper yield curves overall. The two-year/30-year spread is close to reaching its widest level in four years. Steeper curves are typically seen as a reflection of "normal" economic and financial conditions. But that's not the case when the back end of the bond market is getting crushed by fears that the central bank has taken its eye off the inflation ball. 3. SILVER'S SPECULATIVE SPURT If you want evidence of a year-end speculative boom, look no further than silver. It's up 30% in the last three weeks. That is remarkable enough, but what this chart from Brent Donnelly at Spectra Markets shows is even more astonishing: an ounce of silver is now worth more than a barrel of U.S. crude oil for the first time ever, apart from when the price of oil futures briefly dropped below zero in April 2020. 4. ORACLE'S BLURRED VISION In recent months, Oracle has traded more like a "meme" stock than one of the world's biggest companies. Shares rose 36% in a single day in September and last week slid 15% in two days, a magnitude of decline only seen during the pandemic, 2008 and the dot-com crises. Oracle is increasingly becoming a bellwether of investors' broader sentiment about AI – and the current signals aren't looking good. 5. YUAN'S GROWING STRENGTH The U.S. dollar has held up well in the second half of the year, with the dollar index up nearly 2% in that period. But it has been on a steady downward path against the Chinese yuan. Going into the last full week of the year, this cross rate is at a 14-month low, with the 7.00-yuan barrier in sight. Given that China's trade surplus just topped $1 trillion for the first time, pressure is mounting on Beijing to allow the yuan to rise further – much further. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/world/china/global-markets-trading-day-graphic-2025-12-15/

2025-12-15 21:43

FAA to open new aviation safety office, improve hiring and training Transportation Secretary criticizes FAA for inaction before fatal January crash NTSB chair says FAA ignored warnings about safety issues WASHINGTON, Dec 15 (Reuters) - The Federal Aviation Administration is taking action after a collision between an American Airlines (AAL.O) , opens new tab regional jet and an Army helicopter that killed 67 people in January exposed flaws in safety oversight, the agency's head will tell Congress on Tuesday. "The DCA (Reagan Washington National Airport) accident was a defining moment for the FAA and for the country. It exposed gaps, but it also galvanized action," FAA Administrator Bryan Bedford will say in written testimony seen by Reuters for a House aviation subcommittee hearing. Sign up here. Bedford said on Monday that as part of "Flight Plan 2026" the FAA would open a new aviation safety office as part of a strategic plan to improve hiring and training and to identify potential hazards after harsh criticism for failing to address near-miss incidents. "To accomplish this, we will establish a Safety Integration Office, develop safety risk heat maps, increase transparency, and improve accountability across all levels of the organization," Bedford said in a note to employees. He said the plan would create an FAA safety management system and implement an FAA-wide safety risk management process. The system "will help the FAA detect, analyze, and mitigate risk more consistently and ensure that lessons from accidents, incidents, and near misses are acted upon quickly and across the agency," Bedford will tell Congress. Bedford said the FAA would continue to maintain oversight of aerospace manufacturers, including Boeing (BA.N) , opens new tab. In October, he agreed to let Boeing hike 737 MAX production to 42 planes per month, removing a cap put in place last year after a mid-air panel blowout on an Alaska Airlines flight. The FAA also is beginning the process of moving its headquarters into a building that houses the U.S. Transportation Department. The FAA plans to establish a pilot program for aircraft certification applicants to participate in digitized certification processes. Transportation Secretary Sean Duffy harshly criticized the FAA for failing to act despite dozens of near-miss incidents before the fatal crash on January 29, just days after U.S. President Donald Trump returned to office. "We had 84 near misses in the three years before in the D.C. airspace, and no one did anything," Duffy said. "Someone was asleep at the wheel. Someone should have seen that." Lawmakers from both parties have questioned why the FAA failed to act for years to address close calls involving helicopters near Reagan airport. National Transportation Safety Board Chair Jennifer Homendy said in August the FAA had ignored warnings about serious safety issues. Bedford, who took office in July, is overseeing a $12.5 billion rehabilitation of U.S. air traffic control and Duffy wants another $19 billion to complete the job. The FAA in early May barred the Army from helicopter flights around the Pentagon after a May 1 close call that forced two civilian planes to abort landings. In April, the FAA imposed new restrictions to prevent collisions between helicopters and passenger planes around the busy Harry Reid International Airport in Las Vegas and it has expanded buffer zones at Washington, D.C.-area airports. "These assessments revealed operational patterns in several locations that needed attention, and we are diligently working to address them," Bedford will tell Congress. https://www.reuters.com/business/aerospace-defense/faa-reform-safety-efforts-2025-12-15/

2025-12-15 21:41

RIO DE JANEIRO, Dec 15 (Reuters) - A strike at Brazil's Petrobras has reached workers in refineries and offshore oil platforms, according to local union FUP, as the state-run oil firm said the mobilization has had no impact on output so far. The firm said on Monday that it has adopted contingency measures to ensure operational continuity, adding that market supply is "guaranteed". Labor talks are ongoing, Petrobras said. Sign up here. Petrobras and its workers have been in an ongoing dispute over a deficit in the retirement fund and a push for changes to the employee compensation structure, among other issues. FUP said in a statement that the strike has started with strong support from Petrobras' employees, with the oil firm having to adopt contingency measures in six refineries. Workers in 14 offshore oil platforms in Brazil's Campos basin, and two in Espirito Santo state have joined the strike, said the union. https://www.reuters.com/sustainability/sustainable-finance-reporting/brazils-petrobras-sees-no-production-impact-workers-kick-off-strike-2025-12-15/

2025-12-15 21:29

BUENOS AIRES, Dec 15 (Reuters) - Argentina's central bank announced a new monetary framework on Monday, tying the peso's trading band to inflation in a bid to build reserves and stabilize the economy. The measures, effective January 1, are part of a broader program designed to move away from temporary exchange controls toward a more permanent system that can support a budding economic recovery. Sign up here. The bank said the floor and ceiling of the currency band will now be adjusted monthly according to the latest official inflation data. This replaces the previous system of a pre-set 1% monthly shift, a figure that lagged November's inflation rate of 2.5%. A primary goal is to accumulate foreign currency reserves, which the bank said are urgently needed to underpin growth. It aims to purchase up to $10 billion, with a potential overall reserve accumulation of $17 billion, depending on balance of payments flows. The central bank said it intends to expand the monetary base to 4.8% of gross domestic product by the end of 2026 from its current 4.2%, aligning the money supply with an expected recovery in demand for the local currency. The move aligns with recent guidance from the International Monetary Fund, which earlier this month urged Argentina to strengthen reserve accumulation to regain access to international capital markets. IMF spokesperson Julie Kozack on Monday said on X she welcomed the recent market access and steps to strengthen the monetary and FX framework, rebuild reserve buffers, and advance growth-enhancing reforms in Argentina. Financial markets reacted calmly to the changes. The peso firmed up 0.17% to 1,438.5 per U.S. dollar, while the S&P Merval stock index (.MERV) , opens new tab rose 1.13%. Sovereign bond prices also ticked higher, led by dollar-linked issues. The policy shift comes as the country's economy shows signs of a turnaround. GDP is forecast to grow 3.5% year-on-year in the third quarter of 2025, a sharp reversal from the 1.9% contraction recorded a year earlier. https://www.reuters.com/world/americas/argentina-tie-peso-band-inflation-exchange-rate-overhaul-2025-12-15/