2025-12-13 05:17

SpaceX to buy $2.56 billion worth of shares at $421 apiece Company preparing for a possible IPO in 2026, CFO says IPO would be one of the largest global listings Dec 13 (Reuters) - SpaceX is preparing to go public next year and has opened a secondary share sale that would value the company at $800 billion, according to a letter to shareholders sent by the company's CFO Bret Johnsen and reviewed by Reuters. The Elon Musk-led company's move towards a public listing, which could rank among the largest global initial public offerings, has been largely driven by the rapid expansion of SpaceX's Starlink satellite internet business, including plans for direct-to-mobile service and progress in its Starship rocket program for missions to the moon and Mars. Sign up here. In the letter dated December 12, Johnsen said SpaceX has approved an arrangement where new and existing investors and the company will buy up to $2.56 billion of shares from eligible shareholders at $421 a share. "We are preparing the company for a possible IPO in 2026. Whether it actually happens, when it happens, and at what valuation are still highly uncertain, but the thinking is that if we execute brilliantly and the markets cooperate, a public offering could raise a significant amount of capital," Johnsen said. SpaceX aims to use the capital to ramp Starship's flight rate, deploy artificial intelligence (AI) data centers in space, build Moonbase Alpha and send uncrewed and crewed missions to Mars, Johnsen said. SpaceX did not immediately respond to a request for comment. Bloomberg News and The New York Times reported the share sale on Friday. Musk hinted at a possible SpaceX IPO in a post on social media platform X earlier this week. Reuters reported on Tuesday, citing a source familiar with the matter, the rocket and satellite company is looking to raise over $25 billion in an IPO that could come as early as June. Investors have welcomed reports that SpaceX was mulling a potential IPO that would fund Musk's Mars ambitions and value the rocket and satellite company at more than $1 trillion. SpaceX ranks as the world's second-most valuable private startup after ChatGPT maker OpenAI, according to data from Crunchbase. Talks over a listing plan are unfolding against the backdrop of a resurgence in the IPO market in 2025 after a three-year dry spell. https://www.reuters.com/business/spacex-sets-800-billion-valuation-bloomberg-news-reports-2025-12-13/

2025-12-13 03:16

New York must address immigrant truck driver concerns in 30 days or lose funding New York DMV denies non-compliance, calls Duffy's actions a stunt Similar funding threats made to Minnesota, Chicago, and California WASHINGTON, Dec 12 (Reuters) - The U.S. Transportation Department on Friday threatened to pull $73 million in funding from New York state over commercial driver licenses improperly issued to non-U.S. citizens, the latest in a series of Trump administration threats aimed at Democratic-run states. The department said New York must take actions to address concerns about immigrant truck drivers within 30 days or possibly lose federal highway funding after a federal audit. Sign up here. The agency in September issued an emergency regulation to drastically restrict commercial driver licenses to immigrants or non-U.S. citizens after a fatal crash in Florida and a government audit. In August, U.S. Secretary of State Marco Rubio said the U.S. was immediately pausing the issuance of all worker visas for commercial truck drivers. "If we're going to have drivers on American roadways, they need to be the best trained, the best skilled, because if operated incorrectly or inappropriately these are lethal weapons on American roadways," Transportation Secretary Sean Duffy said on Friday. The New York State Department of Motor Vehicles rejected Duffy's contention, saying New York will continue to comply with federal rules, adding every license "is subject to verification of an applicant's lawful status through federally-issued documents reviewed in accordance with federal regulations. This is just another stunt from Secretary Duffy, and it does nothing to keep our roads safer." On December 1, Duffy's department said it could withhold up to $30.4 million in federal highway funding from Minnesota over commercial driver licenses issued improperly to non-U.S. residents. Separately, the Transportation Department removed nearly 3,000 commercial drivers license training providers from a government registry for failing to properly equip trainees earlier this month and said that another 4,000 were on notice for potential noncompliance. On Tuesday, the department threatened to withhold transit funding for Chicago trains and buses, and demanded more police protection, citing an incident in which a 26-year-old woman passenger was attacked and set on fire last month. The department previously sent similar letters over concerns about transit issues in New York City and Boston. Chicago, like the other two cities, is heavily Democratic. President Donald Trump has regularly threatened funding for large cities run by Democrats, including for major infrastructure projects in Chicago and New York. In October, the U.S. Transportation Department threatened to pull $160 million in federal funds from California over the issue. In November, California agreed to revoke 17,000 commercial driver licenses held by foreigners that the government said were improperly issued, the department said. The department in October separately withheld $40.6 million in federal transportation funding from California for failing to comply with truck driver English proficiency rules. It said in 2023 that about 16% of U.S. truck drivers were born outside the country. Late on Friday, California sued the Trump administration to return at least $33 million, saying the federal government made an "arbitrary" decision to withhold that funding. The state is seeking a court order to rescind all actions terminating the funding and preventing the Transportation Department from redistributing the grants. It was unclear what accounted for the discrepancy between the $40.6 million and the $33 million figure cited by California's lawsuit. https://www.reuters.com/world/us/us-threatens-new-york-funding-over-truck-driver-licenses-issued-immigrants-2025-12-12/

2025-12-13 02:43

WASHINGTON, Dec 12 (Reuters) - The U.S. government carried out its seizure of the M/T Skipper off the coast of Venezuela on Wednesday just as a judge-signed warrant was set to expire, according to the document which was unsealed on Friday. The warrant, which was signed by U.S. Magistrate Judge Zia Faruqui on November 26, gave the Trump administration until December 10, 2025 to seize the vessel. The seizure is the first of a Venezuelan oil cargo amid U.S. sanctions that have been in force since 2019. Sign up here. The Skipper left Venezuela's main oil port of Jose between December 4 and 5 after loading some 1.8 million barrels of Venezuela's Merey heavy crude. The Trump administration has said the M/T Skipper was used to transport sanctioned oil from Venezuela and Iran. "The seizure of this vessel highlights our successful efforts to impose costs on the governments of Venezuela and Iran," FBI Director Kash Patel said in a statement on Friday. Sources have told Reuters that the U.S. is preparing to intercept more ships transporting Venezuelan oil. Despite the unsealing of the warrant, the accompanying affidavit remained redacted. Faruqui said other documents in the case will remain under seal temporarily. This week's seizure, which was condemned by the Venezuelan government, of the vessel was the latest escalation in growing tensions between Washington and Caracas. In recent months, the U.S. had carried out several strikes against suspected drug vessels in the region - a move which has been condemned by U.S. lawmakers and legal experts. President Donald Trump has repeatedly floated the possibility of a U.S. military intervention in Venezuela as the U.S. continues to build up its military forces in and around the Southern Caribbean. https://www.reuters.com/business/energy/us-seized-tanker-near-venezuela-just-warrant-was-set-expire-court-document-shows-2025-12-13/

2025-12-13 02:00

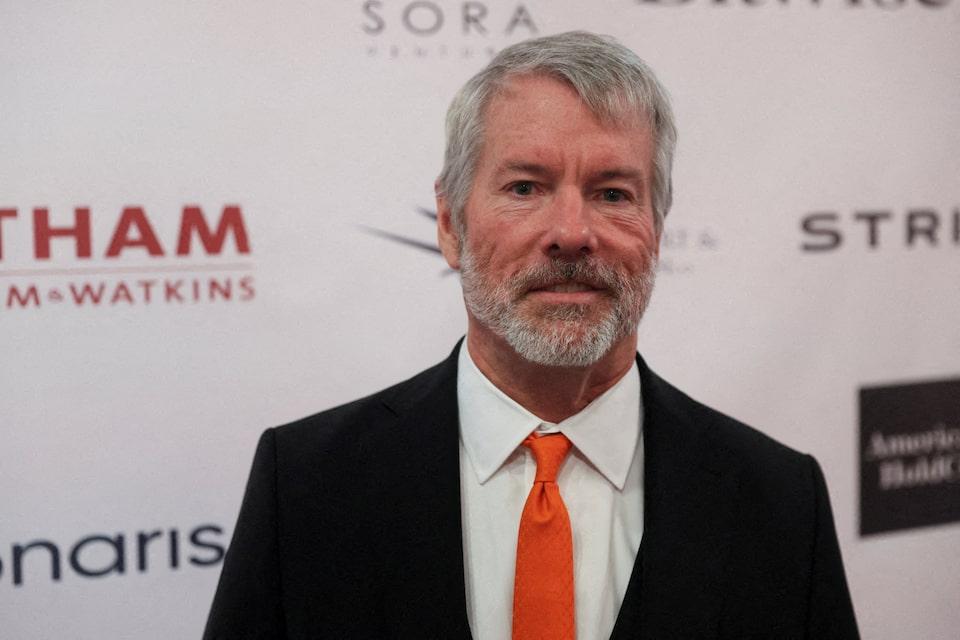

Dec 12 (Reuters) - Bitcoin hoarding giant Strategy (MSTR.O) , opens new tab clung to its place in the Nasdaq 100 (.NDX) , opens new tab on Friday, continuing its year-long stint in the benchmark at a time where analysts have raised questions over its business model. Some market watchers have suggested Strategy's pioneering business model of buying-and-holding bitcoin, which has spawned dozens of copycats, more closely resembles that of an investment fund. Sign up here. Concerns have grown over the sustainability of crypto treasury companies, whose shares have proved extremely sensitive to bitcoin's gyrations. Nasdaq said Biogen (BIIB.O) , opens new tab, CDW Corporation (CDW.O) , opens new tab, Globalfoundries (GFS.O) , opens new tab, Lululemon Athletica (LULU.O) , opens new tab, On Semiconductor (ON.O) , opens new tab and Trade Desk (TTD.O) , opens new tab were removed from the tech-heavy exchange's benchmark index. New entrants included Alnylam Pharmaceuticals (ALNY.O) , opens new tab, Ferrovial (FERF.AS) , opens new tab, Insmed (INSM.O) , opens new tab, Monolithic Power Systems (MPWR.O) , opens new tab, Seagate Technology (STX.O) , opens new tab and Western Digital (WDC.O) , opens new tab. Strategy started out as software company, MicroStrategy, but pivoted to bitcoin investing in 2020. It was included in the Nasdaq 100 last December under the index's technology sub-category. Global index provider MSCI (MSCI.N) , opens new tab has also raised concerns about the presence of digital-asset treasury companies in its benchmarks. MSCI is due to decide in January whether to exclude Strategy and similar companies. The Nasdaq changes are expected to take effect on December 22. The Nasdaq 100 index tracks the largest non-financial companies by market capitalization listed on the exchange. https://www.reuters.com/sustainability/climate-energy/bitcoin-hoarder-company-strategy-remains-nasdaq-100-2025-12-13/

2025-12-12 23:56

Indexes fall: Dow 0.51%, S&P 500 1.07%, Nasdaq 1.69% Nasdaq marks lowest close since Nov 25 Broadcom falls 11% as margin pressures add to AI payoff jitters Lululemon climbs 9.6% after CEO exit, profit forecast boost Investors look ahead to jobs and inflation data Dec 12 (Reuters) - The S&P 500 and the Nasdaq closed down more than 1% on Friday with investors leaving technology for other sectors as Broadcom and Oracle fueled concerns about an AI bubble and rising U.S. Treasury yields added pressure after some policymakers spoke out against easing monetary policy. Treasury yields rose after a group of Federal Reserve officials who voted against the central bank's interest rate cut this week voiced worries that inflation remains too high to warrant lower borrowing costs. Sign up here. Broadcom (AVGO.O) , opens new tab shares tumbled 11.4% after the chipmaker warned of slimmer future margins, causing renewed concerns about the profitability of surging AI investments. Oracle (ORCL.N) , opens new tab fell 4.5% on top of Thursday's almost 11% plunge following the cloud software company's weak financial forecast. Oracle shares were under pressure on Friday even after it denied a Bloomberg report that its data centers for ChatGPT maker OpenAI were being delayed. It didn't help that the S&P 500 and the Dow had notched record closing highs on Thursday and that investors were looking ahead to important labor market and inflation data due out in the week ahead, according to Anthony Saglimbene, chief market strategist at Ameriprise. "It's not surprising that the market's selling off today after a pretty solid couple weeks," said Saglimbene, adding that following record closes, and with "some disruption in the AI theme right now, investors today are looking at some of the more defensive sectors." The Labor Department's reports on nonfarm payrolls, consumer inflation and retail sales data are due next week and may offer greater insight into the economy's health after the October government shutdown starved investors and policymakers of official data releases. "The market is probably a little bit cautious on heading into those big numbers next week," said the strategist. The Nasdaq Composite (.IXIC) , opens new tab lost 398.69 points, or 1.69%, to 23,195.17 while the S&P 500 (.SPX) , opens new tab lost 73.59 points, or 1.07%, to 6,827.41. For the week, the S&P 500 fell 0.63% while the Nasdaq declined 1.62%. The Dow Jones Industrial Average (.DJI) , opens new tab fell 245.96 points, or 0.51% on the day to 48,458.05 but managed to show a weekly gain of 1.05%. Broadcom was the biggest drag on the S&P 500 on the day and heavyweight AI chip leader Nvidia (NVDA.O) , opens new tab, down 3.3%, was the next biggest weight. In sympathy, every stock in the Philadelphia semiconductor index (.SOX) , opens new tab lost ground with the index sinking 5.1%, for its weakest session since October 10. Other companies that have benefited from AI bets but went into reverse on Friday included SanDisk (SNDK.O) , opens new tab, which fell 14.7% and was the S&P 500's biggest percentage decliner. Investors also fled AI infrastructure companies with CoreWeave off 10.1% and Oklo (OKLO.N) , opens new tab, losing 15.1%. Six of the 11 S&P 500 industry sectors closed lower, led by heavyweight tech stocks (.SPLRCT) , opens new tab, which dropped 2.9% for its deepest daily loss since October 10. Defensive consumer staples (.SPLRCS) , opens new tab led the advancers with a 0.9% gain. Also on the bright side, Lululemon Athletica shares rallied 9.6% after the apparel maker raised its annual profit forecast and said that CEO Calvin McDonald was leaving the company. But Costco Wholesale shares ended the day virtually unchanged even after it beat Wall Street estimates for first-quarter revenue and profit as consumers snapped up affordable essentials and nice-to-have items at its stores ahead of the crucial holiday season. Declining issues outnumbered advancers by a 2.23-to-1 ratio on the NYSE. On the Nasdaq, 1,419 stocks rose and 3,315 fell as declining issues outnumbered advancers by a 2.34-to-1 ratio. The S&P 500 posted 32 new 52-week highs and 5 new lows while the Nasdaq Composite recorded 136 new highs and 98 new lows. On U.S. exchanges, 18.08 billion shares changed hands compared with the 17.25 billion average for the last 20 sessions. https://www.reuters.com/business/nasdaq-sp-500-futures-slip-broadcom-outlook-reignites-ai-bubble-fears-2025-12-12/

2025-12-12 23:40

Trump wants new jets before term ends in January 2029 Air Force tasked with upgrading Qatar's gifted 747 for presidential use Air Force One program four years behind schedule with 2028 delivery Dec 12 (Reuters) - The U.S. Air Force said on Friday the delivery of the first of two new Air Force One jets from Boeing (BA.N) , opens new tab has been delayed by another year to mid-2028, the latest in a series of delays. The latest delay risks further upsetting President Donald Trump who said he wants to fly in the new planes before the end of his term in January 2029. Sign up here. The cost for Boeing's current effort to build the two new jets is over $5 billion. The current Air Force One airplanes entered service in 1990. The Air Force One program, which involves converting two 747-8 aircraft into specialized jets equipped with advanced communications and defense systems to serve as the next generation of U.S. presidential air transport, would be four years behind schedule with a 2028 delivery. Boeing said in a statement it is making progress on the program. "Our focus is on delivering two exceptional Air Force One airplanes for the country." Boeing in 2018 received a $3.9 billion contract to build the two planes for use as Air Force One, though costs have since risen. Boeing has posted $2.4 billion in charges against earnings from the project. In May, the United States accepted a luxury Boeing 747 jetliner as a gift from Qatar. The White House asked the Air Force to rapidly upgrade the gift for use as Air Force One. The government tapped defense contractor L3Harris Technologies (LHX.N) , opens new tab to overhaul the 747 from Qatar. Trump expressed his displeasure with Boeing over the delays earlier this year but ruled out European rival Airbus (AIR.PA) , opens new tab as an alternative. Around the same time, Boeing CEO Kelly Ortberg said Elon Musk, who serves as an adviser to Trump, was "helping us a lot" in navigating delivery of the presidential jet. In June, Boeing hired a former Northrop Grumman (NOC.N) , opens new tab executive, Steve Sullivan, to lead the Air Force One program, according to two people briefed on the matter. Sullivan, who previously worked on key Northrop programs including the B-21 bomber, replaced Gregg Coffey, who moved to another role at the U.S. planemaker. https://www.reuters.com/business/autos-transportation/us-delays-new-air-force-one-delivery-date-until-mid-2028-bloomberg-news-reports-2025-12-12/