2025-11-21 07:16

LONDON, Nov 21 (Reuters) - Britain's borrowing in the first seven months of the financial year was the highest on record except during the COVID pandemic, according to data published ahead of finance minister Rachel Reeves budget next week which is expected to raise taxes. Government borrowing between April and October totalled 116.8 billion pounds ($152.90 billion), about 10 billion pounds more than forecast by Britain's budget watchdog earlier this year. Sign up here. It was the highest borrowing since the same period in 2020, during the height of the coronavirus pandemic, the ONS said. In October alone, the government borrowed a bigger than expected 17.4 billion pounds. The government's forecasters at the Office for Budget Responsibility had pencilled in an overshoot of 14.4 billion pounds for October. A Reuters poll of economists showed a median forecast of a 15 billion-pound deficit. The ONS said it had revised down government borrowing in the first six months of the financial year by a relatively small 400 million pounds. ($1 = 0.7639 pounds) https://www.reuters.com/world/uk/uk-borrows-higher-than-expected-174-billion-pounds-october-ons-says-2025-11-21/

2025-11-21 07:15

BANGKOK, Nov 21 (Reuters) - Thailand's economic stability is underpinned by strong financial and fiscal fundamentals, and government stimulus measures will give growth a boost in the final quarter of 2025, the finance minister said on Friday. Inflation and unemployment were both under 1%, Ekniti Nitithanprapas told a business forum, and public debt at 64% of gross domestic product was not high and would be kept below a legislated ceiling of 70%. Sign up here. Further, banks have capital reserve levels higher than minimum requirements, and the country's international reserves are three times larger than short-term external debt, he said. "I believe the economy will recover in the fourth quarter," Ekniti said. Economic growth was just 1.2% on an annual basis in the third quarter, the weakest pace in four years. Southeast Asia's second-largest economy, which has lagged peers since the pandemic, has faced multiple headwinds this year, including U.S. tariffs, high household debt, and a strong baht . TRADE TALKS ONGOING In a bid to stimulate the economy, the government has rolled out a 44 billion baht ($1.36 billion) consumer subsidy scheme, among other measures. Ekniti said that next week the government will offer a new package to support smaller businesses and consider steps to fast-track major investment projects, aimed at boosting investments by 200 billion baht to 300 billion baht in 2026. Commerce Minister Suphajee Suthumpun said the government was trying to increase trade competitiveness as Thai export growth is expected to slow in 2026. "We still have the issue of the strong baht. If it cannot be addressed or if it remains significantly strong, it will certainly impact exports," she told the forum. The baht has strengthened by 5.6% against the U.S. dollar so far this year, making it Asia's second-best-performing currency after Malaysia's ringgit. Suphajee said negotiations on a trade deal with the U.S. were ongoing, with Thailand working on what products it wanted to be exempted from tariffs that Washington has imposed. She said exporters needed to be aware of U.S. concerns about transshipment, where a third country routes exports through Thailand to avoid tariffs. "The world is shifting, and more investors are looking to invest in Thailand. But they need to increase their use of local content," she said. ($1 = 32.4500 baht) https://www.reuters.com/world/asia-pacific/finance-minister-says-thai-economy-is-stable-sees-q4-growth-picking-up-2025-11-21/

2025-11-21 07:12

SYDNEY, Nov 21 (Reuters) - Binance Chief Executive Richard Teng said on Friday bitcoin's sharp drop in the past month was the result of investors deleveraging cryptocurrency holdings and risk aversion in line with that seen in most major asset classes. Bitcoin, the world's most valuable cryptocurrency, has fallen 21.2% in November, raising losses over the past three months to 23.2% as chances increase that it will end the year below $90,000. Sign up here. The fall comes after bitcoin hit an all-time peak above $126,000 in early October. "As with any asset class, there are always different cycles and volatility. What you're seeing is not only happening to crypto prices," Teng said at a media roundtable in Sydney on Friday. "At this point in time, there's a bit of risk (off) and deleveraging happening as well." Global markets sold off this week, with investors rattled by an AI-led valuation bubble and the possibility that it could burst. So far, better-than-expected earnings from Nvidia Corp (NVDA.O) , opens new tab have failed to quell those worries. Teng said despite the decline, bitcoin is trading at more than double its level in 2024, when institutions like BlackRock began launching crypto investments and products. "Over the past 1.5 years, the crypto sector has performed very, very well, so it's not unexpected that people do take profit," Teng said. "Any consolidation is actually healthy for the industry, for the industry to take a breather, find its feet." Teng declined to comment on whether Binance founder Changpeng Zhao would return to the exchange after he was pardoned by U.S. President Donald Trump in October. Zhao, a citizen of Canada who was born in China, paid a $50 million fine and served nearly four months in prison last year after pleading guilty to violating U.S. money laundering laws. Zhao was replaced by Teng in 2023 as chief executive. https://www.reuters.com/world/asia-pacific/binance-ceo-teng-says-bitcoin-volatility-line-with-most-asset-classes-2025-11-21/

2025-11-21 07:02

Investor hedging of dollar exposure has slowed, traders say Development supports case for dollar recovery BNY client data shows dollar hedging levels above average but far from extreme LONDON, Nov 21 (Reuters) - Just months after a U.S. tariff shock whacked the dollar, a rush by overseas investors to protect U.S. holdings from the sliding currency has slowed sharply - a vote of confidence that's helping the greenback recover from its worst rout in years. While analysts say investor hedging is higher than it has been historically, such activity has slowed from the period immediately after the April 2 "Liberation Day", when U.S. President Donald Trump announced sweeping trade tariffs. Sign up here. At that time, foreign investors holding U.S. assets were hit by tumbling stock and bond prices and a plummeting dollar. Nimble investors moved to hedge against a further dollar decline and the trend was expected to gain momentum. Instead, it has slowed, allowing the U.S. currency to stabilise. "The conversations we're having with clients now suggest that these (hedging) flows are less likely to come as imminently as the conversations we had back in May suggested they would," said David Leigh, Nomura's global head of FX and emerging markets. The dollar index , which tracks the greenback against other major currencies, has rallied nearly 4% since the end of June, when it was nursing losses of almost 11% after its biggest first-half dive since the early 1970s. Data on hedging is limited and analysts extrapolate from scarce public figures and numbers compiled by banks and custodians. Analysis of client positioning by BNY, one of the world's largest custodians, shows they were very long U.S. assets in early 2025, suggesting they didn't anticipate much additional dollar weakness and were happy to operate without much hedging. That changed in April and hedging is now higher than normal, although lower than in late 2023 when markets began to anticipate Federal Reserve rate cuts. "The dollar diversification story this year is more talked about than actioned upon," said Geoff Yu, BNY's senior market strategist. It varies by market too. A November National Australia Bank survey of Australian pension funds found "no material change in hedging behaviour towards U.S. equities". Danish central bank data, however, shows hedging by pension funds there has stabilised after increasing post-April. Columbia Threadneedle CIO William Davies said that the firm initially moved to protect its U.S. stock holdings against further dollar weakness but has since unwound some of its hedges, betting the currency won't decline further. NO SNOWBALL EFFECT Hedging itself causes currencies to move - adding protection against dollar downside to a previously unhedged position effectively involves selling the greenback, and vice versa. If combined with shifting interest rates, the effect can be dramatic - a dollar selloff can spark more hedging, sending it lower still. "People, earlier this year, were getting excited that this snowball effect would develop, though in the end it didn't really," said HSBC's Paul Mackel, global head of FX research. For next year, "it's something to keep an eye on, but it's not our baseline scenario". Still investor behaviour may be shifting. BlackRock estimates that 38% of flows into Europe, Middle East and Africa-listed U.S. equity exchange-traded products this year have been into those with FX hedges, a meaningful change from 2024 when 98% of flows were unhedged. COST, CORRELATIONS AND COMPLICATIONS Cost is also a factor, and depends on rate differentials and so varies by market. This may help explain some of the reluctance to hedge positions. Japanese investors pay around an annualised 3.7% to hedge against dollar weakness, estimates Van Luu, Russell Investments' global head of solutions strategy for fixed income and FX. This is a sizeable sum - if dollar/yen holds steady for a year, an investor is down 3.7% versus an unhedged peer. The equivalent cost for a euro-funded investor is around 2%. "I have a rule of thumb for euro investors, if the cost is around 1% they don't care much, but if it's 2% then it becomes a factor," Luu said. Asset correlations matter too. Traditionally the dollar strengthens when stocks fall, meaning overseas investors are effectively protected on their U.S. positions. That did not happen in April, contributing to the hedging rush. This month, the dollar held steady as stocks tumbled again. Change is also complicated for the many investors who aim to outperform a fixed benchmark if that benchmark is unhedged. Fidelity International recommends Europe-based investors move gradually towards hedging 50% of their dollar exposure, but Salman Ahmed, head of macro and strategic asset allocation, notes it is a "very involved" process which can require governance and benchmark changes. If interest rates move against the dollar and it starts to weaken again, and hedges become cheaper, pressure for change may build. "There's still lots of scope for dollar investments to be hedged, whether that comes to pass and how quickly is an open question," said Nomura's Leigh. "That's what the FX market's trying to get its head around." https://www.reuters.com/markets/wealth/much-anticipated-dollar-hedging-rush-slows-now-2025-11-21/

2025-11-21 06:50

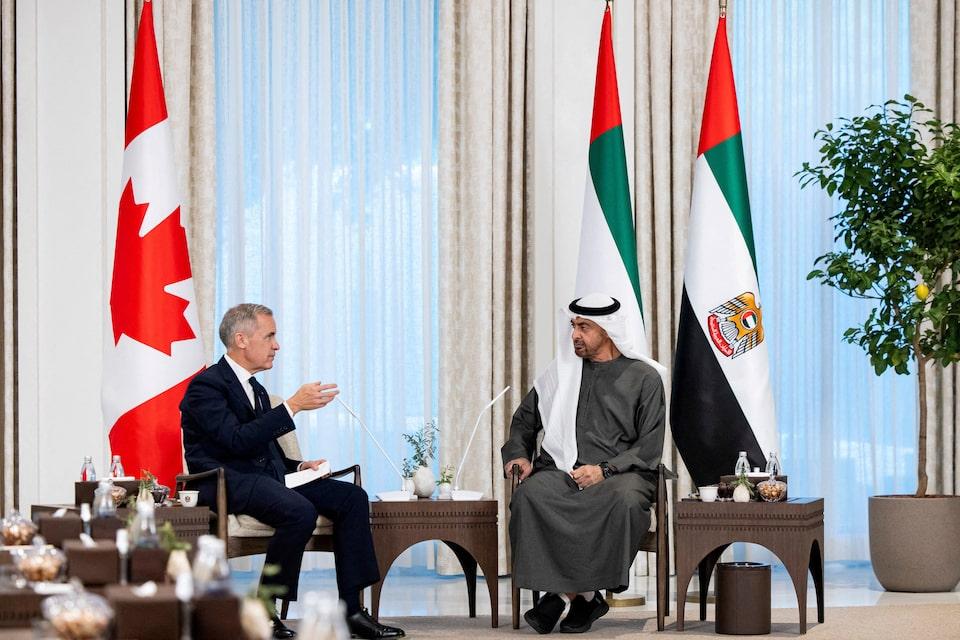

DUBAI, Nov 21 (Reuters) - The United Arab Emirates said on Friday it will invest up to $50 billion in Canada under a framework that includes projects in artificial intelligence, energy, and mining sectors. The UAE has been looking to expand its energy investments abroad, especially through its recently launched firm XRG, the foreign investment arm of Abu Dhabi's oil major, ADNOC. Sign up here. Abu Dhabi is also investing heavily in AI, with plans to build one of the world's largest data center hubs in the country with U.S. technology. Emirati state-linked tech firm, G42, is driving the development of its AI industry. The signing of the framework came at the sidelines of a visit by Canada's Prime Minister Mark Carney to Abu Dhabi, the UAE investment ministry said in a statement. https://www.reuters.com/business/energy/uae-invest-up-50-billion-canada-industries-such-ai-energy-2025-11-21/

2025-11-21 06:49

Fed's William says central bank could cut rates in near term Traders see 74% chance of US interest rate cut in December Wall Street's main indexes gain Nov 21 (Reuters) - Gold prices held steady on Friday, after falling over 1% earlier in the session, as traders boosted bets on a December U.S. interest rate cut following dovish U.S. Federal Reserve comments. Spot gold was steady at $4,086.57 per ounce, as of 01:48 p.m. ET (18:48 GMT), after falling more than 1% earlier in the session. Bullion is set for a weekly gain of 0.1% so far. Sign up here. U.S. gold futures for December delivery settled 0.5% higher at $4,079.5 per ounce. New York Fed President John Williams on Friday said the U.S. central bank could still trim interest rates in the near term, without jeopardizing its inflation goal. The comments "are certainly supportive ... it did give the gold market bulls some friendly fodder early today," said Jim Wyckoff, senior analyst at Kitco Metals. Traders now see a 74% chance of a rate cut at the Fed's next meeting, compared to 40% earlier in the day. The delayed jobs report showed a mixed labor market picture, with nonfarm payrolls rising by 119,000 in October, well above forecasts for a 50,000 gain, while the unemployment rate climbed to a four-year high. Gold, a non-yielding asset, tends to do well in low-interest-rate environments. Meanwhile, other Fed members maintained a hawkish stance, with Dallas Federal Reserve President Lorie Logan calling for leaving the policy rate on hold "for a time." Traders are also keeping a close eye on U.S. stock markets as "if the stock market rallies stronger today, that's probably going to put downside pressure on gold because of the keener risk appetite in the marketplace," Wyckoff added. Wall Street's main indexes gained as traders boosted bets on an interest rate cut by the Fed next month following remarks from policymakers. Meanwhile, physical gold demand across major Asian markets remained weak this week, as volatility in rates deterred potential buyers from making purchases. Elsewhere, spot silver fell 0.4% to $50.39 per ounce, platinum rose 0.1% to $1,512.67, and palladium edged 0.2% up to $1,380. https://www.reuters.com/world/india/gold-subdued-strong-us-jobs-data-dents-rate-cut-hopes-2025-11-21/