2025-11-20 12:59

Shifts production from Laos to Vietnam to limit tariff impact Plans price hikes in US from January to help offset tariffs H1 revenue misses consensus expectations Shares fall as much as 11% Nov 20 (Reuters) - British boot brand Dr Martens (DOCS.L) , opens new tab warned on Thursday its full-year results would be hit by U.S. import tariffs, sending its shares down as much as 11% despite assurances that it would absorb the costs fully from the year after. The company, known for its chunky lace-up boots, said it expected to manage around half of its tariff-related costs - expected to be in the high-single-digit millions of pounds - in the year ending March 2026. Sign up here. It plans to hike prices in the U.S. from January, and has shifted production from Laos, which is subject to a higher U.S. import tariff, to Vietnam, saying it expects to offset all tariff-related costs from fiscal 2027 onwards. "Where we see that a product has room to take a bit of price (increase) and still be competitive, we would do that," CEO Ije Nwokorie said in an interview. The impact of the production shift will only be felt in the spring and summer next year, the company said, as products now in stores were brought in before U.S. tariffs on Vietnam and Laos changed. "Consumers everywhere are cautious at the moment so they’re doing two things: looking for a deal, many of them ... but importantly they’re being much more considered, there is a flight to quality and a trading down from luxury," Nwokorie added, saying Dr Martens' $320 'Weekender' leather bag was selling well. As many consumers spend less on non-essential items, brands are trying to target wealthier shoppers. Levi's, for example, is expanding its $300 jean range to more stores. Dr Martens shares were down more than 10% to 73.4 pence at 1250 GMT as RBC analysts said first-half revenue of 322 million pounds missed consensus estimates, and Peel Hunt analysts cut their full-year profit forecast for the company. Dr Martens has been pulling back on discounts and expanding into shoes, sandals, and bags as it aims to return to profit growth this financial year. The company, which makes most of its sales in autumn and winter, reported an adjusted pretax loss of 9.2 million pounds for the six months to September 28, versus a 16.6 million pound loss a year earlier. Dr Martens in 2019 shifted its supply chain away from China, which previously accounted for 50% of its production, and now sources shoes from Vietnam, Laos, Thailand, Pakistan, and the UK. ($1 = 0.7657 pounds) https://www.reuters.com/business/bootmaker-dr-martens-trims-first-half-loss-americas-sales-rise-2025-11-20/

2025-11-20 12:54

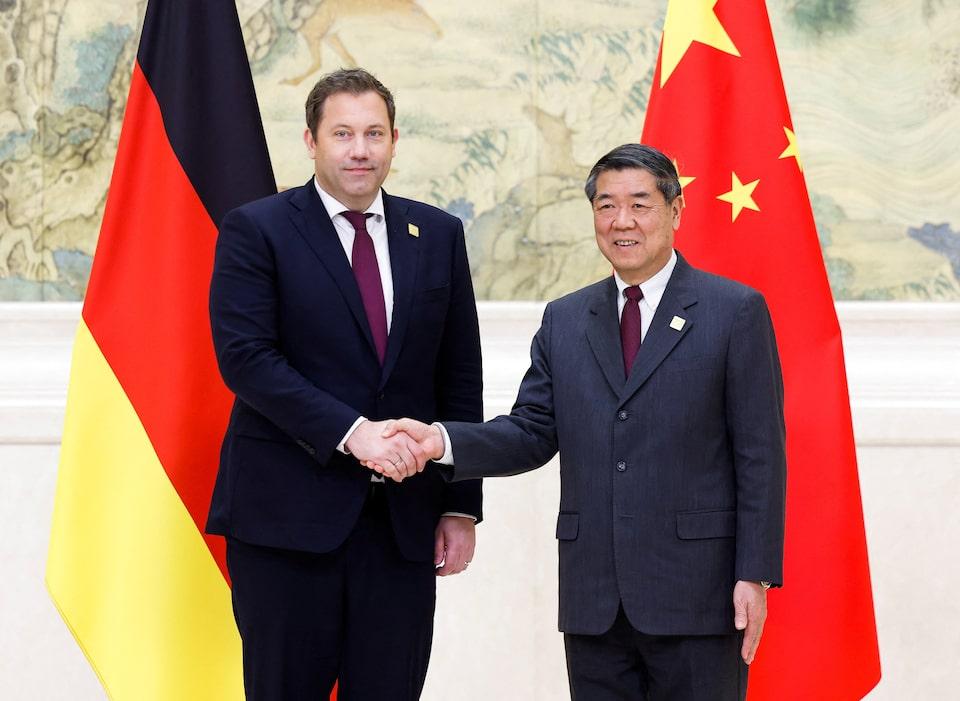

Germany rethinks relationship with China EU to unveil economic security doctrine Spain's China policy could put EU unity at risk BEIJING/BRUSSELS, Nov 20 (Reuters) - The European Union will set out next month how it will square up to increased geopolitical challenges from Beijing and others amid signs its largest member Germany, once a brake on tougher measures against China, is having a rethink. In an economic security doctrine to be unveiled on Dec. 3, the European Commission will review its trade defence arsenal and decide if it must do more to deal with threats including China's squeeze on rare earths and a combative United States. Sign up here. China will be the central policy focus, as concerns rise about Europe's reliance on it for critical minerals to drive the green and digital transitions and unfair competition for European companies from subsidised Chinese imports. Unity will be needed to drive through policy changes that seal and deepen ties with like-minded trading partners or trigger retaliation - something the 27-nation bloc struggled to achieve in response to U.S. tariffs. Significantly, there are signs that Germany, the EU's largest member and economy, is coming into line regarding China. A year ago, Berlin was an opponent of tariffs on Chinese-built electric vehicles. Last week, it established a committee of experts to advise parliament on "security-relevant trade relations" with China, reactivating a "de-risking" push. Chancellor Friedrich Merz said this month Germany will not allow components from Chinese companies in its future 6G mobile network. He also broke with decades of German free-trade dogma to call for protection for Europe's steel industry. Visiting China this week, Finance Minister Lars Klingbeil raised concerns over Chinese export curbs on rare earths and industrial overcapacities. "We have learned from dependencies such as those that arose with Russian energy supplies and we are making ourselves stronger in Germany and Europe," Klingbeil said he told China. "I am in favour of free and open markets. But I do not want us to end up being the losers in Europe and Germany," Klingbeil told Reuters in Shanghai. At a press event with Klingbeil, Chinese Vice Premier He Lifeng said Beijing was committed to joint cooperation and working to "foster a fair, equitable and non-discriminatory business environment". GERMAN SHIFT OPENS WAY FOR TOUGHER EU STANCE China's weaker economy and its move up the value chain of industrial production mean it is no longer the reliable market it once was for German exports. The EU's goods trade deficit with China has ballooned by nearly 60% since 2019, while Germany's trade balance with China shifted from surplus to deficit in 2023 and continues widening. EU leaders agreed in October the bloc should "make effective use of all EU economic instruments" to counter unfair trade - such as accelerating the end of the customs duty exemption for low-value parcels, billions of which arrive from China. Brussels' December doctrine is likely to highlight export controls, screening of investments and restrictions on foreign subsidies for EU-based operations. Its ultimate weapon, the Anti-Coercion Instrument, can curb imports, exports and investment or access to public tenders. Germany's hardening stance could be a game-changer allowing firmer action, said Jacob Gunter of think tank Merics. The EU needs a broad majority of its members to fire up the ACI. "China doesn't worry about Europe's hawkish tone unless it threatens their access to the European market," he said. Calls are meanwhile growing to set conditions on Chinese investments in Europe, such as technology transfers - mirroring what China requires from European firms. "SPAIN-FIRST" APPROACH SEEN AS A RISK TO EU UNITY EU trade chief Maros Sefcovic said last month the EU wanted "real investments" - an aspiration Brussels will translate into proposals that EU states will need to back. Just as Berlin cools towards Beijing, however, Madrid is opening up to Chinese investments in renewables, EV batteries and mining. Spanish pork producers have also benefited from lower tariffs than EU peers in a Chinese anti-dumping probe along with a trade protocol that could increase their sales. King Felipe's visit last week underscored Beijing's success in cultivating Spain as a rare EU ally. Noah Barkin at research provider Rhodium Group said Spain's China policy was increasingly at odds with the European consensus built in Brussels, Berlin and Paris. "It is a Spain-first approach that risks undermining EU unity at a crucial moment, when the bloc faces unprecedented economic coercion from Beijing on rare earths and in relation to the chipmaker Nexperia," he said. Spain's Economy Ministry said in response to Reuters inquiries that its dealings with China would remain within the framework set by Europe's economic security strategy. "Strengthening cooperation and trade relations between Spain and China also serves to strengthen relations between the EU and China," it added in a statement. Nexperia will be front-of-mind as Brussels crafts guidelines on economic security. The Netherlands took control of the company in September over concerns about technology transfer to China, before stepping back after Beijing responded by withholding Nexperia chips needed by German carmakers. EU officials say they were surprised not to have been given prior warning of the Dutch move, which might have been a trigger for using the ACI. "The Anti-Coercion Instrument is our sharpest tool, but unity is key: China exploits EU divisions deliberately," said Ferdinand Schaff, senior manager for Greater China at the BDI industry association. https://www.reuters.com/world/china/eu-toughen-trade-stance-china-germany-pivots-2025-11-20/

2025-11-20 12:43

KYIV, Nov 20 (Reuters) - Ukrainian President Volodymyr Zelenskiy said on Thursday that 22 people were missing at the site of Wednesday's Russian attack on the western city of Ternopil. "As of now, 26 people are confirmed dead, including three children," Zelenskiy wrote on X, adding that the overnight search-and-rescue operation continued into the morning. Sign up here. https://www.reuters.com/world/europe/zelenskiy-says-22-people-missing-site-russian-attack-western-ukraine-2025-11-20/

2025-11-20 12:42

KYIV, Nov 20 (Reuters) - More than 400,000 Ukrainian consumers remained without electricity as of midday on Thursday following a recent large-scale Russian attack on Ukraine's western regions, energy officials said. The attack led to a decrease in electricity production at Ukrainian nuclear power plants. Sign up here. Russia has sharply increased the intensity and number of its attacks on Ukrainian infrastructure in recent months, targeting gas, energy and distribution facilities and plunging entire cities into darkness. Ukraine generates more than half of its electricity at three nuclear power plants, but damage to power lines and transformers has forced the plants to reduce their output, a representative of the national nuclear energy company Energoatom told Reuters. The International Atomic Energy Agency also confirmed the reduction in Ukraine's nuclear power output after Russian attacks on Tuesday night as the power stations lost the connection to their high-voltage power lines. Energoatom said the situation remained unchanged as of Thursday, while the head of Ukrainian power grid operator Ukrenergo Vitaliy Zaichenko told national television that power supply restrictions were in effect across virtually the entire country, with blackouts lasting up to 16 hours. The frontline regions of Chernihiv, Sumy, Kharkiv, Dnipropetrovsk and the Black Sea port of Odesa are the worst affected in terms of electricity supplies, he said. Ukraine's nuclear energy sector has been rocked this month by a corruption scandal that has led to the dismissal of the country's energy and justice ministers. https://www.reuters.com/business/energy/russian-strikes-plunge-400000-ukrainians-into-darkness-energy-officials-say-2025-11-20/

2025-11-20 12:41

LONDON, Nov 20 (Reuters) - The boom in private credit markets and stablecoins warrants close monitoring, the Group of 20's financial risk watchdog told leaders ahead of their summit in South Africa. In a letter to the G20 leaders published on Thursday, its Financial Stability Board Chair, Andrew Bailey, called for global efforts to "modernise and strengthen" financial regulations without compromising stability. Sign up here. The letter also highlighted the growing role of non-bank financial intermediaries, including private credit markets, saying it will be one of the main focal points of the FSB's work next year. It underlined the "urgency" of improving cross-border payments and developing "robust frameworks" for stablecoins - types of cryptocurrencies that are pegged 1:1 to a real-world currency or asset, usually the U.S. dollar. "Divergences in regulatory and prudential frameworks across jurisdictions (around stablecoins) could add an additional layer of complexity and potential risk," Bailey's letter said. "It will be equally important to consider how stablecoins can operate effectively and safely across borders." Policymakers outside of the United States worry the widespread adoption of dollar-backed stablecoins would partly 'dollarise' their economies, diminishing their monetary policy powers and creating issues around bailouts were they to ever be needed. In his letter, Bailey also noted the failure of major economies to implement global banking standards, including Basel III. The Basel Committee on Banking Supervision on Wednesday reiterated that "full and consistent" implementation of tougher capital rules remains its "highest priority". The reforms, agreed in 2017, were the final piece of the post-financial crisis response but both the European Commission and Britain have delayed implementation of Basel 3.1 until 2027 as they wait for clarity from the U.S. which has pushed back against the plans. In response to the pressure, Basel appears to be softening one aspect of its rules. Basel Committee chair Erik Thedéen told the Financial Times on Wednesday that crypto exposure requirements needed to be revisited to reflect the "dramatic" rise in stablecoins since the rules were agreed three years ago. The crypto framework is due to take effect on January 1, though neither the U.S. nor the UK has committed to that date. https://www.reuters.com/sustainability/boards-policy-regulation/private-credit-markets-stablecoins-need-close-monitoring-g20-watchdog-tells-2025-11-20/

2025-11-20 12:06

FRANKFURT, Nov 20 (Reuters) - Siemens Energy (ENR1n.DE) , opens new tab plans to invest 2 billion euros ($2.3 billion) in its global network of transformer and switchgear factories by 2028, the company said in slides ahead of a capital markets day. ($1 = 0.8681 euros) Sign up here. https://www.reuters.com/sustainability/climate-energy/siemens-energy-invest-23-billion-power-grid-factories-by-2028-2025-11-20/