2025-12-12 21:07

Dec 12 (Reuters) - Federal Reserve Bank of San Francisco President Mary Daly said on Friday in a LinkedIn posting that she favored cutting interest rates at this week's monetary policy meeting. "This week’s (Federal Open Market Committee) decision was not an easy choice," Daly wrote , opens new tab, with the Fed facing conflicts between its job and inflation goals. Inflation is too high and the job market is getting softer, she said, adding "we cannot let the labor market falter." Sign up here. Daly wrote the Fed's quarter-percentage-point rate cut on Wednesday "puts us in a good place" to both lower inflation and to support the job market. https://www.reuters.com/business/feds-daly-says-this-weeks-rate-cut-was-right-move-fed-2025-12-12/

2025-12-12 21:03

BRUSSELS, Dec 12 (Reuters) - European Union countries are set to vote early next week to determine whether the bloc should sign a contentious trade agreement with South American bloc Mercosur by the end of the year, Denmark, which holds the rotating presidency of the EU, said on Friday. The EU and the bloc of Argentina, Brazil, Paraguay and Uruguay reached agreement last December to create the EU's largest ever trade accord , opens new tab, some 25 years after negotiations were launched. However, France and other EU countries have expressed reservations, fearing increased imports would hurt their farmers. Sign up here. The European Commission, which negotiated the agreement, is seeking approval from EU members so that Commission President Ursula von der Leyen can travel to Brazil to sign it. "In the planning of the Danish presidency the intention is to have the vote on the Mercosur agreement next week to enable the Commission president to sign the agreement in Brazil on December 20. That has not changed," a Danish presidency official said on Friday. The outcome is uncertain. Approval requires a qualified majority of 15 EU members representing 65% of the EU population. Germany, Spain and the Nordic countries are clear supporters. However, Poland has said it will oppose the agreement, while the French and Italian positions are unclear. If those three, plus one more country, vote against or abstain, the deal would be rejected. The EU executive presented the accord , opens new tab for approval in September and sought to soften opposition by adding a mechanism that would allow the suspension of Mercosur preferential access for some farm products, such as beef, poultry and sugar. Supporters of the agreement, which would be the largest in terms of tariff reductions that the EU has struck, say it is an essential part of the EU's diversification strategy of seeking new markets and greater access to critical minerals amid geopolitical disruption in the form of U.S. tariffs and Chinese curbs on exports of chips and rare earths. Some EU diplomats said France had sought to delay a vote until January and believe it is now make-or-break time for the agreement. "If we don't sign Mercosur in the next days it will be dead," one EU diplomat said. "If we can't agree on Mercosur, we don't need to talk about European sovereignty anymore. We will make ourselves geopolitically irrelevant". https://www.reuters.com/world/americas/eu-vote-mercosur-trade-deal-set-next-week-denmark-says-2025-12-12/

2025-12-12 20:47

Tether bid values Turin club at 1.1 billion euros Agnelli family holding company Exor rejects proposal Exor looking to divest some Italian assets Buying Juventus could burnish crypto firm's image in Europe Juve struggling amid financial and sporting challenges MILAN, Dec 13 (Reuters) - Italy's Agnelli family has no intention of selling Juventus to crypto group Tether or anyone else, the CEO of their holding company said on Saturday, rejecting Tether's shock offer for Italy's most successful soccer club. "Juventus, our history and our values are not for sale," said Exor CEO John Elkann, who wore a team hoodie in a rare video address posted on the Turin-based Serie A club's website. Sign up here. Tether, headquartered in El Salvador and run by Italian Paolo Ardoino, a Juventus supporter, said on Friday it had submitted an all-cash proposal to buy Exor's stake in the club. Tether said it would make a public tender offer for the remaining Juventus (JUVE.MI) , opens new tab shares at the same price and it planned to invest one billion euros to support the club known in Italy as Juve if the deal goes ahead. The crypto company is offering Exor 2.66 euros per share, a source familiar with the matter said, valuing Juventus at just over one billion euros ($1.17 billion) and offering a 21% premium over Juventus' closing share price of 2.19 euros. Amsterdam-listed Exor (EXOR.AS) , opens new tab said in a statement its board had unanimously rejected the offer and had "no intention of selling any of its shares in Juventus to a third party". Juventus has not made an annual net profit for almost a decade, and its shares are down 27% so far this year. TETHER STABLECOIN PEGGED TO DOLLAR Tether, the issuer of a U.S. dollar-referenced stablecoin dubbed USDT, has already built a stake of more than 10% in Juventus this year, becoming its second-largest shareholder. By acquiring a European soccer club, Tether - whose business faces mounting EU regulatory scrutiny - could hope to gain credibility with the continent's establishment, while boosting its wider popularity. Tether said it is proposing to buy Exor's 65.4% of the total Juventus share capital, without officially disclosing a price. Exor, the largest shareholder in automaker Stellantis (STLAM.MI) , opens new tab and which controls sports car-maker Ferrari (RACE.MI) , opens new tab, has been streamlining its Italian portfolio. This year it agreed the sale of truck maker Iveco to India's Tata Motors (TAMO.NS) , opens new tab, and said on Monday it was in talks with Greek media group Antenna to sell its news operations, including two major newspapers and three popular radio stations. A sale of Juventus would likely be seen as the clearest sign yet of the family's gradual disengagement from their home country. The family's ties with the club date back to 1923 when Edoardo Agnelli became chair, and Elkann said in November that the family had no intention of selling shares. Investors, led by Exor, have poured around a billion euros of fresh cash into Juventus in the past seven years. JUVENTUS HAS STRUGGLED IN LAST FIVE YEARS Juventus has won the Italian championship 36 times, more than any other team, but has struggled since a ninth consecutive title in 2020. It currently sits in seventh place in Serie A. Once home to stars such as Michel Platini, Roberto Baggio, Alessandro Del Piero and Cristiano Ronaldo, Juventus has helped the Agnellis build consensus and popularity in Italy. Its support has weathered match-fixing and financial scandals, the most recent in 2023, when a false accounting case linked to player trading led to a 10-point deduction in Serie A. Juventus was also a driving force behind the failed attempt to launch a breakaway European Super League with a dozen other top clubs in 2021, challenging the authority of European soccer's governing body UEFA. Like other leading Serie A teams, it has had a hard time remaining competitive financially amid the growing dominance of England’s Premier League and European powerhouses such as Real Madrid, Barcelona and Paris Saint-Germain. Tether's USDT accounts for more than half the market of stablecoins pegged to the dollar, the Bank of Italy says. It had a market capitalization of around $186 billion as of Friday. The token is backed by U.S. Treasuries and dollars, and Tether is one of the 20 largest holders of U.S. government debt. Stablecoins are digital tokens that aim to maintain a stable value through a one-to-one peg to a traditional currency. They are backed by reserves, government bonds or deposits. ($1 = 0.8519 euros) https://www.reuters.com/sports/tether-submits-offer-buy-italian-soccer-club-juventus-2025-12-12/

2025-12-12 20:32

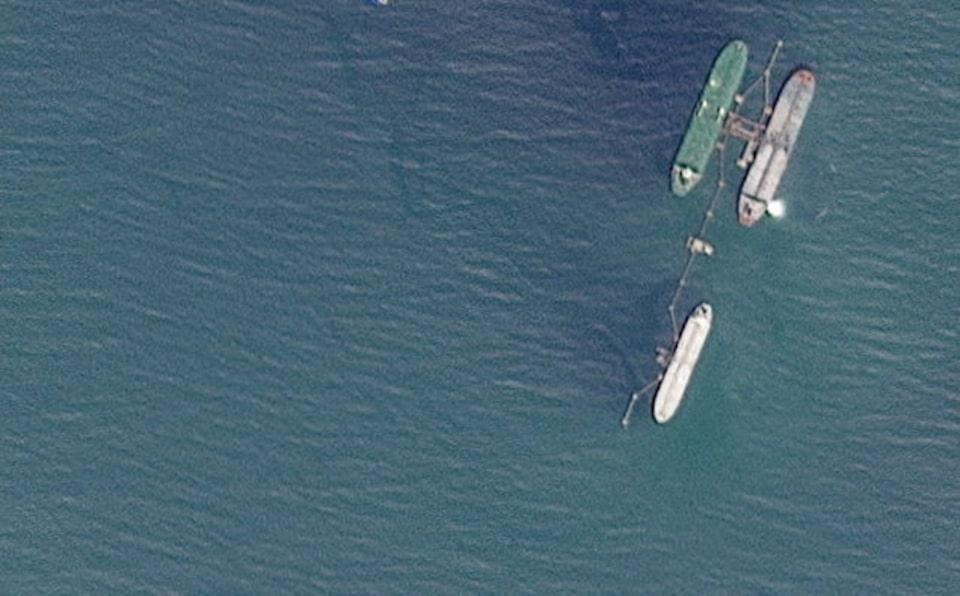

Only Chevron-chartered tankers sailing into international waters About 11 million barrels stuck in vessels in Venezuela Some cargoes are onboard Washington-sanctioned ships HOUSTON, Dec 12 (Reuters) - Venezuela's oil exports have fallen sharply since the United States seized a tanker earlier this week and imposed fresh sanctions on shipping companies and vessels doing business with the Latin American oil producer, according to shipping data, documents and maritime sources. Oil tanker movements into and out of Venezuelan waters have come to a near standstill as the U.S. prepares to seize more vessels. Washington is ratcheting up political and economic pressure on President Nicolas Maduro, who relies on oil export revenue to finance his government. Sign up here. The U.S. has executed a large-scale military build-up in the southern Caribbean and U.S. President Donald Trump is pushing to oust Maduro. The seizure of the vessel on Wednesday was the first interdiction of an oil cargo or tanker from Venezuela, which has been under U.S. sanctions since 2019. Since then, only tankers chartered by U.S. oil major Chevron (CVX.N) , opens new tab have sailed into international waters carrying Venezuelan crude, the data and documents showed. Chevron has a U.S. government authorization to operate through joint ventures with state-run oil company PDVSA in the country and export its oil to the U.S. Chevron has exported two cargoes of Venezuelan heavy crudes to the U.S. so far this month, both of which departed after the seizure. Two more were loading on Friday, according to the data. The U.S. company said this week it was operating in Venezuela "without disruption and in full compliance with laws and regulations applicable." PDVSA did not reply to a request for comment. Venezuela this week criticized the seizure and said it constituted "theft." STUCK IN VENEZUELAN WATERS The threat of further seizures of vessels has left tankers that have loaded about 11 million barrels of oil and fuel stuck in Venezuelan waters, according to the sources and data. Some of those tankers have been hit by U.S. sanctions on Iran or Russia. The U.S. is likely to target vessels that are sanctioned or have carried sanctioned crude in any further action, according to sources. The ship the U.S. seized on Wednesday, the Skipper, had transported both Iranian and Venezuelan crude. Venezuela exported some 952,000 barrels per day of crude and fuel in November, the third-highest monthly average so far this year. About 80% of those shipments were sent directly and indirectly to China, while exports to the U.S. rose to some 150,000 bpd. The OPEC country's oil exports flowed normally in the first days of December prior to the seizure, data and documents showed. Washington this week also sanctioned six supertankers that recently loaded Venezuelan oil, along with related shipping companies, in an escalation of U.S. pressure on Maduro. PDVSA and Venezuela's oil ministry on Friday called executives, workers and joint venture managers to a teleconference led by minister Delcy Rodriguez from the company's Caracas headquarters, according to a document seen by Reuters. https://www.reuters.com/business/energy/venezuelas-oil-exports-fall-sharply-after-us-tanker-seizure-only-chevron-ships-2025-12-12/

2025-12-12 20:26

Dec 12 (Reuters) - Iran has seized a foreign tanker allegedly carrying 6 million liters of "smuggled diesel" in the Gulf of Oman, Iranian state media said on Friday. Iran, which has some of the world's lowest fuel prices due to heavy subsidies and the plunge in the value of its national currency, has been fighting rampant fuel smuggling by land to neighboring countries and by sea to Gulf Arab states. Sign up here. State broadcaster IRIB did not mention the name of the vessel or give its nationality on its website. https://www.reuters.com/world/middle-east/iran-seizes-foreign-tanker-carrying-6-million-liters-smuggled-diesel-gulf-oman-2025-12-12/

2025-12-12 20:21

Rain-swollen Skagit River crests at all-time high Entire town of Burlington under evacuation order 100,000 people statewide urged to seek higher ground National Guard assists in evacuations, food deliveries BURLINGTON, Washington, Dec 12 (Reuters) - Residents and emergency crews in towns along the rain-engorged Skagit River in western Washington state braced on Friday for potential levee failures while National Guard troops assisted in evacuations after days of severe flooding in the Pacific Northwest. The entire town of Burlington, a community of about 9,200 people near Puget Sound, was ordered evacuated early on Friday as the river crested to an all-time high of nearly 38 feet (11.6 meters), well above major flood stage, in the city of Mount Vernon just downstream. Sign up here. "We haven't seen flooding like this ever," said Karina Shagren, a spokesperson for the state's emergency management division. So far there were no reports of casualties or missing people, she said. The Burlington-Mount Vernon area in Skagit County, north of Seattle, remained an epicenter of widespread flooding caused by days of torrential downpours extending from northern Oregon north through western Washington state and into British Columbia. The rains were spawned by a string of atmospheric river storms, vast airborne currents of dense moisture siphoned from the ocean, that swept inland over the Pacific Northwest, including parts of northern Idaho and western Montana. MONTH'S WORTH OF RAINFALL Rainfall totals varied widely, but much of the region received 6 to 20 inches of rain over the past seven days, according to the U.S. Weather Prediction Center in Maryland. "That's easily a month's worth of rain that's fallen in just a week," said Rich Otto, a meteorologist at the center. Even before Burlington residents were forced to flee, the Skagit River flood plain as a whole, home to about 78,000 people, was already under a Level 3 evacuation notice urging residents to immediately seek higher ground. Evacuation notices covered an estimated 100,000 people statewide. National Guard troops and sheriff's deputies went door to door to facilitate the evacuation, and some were seen paddling stranded Burlington residents to safety in inflatable river rafts through muddy floodwaters. Flood control levees appeared to be holding firm immediately following the river's historic crest, testing their strength for the first time since repairs to the earthen embankments were made following the last major flood in that area in 2021, state officials said. 'NOT OVER YET' Rains abated Friday. But the National Weather Service posted a flash-flood watch for the river basin downstream to the mouth of the Skagit, where it drains into Puget Sound, citing the potential for levee failures under heavy pressure from the high water. "It's not over yet," U.S. Senator Maria Cantwell said at a news briefing with Governor Bob Ferguson and others announcing that President Donald Trump, acting at their request, had signed an expedited federal emergency declaration for the flood zone. Cantwell said the declaration would hasten federal support in clearing roads, removing debris, assisting in evacuations and providing emergency shelters for evacuees. Forecasts called for a lull in precipitation going into the weekend, with another atmospheric river expected to produce another wave of showers Sunday night into Monday, Otto said, renewing flood hazards. A levee failure would greatly magnify widespread flooding already occurring across much of western Washington state. Aerial footage broadcast by CNN showed communities inundated in deep, brown water with many homes submerged almost to their rooftops. South of Skagit County, National Guard troops also were dispatched to deliver food and check on stranded residents in a number of communities isolated by flooding in adjacent Snohomish County, Shagren said. Two towns were likewise transformed into islands in neighboring King County, where dozens of flood victims were rescued over the past two days, some from the tops of cars, or from trees or from homes, officials said. King County Executive Girmay Zahilay told reporters an overnight flood patrol team discovered a sinkhole at the edge of one levee, and "got it immediately filled," averting a potential collapse. The flooding washed out or forced the closure of dozens of roads throughout the region, including most of the Canadian highways leading to the British Columbia port city of Vancouver. Several lengthy stretches of the BNSF Railway, a major freight line serving the Pacific Northwest, were also shut down on Thursday. (This story has been corrected to fix range of rainfall totals to 6 to 20 inches, not 6 to 60 inches, in paragraph 6) https://www.reuters.com/sustainability/climate-energy/flood-stricken-towns-washington-state-brace-potential-levee-failures-2025-12-12/