2025-11-18 20:00

SANTIAGO, Nov 18 (Reuters) - Five tourists were killed in a powerful snowstorm in Chile's Torres del Paine National Park, in the southern region of Patagonia, authorities said on Tuesday, adding that four more who were reported missing had been found alive. Jose Antonio Ruiz, the presidential delegate for Chile's southern Magallanes region, said talks had begun with the representatives from the victims' countries of origin so their bodies could be repatriated. Sign up here. Two Germans, two Mexicans and one British national were killed, authorities said, adding the harsh weather was making it difficult to recover the bodies. "I extend my deepest condolences," President Gabriel Boric said on social media in a message to victims' families. "Know that you have the full support and collaboration of Chilean authorities and institutions during these difficult times." Guillermo Ruiz, presidential delegate for the province of Ultima Esperanza, told reporters the tourists became lost near the national park's Los Perros camp, reachable only by a four- to five-hour trek from the closest accessible point by vehicle. The area was struck by a snowstorm causing whiteout conditions with fierce wind speeds surpassing 193 kmh (120 mph), equivalent to a Category 3 hurricane. The Torres del Paine National Park, with its jutting mountain tops and subpolar forests, spans about 1,810 square kilometers (700 square miles) and hosts hundreds of thousands of visitors each year. https://www.reuters.com/sustainability/climate-energy/chile-rescuers-search-tourists-lost-patagonian-snowstorm-two-reported-dead-2025-11-18/

2025-11-18 19:41

Pipeline projects aim to fill void from refinery closures Feasibility hinges on shipper commitments, analysts say Projects face competition from seaborne imports NEW YORK, Nov 18 (Reuters) - A race is on among energy companies to build a major fuel pipeline to the U.S. West Coast, a potentially lucrative prize as the planned closure of two California refineries threatens to send gasoline prices in the isolated market soaring. Motorists in West Coast states have long paid some of the country's highest fuel prices due to limited regional production and minimal connectivity to the Gulf Coast refining hub. There are no pipelines delivering fuel to California from across the Rocky Mountains and only a few pipelines deliver to the West Coast from the Gulf Coast, according to the Energy Information Administration. Sign up here. Phillips 66's Los Angeles plant began winding down operations in September and Valero Energy's Benicia refinery plans to close in April, threatening more price shocks for consumers but presenting an opportunity for pipeline operators. Three groups have outlined different proposals to fill the near 280,000 barrel-per-day supply void the closures create. These include refiner HF Sinclair, a unit of pipeline operator ONEOK (OKE.N) , opens new tab, and a partnership between refiner Phillips 66 (PSX.N) , opens new tab and midstream-focused Kinder Morgan (KMI.N) , opens new tab. However, the first to reach a final investment decision may be the only one to secure a potential multi-billion-dollar windfall because multiple pipelines to the West Coast would eat into each other's margins, which are already limited due to the availability of waterborne imports to California. "When you see multiple pipeline projects being proposed at the same time, typically only one of them gets done," said Skip York, chief energy strategist at Turner, Mason & Co. POLITICAL PRESSURE OPENS RARE WINDOW The planned refinery closures have put intense pressure on California Governor Gavin Newsom to stop fuel prices from surging, creating a rare window for the approval of a fossil fuel project in a state that has long vilified "Big Oil". "Given the backlash to refinery closures, it's hard to imagine much resistance to new projects," East Daley analyst Alec Gravelle said. Capacity commitments make up most of the financing required to build pipelines, so securing at least 70% of the proposed projects' capacity could decide which of them progresses, York said. That gives Western Gateway - the Phillips 66-Kinder Morgan project - and HF Sinclair's proposal an advantage, as the refiners themselves could guarantee some of the supply, Scotiabank analyst Paul Cheng said. None of the proponents have yet announced any capacity commitments. Phillips 66 declined to comment on competing West Coast pipeline proposals. The other proponents did not immediately respond to requests for comment. Proposals reusing existing lines also have a better chance of moving forward than new builds because regulatory approval may be easier, said Debnil Chowdhury, head of Americas and European refining at S&P Global Commodity Insights. Parts of Western Gateway and HF Sinclair's plan propose using existing lines. RIVAL REFINERS BET ON WATERBORNE FUELS While a new pipeline could provide some stability to regional gasoline prices, refining executives have questioned whether any will ultimately get built, pointing to California's access to waterborne fuels. "In terms of the pipelines that are rumored to come into the region, I would say that's a big if," said Rick Hessling, chief commercial officer for Marathon Petroleum, adding the timing and transportation cost of waterborne barrels trumped pipelines. Valero Energy, the second-largest independent refiner, is unlikely to commit to a long-term shipping arrangement with any of the three projects, Chief Operating Officer Gary Simmons said during an investor call last month. "We like the waterborne option because it allows you to source barrels from anywhere in the world and take advantage of international arbs that can be open," Simmons said, referring to price arbitrage opportunities. https://www.reuters.com/business/energy/california-refinery-closures-spark-pipeline-race-west-coast-2025-11-18/

2025-11-18 18:10

Dar Global wants to 'tokenize' up to 70% of Maldives hotel - CEO Dar Global talking to SEC about the matter, spokesperson says Saudi developer's CEO not concerned by any extra scrutiny LONDON, Nov 18 (Reuters) - Saudi luxury real estate developer Dar Global (DARD.L) , opens new tab hopes to fund much of its latest Trump hotel in the Maldives by selling blockchain-based crypto tokens to U.S. retail investors, its CEO told Reuters on Tuesday. London-listed Dar Global is one of The Trump Organization's main overseas partners, with seven projects under development including an 80-storey tower in Dubai, a golf resort in Qatar and hotels and high-end homes across Saudi Arabia and Oman. Sign up here. Developers typically tap institutional investors or wealthy family offices for the cash to fund large-scale projects, but Dar Global CEO Ziad El Chaar said in an interview in London that it hoped to fund up to 70% of its latest Trump International Hotel in the Maldives by selling tokens to retail investors. "We would like to ... tokenize 70% of that development fund to as many token holders as possible," said El Chaar, adding: "The biggest crypto market and the biggest amount of investors are in the U.S.". Dar Global is in discussions with U.S. regulator the Securities and Exchange Commission (SEC) on the matter and is exploring options in other unspecified countries, a spokesperson for the company told Reuters. The Trump Organization and the SEC did not immediately respond to requests for comment on the matter. El Chaar said he was not concerned about any additional scrutiny resulting from Dar Global's relationship with The Trump Organization. "Obviously, with the Trump brand, you have the politics involved, but from our side, this is not our domain," he added. https://www.reuters.com/world/middle-east/saudi-developer-wants-sell-trump-hotel-tokens-us-retail-investors-2025-11-18/

2025-11-18 14:55

LONDON, Nov 18 (Reuters) - Bank of England Chief Economist Huw Pill said on Tuesday that he did not expect his view on interest rates to shift much in the near term, saying wage growth was still substantially above what he viewed as consistent with the BoE's inflation target. "I think when you're talking about wage growth ... that's still growing substantially above ... what is consistent with the 2% inflation target," Pill told a panel hosted by French financial services company Natixis, pointing to weak productivity in the labour market. Sign up here. The BoE's Monetary Policy Committee was split 5-4 this month, with Pill part of the majority supporting keeping rates on hold. Governor Andrew Bailey indicated that he might change his vote to support a cut at December's meeting, depending on incoming data. Asked whether his view on borrowing costs had shifted since the BoE's meeting earlier this month, Pill said that he did not expect his view on rates to shift that much. He also said policymakers should not place too much weight on often-noisy short-run economic data when assessing how rapidly inflation pressures are easing. Pill said that he did not think Britain's underlying inflation pressures were as high as headline inflation of 3.8% might suggest. But he noted that data measures related to inflation had not slowed as much as he would have expected in the past, despite an apparent recent slowdown in wage growth and higher unemployment. "I think policymakers should be cautious about over-interpreting the latest news in data, because there is a lot of noise in the data flow, and partly because of some of the challenges our colleagues in the Office for National Statistics have faced," he said. https://www.reuters.com/sustainability/sustainable-finance-reporting/boes-pill-says-he-cannot-place-too-much-weight-latest-data-2025-11-18/

2025-11-18 14:23

LONDON, Nov 18 (Reuters) - Bank of England Chief Economist Huw Pill said he expected the central bank to reduce the British government bonds it holds for monetary policy purposes to "very low" levels, though it could still retain gilts for other reasons. The BoE bought 875 billion pounds ($1.15 trillion) of gilts between 2009 and 2021 to support the economy, and has been reducing its holdings since 2022, in part through active sales. Sign up here. The central bank has not been explicit about how far it will reduce gilt holdings beyond the point when banks no longer have excess reserves with the BoE, which could be reached as soon as next year. Pill indicated that gilt sales were likely to continue for some distance beyond that point. "That doesn't mean we won't have some gilt portfolio, perhaps to back banknotes or for structural reasons, but I would say the expectation at the moment is the QE portfolio held for monetary policy reasons will be run to very low levels," he said at an event hosted by French financial services firm Natixis. The BoE's Monetary Policy Committee voted in September to reduce its gilt holdings by 70 billion pounds over the next 12 months to 488 billion pounds, but Pill had voted to maintain the previous 100 billion pounds a year pace of reduction. Pill disagreed with a proposal from one participant at the event that the BoE should halt gilt sales when yields rose above a certain point, and said the BoE's commitment not to sell gilts in disorderly markets was enough. "I would be very cautious about putting a kind of cap, especially a pre-announced explicit cap, on yields," Pill said. "I think that is a target for speculation." ($1 = 0.7605 pounds) https://www.reuters.com/business/finance/bank-englands-pill-expects-qe-gilt-holdings-be-reduced-very-low-level-2025-11-18/

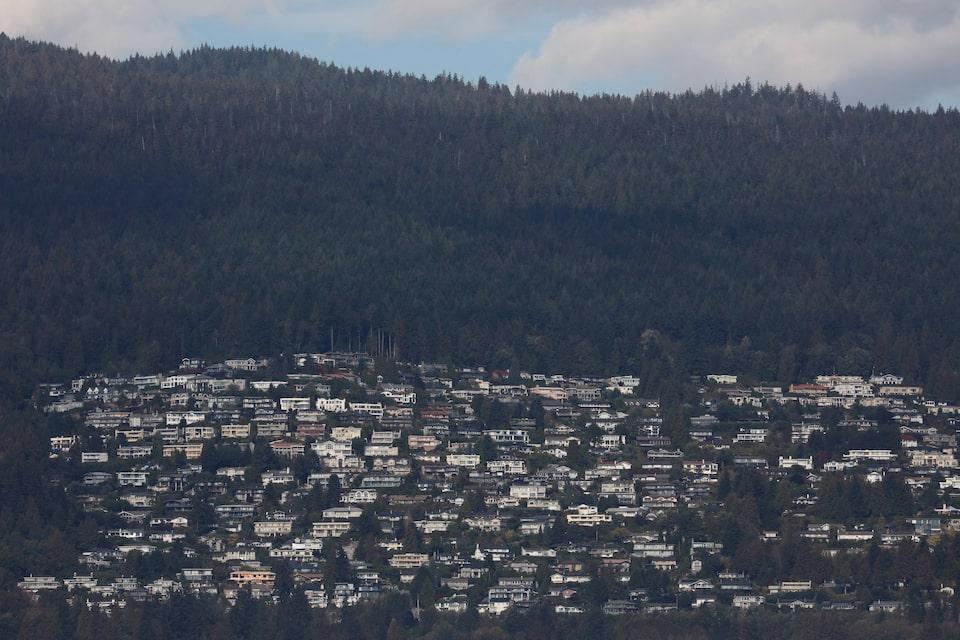

2025-11-18 13:23

TORONTO, Nov 18 (Reuters) - Canadian housing starts fell 17% in October from the previous month, data from the national housing agency showed on Tuesday. The seasonally adjusted annualized rate of housing starts dropped to 232,765 units from a revised 279,174 units in September, the Canada Mortgage and Housing Corporation (CMHC) said. Economists had expected starts to fall to 265,000. Sign up here. https://www.reuters.com/world/americas/canadian-housing-starts-fall-more-than-expected-october-2025-11-18/