2025-11-18 11:36

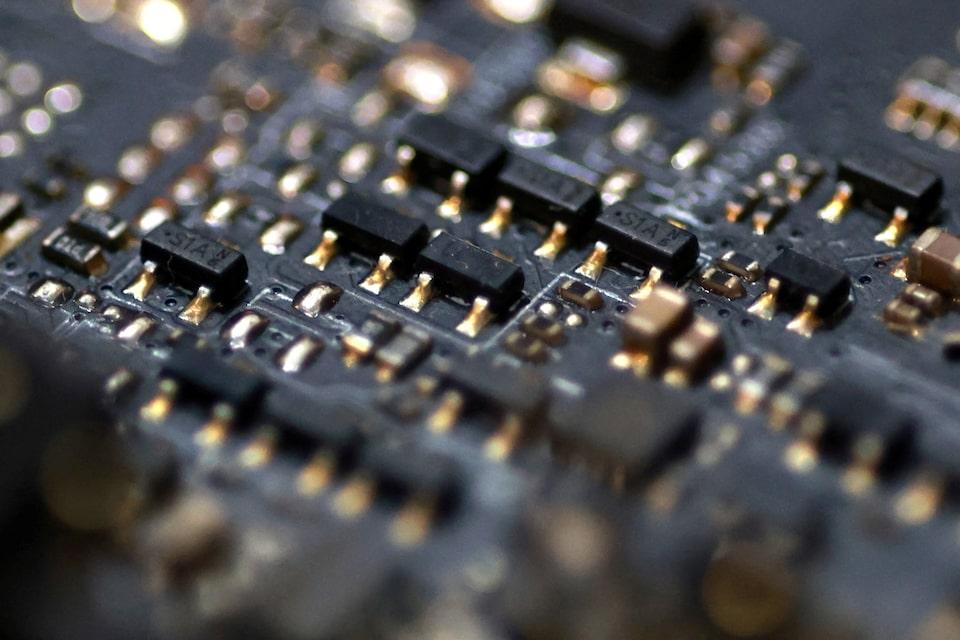

Nov 18 - What matters in U.S. and global markets today By Mike Dolan , opens new tab, Editor-At-Large, Finance and Markets Sign up here. Persistent tech sector valuation and leverage jitters, a deepening crypto drawdown and trepidation ahead of Nvidia's quarterly results all stoked the highest volatility in a month on Wall Street. The main U.S. equity indexes swung back and forth intraday on Monday but ended almost 1% in the red, and futures remained lower ahead of Tuesday's bell. The VIX "fear index" of S&P500 implied volatility hit its highest since mid-October at more than 23, and tech-heavy stock markets around the world fell sharply on Tuesday - with 3% losses in Tokyo and Seoul. Wariness of earnings day swings in the world's most valuable stock Nvidia was part of the anxiety, with the $5 trillion market cap chip giant due to report on Wednesday. Its stock fell 2% on Monday, with filings showing tech billionaire Peter Thiel's hedge fund sold its entire stake in Nvidia during the third quarter. But doubts about creeping leverage in the sector amid the AI investment frenzy were also stoked by Amazon's $15 billion debt offering, its first in three years. And that spoke to growing demand to hedge AI-related equity exposure via credit default swaps on some of the leading tech companies in the sector. Private credit nerves were also jangled as alternative asset manager Blue Owl tumbled 3% premarket after it moved to block redemptions from one of its private credit funds ahead of a merger. Blue Owl is involved with Meta in the financing of a huge Louisiana data center. The tech sector jitters are also seeping into crypto markets, with the world's biggest digital token bitcoin extending its recent sharp shakeout on Tuesday. Bitcoin plunged below $90,000 for the first time since April 22, almost 30% below its record peak it hit early last month. Alphabet was one of the few big names to escape Monday's latest downdraft, which included 7-8% stock price hits for Dell and Hewlett Packard, and the Google parent gained 3% on news of a $4 billion Berkshire Hathaway stake in the search giant. But, adding to the wary mood, Alphabet Chief Executive Sundar Pichai told the BBC on Tuesday that no company would be unscathed if the AI boom collapses, acknowledging "elements of irrationality" in the "extraordinary" tech breakthrough. "I think no company is going to be immune, including us." The European Commission, meantime, said it had launched market investigations into cloud computing services by Amazon and Microsoft under the Digital Markets Act, which aims to curb the power of Big Tech and ensure a level playing field for smaller rivals. The other big earnings updates of the week come from the big U.S. retailers, with Home Depot due to report on Tuesday and Walmart later in the week. Macro markets were more subdued on Tuesday, with hopes of another Federal Reserve interest rate cut this year knocked back considerably over the past week by hawkish Fed comments on needing to keep above-target inflation in check. Treasury yields did dial back, however, amid the fresh burst of equity volatility. With a backlog of government economic releases focused on Thursday's September payrolls report, more up-to-date soundings on the economy underlined the more cautious Fed policy stance. The New York Fed's latest business survey showed business conditions well above forecast for November. In today's column, I take a look at the recent wobble in UK gilts amid confusing government budget signals and rumblings of a leadership challenge within the ruling Labour Party. Today's Market Minute Chart of the day Nvidia shares have soared about 1,000% since the launch of ChatGPT in November 2022. This includes a year-to-date gain of more than 40% that made Nvidia the first company to surpass $5 trillion in market value last month. That market heft means the stock's moves can sway equity indexes. Nvidia carries an 8% weight in the S&P 500 and a roughly 10% weight in the widely followed Nasdaq 100. Analysts on average expect the company to post a 53.8% year-over-year rise in third-quarter earnings per share, on revenue of $54.8 billion, according to LSEG. Today's events to watch (all times EDT) * U.S. November NAHB housing sentiment (1000), August factory goods orders (1000), Treasury September TIC data on overseas holdings (1600), Canada October housing starts (0815) * Dallas Federal Reserve President Lorie Logan, Richmond Fed President Thomas Barkin and Fed Board Governor Michael Barr all speak; Bank of England policymaker Swati Dhingra speaks * U.S. corporate earnings: Home Depot, Medtronic * Saudi Crown Prince Mohammed bin Salman meets U.S. President Donald Trump at the White House Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-11-18/

2025-11-18 11:27

Nov 18 (Reuters) - Reverse stock splits globally have climbed to a record this year, underscoring the strain on small-cap companies struggling to stay listed even as an AI-fueled rally lifts technology heavyweights to fresh highs. Companies carried out a record 288 reverse splits through the end of October, compared with just 53 traditional splits, according to research firm Wall Street Horizon. Sign up here. Nearly 80% of the companies that executed reverse splits had a market value below $250 million, a Reuters analysis of the data showed. Reverse stock splits consolidate multiple shares into one and are typically used to lift a company’s share price above exchange-listing requirements. They are often viewed as a sign of financial stress, unlike traditional stock splits, which reduce the price per share and tend to draw increased interest from retail investors. The record gap between reverse and traditional splits this year highlights a widening divide in equity markets, with struggling small caps using financial maneuvers to support their share prices while megacaps extend a powerful rally driven by AI and technology spending. "Slower earnings growth and higher funding costs have exacerbated the problems at smaller companies," said Brett Mitstifer, chief investment officer of private banking and wealth management at Flagstar Bank. Small caps represent just 1.2% of total U.S. market capitalization, close to a 100-year low and well below the historical average of 3.6%, according to data from Pzena Investment Management. By contrast, AI-linked and large technology stocks have driven 75% of the S&P 500’s (.SPX) , opens new tab returns between November 2022, when OpenAI launched ChatGPT, and September 2025, J.P. Morgan Asset Management said. Major companies including Netflix (NFLX.O) , opens new tab, ServiceNow (NOW.N) , opens new tab, Apple (AAPL.O) , opens new tab, Amazon.com (AMZN.O) , opens new tab, Nvidia (NVDA.O) , opens new tab and Walmart (WMT.N) , opens new tab have split their shares in recent years as they pushed deeper into the megacap ranks. "There's a lot of competition among asset classes and companies. So stock splits can increase a company's profile and bring it back into the fold," said Christine Short, head of research at Wall Street Horizon. Retail appetite for Big Tech has surged this year. So far in 2025, retail investors have poured 34% more capital into Netflix than in all of 2024, while Alphabet (GOOGL.O) , opens new tab has drawn 19% higher inflows, according to VandaTrack. Meta (META.O) , opens new tab, Tesla (TSLA.O) , opens new tab and Nvidia have also recorded increases of 19%, 13% and 10%, respectively. https://www.reuters.com/business/record-reverse-splits-expose-growing-divide-between-small-caps-megacaps-2025-11-18/

2025-11-18 11:25

KARACHI, Nov 18 (Reuters) - Pakistan approved a new offshore exploration consortium on Tuesday, clearing Turkish Petroleum Overseas Company to take over operatorship of the Eastern Offshore Block-C as part of a push to revive drilling, the adviser to the finance ministry said. Pakistan's Economic Coordination Committee approved Pakistan Petroleum Limited's (PPL.PSX) , opens new tab request to assign part of its interest in the block to TPOC, Mari Energies (MARE.PSX) , opens new tab and state-run Oil & Gas Development Co Ltd (OGDC.PSX) , opens new tab, leaving PPL with a 35% stake. Sign up here. TPOC will hold 25% and will operate the block once a formal agreement is signed. "This will bring valuable international offshore operating experience to Pakistan’s exploration landscape and this transition is expected to enhance technical capabilities, operational efficiency, and overall project delivery," Khurram Schehzad, the adviser to the finance ministry said on X. He said the block contains a drill-ready prospect that the consortium will now pursue, a step he added could attract fresh foreign investment. With the ECC's approval, the consortium is now set to advance preparations for drilling operations, he said. In October, bids were awarded for 23 of 40 offshore blocks offered, covering around 53,500 square kilometres, in Pakistan's first offshore bidding round since 2007. Pakistan's 300,000 square kilometre offshore zone, bordering energy-rich Oman, the United Arab Emirates and Iran, has seen just 18 wells drilled since independence in 1947, too few to fully assess its hydrocarbon potential. https://www.reuters.com/business/energy/pakistan-clears-tpoc-led-consortium-operate-offshore-block-2025-11-18/

2025-11-18 11:24

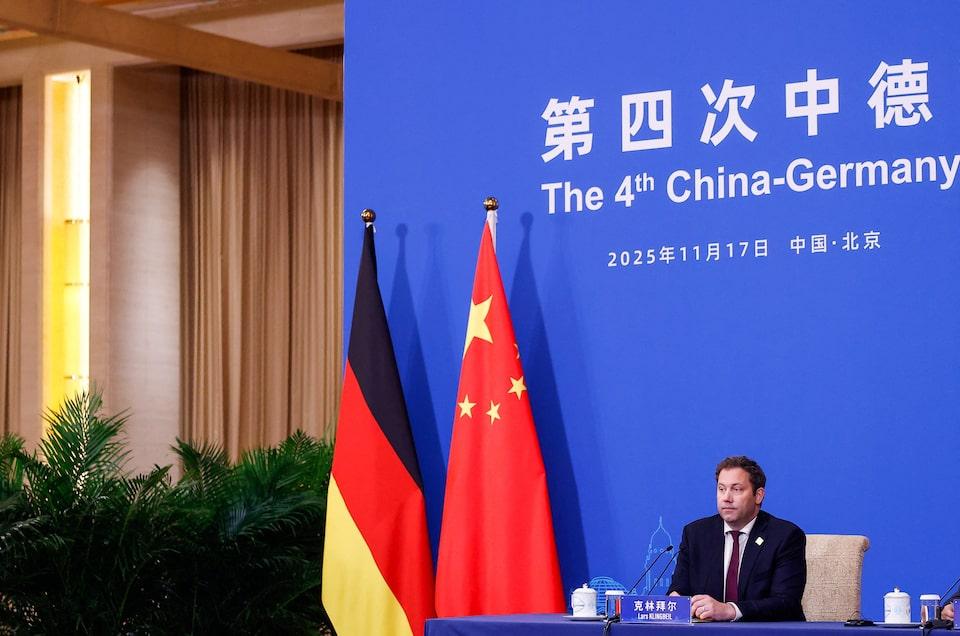

BEIJING, Nov 18 (Reuters) - German Finance Minister Lars Klingbeil discussed overcapacity in China on Tuesday during his visit to Beijing and stressed that the Europen Union would act if a solution was not found. "I made it clear that, if necessary, decisions will be made at the European level to better protect our markets," Klingbeil said. "I’d like to avoid that, but in the end, Europeans — and we Germans — must not be the ones left behind." Sign up here. On his second day in China, Klingbeil discussed overcapacity, German-Chinese cooperation in multilateral organizations and the war in Ukraine at the Party Dialogue in Beijing. Asked about EU divisions on relations with China, Klingbeil said coordination among Europen countries was key, and that he had liaised with his colleagues in the bloc before his trip. "It’s crucial that Europe, where we have a lot of common ground, doesn’t present different voices and positions in China," Klingbeil said. Ties between the two industrial powerhouses have been strained, in particular over Chinese export curbs on chips and rare earths that have caused major disruption for German firms. Germany must diversify its supply chains to avoid disruption in the sourcing of rare earth minerals, he said, although he said the Chinese side gave him clear assurances about reliable access on Monday. "Still, I want to stress: We need to do our homework in Germany," said Klingbeil. https://www.reuters.com/world/china/eu-will-protect-its-market-if-needed-german-finance-minister-says-china-2025-11-18/

2025-11-18 11:16

TSX ends down 0.1% at 30,036.46 Posts lowest closing level since November 7 Tech sector falls 1.1% with Celestica down 3.5% Energy rises 1.9% as oil settles 1.4% higher Nov 18 (Reuters) - Canada's main stock index edged lower on Tuesday as doubts lingered that booming investment in artificial intelligence will pay off, with declines for the technology and industrial sectors offsetting gains for energy. The S&P/TSX composite index (.GSPTSE) , opens new tab ended down 39.75 points, or 0.1%, at 30,036.46, its lowest closing level since November 7. Sign up here. Investors are concerned about possible overspending by companies on artificial intelligence and signs of a slowdown in U.S. job growth, said Michael Dehal, a senior portfolio manager at Dehal Investment Partners at Raymond James. "It's spooking the markets all week," Dehal said. U.S. stocks also ended lower, with the S&P 500 putting in a fourth day of losses as valuation worries hit big technology-related shares. Quarterly results from artificial intelligence and market leader Nvidia (NVDA.O) , opens new tab are due after the bell on Wednesday and the September U.S. jobs report is set to be released on Thursday. The report was delayed by the long U.S. government shutdown. The Toronto market's technology sector (.SPTTTK) , opens new tab fell 1.1%, with shares of electronic equipment firm Celestica Inc (CLS.TO) , opens new tab ending 3.5% lower. Industrials were down 1% as railroad stocks lost ground. Shares of Telus Corp (T.TO) , opens new tab dropped 5.3% after JP Morgan downgraded the telecommunications company to an "underweight" rating from "neutral." Energy (.SPTTEN) , opens new tab was up 1.9% as the price of oil settled 1.4% higher at $60.74 a barrel. Investors weighed the impact of Western sanctions on Russian oil flows. Activist investor Elliott Investment Management has built a significant stake in Barrick Mining Corp (ABX.TO) , opens new tab, a source familiar with the matter said. Barrick's shares gained 1.5%. https://www.reuters.com/business/tsx-futures-fall-investors-avoid-risks-commodity-prices-fall-2025-11-18/

2025-11-18 10:43

Nov 18 (Reuters) - Sterling was little changed versus the dollar and the euro on Tuesday as investors awaited British inflation data on Wednesday which could provide additional clues about the Bank of England policy path. While investors were becoming increasingly aware that it will take time to clarify the trajectory of the U.S. economy as U.S. agencies clear a backlog of data, British inflation figures are likely to affect expectations for future BoE cuts. Sign up here. "Short covering aside, the pound remains very vulnerable, particularly if the October consumer price index data comes in lower, in line with consensus forecasts," said Kit Juckes, forex strategist at SGCIB. "Our economists expect the core to remain at 3.5%, but that might not be enough to prevent the market’s confidence in a December rate cut hardening further," he added. Many central banks have largely completed their normalisation cycles, but traders expect the BoE to cut rates by 59 basis points by December 2026, compared with 54 bps late on Monday, while pricing in an 80% chance of a rate cut next month. Analysts noted that the quick rise in Gilt yields last Friday did not coincide with a weaker Sterling. This could imply that the pound's recent weakness has had more of a cyclical component than one to do with fiscal concerns, at least for now. London stocks tumbled on Friday as gilt yields surged following reports that the UK government had abandoned plans for income tax hikes in the upcoming budget, severely undermining investor confidence in the government's ability to meet fiscal targets. British Finance Minister Rachel Reeves is expected to need to raise tens of billions of pounds to meet her fiscal targets in November 26's annual budget. The British government is likely to repeat tax rises next year, Franklin Templeton head of European fixed income David Zahn said on Tuesday, adding that long-term gilt yields could rise towards 6%, as concern mounts about UK government finances. The euro was up 0.05% at 88.12 pence, having traded as high as 88.64 pence on Friday, its highest since August 2023. The euro has gained on the pound for the past four weeks in succession. Versus the dollar, sterling was flat at $1.3153. https://www.reuters.com/world/uk/sterling-little-changed-before-uk-inflation-data-budget-still-focus-2025-11-18/