2025-11-18 00:09

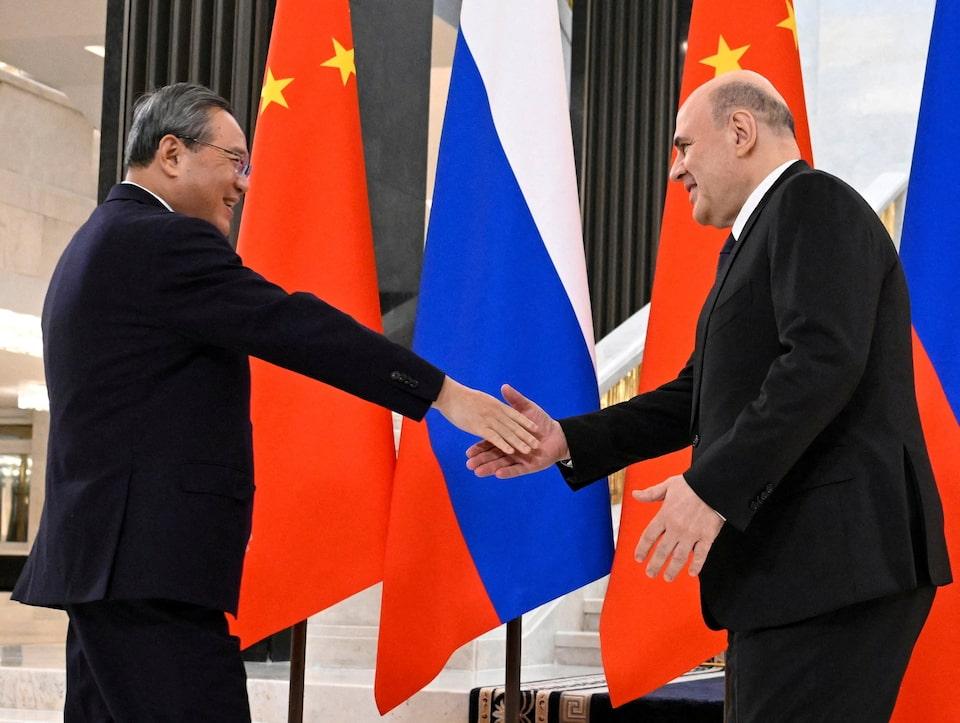

BEIJING, Nov 18 (Reuters) - China is ready to deepen cooperation with Russia in energy, agriculture and other investments, Premier Li Qiang said during a meeting with Russian Prime Minister Mikhail Mishustin in Moscow on Monday. Li told Mishustin that China welcomes more agricultural and food products from Russia, according to the official news agency Xinhua. Sign up here. China also hopes Russia will make it easier for Chinese enterprises to invest and operate there, Xinhua said in its report, citing Li. Mishustin told Li that the cooperation between the two sides has repeatedly proven its resilience to external challenges. "Our cooperation in the energy sphere is of a special, strategic nature and spans the oil, gas, coal and nuclear sectors," Mishustin told Li, according to a transcript from the meeting published on Russia's government website. Russia, waging war against NATO-supplied Ukrainian forces, and China, under pressure from a concerted U.S. effort to counter its growing military and economic strength, have increasingly found common geopolitical cause. Beijing and Moscow announced a "no limits” strategic partnership just days before Putin sent tens of thousands of Russian troops into Ukraine in February 2022. Xi has met Putin more than 40 times over the past decade, and in recent months Putin has publicly referred to China as an ally. https://www.reuters.com/world/asia-pacific/china-seeks-more-cooperation-with-russia-energy-agriculture-2025-11-18/

2025-11-17 23:54

WASHINGTON, Nov 17 (Reuters) - The U.S. Treasury said on Monday that U.S. sanctions against Russian oil majors Rosneft (ROSN.MM) , opens new tab and Lukoil (LKOH.MM) , opens new tab are already reducing Russian oil revenues and are likely to reduce the quantity of Russian oil sold in the long term. The Treasury's Office of Foreign Assets Control said in a statement that its analysis of the initial market impact of the sanctions announced on October 22 showed they "are having their intended effect of dampening Russian revenues by lowering the price of Russian oil and therefore the country's ability to fund its war effort against Ukraine." Sign up here. The Treasury action was among the strongest U.S. sanctions since Russia's full-scale invasion of Ukraine in February 2022 and the first direct sanctions imposed by President Donald Trump against Russia since taking office in January. The sanctions set a November 21 deadline for companies to wind down dealings with Rosneft and Lukoil. Violators could be cut off from the dollar-based financial system. But it was unclear how Treasury will enforce the sanctions. The two largest buyers of Russian oil have been China and India. The OFAC analysis said that several key grades of Russian crude were selling at multi-year-low prices and noted that nearly a dozen major Indian and Chinese purchasers of Russian crude have announced intentions to pause their purchases of Russian oil for December deliveries. LSEG Workspace data on Monday showed benchmark Urals crude loaded at Russia's Black Sea oil hub of Novorossiysk traded at $45.35 per barrel on November 12, the lowest level since March 2023. At that time, Russia was just beginning to assemble a "shadow fleet" of tankers to avoid a G7-led price cap of $60 a barrel imposed in December 2023. Brent crude futures were $62.71 on November 12 and traded at $64.03 on Monday. Urals Novorossiysk rose to $47.01 on Monday. Loadings resumed at the Black Sea port after being suspended by a Ukrainian drone and missile attack. Reuters reported earlier this month that Russian oil discounts to Brent had widened as major Indian and Chinese refiners cut purchases in response to the U.S. sanctions. A Treasury spokesperson said the sanctions were "starving Putin's war machine" and the department "is prepared to take further action if necessary to end the senseless killing" in Ukraine. https://www.reuters.com/business/energy/us-treasury-says-russian-oil-revenues-cut-by-sanctions-rosneft-lukoil-2025-11-17/

2025-11-17 23:43

WASHINGTON, Nov 17 (Reuters) - The U.S. Securities and Exchange Commission on Monday dropped its emphasis on the oversight of companies offering crypto asset-related services as part of its priorities for examining Wall Street firms for the current fiscal year, according to an annual statement published by the agency. The SEC's Division of Examinations, which scrutinizes the legal compliance of investment advisers, broker-dealers, clearing agencies, stock exchanges and others, said it would focus on fiduciary duty, standards of conduct, and asset custody as well as new requirements for customer data privacy, among other subjects. Sign up here. However, the statement contained no standalone section explicitly focusing on crypto activity and the volatility of digital assets, as it has in prior years. The U.S. government's current fiscal year ends on September 30, 2026. WHY IT'S IMPORTANT Under President Donald Trump, who has embraced the crypto sector politically and personally, the SEC has laid out a sweeping agenda to promote the development of the digital asset sector, marking an about-face from the prior administration, which viewed the industry as rife with fraud and noncompliance. The industry is likely to interpret Monday's shift in emphasis as another encouraging sign. In response to a request for comment, an SEC spokesperson referred to a passage in Monday's announcement according to which this year's priorities were "not ... an exhaustive list of all areas" SEC examiners will focus on. KEY QUOTE “Examinations are an important component to accomplishing the agency’s mission, but they should not be a ’gotcha’ exercise," SEC Chairman Paul Atkins said in the announcement. "Today’s release of examination priorities should enable firms to prepare to have a constructive dialogue with SEC examiners and provide transparency into the priorities of the agency’s most public-facing division." https://www.reuters.com/sustainability/boards-policy-regulation/wall-street-regulator-drops-emphasis-crypto-sector-exams-2026-2025-11-17/

2025-11-17 23:24

Venture Global seeks FERC approval for Plaquemines LNG expansion Expansion aims to meet strong market demand, says CEO Mike Sabel Plaquemines expansion to be built in three phases, fully commissioned by 2027 HOUSTON, Nov 17 (Reuters) - Venture Global (VG.N) , opens new tab said on Monday it had asked the U.S. Federal Energy Regulatory Commission for permission to more than double the capacity of its Plaquemines liquefied natural gas export facility under development in Louisiana. The company wants to add 30 million metric tons per annum (mtpa) of additional LNG capacity to the previously approved 28 mtpa. Plaquemines is already the second-largest LNG facility in the U.S. and last month was responsible for 22% of total exports from the country, according to data from financial firm LSEG. Sign up here. "Our decision to significantly increase the project’s permitted capacity reflects the strong market demand we continue to see and this expansion will play a vital role in meeting that demand," Venture Global CEO Mike Sabel said in a statement. The proposed expansion would allow the company to produce over 100 million mtpa of the liquid fuel and challenge QatarEnergy and Cheniere (LNG.N) , opens new tab as the world's top exporter of LNG. A mere startup three years ago, Venture Global quickly became the second-largest U.S. LNG exporter with a business model that lets it export cargoes while construction and commissioning phases are still underway. The strategy has allowed the company to profit from higher spot market prices before it begins supplying longer-term customers, but the practice has also resulted in arbitration cases and lawsuits from customers that include several of the world's largest energy companies. The Plaquemines expansion will be built incrementally in three phases and consist of 32 modular liquefaction trains, the company said. Venture Global has also filed an application with the U.S. Department of Energy for the export authorizations associated with the additional planned capacity, the company said. https://www.reuters.com/business/energy/venture-global-wants-double-planned-capacity-plaquemines-lng-facility-2025-11-17/

2025-11-17 23:24

NEW YORK, Nov 17 (Reuters) - BP (BP.L) , opens new tab was responding to a release of refined products on the Olympic Pipeline System east of Everett, Washington, and had partially restored part of the system, the company said on Monday. The BP-operated Olympic shut its pipelines in the area after the discharge on Sunday. The system consists of two pipelines in the area. Sign up here. The segment of the pipeline system unimpacted by the issue was restored on Sunday, resuming product delivery on that line, the company said. The incident is still under investigation, BP said. Olympic Pipeline is a 400-mile pipeline system moving fuels from northern Washington to Oregon. The pipeline transports key refined petroleum products including gasoline and diesel and supplies jet fuel to Seattle-Tacoma International Airport (Sea-Tac). Operations at Sea-Tac were not impacted by the incident and the airport had plenty of stored fuel on hand to manage the situation, a Sea-Tac spokesperson said. https://www.reuters.com/business/energy/bp-partially-restored-olympic-pipeline-system-after-leak-2025-11-17/

2025-11-17 23:19

September jobs report expected on Thursday Dell drops after downgrade Nvidia results due on Wednesday Indexes: Dow down 1.2%, S&P 500 down 0.9%, Nasdaq down 0.8% NEW YORK, Nov 17 (Reuters) - U.S. stocks ended sharply lower on Monday, with the S&P 500 and the Nasdaq closing below a key technical indicator for the first time since late April as investors braced for quarterly results from retailers and chip giant Nvidia and awaited a long-delayed U.S. jobs report this week. Losses accelerated in afternoon trading as all three main indexes traded below their 50-day moving averages. This closely followed moving average is seen as a proxy for the intermediate-term trend. The Dow closed below its 50-day moving average for the first time since October 10. Sign up here. Results this week from major retailers Walmart (WMT.N) , opens new tab, Home Depot (HD.N) , opens new tab and Target (TGT.N) , opens new tab will round out the quarterly earnings season. Shares of Home Depot, due to report on Tuesday before the bell, ended 1.2% lower. Investors eagerly awaited the September jobs report, which is due to be released on Thursday after the long U.S. government shutdown ended last week. Investors are waiting for two big things: "a look at the consumer ... and Nvidia's earnings," said Adam Sarhan, chief executive of 50 Park Investments in New York, noting that "you have a consumer that is potentially getting weaker, not stronger." Also, he said, the market is consolidating after strong gains this year. The S&P 500 remains up 13.4% for the year to date. Nvidia (NVDA.O) , opens new tab, the world's largest company by market value, which is at the heart of Wall Street's artificial intelligence trade, is due to report after the bell on Wednesday. Its shares fell 1.9% on Monday and were the biggest drag on the Nasdaq and S&P 500. Stocks have been pressured this month by concerns that AI exuberance has driven up valuations to expensive levels. The Dow Jones Industrial Average (.DJI) , opens new tab fell 557.24 points, or 1.18%, to 46,590.24, the S&P 500 (.SPX) , opens new tab lost 61.70 points, or 0.92%, to 6,672.41 and the Nasdaq Composite (.IXIC) , opens new tab lost 192.51 points, or 0.84%, to 22,708.08. It was the first time the S&P 500 and Nasdaq closed below their 50-day moving averages since April 30. Among the day's gainers, Google parent Alphabet (GOOGL.O) , opens new tab rose 3.1% after Berkshire Hathaway (BRKa.N) , opens new tab revealed a stake of $4.3 billion in the company. Berkshire also further reduced its stake in Apple (AAPL.O) , opens new tab, whose shares ended 1.8% lower on Monday. Among other declining shares, Dell Technologies (DELL.N) , opens new tab dropped 8.4% and Hewlett Packard Enterprise (HPE.N) , opens new tab fell 7%, both after Morgan Stanley ratings downgrades. Investors also digested views on the outlook for stocks next year. Brokerage Morgan Stanley expects U.S. stocks to outperform peers next year and prefers global equities over credit and government bonds. Declining issues outnumbered advancers by a 4.03-to-1 ratio on the NYSE. There were 90 new highs and 248 new lows on the NYSE. On the Nasdaq, 1,168 stocks rose and 3,577 fell as declining issues outnumbered advancers by a 3.06-to-1 ratio. Volume on U.S. exchanges was 19.06 billion shares, compared with the roughly 20 billion average for the full session over the last 20 trading days. https://www.reuters.com/business/us-stock-futures-rise-markets-await-nvidia-earnings-government-data-2025-11-17/