2025-11-17 18:42

Trump met McDonald's execs amid inflation concerns President plans rallies in battleground states in coming months Trump reverses tariffs on 200+ imported food items Firms say inflation impacts lower- and middle-income earners most WASHINGTON, Nov 17 (Reuters) - Feeling the heat from Americans worried about inflation, U.S. President Donald Trump told owners, operators and suppliers of fast-food chain McDonald's (MCD.N) , opens new tab on Monday that his administration was making progress in combating inflation, but more work needed to be done. Trump, who promised during the 2024 election campaign to bring down costs, insists that his administration's tax cuts and steps to re-shore domestic manufacturing will help boost Americans' real income and spur growth. Still, he has conceded of late that it could take time for those measures to kick in. Sign up here. "As president, I'm fighting every day to support small businesses like yours," Trump told the group. "There's still a lot of work to do, and we're making tremendous progress. Costs have continued to rise in the U.S., not least because of sweeping tariffs Trump has imposed against nearly every country. Inflation worries fueled Democratic victories in state and local elections this month. Trump's approval ratings have continued to languish amid Americans' frustration over persistently high prices. On Monday, Trump appealed directly to the nation's largest fast-food chain in a speech that offered no new initiatives but touched on military attacks on Iranian nuclear facilities to his personal devotion to McDonald's products and his renaming of the Gulf of Mexico. He peppered his remarks with false and misleading claims about the economy's performance under his stewardship. TRUMP SAYS WORKING TO LOWER INFLATION McDonald's CEO Chris Kempczinski this month warned that low-income consumers were having to absorb "some significant inflation." The company, keenly aware of how resistant low-income earners are to higher prices, has been offering a $5 value meal for more than a year now. Trump reminisced about serving french fries during a campaign stop at a Philadelphia-area McDonald's in 2024, telling the chain's bipartisan "Impact Summit" in Washington on Monday his administration was working to reduce inflation. "We're going to get it a little bit lower," he said, without providing any details. Trump, who has long argued that his tariffs are not fueling price increases, reversed course on Friday when he announced the elimination of duties on more than 200 imported food items, including coffee and bananas, later conceding to reporters that tariffs could raise costs "in some cases." Trump has already floated the idea of a $2,000 tariff-funded check for lower- and middle-income Americans, although such a measure would require congressional approval. He also suggested 50-year mortgages as a way to make houses more affordable, although homeowners would pay more in interest. TRUMP PLANS RALLIES FOCUSED ON ECONOMY IN COMING MONTHS Trump plans to hold rallies around the United States in coming months in battleground states to tout his economic agenda, two administration officials said, ahead of midterm elections next November. Trump insists that inflation is far lower now than during former Democratic President Joe Biden's term, when consumer prices spiked up to around 9%. But Americans remain skeptical. The Economist's longtime "Big Mac" index, which measures the cost of the famous double-decker hamburger across numerous countries, shows that a Big Mac cost on average $6.01 as of July, up from $5.69 a year ago and $5.15 three years ago. Meat costs have remained a sore point. A pound of ground chuck beef cost consumers about $6.33 in September, up 13.5% from a year earlier, according to U.S. government data. The most commonly cited measure of U.S. inflation, the Consumer Price Index, was 3% higher year over year in September, its highest since January, with more than half of line items tracked showing gains that topped the 3% overall rate. The annual cost increase overall for food consumed at home, while seemingly more modest at 2.7% in September, is the largest in more than two years. Consumers remain frustrated with high prices, a fact corporate executives frequently noted during third-quarter earnings calls. They said lower- and middle-income earners were bearing the brunt of higher costs on food, rent and other costs. Companies like Procter & Gamble (PG.N) , opens new tab, Coca-Cola (KO.N) , opens new tab and Colgate-Palmolive (CL.N) , opens new tab all cited concerns about rising costs and a widening gap between low- and higher-income consumers. McDonald's, keenly aware of how resistant low-income earners are to higher prices, has been offering a $5 value meal for more than a year now. https://www.reuters.com/world/us/trump-talk-up-economy-meeting-with-mcdonalds-owners-operators-2025-11-17/

2025-11-17 18:20

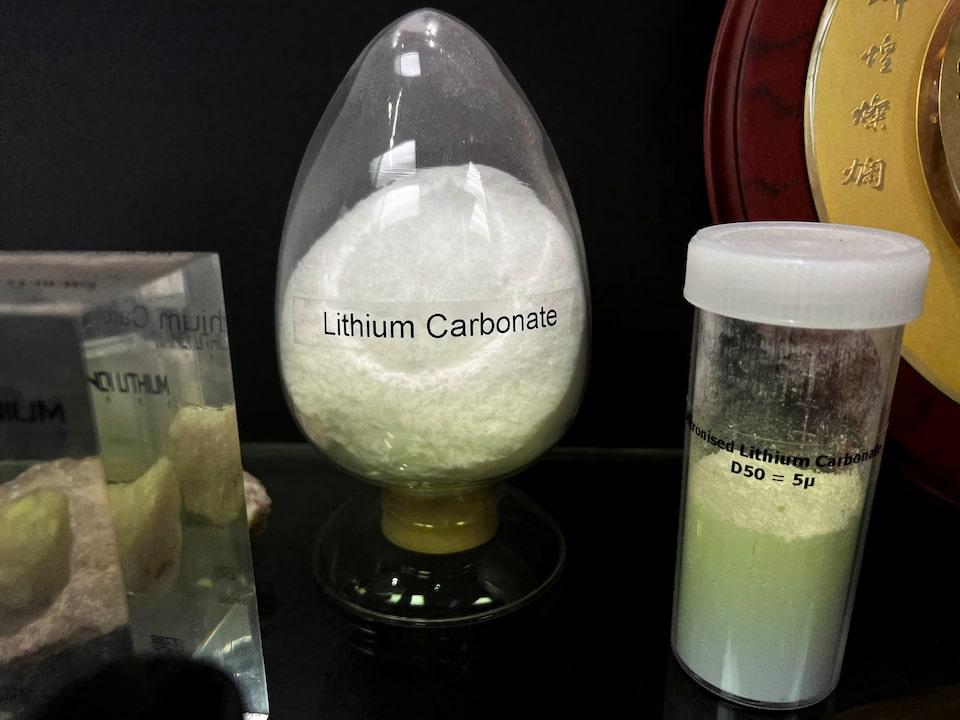

BRUSSELS, Nov 17 (Reuters) - The EU's European Investment Bank and the Australian government said in a joint statement on Monday they would deepen cooperation on critical raw materials, as Western powers scramble to cut their reliance on China. With the exception of Japan, Group of Seven countries and the EU are heavily or exclusively reliant on China for a range of materials from rare earth magnets to battery metals. Sign up here. European officials and industry sources say financing remains a key hurdle in the bloc's efforts to secure its supply chains of strategic minerals. Even the EU's list of strategic projects receives no financial benefits. The European Commission is due to present a wide-ranging economic security package on December 3. "This declaration is the first step towards enabling the EIB to support the financing of critical minerals projects in Australia," the statement said. "(It) furthers existing collaboration between Australia and the EU across the critical raw materials value chain – from exploration and extraction to processing, recycling and innovation." The EIB set up a dedicated task force to support project development in critical materials early this year, with an aim to double the group's financing. The G7, led by Canada this year, formed a Critical Minerals Production Alliance with like-minded countries and agreed in October to mobilize public and private capital to fast-track graphite, rare earth elements, and scandium production. Australia, which holds vast mineral reserves, offered to sell shares , opens new tab in its new strategic stockpile to G7 nations. Last month, the U.S. and Australia committed $3 billion to mining and processing projects, and to a price floor for critical minerals, a step long sought by Western miners. The countries will also sign off on financing that includes offtake rights. Similarly, Canada has signed an offtake agreement for scandium and graphite with Australian miner Rio Tinto (RIO.AX) , opens new tab, and Quebec-based Nouveau Monde Graphite (NOU.TO) , opens new tab. https://www.reuters.com/business/finance/eus-eib-work-with-australian-government-critical-raw-materials-2025-11-17/

2025-11-17 18:08

Saba sells credit derivatives to hedge against tech stock risks, source says Sells Oracle, Microsoft, Meta, Amazon, Google CDSs AI stocks have sold off in recent weeks LONDON, Nov 17 (Reuters) - Boaz Weinstein's Saba Capital Management has sold credit derivatives in recent months to lenders seeking protection on big tech names like Oracle and Microsoft due to concerns over a debt-financed AI investment frenzy, a source told Reuters. Banks have sought to shield their exposure to potential losses by buying credit default swaps (CDS) from the U.S. hedge fund manager, known for his winning bet against the JPMorgan Chase (JPM.N) , opens new tab trader dubbed the "London Whale", the person said. Sign up here. While the credit insurance rises in value in tandem with the perceived risk of a company's default, current prices indicate those risks are still low compared to other sectors. Saba sold banks CDSs on Oracle (ORCL.N) , opens new tab, Microsoft (MSFT.O) , opens new tab, Meta (META.O) , opens new tab, Amazon (AMZN.O) , opens new tab and Google parent Alphabet (GOOGL.O) , opens new tab, said the source, who had direct knowledge of the deals. Some large asset managers, including a private credit fund, were also keen to buy the product, the source said. Microsoft and Oracle declined to comment. Meta, Google and Amazon did not immediately respond to requests for comment. BANKS SEEK PROTECTION AS TECH FIRMS RACK UP DEBT The development highlights a scramble to hedge against an explosion in the value of AI companies and their growing debt burdens. It also points to fears that, if the current AI enthusiasm proves to be a bubble, any pop would echo across equity markets as a sharp correction, denting the economy. The person said it was the first time Saba has sold hedging protection on some of the companies and the first time banks had asked for this kind of trade from the hedge fund. The finance firms, the source said, were seeking protection against the debt accumulating on companies' balance sheets as they borrow heavily to fund their multi-billion-dollar AI projects. Equity derivatives trading also saw increased client demand for hedging protection against the sector, a Goldman Sachs client note released on Friday showed. "Some of this is concern about AI corporate bond supply over the next few quarters after a surprise surge in recent weeks," Deutsche Bank's Jim Reid said in a note on Monday speaking in general about the tech-related CDS market. "However, it seems that they are also being used as a general hedge for all sorts of positive AI positions." RISKS LOW COMPARED TO OTHER SECTORS DESPITE BUBBLE WORRIES While ultimately CDSs are meant to pay compensation if a company goes bust, the derivatives themselves grow in value as the company's economic health declines. Oracle and Alphabet CDSs are trading at their highest levels in two years, while data from S&P Global shows such contracts for Meta and Microsoft have jumped in recent weeks. Data for Meta CDSs was only available from late October, according to S&P. Though CDS contracts for big tech names have surged, analysts note that current levels are lower than those for some investment-grade firms in other sectors. CDS five-year spreads for Oracle reached over 105 basis points last week, while Alphabet and Amazon traded around 38 bps and Microsoft traded around 34 bps, according to S&P data. Borrowing by so-called hyperscalers - essentially large AI tech firms – has ballooned in recent weeks. Meta raised $30 billion of debt last month. Oracle raised $18 billion in September. And Google owner Alphabet has also tapped the market. In fact, more than double the sector's average annual IG bond issuance hit the market in September and October alone, BofA data showed. Societe Generale noted on Tuesday, however, that bond yield spreads are still below the aggregate investment-grade credit, while others such as Citi flag the hyperscalers' healthy balance sheets. In his weekly "flow show" report on Friday, Bank of America chief investment strategist Michael Hartnett said: "Best short is AI hyperscaler corporate bonds." https://www.reuters.com/business/finance/weinsteins-saba-sells-credit-derivatives-big-tech-as-ai-risks-grow-source-says-2025-11-17/

2025-11-17 13:41

Nov 17 (Reuters) - White House economic adviser Kevin Hassett on Monday said there have been mixed signals in the job market, and that the labor market could be slowing down. "I think that there have been mixed signals in the job market and really, really positive signals in the output markets," Hassett told CNBC in an interview. Sign up here. "I think that there could be a little bit of almost quiet time in the labor market because firms are finding the AI is making their workers so productive that they don't necessarily have to hire the new kids out of college," he said. A weakening labor market could prompt the U.S. Federal Reserve to again lower its key interest rate by 25 basis points next month, economists say. https://www.reuters.com/business/white-house-adviser-hassett-says-there-have-been-mixed-signals-job-market-2025-11-17/

2025-11-17 12:51

Nov 17 (Reuters) - Alstom (ALSO.PA) , opens new tab agreed to supply Ukrainian Railways with 55 locomotives in a contract valued at roughly 470 million euros ($545 million), the French rail transport manufacturer said on Monday. The delivery of Traxx locomotives, scheduled to begin in 2027, will be financed mainly by the European Bank for Reconstruction and Development, and the World Bank, the firm added. Sign up here. ($1 = 0.8620 euros) https://www.reuters.com/business/alstom-supply-ukrainian-railways-with-55-locomotives-470-million-euros-2025-11-17/

2025-11-17 12:14

LONDON, Nov 17 (Reuters) - Calm returned to British markets on Monday after the previous week's sharp swings, with the pound a touch firmer on the euro and steady on the dollar, trading well above recent lows. UK markets were roiled on Friday by reports Finance Minister Rachel Reeves has no plans to raise income tax rates in the budget, alarming investors who had been anticipating an increase to help fill an expected fiscal shortfall. Sign up here. The drama weighed on British government bonds, and dragged on the pound, which hit its weakest on the euro since early 2023. Things were less dramatic on Monday morning, however, with British government bond yields lower, and outperforming European peers. The pound strengthened on the euro, which was down 0.1% at 88.1 pence having traded as high as 88.64 pence on Friday. Versus the dollar, sterling was effectively flat at $1.3166. In a sign of the calmer mood, its high and lows for the day were inside both Friday and Thursday's ranges. But the calm could be short-lived because of politics and upcoming economic data. "Whether sterling can continue to fall against the euro at its recent pace is a moot point, but over time it looks distinctly vulnerable," said Kit Juckes, chief FX strategist at Societe Generale. The euro has gained on the pound for the past four weeks in succession. Regardless of politics there is also economic data due this week, most notably consumer inflation due Wednesday. "If we get a softish print in CPI, it looks like that will open the door to a December rate cut," said Juckes. "The market thinks that's the more likely outcome, it probably thinks its a shoe in if we get that outcome." The Bank of England held rates steady at its meeting this month, but in a close vote with four of its rate-setting monetary policy committee voting to cut rates by 25 basis points. At present, markets see roughly a three in four chance of such a cut at the BoE's December meeting. https://www.reuters.com/world/uk/sterling-finds-its-footing-after-last-weeks-ructions-2025-11-17/