2025-11-14 23:17

MILAN, Nov 14 (Reuters) - Italian gas grid operator Snam (SRG.MI) , opens new tab said on Friday it has scrapped plans to acquire a minority stake in Germany's largest independent gas transmission firm, amid resistance from the German economy ministry. Berlin's concerns over the 920-million-euro ($1.1 billion) transaction stem from the presence of China's State Grid as an indirect investor in Snam, Reuters reported earlier in the day, citing two sources familiar with the matter. Sign up here. The Italian group signed a deal in April to buy a 24.99% stake in Open Grid Europe's (OGE) owner Vier Gas Holding from Abu Dhabi's Infinity Investments, aiming to enter the German gas market, the biggest in Europe. The agreement was terminated after a prolonged foreign direct investment review by Germany, Snam said in a statement, saying its proposed remedies to secure regulatory clearance were found inadequate by the authorities. The company added that the development will not impact its full-year 2025 financial outlook. Germany's economy ministry had been reviewing the deal since it was agreed. Its resistance reflects European governments taking a tougher stance against Chinese investment in Europe due to security concerns. Snam would not pursue the acquisition "come hell or high water" amid the lengthy approval process, CEO Agostino Scornajenchi previously signalled. Germany blocked an attempt by China's State Grid to buy a stake in power grid operator 50Hertz in 2018. ($1 = 0.8575 euros) https://www.reuters.com/business/energy/italys-snam-set-scrap-german-gas-deal-amid-berlins-concern-over-china-sources-2025-11-14/

2025-11-14 22:53

Nov 14 (Reuters) - Global ratings agency Fitch affirmed Ukraine's long-term foreign currency sovereign credit rating at "restricted default" on Friday, saying it would remain unchanged until the country normalizes relations with most external commercial creditors. As Ukraine's war with Russia nears its fourth year, the prolonged conflict continues to strain the economy, pushing defense spending to about 2.96 trillion hryvnias ($70.86 billion) this year. Sign up here. Talks between Ukraine and holders of its GDP warrants collapsed for a second time in six months earlier in November, further delaying efforts to restructure the $3.2 billion in bond-like instruments. The country's central bank also cut its 2025 GDP growth forecast. "Spending pressures will remain heavy even after the end of the war, with Ukraine likely to retain a large military force," Fitch said. Ukraine is in talks with the International Monetary Fund for a new four-year lending program to replace its existing $15.5 billion arrangement, of which it has already received $10.6 billion. The country is seeking a new IMF program because the one agreed in 2023 assumed the war would end by late 2025, a prospect that remains distant. "Ukraine will remain reliant on external funding sources to cover its sizeable funding needs over the medium term," Fitch said. The agency typically does not assign outlooks to sovereigns with a rating of "CCC+" or below. ($1 = 41.7754 hryvnias) https://www.reuters.com/markets/asia/fitch-retains-ukraines-sovereign-rating-restricted-default-2025-11-14/

2025-11-14 22:30

US sanctioned Lukoil last month over Russia's war on Ukraine US approves talks with Lukoil through Dec 13 on buying assets Sale of assets must ensure complete break from Lukoil WASHINGTON/NEW YORK/LONDON, Nov 14 (Reuters) - The Trump administration on Friday gave clearance to potential buyers to talk to Russia's Lukoil about buying its foreign assets and allowed business dealings with Lukoil's Burgas refinery after Bulgaria moved to seize the plant. The U.S. last month imposed sanctions on Russia's two biggest oil companies, Lukoil (LKOH.MM) , opens new tab and Rosneft (ROSN.MM) , opens new tab, for their help in financing Russia's nearly four-year war in Ukraine. Lukoil has faced growing disruptions to its foreign assets, which account for about 0.5% of global oil production, since the sanctions were imposed. Sign up here. The Treasury Department on Friday issued a set of licenses, one of which authorized companies to talk to Lukoil through December 13 about buying its foreign assets. U.S. WILL ONLY AUTHORIZE DEALS IF ASSETS SEVER LUKOIL TIES The U.S. will only authorize a transaction involving the sale of those assets if it completely severs ties with Lukoil and if the funds from that sale are placed into an escrow account that Lukoil cannot access as long as it is sanctioned. The Treasury Department also allowed transactions until April 29, 2026, involving Lukoil entities in Bulgaria. The Bulgaria Energy Ministry said in a statement that the U.S. move "is a direct result of the intensive actions, negotiations, and diplomatic talks we have been conducting since day one to ensure stability, predictability, and peace of mind for Bulgarian citizens and businesses." Britain's Office of Financial Sanctions Implementation has also granted licenses for Lukoil Bulgaria EOOD and Lukoil Neftochim Burgas AD. The latter manages the country's only oil refinery at Burgas. "These authorizations support the energy security of our partners and allies without benefiting the Russian government," a Treasury spokesperson said. Treasury also issued a license to allow transactions with the Caspian Pipeline Consortium and Tengizchevroil projects even if they involve the sanctioned oil companies. CPC is a pipeline bringing more than 1.6 million barrels per day of crude, or 1.5% of global oil, from Kazakhstan's oil fields developed by U.S. and EU majors Chevron, Exxon Mobil, Eni, Shell, TotalEnergies and Lukoil. It crosses Russian territory and can be fully shut by Moscow if it decides it wants to retaliate against Western sanctions. BUYER INTEREST IN LUKOIL ASSETS Reuters reported on Thursday that U.S. private equity firm Carlyle is exploring options to buy Lukoil's foreign assets, according to sources familiar with the situation. Carlyle was looking to apply for a U.S. license allowing it to buy the assets before beginning due diligence, one of the sources had said. Analysts had said Carlyle was better suited to get U.S. approval to buy the assets, compared with Swiss commodities trader Gunvor, which had earlier walked away from an agreement with Lukoil after Treasury called the trading house the Kremlin's "puppet" in a post on social media. Gunvor strongly disagreed with that characterization. Carlyle declined to comment on Friday. Other firms around the globe have also been considering bids for parts of the Lukoil empire, Reuters reported on Wednesday. These include Kazakhstan's state firm KazMunayGas (KMGZ.KZ) , opens new tab and European oil major Shell (SHEL.L) , opens new tab, sources said. Lukoil has three refineries in Europe, as well as stakes in oilfields in Kazakhstan, Uzbekistan, Iraq, Mexico, Ghana, Egypt and Nigeria. It also has hundreds of retail fuel stations around the world, including in the United States. Lukoil's international assets are estimated to be worth about $22 billion, based on 2024 filings. Jeremy Paner, a partner at Hughes and Hubbard law firm and a former Treasury official, said the license that authorizes negotiations with Lukoil allows companies to enter into binding memorandums of understanding and other agreements, but the actual acquisition of the assets must be separately authorized by Treasury through a specific license. https://www.reuters.com/business/energy/us-paves-way-talks-sale-lukoils-foreign-assets-2025-11-14/

2025-11-14 22:11

FAA had earlier frozen flight cuts at 6% as shutdown disruptions declined Airlines cancel far fewer flights than ordered FAA still short of 3,500 air traffic controllers WASHINGTON, Nov 14 (Reuters) - The Federal Aviation Administration said Friday it halved a requirement that U.S. airlines reduce domestic flights at 40 major airports from 6% to 3% starting Saturday to address air traffic control safety concerns after the end of the government shutdown. Airlines have been pushing for the FAA to end the required cuts entirely and were largely not in compliance with the FAA order that required the 6% cut on Friday. It remains to be seen if they will be in compliance with the 3% order. Sign up here. "The 3% reduction will remain in place while the FAA monitors system performance throughout the weekend and evaluates whether normal operations can resume," the FAA said. Cirium, an aviation analytics firm, said airlines canceled just 2% of overall flights Friday, down from 3.5% on Wednesday and Thursday. On Friday, air traffic controllers and other FAA employees began receiving back pay equal to about 70% of what they are owed excluding overtime. Airlines have been privately making the case to the FAA that it is time to end the cuts and some said earlier they plan to cut few or no flights on Saturday, officials told Reuters. The FAA opted on Wednesday to ease those required cancellations after disruptions due to air traffic control absences declined dramatically as Congress voted to reopen the government after a 43-day shutdown. The FAA had initially planned to hike the cuts to 8% on Thursday and 10% on Friday. Separately, a group of House Democrats led by Representative Rick Larsen, the ranking member of the Transportation and Infrastructure Committee, asked the administration on Friday to turn over the specific safety data and how it compares to the last six months. "It appears that the administration made this decision without adequate coordination with key aviation stakeholders," the Democrats wrote. United Airlines (UAL.O) , opens new tab said it had canceled 134 flights for Friday, or almost 3% of its flights, after cancelling 222 flights on Thursday. The FAA is about 3,500 air traffic controllers short of targeted staffing levels. Many had been working mandatory overtime and six-day weeks even before the shutdown led to them working without pay. Air traffic absences led to tens of thousands of flight cancellations and delays since October 1, when the 43-day shutdown began. https://www.reuters.com/sustainability/sustainable-finance-reporting/airlines-urging-faa-drop-flight-cuts-controllers-get-paid-2025-11-14/

2025-11-14 21:57

US gas prices may rise on LNG build-out US to be main supplier of new LNG to the world Rising LNG construction costs force projects to take early FID HOUSTON, Nov 14 (Reuters) - U.S. liquefied natural gas plants could take on as much as 40 billion cubic feet of natural gas per day in coming years, Cheniere Energy (LNG.N) , opens new tab Chief Commercial Officer Anatol Feygin said on Friday. U.S. plants are currently using a record 18 bcfd of natural gas to produce LNG, according to data from financial firm LSEG. Sign up here. The increased demand for liquefaction could lead to natural gas prices, which have risen around 62% over the past year, becoming even more expensive toward the end of the decade, Feygin said at a seminar held by the Federal Reserve Bank of Kansas City. "You kind of saw that in 22/23 coming out of COVID. LNG went back up to full utilization and then grew, so Nymex had an incursion into the high single digits. Very quickly supply responded," Feygin said, suggesting that natural gas drillers would be able to increase output to match the increased demand. While there are fears about an oversupplied market as new LNG capacity comes online, the executive said that Asian countries such as Bangladesh and Pakistan could be attracted by lower prices and end up increasing demand. The world will need to add 30 million metric tons of LNG every year to meet global demand growth, with most of the new capacity coming from the U.S., Feygin said. Rising construction costs have driven some of the recent final investment decisions in U.S. LNG, he said. "Over two-thirds of the FID this year was done because the fixed-priced EPC contracts were about to expire and there was a rush to maintain the construction cost of building the LNG plant," Feygin said. The U.S. LNG sector could eventually produce as much as 300 mtpa, Feygin said, acknowledging that the sharp growth could challenge some producers if they're not prepared to weather periods of lower prices. Only 17% of the new capacity to come from plants that reached FID this year has been sold under long-term contracts, and many portfolio players are unprepared, he warned. https://www.reuters.com/business/energy/cheniere-sees-us-lng-plants-using-40-bcf-natural-gas-per-day-coming-years-2025-11-14/

2025-11-14 21:44

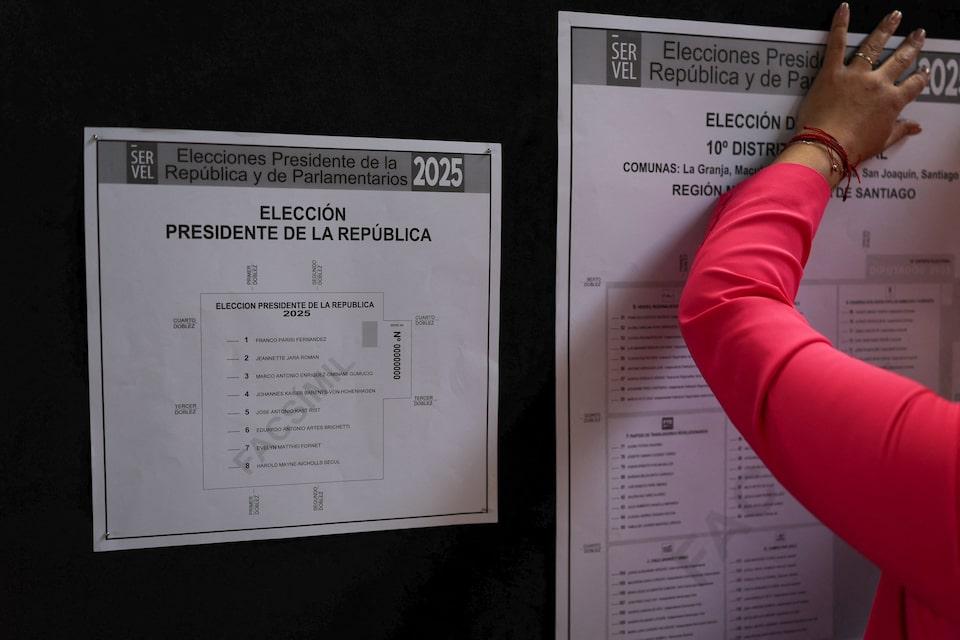

Leftist candidate Jara takes narrow lead with 27% of vote Crime and immigration dominate Chile's electoral agenda Chile's rightward tilt would mirror recent leftist defeats across Latin America SANTIAGO, Nov 16 (Reuters) - Far-right candidate Jose Antonio Kast is favored to clinch a runoff victory next month despite lagging slightly behind governing coalition candidate Jeannette Jara in Chile's first-round presidential vote on Sunday. With nearly all ballots tallied, Jara, the first Communist Party member to be a finalist for the Chilean presidency, was holding 27% of the vote versus 24% for Kast, a tight margin that underscored deep political divisions. Sign up here. An eventual win for Kast would put in place an administration that is further to the right than any other since the Pinochet dictatorship. A December 14 runoff will pit those two ideological extremes against each other, as many voters signaled that they were prioritizing crime and immigration over the progressive reforms that defined the last election. "Change will come," Kast told supporters on Sunday evening, adding that a "real victory" would come when authorities defeat organized crime, close the borders to undocumented migrants and fix an overburdened healthcare system. Chile's rightward tilt would mirror recent leftist defeats across Latin America and it signals growing momentum for right-wing candidates in Colombia, Peru and Brazil, where security fears also loom as key issues. It may also offer the Trump administration an opportunity to build upon the alliances it has forged with rightist governments in Argentina, Ecuador and El Salvador. In a sign of popular revolt against the status quo, Franco Parisi, of the center-right Party of the People who proposed installing land mines along parts of the northern border to deter migrants, bucked poll estimates by landing in third place. Parisi was supported by working-class men from Chile's mining-heavy north - many of them leery of elites and traditional political parties who will likely now opt for Kast given security and employment concerns - and they may push Chile closer to U.S. President Donald Trump, said Claudio Fuentes, a political science expert at Chile's Diego Portales University. "Kast will move closer to the right-wing axis of the region and probably establish a close relationship with Trump," Fuentes said. Chile is the world's largest copper miner and a major provider of lithium, a key metal in electric batteries, making it a potentially useful ally for the U.S., though China remains its dominant trading partner. Votes for the four right-wing candidates in the first round reached over 70% combined, which should put Kast in a strong position for the second round, assuming most of their voters migrate to him. Libertarian congressman Johannes Kaiser, who had looked to be in contention to be the conservative standard-bearer, and moderate-right politician Evelyn Matthei, both said they supported Kast as voting results came in. "If you add up the votes for Kast, Matthei, and Kaiser ... it’s very difficult for Jara to really make a comeback in the second round," said Claudia Heiss, a government expert at the Universidad de Chile. The dominance of law-and-order issues has marked a drastic change from the wave of left-wing optimism and hopes of drafting a new constitution that brought current President Gabriel Boric, who isn't allowed to run for reelection, to power. OPPOSITE ENDS OF POLITICAL SPECTRUM Kast, 59, won a second chance with many voters who rejected him in 2021 for being too extreme. He has proposed building a border wall with trenches, expelling all undocumented migrants and deploying the military to high-crime neighborhoods. "You can ask all the neighbors, even in a small town ... whether they feel safe or not. And most people will tell you they are afraid," he said after voting in his hometown of Paine, south of Santiago. A Catholic with nine children, Kast has been criticized over his late father's Nazi party membership and his affinity for Augusto Pinochet, the brutal dictator who led the country from 1973 to 1990. His brother, Miguel Kast, was a minister and head of the central bank during the dictatorship. Pia Tarifenos, a 37-year-old nutritionist waving a Chilean flag outside Kast's party headquarters in Santiago, said she felt represented by his values, adding that she believed Kast's third bid would be different from his previous attempts. "This time will be different because the majority of Chileans need a change," she said. "We know the current government never delivered on its promises." Jara, 51, a former labor minister under Boric, has downplayed her Communist Party ties and has proposed increasing the minimum wage while boosting funding for social welfare and health care. She has also advocated for stronger gun controls, technological surveillance on the border and lifting banking secrecy laws to pursue organized crime groups. Despite accomplishments including passing a long-awaited pension reform, she has also faced criticism for a sticky unemployment rate which currently stands at 8.5%. https://www.reuters.com/world/americas/chilean-right-wing-eyes-return-power-crime-migration-dominate-election-2025-11-14/