2025-11-12 20:12

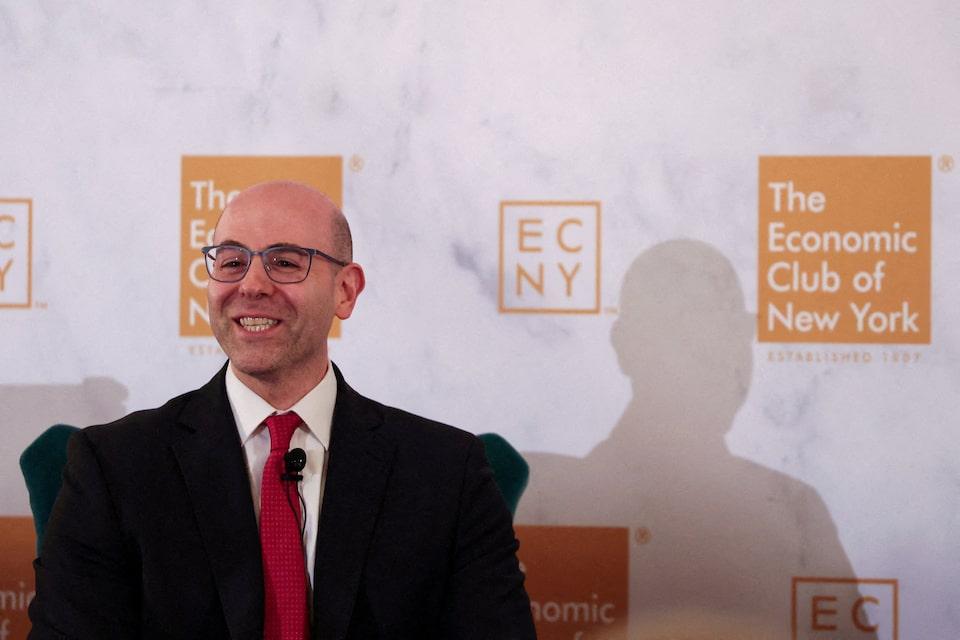

WASHINGTON, Nov 12 (Reuters) - The head of the U.S. Securities and Exchange Commission said on Wednesday the agency would soon consider establishing a classification for digital assets to help determine when they can be considered securities. "In the coming months, I anticipate that the Commission will consider establishing a token taxonomy" anchored in legal reasoning that distinguishes securities from commodities, SEC Chair Paul Atkins said, according to prepared remarks. This will recognize that there are "limiting principles to our laws and regulations," he added. Sign up here. The statement in an address to an annual financial technology gathering at the Philadelphia Federal Reserve Bank promised to deliver on key demands of the ascendant crypto sector, which, under the prior administration, had long clamored for greater clarity about the SEC's jurisdiction. U.S. President Donald Trump has embraced cryptocurrency after courting cash from the industry on the campaign trail, and has pledged to overhaul regulations that top crypto companies have long decried. In his speech, Atkins also said he expected the Commission would consider a "package" of exemptions allowing for a "tailored offering regime" for digital assets legally considered securities because they are subject to investment contracts. This would match legislation currently being drafted in Congress. Atkins also echoed President Donald Trump's call for lawmakers to adopt crypto market structure legislation before the end of this year. https://www.reuters.com/sustainability/boards-policy-regulation/wall-st-regulator-consider-crypto-token-classification-chair-says-2025-11-12/

2025-11-12 19:53

US oil output to hit record 13.59 million bpd this year, EIA says Agency raises global oil output, demand forecasts Still sees large surplus in global oil market US fuel prices to decline this year and next, EIA says NEW YORK, Nov 12 (Reuters) - U.S. oil production is expected to set a larger record this year than previously forecast, even as global oil supply outpaces fuel demand, the Energy Information Administration said in its Short-Term Energy Outlook report on Wednesday. The Department of Energy's statistical arm expects U.S. oil output to average 13.59 million barrels per day this year and then decline marginally to about 13.58 million bpd next year, the EIA said. Sign up here. The agency had earlier forecast U.S. oil output would post a slightly steeper decline from about 13.53 million bpd in 2025 to 13.51 million in 2026. It said the revisions to its forecasts were due to higher-than-expected production in August. Oil output averaged 13.23 million bpd last year, which was the prior record. Global crude oil and liquid fuels output is now expected to average 106 million bpd this year, the EIA said, up 100,000 bpd from its prior forecast. Global consumption is now forecast to average 104.1 million bpd, also up by a similar amount as the production forecast. RISING INVENTORIES Global oil inventories will grow through 2026 as production is increasing faster than demand for petroleum fuels, the EIA said, expecting it to pressure crude oil prices. Global crude oil stocks will rise to 2.93 billion barrels in the fourth quarter, up 52 million barrels from the third quarter, the EIA said. Inventories will reach 3.18 billion barrels by the final quarter of next year, the agency said. The changes to EIA's monthly forecasts were mostly neutral, but the agency continues to point to a large market surplus this year and next, UBS analyst Giovanni Staunovo noted. Global benchmark Brent crude is set to fall to an average of $68.76 per barrel this year, from an average of $80.56 last year, the EIA said. U.S. West Texas Intermediate crude futures are expected to average about $65.15 a barrel this year, down from $76.60 last year. FUEL PRICES TO FALL Petroleum fuel prices will fall as the price of oil comes down. U.S. retail gasoline prices are expected to fall to an average of $2.98 a gallon next year, which would mark the first time prices have averaged less than $3 a gallon since 2020. Retail diesel prices will drop to $3.50 per gallon in 2026, down over 4% from this year, the EIA said. https://www.reuters.com/business/energy/eia-raises-us-oil-output-forecast-says-oversupply-will-weigh-prices-2025-11-12/

2025-11-12 19:41

Bessent says no decisions yet on $2,000 rebate check Trump told Fox News that US would lower tariffs on coffee Bessent says other tax measures will boost incomes WASHINGTON, Nov 12 (Reuters) - U.S. President Donald Trump plans more domestic travel to sell his administration's efforts to drive down the cost of living, two people with knowledge of the matter said, as a top aide promised big moves to lower the price of coffee, bananas and other goods. Trump has focused intensely on the issue of affordability after a string of defeats for Republican candidates in last week's elections, while insisting that any higher costs were triggered by policies enacted by former President Joe Biden, and not his own sweeping tariffs. Sign up here. Democratic wins in New Jersey, New York and Virginia, driven in part by cost-of-living concerns, revealed concerns among voters over ongoing inflation, which economists say has been fueled in part by high import tariffs imposed by Trump. More than half of the line items reported in the monthly Consumer Price Index from the Labor Department were rising at more than a 3% annualized rate as of the latest report for September, according to analysis by Apollo Global Management Chief Economist Torsten Slok. “Cleaning up Joe Biden’s inflation and economic disaster has been a top focus for President Trump since Day One, when he signed an array of executive orders to unleash American energy and slash costly regulations," said White House spokesman Kush Desai, citing ongoing efforts to reduce prices for gasoline, eggs, medicines and other goods. "The Trump administration will continue to implement and emphasize these and other economic policies that are cutting costs, raising real wages, and securing trillions in investments to make and hire in America," he said. It was not immediately clear where or when Trump planned to travel to discuss his economic agenda. Treasury Secretary Scott Bessent told Fox News' "Fox and Friends" program earlier Wednesday that "substantial announcements" were planned in coming days to lowering the prices of products like coffee, bananas and other items not grown in the U.S. He gave no details, but said the measures would bring down prices "very quickly," adding that people would start feeling better about the economy in the first half of 2026. Coffee prices fell sharply on Wednesday amid signs that the U.S. will cut selected import tariffs, potentially easing supply tightness in the world's top consuming country. After last week's election defeats, Trump once again floated the prospect of giving households rebate checks funded by tariffs, and raised the prospect of a 50-year mortgage to encourage more people to buy homes. Bessent, asked about those ideas, said a $2,000 rebate check proposed by Trump would benefit those earning less than $100,000 per year, but no decisions had been made. He did not address the 50-year mortgage idea, which has sparked criticism from conservative allies, business leaders and lawmakers. LOWERING TARIFFS Trump, in an interview aired on Fox News' "The Ingraham Angle" show on Tuesday, said the U.S. would lower some tariffs on coffee imports, repeating comments he first made in late October during his trip to Asia. Coffee roasters in the U.S. have been plowing through their stockpiles as they await the outcome of ongoing U.S.-Brazil trade negotiations. Brazilian coffee, which accounts for a third of the beans consumed in the U.S., has been priced out of that market by the 50% import tariffs that Trump imposed in August. Asked about Trump's comments about lowering tariffs on coffee producers Vietnam and Brazil, Bessent said, "It's tough to do a lot of specific things, but I can tell you ... you're going to see some specific announcements in coming days in terms of things we don't grow here in the United States, coffee, coffee being one of them, bananas, other fruits, things like that." In September, U.S. consumers paid nearly 19% more than a year earlier for roasted coffee and nearly 22% more for instant coffee, according to that month's CPI report. Banana prices were up nearly 7% year over year compared with essentially no change for fresh fruit more widely. The U.S. grows bananas in Hawaii and Florida, but commercial production is limited and most bananas are imported from countries where labor is cheaper and land costs are lower. Bessent said other measures already taken by the Trump administration, including reducing taxes on overtime and tips, would kick in early next year, as well as moves to boost domestic manufacturing through foreign investment. "Real wages are going to increase," Bessent said. "I would expect in the first quarter, second quarter of next year .... Americans are going to start feeling better." Many households will see large tax refunds next year given changes in tax law, allowing deductions for car loans and ending taxes on Social Security benefits for some seniors. Parents of children born after December 31, 2024 and before January 1, 2029 could also receive a $1,000 initial deposit if they opened a Trump account, Bessent said. https://www.reuters.com/world/americas/bessent-says-substantial-moves-coming-cut-us-prices-coffee-other-items-2025-11-12/

2025-11-12 19:32

Nov 12 (Reuters) - Argentina's annual inflation rate fell for the 18th straight month in October, official data showed on Wednesday, as the monthly rate was a tick above market expectations. Consumer prices rose 2.3% in October, up from the 2.1% registered in September and just above analysts' forecast of 2.2%. Sign up here. Headline inflation fell in the 12 months through October to 31.3%, easing from the previous month's 31.8% rate and in line with forecasts. The annual rate is the lowest since July 2018, Economy Minister Luis Caputo said. The data comes after Argentine President Javier Milei secured in last month's midterm elections, enabling him to push ahead with overhauling the economy, despite discontent among many with his deep austerity measures. Fears about a possible inflationary spike ahead of last month's midterm vote were quelled following the disbursements of to calm the Latin American country's currency market. The October data "underscores the strength of the government's economic program and the success of its fiscal and monetary discipline in limiting the impact of financial volatility on Argentines' purchasing power," Caputo said in a post on X. Inflation is on track to end the year at its lowest annual level since 2018. Argentine analysts see annual inflation closing the year at 29.6%, according to a central bank market expectations survey released last week. https://www.reuters.com/world/americas/argentinas-annual-inflation-falls-october-lowest-since-mid-2018-2025-11-12/

2025-11-12 19:16

MOSCOW, Nov 12 (Reuters) - Russia and Kazakhstan have agreed to boost their partnership in the oil sector following talks between their respective presidents in the Kremlin on Wednesday. Russian President Vladimir Putin and Kazakh President Kassym-Jomart Tokayev concluded a two-day meeting in Moscow, where they were expected to discuss gas projects and the fallout from U.S. sanctions on Russian oil companies. Sign up here. "We agreed to strengthen our partnership in the areas of oil, oil products, coal, and electricity production, transportation, and supply. We discussed in detail the prospects for gas cooperation, in particular gas supply to Kazakhstan’s regions bordering Russia, as well as transit to third countries," Tokayev said in televised remarks following the talks with Putin. (This story has been corrected to fix the spelling of Kazakh president Kassym-Jomart Tokayev's first name in paragraph 2) https://www.reuters.com/business/energy/russia-kazakhstan-agree-strengthen-ties-oil-oil-products-after-talks-moscow-2025-11-12/

2025-11-12 19:01

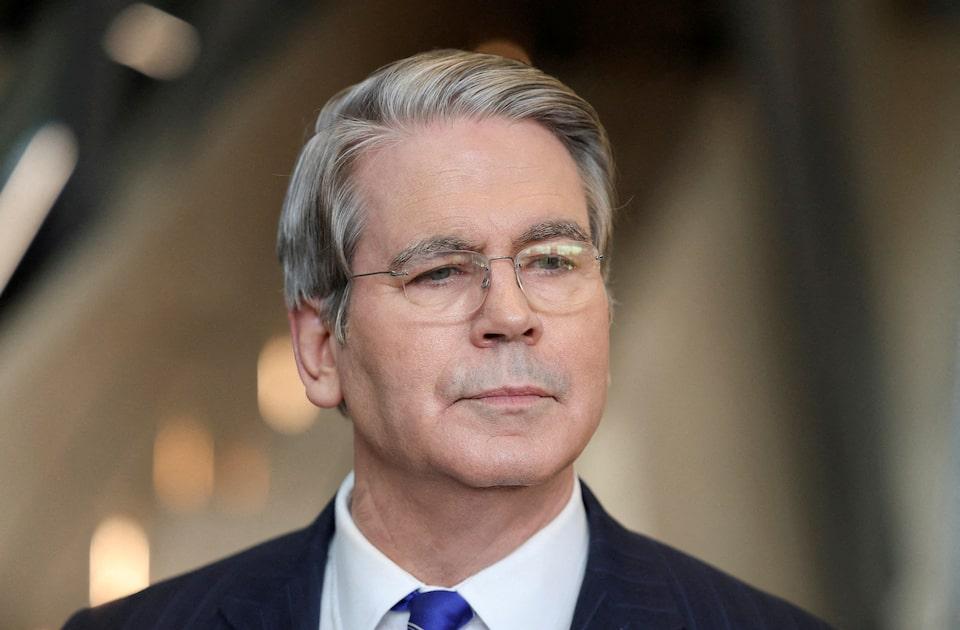

Nov 12 (Reuters) - Federal Reserve Governor Stephen Miran on Wednesday repeated his view that data showing inflation running above 2% is backward-looking and should not be taken at face value, and again described U.S. monetary policy as too tight mainly because he believes cooling housing inflation is easing price pressures. "To keep policy so tight in response to an artifact of the statistical measurement process rather than any actual supply-demand imbalances in the economy will then create the labor market weakness that we were tasked with avoiding," Miran said during an event hosted by the University of Cambridge Judge Business School. Sign up here. Inflation measures aren't fully capturing current and expected declines in rents as demand drops amid President Donald Trump's immigration crackdown, Miran argued. They are also elevated mechanically by stock market gains which should not be a driver of Fed policy, he said. "It's incumbent upon us to get monetary policy right, to get it out of such a restrictive state that would eliminate some of the downside risks to the economy." Miran, who is expected to return to his post as a top White House economic advisor when his term as a Fed governor ends in January, dissented at both of the U.S. central bank's most recent rate-setting meetings, calling for half-percentage-point rate cuts instead of the quarter-percentage-point reductions the Fed delivered at both meetings. Fed Chair Jerome Powell explained those rate cuts as insurance against further labor market slowing, and describes monetary policy now as modestly restrictive. Miran's self-described "out-of-consensus" view is that the Fed's policy rate is much too tight. Asked about his outlook for the economy, he pointed to the potentially stimulative effects of Trump administration policies like deregulation and tax policy, but said he did not have enough data to know where the economy stands now, a reference to the lack of official data during the U.S. government shutdown. https://www.reuters.com/markets/us/feds-miran-repeats-call-less-restrictive-monetary-policy-2025-11-12/