2025-11-10 22:54

WASHINGTON/ZURICH, Nov 10 (Reuters) - The United States is working with Switzerland on a deal to lower the 39% tariff rate it faces on exports to the U.S., President Donald Trump told reporters in the Oval Office on Monday, but said he had not yet settled on a new rate. Switzerland has been scrambling to secure a trade agreement with Trump that could reduce the 39% tariff rate that he slapped on Swiss imports in August, among the highest duties levied in his global trade reset. Sign up here. "We're working on a deal to get their tariffs a little bit lower," Trump said. "I haven't set any number, but we're going to be working on something to help Switzerland." Trump acknowledged that the U.S. had hit Switzerland hard, but said Washington viewed Switzerland as a good ally and wants the Alpine country to remain successful. The Swiss government declined to comment on Monday after Bloomberg reported the country was close to reaching a deal with the U.S. that would reduce Washington's tariffs on its exports to 15%. "The talks are ongoing and we do not comment further," a spokesman for the Swiss Department of Economic Affairs said. Bloomberg said a deal could be reached in the next two weeks, citing unnamed sources, adding that nothing had been finalized. Washington imposed duties of 39% on Swiss imports in August, threatening access for Swiss companies, which number the United States as one of their biggest markets for watches, machine tools and chocolate. https://www.reuters.com/business/swiss-government-declines-comment-report-new-tariff-deal-with-us-is-close-2025-11-10/

2025-11-10 22:27

EU Parliament supports 90% emissions cut by 2040 Backs plan to cover 5% of goal with carbon credits Committee rejects far-right lawmaker proposal to scrap the target Lawmakers, countries must agree on final goal BRUSSELS, Nov 10 (Reuters) - A committee of European Union lawmakers endorsed on Monday the EU's plan to cut net planet-warming emissions by 90% by 2040 and water down the effort required by domestic industries by allowing them to use foreign carbon credits for 5% of the goal. EU countries' climate ministers struck a final-hour deal on the legally-binding climate goal last week, just in time to avoid going empty-handed to the U.N.'s COP30 climate summit, which starts on Monday in Belem, Brazil. Sign up here. The target would let countries buy foreign carbon credits to cover up to 5% of the 90% emissions-cutting goal - weakening to 85% the emissions cuts required from European industries. A majority formed of centre-right, socialist and green lawmakers in the European Parliament's environment committee backed the deal on Monday, with 49 in favour, 33 against and 6 abstentions. The committee rejected a proposal by the Patriots for Europe, a far-right lawmaker group, to scrap the climate target completely. EU countries and lawmakers must negotiate the final target, before it can be fixed into law. Before those negotiations can start, the proposal has to win majority support from the full EU Parliament on Thursday. A 2040 target to cut domestic emissions 85%, against 1990 levels, falls short of the 90% the EU's scientific advisors had said would be in line with limiting global warming to 1.5 Celsius. The EU goal would still be one of the most ambitious climate change commitments among major economies worldwide. It reflects a hard-fought political compromise among EU governments, some of whom have sought to weaken EU climate measures against a tough geopolitical backdrop that has left them scrambling to increase defence spending and support industries reeling from U.S. tariffs. Ondřej Knotek, EU lawmaker with the far-right Patriots for Europe group, said the deal "makes, in my eyes, the life of citizens little bit more expensive". Green lawmakers had opposed the use of foreign carbon credits. However, they said they had managed to insert stronger rules, including that the EU would only buy credits from countries whose national climate plans are aligned with the Paris Agreement, which commits governments to try to limit temperature rise. https://www.reuters.com/legal/litigation/eu-lawmaker-committee-gets-behind-new-2040-climate-target-2025-11-10/

2025-11-10 22:25

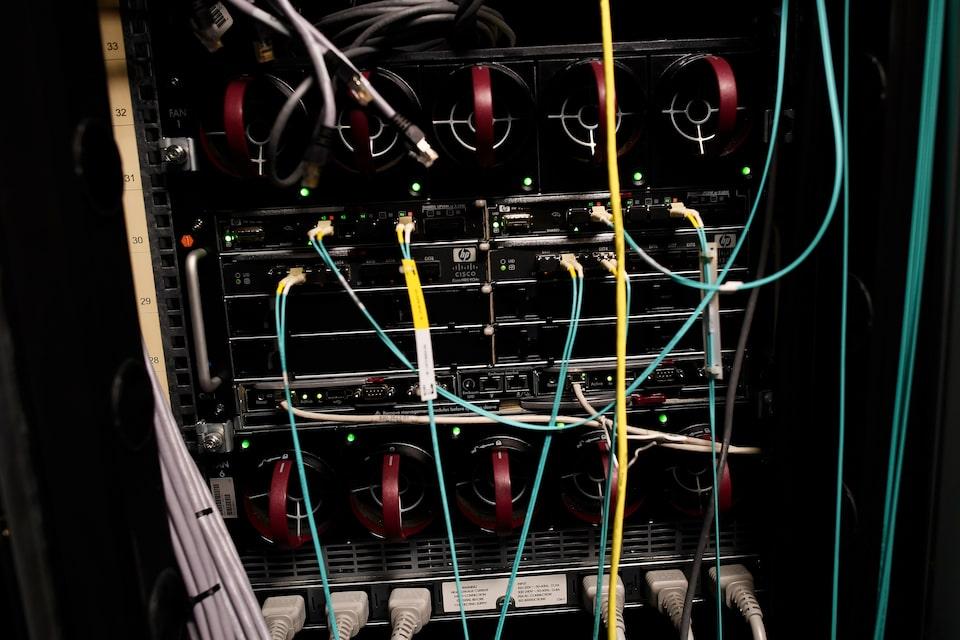

WASHINGTON, Nov 10 (Reuters) - U.S. Energy Secretary Chris Wright said on Monday the biggest use of the Department of Energy's Loan Programs Office will be for nuclear power plants. The LPO has hundreds of billions of dollars in financing aid, including loan guarantees for projects that struggle to get bank loans. During President Donald Trump's first term in the White House, the only use he made of the LPO was for financing reactors at the Vogtle nuclear power plant in Georgia. Sign up here. "By far the biggest use of those dollars will be for nuclear power plants to get those first plants built," Wright told a conference of the American Nuclear Society. The U.S. currently has no commercial nuclear reactors being built, though several intend to reverse their permanent shutdown status and open again, and there are other plans to build new large and small reactors. Wright said electricity demand from artificial intelligence and data centers will bring in billions of dollars of equity capital from "very creditworthy providers." That financing will be matched "three to one, maybe even up to four to one, with low-cost debt dollars from the Loan Programs Office," Wright said. https://www.reuters.com/business/energy/us-energy-secretary-says-biggest-use-loan-office-will-be-nuclear-power-plants-2025-11-10/

2025-11-10 22:16

ORLANDO, Florida, Nov 10 (Reuters) - U.S. and world stocks leaped on Monday as hopes that the U.S. government shutdown could soon end sparked a tech-fueled relief rally, while the yen slumped after Japan's Prime Minister Sanae Takaichi indicated her preference for looser fiscal and less hawkish monetary policy. More on that below. In my column today I look at the role currency hedging played in delivering a surprise 'win-win' for the Trump administration this year - a weaker dollar, and a Wall Street boom. Could the same stars align next year? Sign up here. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Today's Talking Points * Shutting down the shutdown The end of the longest U.S. government shutdown in history is close at hand, it seems, and financial markets are breathing a big sigh of relief. At least stocks are - the dollar is flat and Treasury yields rose no more than four basis points. Beyond the immediate 'relief rally,' is there much else markets can take from this? Other than the resumption of data collection and releases, perhaps not. Most of the lost economic output this quarter will be recouped the next. Maybe this just goes to show that investors are still more inclined to 'buy the dip' than 'sell the rip.' * Trump's $2,000 dividend checks U.S. President Donald Trump has floated the idea of sending most American households $2,000 'tariff dividend' checks. Now, with an end to the government shutdown potentially in sight, and following a bruising bout of gubernatorial and mayoral elections, could he actually deliver? There are plenty of hurdles, presumably including Congressional approval. And many analysts say it's not a credible policy while inflation is sticky, growth is solid and the deficit is so wide. But it is an insight into how the administration views the economy - run it hot and ignore the deficits. * US-China detente U.S.-China relations appear to be thawing. Two Reuters exclusives in recent days reveal that Beijing is designing a new rare earth licensing regime that could speed up exports, and FBI Director Kash Patel was in China last week to discuss fentanyl and law enforcement issues. It will be a long process, but it does look like both sides are putting the foundations of the trade deal framework agreed by Presidents Trump and Xi last month in place. And Washington will no doubt be pleased that Beijing's daily dollar/yuan fixing rate continues to grind lower. Another reason to 'buy the dip'? Trump's dollar balancing act may hinge on hedging The Trump administration scored a surprise win-win this year, as Wall Street boomed while the dollar fizzled. But a repeat next year is unlikely as the root of that sweet spot, dollar hedging, may be missing. A weaker exchange rate is central to President Trump and Treasury Secretary Scott Bessent's vision of restoring the might of U.S. manufacturing, increasing U.S. exports, and narrowing the country's huge trade deficit. The administration got its wish this year, with the dollar index clocking its worst January-June period in more than half a century, plunging as much as 12% at one point, while the S&P 500 shrugged off the 'Liberation Day' tariff chaos in April and soared to new highs. The key ingredient in this unusual mix was dollar hedging. Overseas investors baulked at Trump's economic and foreign policy agendas early into his second term in office, but they still wanted exposure to the artificial intelligence-fueled equity boom. So they hoovered up U.S. stocks, but hedged the currency risk by selling the dollar via derivatives contracts. PEAK HEDGING? The dollar has been broadly steady since June, while Wall Street has moved ever higher, suggesting there may still be sufficient hedging activity capping the dollar's upside. In fact, more than 80% of U.S. equity inflow from abroad is now hedged, according to Deutsche Bank. If true, that suggests there's not much scope to increase. Of course, no official hedging data exists, nor any singular method to measure it, resulting in a wide range of estimates, with Deutsche Bank's approximation at the top end. Strategists at JPMorgan reckon hedging demand has cooled in recent months as the apocalyptic trade war fears of earlier this year have faded and the dollar has stabilized. They analyze net inflows into U.S. equity exchange-traded funds domiciled abroad, assessing what percentage of this capital goes to currency-hedged versus unhedged ETFs. There has been steady demand for both from foreign investors since July, but the flow in dollar terms has been significantly skewed to the much-larger pool of unhedged ETFs. ON THE WANE How will hedging demand shape up next year? If the world's view of the dollar and the U.S. darkens as it did early this year, investors are likely to maintain high hedge ratios, limiting the dollar's upside even if foreign buyers retain their appetite for Big Tech-related equities. On the other hand, the AI-driven 'U.S. exceptionalism' narrative has re-emerged since mid-year. Just look at Nvidia's recent $5 trillion valuation. If the U.S. economy outperforms next year, foreign investors may have little reason to hedge at all. A Bank for International Settlements study in June concluded that "the relative importance of hedging may wane as a driver" for the dollar, and that the U.S. economic outlook is likely to weigh more heavily in investors' minds moving forward. POLICY PARADOX How does this tie in with Trump's economic agenda? This is where things get complicated. While a softer greenback is at the core of Trump's policy, it is also at odds with another administration goal for the coming year - attracting a tidal wave of record investment from overseas governments and corporations into the U.S. that Bessent claims will lift Main Street and Wall Street in tandem. "Trillions and trillions of dollars (are) being poured back into our country by other countries and other places and people," Trump told a business forum in Miami last week, claiming that he has already secured $18 trillion in pledged investment from abroad, which will allegedly rise to $21 trillion. Even if these figures are heavily embellished, there remains a fundamental inconsistency, for Main Street at least. Huge capital inflows should, all else being equal, cause the dollar to appreciate. Hedging is a key reason why the dollar has weakened so much this year even as investors ploughed cash into the U.S. stock market. If this drag on the dollar is removed, but significant capital inflows keep coming, the administration's 'America First' industrial policy has a big problem. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/world/china/global-markets-trading-day-graphic-2025-11-10/

2025-11-10 21:38

Nov 10 (Reuters) - Plug Power (PLUG.O) , opens new tab expects to generate more than $275 million by monetizing assets, releasing restricted cash and lowering maintenance expenses, it said on Monday, as the hydrogen fuel cell maker shifts focus to higher-return opportunities and the fast-growing data center market. Shares of the company were up over 10% in premarket trade. Sign up here. The company signed a non-binding letter of intent to monetize its electricity rights in New York and another U.S. location, and to partner with a domestic data center developer expanding facilities across the country. Plug said the collaboration will explore using its hydrogen-powered fuel cells to supply backup and auxiliary power for data centers, a sector facing rising demand for reliable, low-carbon energy. The move underscores Plug's shift toward higher-return projects and its push to commercialize hydrogen technology in energy-intensive industries. The company said it would suspend participation in the U.S. Department of Energy's loan program and redirect capital to faster-payback opportunities across its hydrogen network. "The actions we are taking today reflect Plug's agility and financial discipline," CEO Andy Marsh said. "Monetizing these assets strengthens our balance sheet, while partnering on a large-scale data center development expands our reach into a dynamic, high-growth market that values reliability, resiliency and sustainability." Last month, the company named insider Jose Luis Crespo as its next chief executive officer, who will take on the role after the filing of Plug's 2025 annual report in March 2026. Plug had over $140 million in unrestricted cash and cash equivalents as of June 30. Plug Power said on Monday it will continue to evaluate hydrogen production and infrastructure projects aligned with its long-term cost and growth goals. The company operates plants in Georgia, Tennessee and Louisiana with total production capacity of 40 tons of hydrogen supply per day, serving major customers including Walmart (WMT.N) , opens new tab, Amazon (AMZN.O) , opens new tab and BP (BP.L) , opens new tab. https://www.reuters.com/business/energy/plug-power-unlock-275-million-pivot-toward-data-center-power-market-2025-11-10/

2025-11-10 21:37

Nov 10 (Reuters) - Oilfield services provider Baker Hughes (BKR.O) , opens new tab will supply key equipment for the proposed Alaska LNG project that aims to build a pipeline and terminal to send natural gas from the North Slope of Alaska for export to Asia and other markets, the project's top developer said on Monday. PROJECT DETAILS • Baker Hughes will supply refrigerant compressors for the terminal and power generation equipment for a gas treatment plant on the North Slope. Sign up here. • The $44 billion project involves building an 800-mile (1,287-km) pipeline to transport gas from Alaska's North Slope to the Gulf of Alaska for liquefaction and export. • The project has received new impetus under President Donald Trump, who wants to maximize fossil fuel development, but faces hurdles including high costs and rugged terrain. • "With someone like Baker Hughes coming in it's a stamp of approval," said Brendan Duval, CEO of Glenfarne Group, the project's lead developer. • Glenfarne bought a 75% stake in Alaska LNG in March from the Alaska Gasline Development Corporation. • A final engineering study is expected late this year, with investment decisions on the pipeline expected early next year and the terminal in late 2026. https://www.reuters.com/business/energy/baker-hughes-commits-investment-glenfarne-alaska-lng-project-2025-11-10/