2025-11-03 17:09

WASHINGTON, Nov 3 (Reuters) - Google owner Alphabet (GOOGL.O) , opens new tab is tapping the U.S. dollar and euro debt markets in a multi-tranche senior unsecured notes offering. The digital media and tech giant will use the proceeds from the note sale for general corporate purposes, including the potential repayment of a portion of its outstanding debt, according to a Monday report by Moody's Ratings. Sign up here. Alphabet last took out fresh debt in April, tapping the euro debt market for 6.75 billion euros ($7.87 billion) for the first time. Tech peer Oracle (ORCL.N) , opens new tab itself sought $18 billion in new debt in September, while Meta (META.O) , opens new tab raised $30 billion in bonds last month. Demand for cloud and artificial intelligence services from Alphabet and other tech conglomerates is on the rise. "These corporations are saying they’re capacity constrained," said Emile El Nems, senior credit officer at Moody's Ratings. "Layer on top of that the potential demand that could be coming in from AI computing and you say to yourself there is something there," he added, referring to an apparent trend of tech companies tapping the debt markets. Alphabet, Oracle and Meta are also less levered than their peers, he said. Alphabet has maintained a leading market position through its array of digital services, most notably its Google search service where it has integrated its Gemini AI platform. The company also holds dominant market positions through its advertising and YouTube businesses. A representative for Alphabet did not immediately return a request for comment. ($1 = 0.8575 euros) https://www.reuters.com/business/media-telecom/google-owner-alphabet-tap-us-euro-bond-markets-2025-11-03/

2025-11-03 16:33

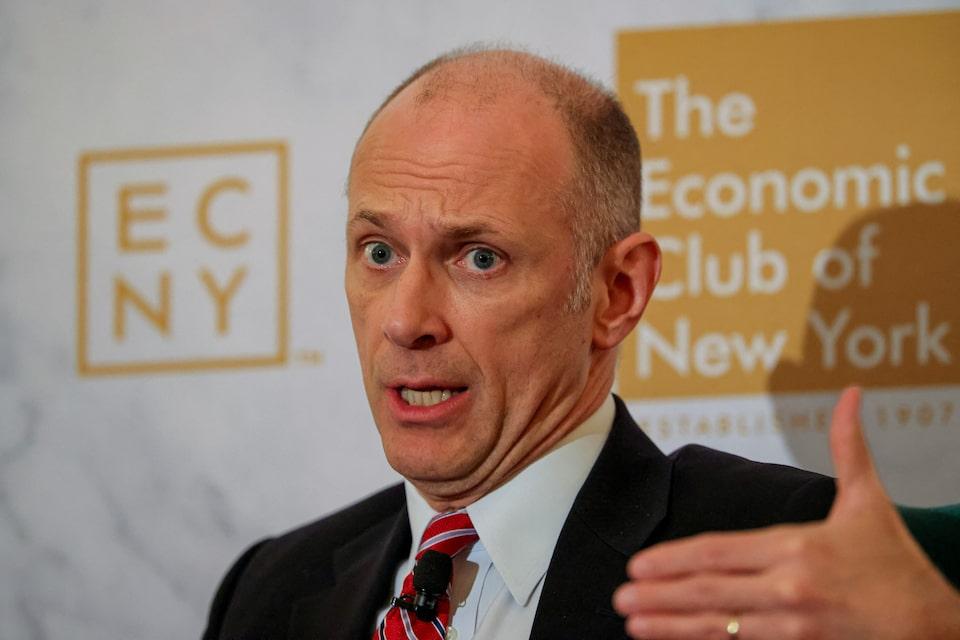

Goolsbee undecided on December rate cut amid high inflation Fed Chair Powell warns rate cut not guaranteed in December Goolsbee cautious due to unclear economic data from government shutdown Nov 3 (Reuters) - Federal Reserve Bank of Chicago President Austan Goolsbee said on Monday he's in no hurry to cut interest rates again with inflation still too far above the central bank's 2% target. "I'm not decided going into the December meeting" and "my threshold for cutting is a little bit higher than it was at the last two meetings," Goolsbee said in a Yahoo Finance interview. "I am nervous about the inflation side of the ledger, where you've seen inflation above the target for four and a half years, and it's trending the wrong way." Sign up here. Goolsbee was interviewed after last week's Federal Open Market Committee meeting that saw policymakers cut their interest rate target by a quarter percentage point, to between 3.75% and 4%, as officials sought to offset rising risks to the job market while still keeping interest rates in a position where they'll help lower inflation pressures. He holds a vote this year. While financial markets still expect the central bank to deliver an interest rate cut at the FOMC meeting in December, Fed Chair Jerome Powell cautioned last week that "a further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it. Policy is not on a preset course." In the interview, Goolsbee acknowledged that the job market is showing some signs of weakness but that many key metrics are still pointing to stability, although there's an unwelcome lack of clarity given the government shutdown that's thwarted the release of key economic data. Goolsbee tied his preferred path for monetary policy to what happens with price pressures. "Rates can come down a fair amount," he said, noting "it would probably be most judicious to have the rates come down with inflation." The Chicago Fed leader said that his current reading on the economy was not that different from what he thought in September, when officials last offered forecasts for the economy. He cautioned against cutting rates too much given the current lack of clarity on what's happening. He flagged concerns about "front loading" rate cuts when "we have the data shutdown, we're getting some information about the job market, and we have very little private sector information about inflation. So I think we want to be wary" about lowering the cost of short-term credit. https://www.reuters.com/sustainability/boards-policy-regulation/feds-goolsbee-is-fence-about-need-cut-rates-december-2025-11-03/

2025-11-03 16:21

BRASILIA, Nov 3 (Reuters) - Brazil has established new rules raising the minimum capital required for financial institutions to operate in the country to 9.1 billion reais ($1.68 billion) from 5.2 billion reais, the Central Bank of Brazil said on Monday. Around 500 firms could be affected, with the changes potentially triggering market exits, mergers or corporate restructuring, the bank said in a statement. Sign up here. The new framework will base minimum capital and net worth requirements on the activities performed by institutions, rather than their classification. Institutions that use the term "bank" or similar expressions in their name will be subject to an additional capital buffer, it added. The rules take effect immediately, with a phased implementation through January 2028. Accounts opened by financial technology firms at traditional banks but with limited traceability of the actual fund holder must be closed if used for unauthorized financial services or to conceal third-party obligations, according to the regulation. The move aims to close loopholes that obscure final beneficiaries following police investigations under Operation Hidden Carbon, which found fintechs were used for criminal activity. It also addresses cybersecurity risks linked to technology service providers. ($1 = 5.4039 reais) https://www.reuters.com/world/americas/brazil-tightens-minimum-capital-requirement-rules-could-impact-500-firms-2025-11-03/

2025-11-03 15:51

HARARE, Nov 3 (Reuters) - Zimbabwe's annual inflation rate could halve from current levels by the end of 2025, driven by a stable local currency supported by high gold prices, according to a report by the Confederation of Zimbabwe Industries released on Monday. Annual inflation in Zimbabwe measured in the Zimbabwe Gold (ZiG) currency fell sharply to 32.7% in October from 82.7% in September, the CZI said. The organization expects inflation to decline further, potentially reaching between 15% and 20% by December 2025. Sign up here. This projection is attributed to negative month-on-month inflation in recent months and a stable ZiG currency, bolstered by surging gold prices. "The policy target is for an annual ZiG inflation of about 30%. The negative month-on-month inflation for the past two months has helped increase chances of this happening," the CZI said in its October 2025 Inflation and Currency Developments Update. The CZI, Zimbabwe's main business lobby representing manufacturing and industrial firms, publishes independent macroeconomic data that investors use as an early indicator of domestic price and currency trends. The ZiG currency, partly backed by gold, has maintained stability in official markets, with a parallel market premium of approximately 20%, analysts at Oxford Economics said. Gold production in Zimbabwe is forecast to surpass the record 38.4 tonnes achieved in 2024, driven by high bullion prices, according to the same analysts. Zimbabwe has grappled with persistent inflation and currency instability for over two decades, with frequent dollarization episodes undermining confidence in local money. A sustained reduction in inflation would be a critical step toward restoring policy credibility and facilitating economic recovery in the Southern African nation. https://www.reuters.com/world/africa/zimbabwes-inflation-set-drop-amid-stable-currency-gold-boom-2025-11-03/

2025-11-03 15:18

EBA flags 'meaningful currency mismatch' in banks' balance sheets Warning comes as banks asked to stress test dollar resilience EBA study shows EU banks subsidiaries increase dollar dependence MILAN/LONDON, Nov 3 (Reuters) - European banks increased their reliance on U.S. dollars last year, Europe's banking regulator said on Monday, amid growing concerns about the region's vulnerability should dollar financing dry up. Banks globally have significant dollar exposure in their balance sheets, making them vulnerable to potential funding shocks. Sign up here. Dollar funding fears have grown since U.S. President Trump announced a wave of trade tariffs and began putting pressure on the Federal Reserve earlier this year. That has led some European central banking and supervisory officials to question whether they can still rely on the Fed to provide dollar funding in times of market stress. The European Central Bank's Chief Economist Philip Lane said last month that euro zone banks may come under pressure if dollar funding were to dry up. The European Banking Authority said in a new report that European banks' funding in dollars including deposits represented 13.1% of their total funding in December 2024, up from 12.4% a year earlier. Banks' total exposure to assets denominated in dollars also rose to 23% from 19.3%, the EBA said. Reuters reported earlier this year that European and UK regulators have asked banks to monitor and stress test their resilience to dollar shocks. The EBA - which has a mandate to protect and support the EU financial system - also said that data indicated banks' subsidiaries are increasing their reliance on U.S. dollar funding at a faster pace than their parent entities. The share of dollar funding increased the most during 2024 for securities financing transactions and unsecured wholesale funding, the EBA study shows. BANKS FACING A 'MEANINGFUL CURRENCY MISMATCH' The banking authority also warned about "a rather meaningful currency mismatch" in European banks' balance sheets, something regulators in Europe have asked lenders to monitor, Reuters has reported. The EBA added that, as of December 2024, one third of EU banks' assets were denominated in foreign currencies, compared with just one fifth of their liabilities. Earlier in October, the International Monetary Fund said supervisors and banks should effectively monitor and manage liquidity risks in significant currencies. "At the individual institution level, attention needs to be paid to any significant currency gaps in the stable funding requirements unless these are adequately hedged," the regulator added. Some EU banks have a net stable funding ratio (NSFR) - a measure of stable funding to cover a lender's long-term assets - below the 100% minimum in some foreign currencies including the dollar, the EBA said. https://www.reuters.com/sustainability/boards-policy-regulation/european-banks-increase-reliance-us-dollar-funding-eu-regulator-finds-2025-11-03/

2025-11-03 14:44

Treasury to keep auction sizes for notes, bonds steady QT end to reduce Treasury's financing needs Economists note strong tariff receipts Focus on T-bills with Fed as ready buyer JP Morgan sees lower deficit for 2026 NEW YORK, Nov 3 (Reuters) - The U.S. Treasury is widely expected this week to announce its intention to keep note and bond auction sizes unchanged over the next 12 months, at least, as it likely continues to issue more bills and shorter-term debt to manage a sizable fiscal deficit. The Treasury will release its quarterly borrowing estimates on Monday at 3:00 p.m. ET (2000 GMT), followed by the quarterly refunding on Wednesday at 8:30 a.m. ET (1330 GMT). The refunding outlines details of the Treasury's financing plans for the upcoming quarter, including auction sizes for three-year and 10-year notes and 30-year bonds. Sign up here. The government's top fiscal authority has held bond and note auction sizes steady since February 2024 - a stance unlikely to change until late next year or early 2027, analysts said. "The (yield) curve has not steepened enough to the point that the Treasury will respond aggressively with their issuance patterns," said Brendan Murphy, head of fixed income, North America at Insight Investment. "There certainly has been more focus and pressure on the long end. The Treasury will likely adapt to that by issuing more bills and less coupons." The share of Treasury bills in the overall debt mix is expected to climb further from its current 21%, analysts said, as the government leans more heavily on short-term borrowing. Net bill issuance for 2026, excluding Federal Reserve purchases, is expected to rise to $555 billion from $344 billion this year, while net issuance of coupons - Treasury notes and bonds that pay interest - is seen falling to $1.5 trillion from $1.9 trillion this year, J.P. Morgan estimates showed. Analysts said the end of the Fed's balance sheet reduction program, also known as quantitative tightening (QT), will help keep debt issuance steady as it reduces the Treasury's financing needs. Under QT, the Fed allows bond holdings to mature without reinvestment, effectively increasing Treasury's borrowing requirements. To redeem maturing debt held by the Fed, the Treasury draws from its cash balance at the central bank, which it must then replenish by issuing new securities. The end of QT reverses that process. The Fed also announced last week it will start reinvesting all proceeds from maturing mortgage-backed securities into T-bills starting December 1, a move likely to encourage more bill issuance. "You probably need to increase bill supply by about $600 billion if the Fed is reinvesting mortgages into bills," said Joseph Abate, head of rates strategy at SMBC Nikko Securities. "It may seem like a lot, but if the Fed is there buying, $600 billion hopefully is not going to be hard to digest." LOWER BORROWING ESTIMATES Economists overall foresee lower borrowing estimates for the fourth quarter. In the last July announcement, the Treasury said it expected to borrow $590 billion in the last three months of 2025, with a projected cash balance of $850 billion by end-December. Jefferies Chief U.S. Economist Tom Simons said, in a research note, that he expects a moderate downward revision in net borrowings in the fourth quarter to $525 billion due in part to stronger-than forecast tariff revenue. J.P. Morgan also expects slightly lower-than-expected borrowings in the fourth quarter of $564 billion and $639 billion in the first three months of next year. The Treasury said in July that it expected to borrow $1.007 trillion in the third quarter partly to replenish its cash balance that dwindled during the latest debt ceiling episode. It is set to reveal the actual borrowing total later on Monday. In the meantime, strong demand for T-bills has allowed the Treasury to delay increases in longer-dated debt auctions, a strategy that has raised concerns about the potential risk of relying too much on short-term funding. Analysts warned that over-reliance on short-term borrowing could increase volatility in financing the deficit and heighten rollover risks if market conditions shift. That said, the fiscal picture seems to have evolved, analysts said. J.P. Morgan has revised lower its 2026 U.S. deficit forecast to $2.035 trillion from $2.125 trillion, citing a $350 billion boost in tariffs. Other financial institutions such as SMBC Nikko Securities also slightly lowered their deficit estimates for next year. One potential complication, however, is a looming U.S. Supreme Court ruling that could determine whether President Donald Trump's authority under the International Emergency Economic Powers Act extends to imposing tariffs without congressional approval. If the ruling goes against Trump, the U.S. government would have to return hundreds of billions of dollars in tariffs. The Supreme Court is set to hear oral arguments on November 5, with a decision likely before year-end. "Uncertainty around the future of tariff collections is hugely important for the overall deficit and issuance needs by the Treasury," said Zachary Griffiths, head of investment grade and macro strategy at CreditSights. https://www.reuters.com/business/no-surprises-seen-us-debt-issuance-t-bills-up-bonds-steady-2025-11-03/