2025-11-03 07:45

ANKARA, Nov 3 (Reuters) - Turkish inflation eased to 32.87% annually and to 2.55% monthly in October, both below expectations, according to official data on Monday that could reinforce the central bank's decision to slow but not stop its rate-cutting cycle. A Reuters poll had forecast annual inflation of 33.24% and a monthly rise of 2.83%. Sign up here. Consumer price inflation (CPI) in the heavily weighted food group came in at 34.9% annually and 3.4% monthly, Turkish Statistics Institute data showed. Driving some of the price pressure, housing inflation topped 50% on an annual basis while clothing topped 12% on a monthly basis. In September the annual rate was 33.3% and the monthly rate was 3.2%, marking the second month in a row that CPI was higher than expected. That prompted the central bank to slow its interest rate easing cycle with a 100-point cut last month to 39.5%. Some analysts had expected the central bank to halt its easing, especially if October inflation was higher than expected. Minutes published on Friday showed the bank warning that risks to disinflation, particularly from food prices, had become more pronounced and that inflation expectations picked up in October, even as the pace of food price increases slowed. Finance Minister Mehmet Simsek said on Friday that it appears difficult to hit the 25-29% forecast range for inflation at the end of this year but added that disinflation would continue strongly in 2026. Producer prices rose 1.63% month on month in October for an annual increase of 27%, the data showed. https://www.reuters.com/world/middle-east/turkey-inflation-dips-below-33-more-than-expected-2025-11-03/

2025-11-03 07:35

LONDON, Nov 3 (Reuters) - A 32-year-old British man accused of stabbing multiple passengers on a train in eastern England was not known to counter-terrorism police or security services, transport minister Heidi Alexander said on Monday. The attack on Saturday evening - which police said was not being treated as terrorism - left 11 people injured, including a member of the train crew who remains in hospital in a critical but stable condition, Alexander said. Sign up here. Five of the injured had been discharged from hospital by late on Sunday. Alexander told Times Radio on Monday that the suspect, who was arrested on suspicion of attempted murder, had not been flagged to counter-terrorism authorities prior to the attack. "I can tell you he was not known to counter-terrorism police, he was not known to security services," Alexander said, adding that she could not comment on whether the man had been known to mental health services. British Transport Police said officers responded within eight minutes of the first emergency call. A knife was recovered at the scene and CCTV footage reviewed by detectives showed a train crew member intervening to stop the attacker. "He literally put himself in harm's way," Alexander said. "There will be people who are alive today because of his actions." The suspect was arrested after the train made an emergency stop at Huntingdon, about 80 miles north of London. Authorities said they were not seeking anyone else in connection with the incident. https://www.reuters.com/world/uk/uk-train-stabbing-suspect-not-known-counter-terrorism-police-minister-says-2025-11-03/

2025-11-03 07:18

MUMBAI, Nov 3 (Reuters) - Goldman Sachs is advising clients to take a bullish position on the Indian rupee, using an exotic option structure, despite its latest slide toward its all-time low. Taking positive cues from developments in India-U.S. trade negotiations - such as the reduction of Russian oil purchases by state-run refiners - analysts at Goldman Sachs expect the rupee to appreciate by 1-2% if U.S. tariffs on Indian goods are set at or below 25%. Sign up here. The upbeat view comes despite the currency on Monday dipping near its lifetime low of 88.80 to the U.S. dollar. BY THE NUMBERS The firm recommends buying a put option on the dollar-rupee pair with a strike price of 88, expiring in March 2026 and with a European knock-out at 85.5. The option is essentially a bet on a rally in the rupee. It pays off if the rupee appreciates, though it would be knocked out — or expire worthless — if the dollar/rupee exchange rate drops below 85.50 at any point before expiry. The knock-out helps lower the cost of the option. The analysts also recommend one more bullish wager on the rupee - a relative-value position that bets the Indian currency will outperform its Indonesian peer over the next 3 months. WHY IT'S IMPORTANT The rupee has been the worst-performing major Asian currency this year, having fallen about 3% so far due to concerns over steep U.S. trade tariffs and heavy outflows from local shares. Goldman is counting on better news on the tariff front. KEY QUOTES "In a scenario where tariff discussions stall, we expect the RBI to manage the pace of INR depreciation and intervene more aggressively near 88.80 in the near term, a level which RBI had been defending recently," the analysts said in a note. "We believe any INR appreciation will likely be capped due to the RBI’s preference to trim forward book shorts in an appreciating INR environment, along with higher corporate hedging activity." GRAPHIC https://www.reuters.com/world/india/goldman-sachs-backs-bullish-indian-rupee-wager-banking-tarriff-turnaround-2025-11-03/

2025-11-03 07:15

Oil majors’ refining earnings rise sharply in Q3 Russian fuel exports drop after months of attacks on its refineries US, European sanctions offer further boost to oil majors LONDON, Nov 3 (Reuters) - Top Western oil companies are enjoying a windfall from the expanding attacks on Russia's oil industry – both literal and economic – that have boosted global refining profit margins and mitigated concerns over a looming supply glut. Waves of Ukrainian drone strikes on Russia's vast network of refineries and export terminals since July have hammered the country's exports of refined fuel, such as diesel and fuel oil. Russia's seaborne refined product exports in September dropped by 500,000 barrels per day from their 2025 highs to around 2 million bpd, the lowest level in over five years, according to Kpler data. Sign up here. Curtailed Russian exports have boosted global refining margins, benefiting energy giants like Shell (SHEL.L) , opens new tab, Exxon Mobil (XOM.N) , opens new tab, Chevron (CVX.N) , opens new tab and France's TotalEnergies (TTEF.PA) , opens new tab, which jointly operate nearly 11 million bpd, over 10% of global refining capacity. The four companies posted a combined 61% rise in profits from refining operations in the third quarter compared with the previous quarter, which contributed in large part to their 20% rise in overall profits. Exxon, the largest U.S. oil company, saw earnings in its energy product division rise more than 30% on a quarterly basis to $1.84 billion, driven by strong refining margins "due to supply disruptions," the company said on Friday. BP (BP.L) , opens new tab will report results on Tuesday, and it also looks set to benefit from these positive global refining trends. The British firm’s refining indicator margin, a gauge for its global operations, rose to $15.8 per barrel in the three months through September, a 33% quarter-on-quarter increase, and this figure is running at $15.1 per barrel in the fourth quarter thus far. Stronger refining earnings will help offset declines in oil prices as the market appears to enter a period of significant oversupply. The volatility in energy markets created by Western sanctions and other geopolitical conflicts has also benefitted the trading divisions of the oil majors, in particular Shell, BP and TotalEnergies. These trading desks can generate huge profits by rapidly responding to small changes in supply and demand dynamics. Shell, the world's largest oil trader, does not disclose the division’s profits. However, it reported that stronger trading and refining margins boosted adjusted earnings in its chemicals and products division by $706 million in the third quarter compared with the previous three months. BENEFICIAL BANS Refining margins are apt to stay elevated in the near term in response to the recent escalation in Western governments’ efforts to pressure Moscow to end the war in Ukraine. The European Union stepped up its economic warfare against Russia in July when it announced plans to ban imports of fuels produced from Russian crude oil as of January 2026. The EU is seeking to close a loophole in previous sanctions packages that allowed refiners in India, Turkey and elsewhere to use discounted Russian feedstock to produce diesel and jet fuel that was then often sold to Europe. The ban, which the EU formally approved earlier this month, again puts the Western oil majors in an advantageous position as non-Russian crude – including refined products made with non-sanctioned crude – will now be in higher demand. Western energy giants then got another positive surprise last month when U.S. President Donald Trump on October 22 sanctioned Russia's two top oil companies, Rosneft and Lukoil, which together account for 5% of global crude supply and 3.3 million bpd of crude and refined product exports, roughly half of Russia's total. The sanctions boosted oil prices and refining margins as buyers of Russian crude and products, particularly in India and Turkey, scrambled to find alternative supplies. Does the combination of escalating Western sanctions and Ukrainian drone strikes mean the oil market should expect to see a repeat of the huge price rally that shook the market in the immediate aftermath of Russia's invasion in 2022, leading to record profits for the oil majors? Probably not. The oil market today is well supplied and far better equipped to adapt to the impact of sanctions, especially given the expansion of the so-called “shadow fleet” of tankers that has been able to circumvent Western sanctions to sell Russian oil. But the targeting of Russia’s oil and gas industry should, nevertheless, continue to be a boon to Western oil majors, which benefit from large upstream oil production as well as sprawling refining and trading operations. Want to receive my column in your inbox every Monday and Thursday, along with additional energy insights and links to trending stories? Sign up for my Power Up newsletter here. Enjoying this column? Check out Reuters Open Interest (ROI), , opens new tabyour essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis. Markets are moving faster than ever. ROI , opens new tab can help you keep up. Follow ROI on LinkedIn , opens new tab and X. , opens new tab https://www.reuters.com/markets/commodities/big-oil-gets-big-boost-escalating-economic-war-russia-2025-11-03/

2025-11-03 07:02

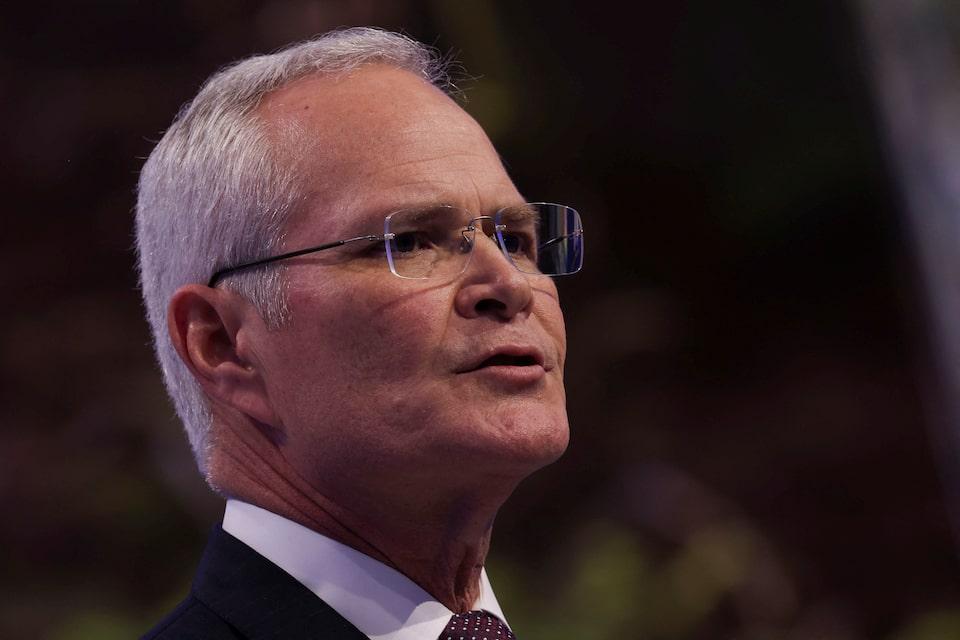

ExxonMobil CEO warns EU law could force exit from Europe EU law demands climate plan aligned with Paris Agreement, Woods says Qatar threatens again to halt LNG supply to Europe over sustainability law ABU DHABI, Nov 3 (Reuters) - Executives at two of Europe's top gas suppliers, ExxonMobil and QatarEnergy, on Monday warned they could stop doing business with the European Union if it does not significantly loosen a sustainability law that could impose fines of 5% of their global revenue. Exxon CEO Darren Woods told Reuters on the sidelines of the ADIPEC meeting in Abu Dhabi that the EU's Corporate Sustainability Due Diligence Directive would have "disastrous consequences" if adopted in its current form. Sign up here. The directive requires companies doing business in the bloc to address human rights and environmental risks across their supply chains, and aims to hold companies accountable for harm even in operations outside Europe. "If we can't be a successful company in Europe, and more importantly, if they start to try to take their harmful legislation and enforce that all around the world where we do business, it becomes impossible to stay there," Woods said. Qatar's Energy Minister Saad al-Kaabi, who is also QatarEnergy's CEO, told Reuters at the same conference that the gas giant has contingency plans in place if it decides to halt European shipments - a threat Kaabi has repeatedly warned is not a bluff. 'WE CAN'T REACH NET ZERO' Speaking at ADIPEC on Monday, Kaabi reissued a threat to halt supplying Europe with liquefied natural gas, saying it will not be able to continue doing business in Europe if the EU doesn't change or cancel the law. "We can't reach net zero, and that's one of the requirements, among other hosts of things," said Kaabi. "Europe needs to understand that, I think, they need the gas from Qatar. They need gas from the U.S.," he said. "They need the gas from many places around the world ... it's very important that they look at this very seriously." Woods said the legislation demands that large companies like ExxonMobil implement climate transition plans aligned with the Paris Agreement's goal of limiting global warming to 1.5°C above pre-industrial levels - a requirement he described as technically unfeasible. "What's astounding to me is the overreach not only requires us to do that for the business that we're doing in Europe, but it would require me to do that for all my business around the world, irrespective of whether it touches Europe or not," he said. COMPANIES AMONG EUROPE'S TOP SUPPLIERS ExxonMobil and QatarEnergy are among Europe’s top LNG suppliers, with the U.S. major contributing to the roughly 50% of EU imports from American producers in 2024, while Qatar has supplied between 12% and 14% of the bloc’s LNG since Russia’s 2022 invasion of Ukraine. Europe is also a significant market for both companies, with Exxon saying last year it had invested 20 billion euros ($23.32 billion) in the region in the previous decade, while QatarEnergy has long-term supply contracts with Britain's Shell (SHEL.L) , opens new tab, France's TotalEnergies (TTEF.PA) , opens new tab, and Italy's ENI (ENI.MI) , opens new tab. The two companies, whose gas shipments to the continent ramped up sharply after it cut off supplies from Russia, are now pushing the bloc to abandon part of its green strategy. The governments of Qatar and the U.S. last month urged European heads of state to reconsider the law, which they said threatens Europe's supply of reliable, affordable energy. The European Parliament has agreed to negotiate further changes to the law, and the EU aims to approve the final changes by year-end. "We would love to serve Europe. We have been committed to Europe," Kaabi said. "We're not asking for anything special, we're saying we want to compete in a market that is fair." https://www.reuters.com/sustainability/exxonmobil-ceo-warns-eu-sustainability-law-could-end-europe-operations-2025-11-03/

2025-11-03 06:46

PERTH, Australia, Nov 3 (Reuters) - U.S. independent ConocoPhillips (COP.N) , opens new tab began drilling its first exploration well as part of larger campaign searching for natural gas offshore eastern Australia, 3D Energi (TDO.AX) , opens new tab, its junior partner in the project, said on Monday. Work began over the weekend on the Essington-1 well, which will take 32 days to drill down to 2,650 metres (8,694 feet), 3D Energi said in a filing to the ASX. Sign up here. The well is the first in the Otway Exploration Drilling Program to develop new gas for Australia’s eastern domestic market, the company said. Eastern and southern Australia are facing supply shortfalls before the end of the decade, causing tension between gas exporters and domestic manufacturers. The campaign represents one of the first major offshore exploration campaigns in East Coast waters in almost seven years as the old fields in the Bass Strait offshore the state of Victoria run dry. Under the Otway program, Conoco will drill two wells this year, out of a total of six planned, and an option for four additional wells if needed. The tight domestic eastern gas market has been a source of political tension for many years. An "Australian Domestic Gas Mechanism" trigger was introduced in late 2017, limiting the export of spot cargoes when gas was tight from the three liquefied natural gas consortia in Queensland fed by the state’s onshore coal seam gas fields, with backup from Victorian gas supplies. ConocoPhillips is operator of one, Australia Pacific LNG. The current Labor government has considered expanding export controls since its first term in 2022. Japan has argued against controls as it is Australia’s largest LNG buyer. https://www.reuters.com/business/energy/conocophillips-begins-natural-gas-drilling-campaign-offshore-eastern-australia-2025-11-03/