2025-12-15 06:00

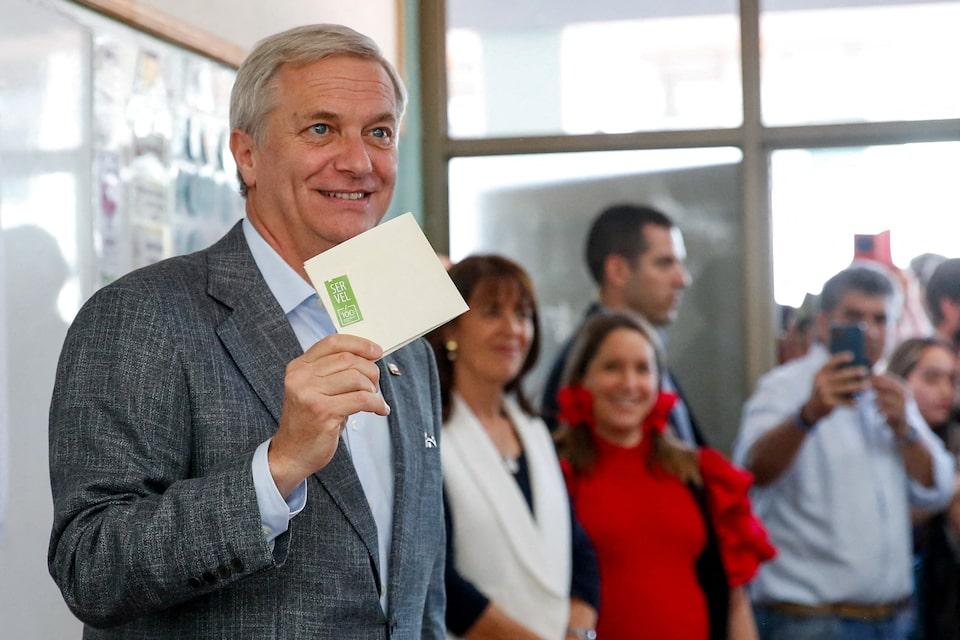

Kast has pledged crackdowns on crime, migration He is a veteran right-wing politician Supported Pinochet in 1988 referendum SANTIAGO, Dec 15 (Reuters) - After falling short in two previous presidential runs, Jose Antonio Kast finally secured the Chilean presidency on Sunday, a sign of how his far-right, anti-immigrant views have gained a wave of new support amid fears about increased crime. Kast, 59, easily beat leftist presidential candidate Jeannette Jara, winning 58% of the vote and steering the South American country toward its sharpest rightward shift since the end of the military dictatorship in 1990. Sign up here. He lost to leftist President Gabriel Boric in the election in 2021, a time when Kast's hardline policies were out of step with an electorate rattled by the COVID-19 pandemic, widespread protests against inequality, and hopes of drafting a new constitution. But now sentiment has shifted and Kast's proposals are resonating with voters who are overwhelmingly concerned about crime and immigration. While Chile remains one of the safest countries in Latin America, an influx of organized crime has led to a rising murder rate and hurt economic growth, with a recent spike in high-profile incidents like kidnappings and assassinations. As well as promising a crime crackdown, Kast has vowed to build border walls and form a specialized police force modeled on U.S. Immigration and Customs Enforcement and tasked with tracking down and deporting migrants in the country illegally. Government data shows the majority are Venezuelans. "This government caused chaos, this government caused disorder, this government caused insecurity," Kast said at the end of the recent campaign. "We're going to do the opposite. We're going to create order, security and trust." DRAWING INSPIRATION FROM EL SALVADOR Kast has taken inspiration from the U.S. for his tough-on-borders approach, and last year visited the mega-prison system built by El Salvador's President Nayib Bukele, a model his platform calls for emulating. The Chilean politician's success makes his country the latest in Latin America to tilt right after Bolivia's election in August and President Javier Milei's success in Argentina's midterm vote in October. Like Milei, Kast - a Catholic with nine children - has expressed strong objections to abortion. He has previously said he would repeal Chile's limited abortion rights and ban sales of the morning-after pill, though he largely focused on other issues during his campaign. Polls show public opinion overwhelmingly supports maintaining existing abortion rights. His economic plan involves more flexible labor laws, corporate tax cuts and less regulation - though he is expected to moderate planned spending cuts widely seen as unrealistic. LINKS TO PINOCHET Kast is the son of a German immigrant, a Nazi party member and army lieutenant who fled to South America after World War Two, where he eventually founded a lucrative sausage business in Paine, south of Santiago. Kast has said his father was a forced Nazi conscript. The president-elect has been married to Maria Pia Adriasola, a lawyer who has frequently campaigned at his side, for more than three decades. His eldest brother, Miguel Kast, was a government minister and central bank president in the early 1980s under the dictatorship of General Augusto Pinochet, during which more than 40,000 people were executed, detained and disappeared, or tortured. One of the "Chicago Boys" who pioneered shock-therapy economics, he pushed deregulation and privatizations. As a law student, Jose Antonio Kast campaigned for the "yes" vote in a referendum on whether Pinochet should remain in power in 1988, a vote that Pinochet lost. After serving as a congressman for the right-wing Independent Democratic Union (UDI) party for more than a decade, Kast stepped down in 2016 to pursue the presidency as an independent but ended up winning less than 10% of the vote. He gained more traction in 2021 running under the banner of his self-founded Republican Party. His style is quite different to that of Milei or Bukele, said Nicholas Watson, Latin America managing director at Teneo. "He is much less flamboyant and more reserved. He is also more of a political insider; he has not burst onto the political scene in the way that Milei did." As such, Chileans view Kast as a familiar face with more than two decades of political experience, said David Altman, a political scientist at Chile's Pontifical Catholic University, adding that Kast benefited from growing rejection of Boric's incumbent government. "It's not that people became more fascist in the space of four years," Altman said. "People abandoned the left and as there essentially was not a political center, they went right. It was the only place where they could land." https://www.reuters.com/world/americas/who-is-jose-antonio-kast-far-right-front-runner-chiles-presidency-2025-11-17/

2025-12-15 05:52

LAGOS, Dec 15 (Reuters) - Nigeria’s richest man Aliko Dangote escalated his fight with regulators on Sunday, accusing them of enabling cheap fuel imports that threaten local refineries. Nigeria is Africa’s biggest oil producer but relies heavily on imports and Dangote’s refinery was meant to change that. Sign up here. Dangote said if imports continue unchecked, they will threaten jobs, investment and energy security. Speaking at his 650,000-barrel-per-day oil refinery in Lagos, Dangote said imports were being used “to checkmate domestic potential”, creating jobs abroad while Nigeria struggles to industrialise. “You don’t use imports to checkmate domestic potential,” he told reporters. Dangote called for an official inquiry into Farouk Ahmed, head of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, citing concerns over his management of the sector and allegations of private expenditures exceeding legitimate earnings. Ahmed did not immediately respond to a request for comment, but he has previously said Dangote refinery wants a monopoly on petroleum products sales, but the refinery's output can not meet local demand. Last month, the regulator urged the president to drop plans to ban imports of refined petroleum products because local output cannot meet the national demand of 55 million litres daily. Dangote disputes this, saying the regulator was distorting the refinery's actual capacity by reporting offtake statistics instead of the true production data. The refinery, designed to end Nigeria’s reliance on imported fuel and save billions in foreign exchange, says it has been unable to secure all the required crude it needs because the regulator has failed to implement a rule that guarantees crude supply to local refiners before exports Dangote said the refinery imports 100 million barrels of crude oil annually — a figure expected to double after expansion of the refinery and limited domestic supply. Despite these hurdles, Dangote vowed to continue with expansion plans for the facility and safeguard his investment, which he said is "too big to fail". He also reiterated plans to list the company on the local stock market and pay dividends in U.S. dollars so “every Nigerian can own a piece of the economy.” Nigeria, Africa’s top oil producer, has long depended on imports due to mothballed state refineries. https://www.reuters.com/world/africa/nigerias-richest-man-dangote-escalates-oil-fight-with-regulator-seeks-corruption-2025-12-15/

2025-12-15 05:45

China tells GCC conditions are ripe for free trade deal FM Wang Yi says China-GCC FTA will signal importance of free trade China, Saudi seek closer coordination on wider diplomacy, security issues Wang emphasises energy and investment cooperation with Saudi Arabia BEIJING, Dec 15 (Reuters) - China's foreign minister has pressed the Gulf Cooperation Council to conclude long-running talks on a free trade agreement with China, attributing the urgency to rising protectionism and unilateralism as free trade comes "under attack", according to a Monday statement from the ministry. Chinese Foreign Minister Wang Yi is on a three-nation tour in the Middle East that began in the United Arab Emirates and is expected to end in Jordan. He met GCC Secretary-General Jasem Mohamed Albudaiwi in Riyadh on Sunday, when he also met top Saudi officials separately. Sign up here. "The talks have lasted for more than 20 years, and conditions for all aspects are basically mature, it is time to make a final decision," he said during a meeting with Albudaiwi, according to the Chinese foreign ministry. A successful FTA will send a "strong signal to the world about defending multilateralism," Wang said, adding that China was supportive of the bloc strengthening its strategic autonomy and coordination, and advancing its integration process. China has interests in deepening cooperation in economy, trade, investment and other fields with the GCC as well, Wang said. CLOSER COORDINATION WITH SAUDI China and Saudi Arabia agreed to closer communication and coordination on regional and international issues, with Beijing lauding Riyadh's role in Middle East diplomacy and security, other statements following a meeting between the nations' foreign ministers showed. Wang's meeting with Saudi Arabia's Foreign Minister Prince Faisal bin Farhan Al-Saud also took place on Sunday in the Saudi capital. A joint statement published by China's official news agency Xinhua did not elaborate on the issues where the two countries would strengthen coordination, but mentioned China's support for Saudi Arabia and Iran enhancing their relations as well as support from both sides for the "comprehensive and just settlement" of the Palestinian issue. "(China) appreciates Saudi Arabia's leading role and efforts to achieve regional and international security and stability," said the statement released on Monday. Wang told his Saudi counterpart that China regarded Saudi Arabia as a "priority for Middle East diplomacy" and an important partner in global diplomacy, a Chinese foreign ministry statement on Monday said. He also encouraged more cooperation in energy and investments, as well as in the fields of new energy and green transformation. In a separate meeting with Saudi Crown Prince Mohammed bin Salman, Wang underscored China's readiness to play a part as the "most reliable partner" in the Middle Eastern country's revitalisation, as well as "inject more stabilising factors" to realise peace and security in the region, another foreign ministry statement showed. The countries have agreed to mutually exempt visas for diplomatic and special passport holders from both sides, according to the joint statement. https://www.reuters.com/world/china/china-saudi-arabia-agree-strengthen-coordination-regional-global-matters-2025-12-15/

2025-12-15 05:36

A look at the day ahead in European and global markets from Gregor Stuart Hunter China's property sector is taking centre stage as traders kick off the last full trading week of the year, contending with a calendar strewn with risk events. No fewer than five G10 central bank decisions are due, alongside a slew of delayed economic data releases from the U.S. Sign up here. Among the central banks making decisions this week, the Bank of Japan is expected to hike rates by 25 basis points to 0.75%, while the Bank of England may make an equal-sized cut to 3.75%. The European Central Bank is expected to keep interest rates on hold, alongside Sweden's Riksbank and Norway's Norges Bank. But markets start the week grappling with news from China Vanke (000002.SZ) , opens new tab, which said it would convene a second bondholder meeting after failing to secure bondholder approval last week to extend by one year a bond payment falling due today, which has a five-business-day grace period. Shares of Vanke tumbled in Shenzhen and Hong Kong <2202.HK , opens new tab>. The development increases the risk of default by the state-backed developer and has renewed concerns about the crisis-hit property sector. Official Chinese data showed on Monday that new home prices extended declines in November, indicating that a recovery in demand remains elusive despite the government vowing to stabilise the sector. Adding to pressure on policymakers in Beijing: The Chinese yuan appreciated to its strongest level in more than a year, after factory output and retail sales data slowed further in November, providing fresh evidence that the economy is stalling. With the prevailing mood more "lump of coal" than "Santa rally", investors are taking risk off the table in Asian trading on Monday and booking profits for the year. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab shed 1.2%, led by a drop of as much as 2.7% in South Korean shares (.KS11) , opens new tab, one of the world's best-performing markets this year. In early European trades, pan-region futures were last up 0.4%, German DAX futures were up 0.4% and FTSE futures were up 0.3%. Key developments that could influence markets on Monday: Economic data: Euro Zone: Industrial Production for October Debt Auctions: France: 1-month, 3-month, 7-month and 1-year government debt https://www.reuters.com/world/china/global-markets-view-europe-2025-12-15/

2025-12-15 05:20

Increased interest in EM FX a key takeaway from whipsawed 2025 Dollar weakness expected to continue in 2026, bolstering EMs Hedge funds, bank FX desks benefited the most LONDON, Dec 15 (Reuters) - Trading in the Hungarian forint, long a niche emerging market currency, has more than doubled since U.S. President Donald Trump took office in January, with trader interest only growing since his sweeping "Liberation Day" import tariffs announcement. These increased volumes are no blip either, say traders, strategists and hedge funds navigating the almost $10-trillion-a-day global FX markets. Sign up here. The forint has strengthened roughly 20% against the dollar this year, set for its best year in almost a quarter of a century and making it one of 2025's top emerging currency performers . It has been a good year more widely: MSCI's Emerging Market Currency Index (.MIEM00000CUS) , opens new tab hit a record in July and is on course for its best year since 2017, having gained more than 6%. Traders, fund managers and analysts spoken to by Reuters mostly expect this trend to continue next year, too. The gains come as a more volatile and weakening dollar prompts investors to rethink exposure to the currency and question long-held assumptions about the direction and standing of the greenback. Meanwhile, they are betting on improving value across some developing countries from South Africa to Hungary as they diversify away from U.S. assets. "We think that the cycle of what we would call a bear market for EM currencies, which has lasted for 14 years now, has likely turned," said Jonny Goulden, head of EM Fixed Income Strategy Research at JPMorgan. "That is part of this turn in the dollar cycle, where the world owns a lot of U.S. assets and has avoided EM assets." TRADING RISKS DRAW IMF WARNING For Elina Theodorakopoulou, portfolio manager for emerging markets debt at Manulife, the surprise this year was that price swings were triggered by events in developed economies. "It was the cool kid in the class this year, emerging markets, in the sense that it wasn't the driver of volatility," said Theodorakopoulou. The U.S.-driven splintering of world trade, geopolitical upheaval and divergent central bank policy is expected to continue to drive price moves. Investors, including hedge funds, are making and losing money, while for governments, appreciating currencies and capital inflows have major economic implications, from reducing the appeal of exports to bolstering their ability to raise and repay debt. The risks have not gone unnoticed. The International Monetary Fund in its latest financial stability report warned about dangers from currency markets. Nearly half of global FX turnover is intermediated by just a small group of mostly large banks, leaving the market exposed should they scale back activity during periods of stress, the IMF said. Currency volumes are up almost 30% in the past three years, the latest data by the Bank for International Settlements from April shows. And 2025 has been a rollercoaster ride, with developed market currency volatility (.DBCVIX) , opens new tab spiking to two-year highs in April before easing. A steadier market has made it a more attractive environment for carry trades -- borrowing in low-yielding currencies to invest in higher-yielding ones. Hedge fund EDL Capital, which manages $1 billion, is up 28% this year, on gains at the start of the year and around so-called Liberation Day, helped by bets against the dollar, said a source with knowledge of the matter. As a money-spinner for banks, trading EM currencies was a boon, data compiled for Reuters by Vali Analytics shows. EM currency trading generated almost $40 billion in revenue for the top 25 global banks in the first nine months, their best year so far. That's more than twice the $19 billion the banks earned from Group of 10 currencies, the data firm's analysis shows. The G10 comprises major currencies from the dollar to sterling to the euro. Finding opportunities to make money in currency trading, especially among the G10, has been challenging, said Samer Oweida, global head of foreign exchange and emerging markets trading at Morgan Stanley. "If investors stayed within FX, they rotated into higher-yielding structural stories across emerging markets." Just over half of 14 top currency traders, hedge fund managers and analysts Reuters spoke to see greater interest in EM currencies as a key trend likely to continue in 2026. Increased hedging and volatility in an era where dollar strength is no longer a given are also likely to persist, they said. A NEW LIGHT The soft dollar tide has not floated all boats, however. Anaemic trade and investment flows pushed India’s rupee to record lows, while worries about central bank independence and political unrest have hurt Indonesia's rupiah IDR=. But while the dollar has recovered from a beating -- it suffered its biggest first-half dive since the early 1970s with losses of almost 11% -- analysts expect U.S. rate cuts will bring further weakness. Traders are pricing two more quarter-point rate cuts by the Federal Reserve next year, LSEG data show. For many EM currencies that backdrop is key and has fuelled inflows. For some, ramped-up carry trades have added to momentum. Mexico's peso and Brazil's real are also among the best-performing emerging currencies this year. They feature prudent central banks and high interest rates, in Brazil's case rates are at a two-decade high of 15%, as well as easily accessible currency and bond markets. "There have been strong inflows into broad EM, across both local and external (bond markets), and I would not bet on that trend reversing anytime soon,” said Nikolas Skouloudis, portfolio manager at Amia Capital, which manages roughly $1.4 billion. The hedge fund returned 16% in the year so far, said a separate source familiar with the fund's performance. https://www.reuters.com/business/wild-currency-swings-put-emerging-markets-spotlight-2025-12-15/

2025-12-15 05:01

Brent, WTI prices steady after 4% losses last week Venezuelan oil exports down sharply since US seizure of tanker Surplus outlook, potential Ukraine peace deal weigh on prices DENVER, Dec 15 (Reuters) - Oil prices slid on Monday as investors balanced disruptions linked to escalating U.S.-Venezuelan tensions with oversupply concerns and the impact of a potential Russia-Ukraine peace deal. Brent crude futures settled down 56 cents, or 0.92%, to $60.56 a barrel, and U.S. West Texas Intermediate crude settled at $56.82 a barrel, down 62 cents, or 1.08%. Sign up here. Both contracts slid more than 4% last week, weighed down by expectations of a global oil surplus in 2026. Venezuela's oil exports have fallen sharply since the U.S. seized a tanker last week and imposed fresh sanctions on shipping companies and vessels doing business with the Latin American oil producer, according to shipping data, documents and maritime sources. The market is closely monitoring developments and their impact on oil supply, with Reuters reporting the U.S. plans to intercept more ships carrying oil from Venezuela following the tanker seizure, intensifying pressure on Venezuelan President Nicolas Maduro. Venezuela's state-run oil company PDVSA suffered a cyberattack , opens new tab, it said on Monday, and tankers due to pick up crude there were making u-turns as tensions esclated. "The grind lower in oil prices and the achieving of month-to-date lows across the major futures complex last week might have seen more negative pricing if it were not for the upping of the ante by the United States with regard to Venezuela," said John Evans, an analyst with PVM. Still, ample oil supplies already en route to China - Venezuela's biggest oil buyer - as well as plentiful global supplies and weaker demand are buffering some of the impact of supply disruptions tied to the tanker seizure. MARKET REMAINS FOCUSED ON GEOPOLITICS Progress in U.S. peace talks also pushed the market lower on Monday. Ukrainian President Volodymyr Zelenskiy offered to drop his country's aspiration to join the NATO military alliance as he held five hours of talks with U.S. envoys in Berlin on Sunday. A second round of talks concluded on Monday. "Over the past two days, Ukrainian-U.S. negotiations have been constructive and productive, with real progress achieved," Rustem Umerov, secretary of the National Security and Defence Council, wrote on X after Monday's talks. A possible peace deal could eventually increase Russian oil supply, which is currently sanctioned by Western countries. Rising expectations of a surplus also weighed on prices, as did weaker economic data out of China. Factory output there slowed to a 15-month low in November, while retail sales grew at their weakest pace since December 2022. J.P. Morgan Commodities Research said in a note on Saturday that oil surpluses in 2025 were expected to widen further into 2026 and 2027, as global oil supply was projected to outpace demand, expanding at three times the rate of demand growth through 2026. "Risk off, with US equities markets trading lower, and weaker than expected Chinese economic data are not helping crude oil," said Giovanni Staunovo, an analyst with UBS. https://www.reuters.com/business/energy/oil-rises-fears-supply-disruption-us-venezuela-tensions-escalate-2025-12-15/