2025-10-30 11:55

Oct 30 (Reuters) - Indian firm Megha Engineering & Infrastructures said on Thursday it has bought a thermal power plant in the southern state of Tamil Nadu from Abu Dhabi's TAQA (TAQA.AD) , opens new tab to expand its power generation portfolio. The deal entails MEIL Energy, an unit of Megha, to take control of TAQA Neyveli Power Company, which owns the coal plant. Sign up here. The 250 MW lignite-based power plant has a long-term power offtake commitment with the state discom and has a well-established track record of delivering reliable and efficient power to meet the state's growing energy demands, MEIL said. Hyderabad-based Megha Engineering was established in 1989 and has more than 5.2 GW of power generation assets in its portfolio. https://www.reuters.com/business/energy/indian-firm-meghas-unit-buys-coal-plant-abu-dhabis-taqa-2025-10-30/

2025-10-30 11:49

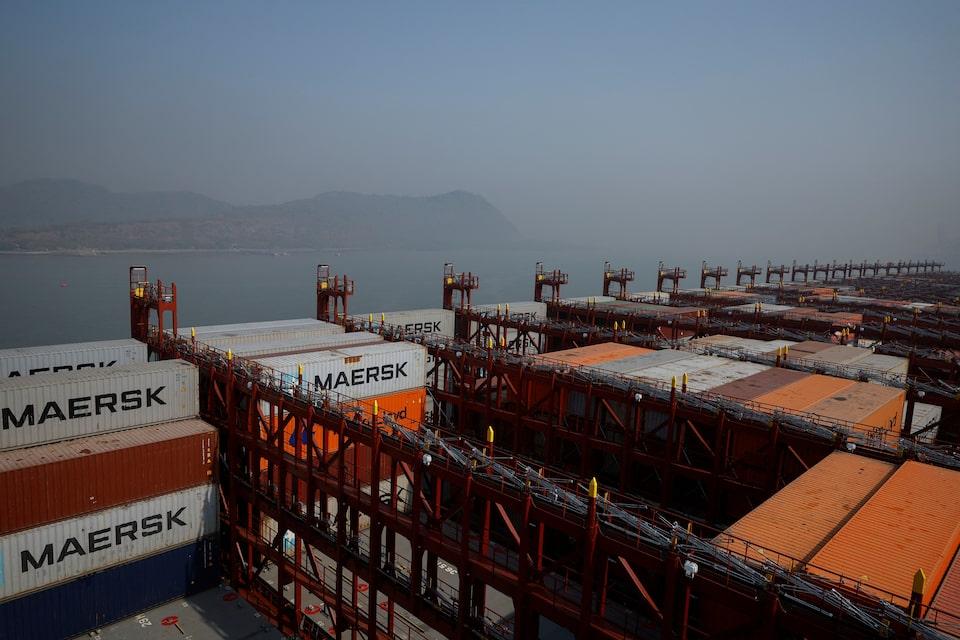

COPENHAGEN, Oct 30 (Reuters) - Danish shipping company Maersk (MAERSKb.CO) , opens new tab said on Thursday its APM Terminals unit may invest around $2 billion in the Pipavav Port in western India. Maersk said in a statement it had signed a memorandum of understanding with the Gujarat Maritime Board on increasing capacity at the port. Sign up here. "Subject to a long-term concession agreement with Indian authorities, the expansion will significantly enhance the port's capacity and capabilities," it said. Maersk said it had also signed memorandums of understanding with several shipyards on exploring deeper cooperation. "India possesses significant infrastructure capabilities that Maersk wishes to capitalise on," it said. https://www.reuters.com/business/maersks-apm-terminals-plans-2-billion-investment-india-2025-10-30/

2025-10-30 11:36

Oct 30 (Reuters) - U.S. utility Xcel Energy (XEL.O) , opens new tab missed third-quarter profit estimates on Thursday, hurt by higher interest charges as well as operating and maintenance expenses. Higher-for-longer interest rates can put pressure on utilities by raising the cost for constructing and maintaining infrastructure such as electrical grids. Sign up here. Minneapolis, Minnesota-based Xcel's total interest charges rose to $384 million in the three months ended September 30, up from $326 million a year earlier. In addition, its quarterly operating and maintenance expenses rose 5.6% to $692 million. The utility has ramped up its capital investment plan to $60 billion for the next five years to cater to increased power demand and make required investments to strengthen its transmission and distribution systems. Utilities have been adding billions of dollars to their capital expenditure budgets as they field massive requests for new power capacity from data centers, which aim to support complex AI-related tasks. Xcel said in September it had reached settlement agreements to resolve all claims related to the 2021 Marshall Fire in Colorado. Its unit, Public Service Company of Colorado, is expected to pay roughly $640 million as part of these agreements, while $350 million will be funded by remaining insurance coverage, the company added. Xcel provides electric services to about 3.9 million customers and natural gas services to 2.2 million customers across eight Western and Midwestern states. Quarterly operating revenue at its electric segment rose 7.2% to $3.64 billion, while that at its natural gas division climbed to $264 million from $239 million a year ago. Xcel also initiated 2026 adjusted earnings in the range of $4.04 to $4.16 per share, the midpoint of which is less than analysts' average estimate of $4.12 apiece, according to data compiled by LSEG. The company's third-quarter profit came in at $1.24 per share on an adjusted basis, missing estimates of $1.32 per share. https://www.reuters.com/business/energy/xcel-energy-misses-quarterly-profit-estimates-higher-interest-charges-expenses-2025-10-30/

2025-10-30 11:35

Oct 30 (Reuters) - U.S. Treasury Secretary Scott Bessent on Thursday said that the U.S. would enact a one-year suspension of Entity List restrictions that make it harder for Chinese firms to use affiliates to buy off-limits technology. The moratorium comes after President Donald Trump and Chinese leader Xi Jinping were able to discuss big picture issues with great respect at their meeting earlier in the day in South Korea, Bessent said in an interview on Fox Business Network. Sign up here. https://www.reuters.com/world/china/us-halt-entity-restrictions-one-year-after-trump-xi-meeting-bessent-says-2025-10-30/

2025-10-30 11:34

Oct 29 (Reuters) - What matters in U.S. and global markets today By Mike Dolan , opens new tab, Editor-At-Large, Finance and Markets Sign up here. Perhaps because many of the positive twists this week were already priced in, markets have been slightly underwhelmed by the blizzard of top level trade, central bank and corporate developments over the past 24 hours. The Federal Reserve delivered an expected quarter point rate cut on Wednesday and an end to its "quantitative tightening" this year. But Chair Jerome Powell ruffled bond market feathers by saying another cut in December was not a "foregone conclusion". "Far from it", he added. Treasury yields and the dollar firmed heading into Thursday's trading day, with markets now seeing only a 70% chance of another Fed cut by year-end. Wall Street indexes stalled after the Fed move and futures remained subdued overnight. The Bank of Japan, meanwhile, deferred any further interest rate rises for now - knocking the yen back to eight-month lows despite pressure from U.S. Treasury Secretary Scott Bessent earlier this week for the BOJ to keep on tightening. In South Korea, President Donald Trump hailed his summit with Chinese counterpart Xi Jinping in Busan as "amazing" and gave it a 12 out of 10 rating. But markets seemed less impressed, initially at least. The two sides laid out a 12-month agreement that removes the cliff edge of 100% U.S. tariffs next week, seeing Washington halve fentanyl-related tariffs on China to 10% in return for Beijing freeing up rare earth exports and pledging to buy more U.S. soya beans. No mention was made of allowing China to import Nvidia's cutting-edge AI chip Blackwell, despite Trump indicating on Wednesday that it would be on the agenda. China's stocks and yuan fell back as readouts from the meeting unfolded. Just before the summit, Trump threw another geopolitical curve ball by ordering the U.S. military to immediately resume testing nuclear weapons after a gap of 33 years. Meantime, the market reaction to this week's first sweep of megacap tech earnings was also something of a mixed bag. With AI-related investments still booming despite ongoing fears of a bubble in valuations, Alphabet outshone Microsoft and Meta and its stock jumped 7% ahead of today's bell on another beat - lifting its capex plan for the year to $91-93 billion. Microsoft and Meta shares went the other direction, however, dropping 3% and 7% respectively overnight. Meta's copybook was blotted by a hefty $16 billion tax charge and Microsoft's forecast of rising spending seemed to unnerve those wary of the cost of sustaining the boom. An outage on Thursday in its Azure cloud computing platform didn't help, even though it appears to have been resolved overnight. Next up on the corporate diary are Apple and Amazon results after Thursday's close. Elsewhere, the European Central Bank is expected to leave its key interest rates unchanged at 2% today, with euro zone GDP growth for the third quarter coming in slightly ahead of forecasts thanks to an unexpected French beat. And after Wednesday's election, the next Dutch government looks likely to exclude the far right after support surged for the centrist D66 party. Sterling's eye-catching slide to its lowest in more than two years against the euro is ostensibly on rising speculation of another Bank of England rate cut this year and possible income tax rises at next month's budget. Prime Minister Keir Starmer rejected calls for a probe into finance minister Rachel Reeves' failure to secure the correct paperwork for a house rental. In today's column, I discuss Treasury Secretary Bessent's pressure on Japan to keep lifting interest rates and prevent yen volatility as a sign of how sensitive the Trump administration will be to any renewed dollar appreciation. Today's Market Minute Chart of the day Of the three tech giants' reporting overnight, investors seemed most impressed by Alphabet's ability to balance its soaring expenses with strong cash flow. Alphabet's capital expenditure of $23.95 billion in the September quarter was 49% of its cash generated from operations. The percentage for Meta, however, is 64.6%, with Microsoft even higher at 77.5%. Today's events to watch * European Central Bank interest rate decision (9:15 AM EDT) and press conference * Federal Reserve Vice Chair for Supervision Michelle Bowman and Dallas Fed President Lorie Logan * U.S. corporate earnings: Apple, Amazon, Eli Lilly, Comcast, Coinbase, Mastercard, Fox, Merck, Bristol-Myers Squibb, Biogen, International Paper, Intercontinental Exchange, S&P Global, Gilead Sciences, Weyerhaeuser, Estee Lauder, Cigna, Kellanova, Kimberly-Clark, Edwards Lifesciences, Southern, Howmet, Altria, Dexcom, Ameriprise, Western Digital, Huntington Ingalls, Ingersoll Rand, First Solar, Stryker, Hershey, GoDaddy etc Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-10-30/

2025-10-30 11:34

NEW DELHI, Oct 30 (Reuters) - Indian companies have received licences for importing rare earth magnets from China, India's foreign ministry said on Thursday, signalling some easing in Beijing's export control. Rare earths, a group of 17 elements that play a crucial role in cars, planes and weapons, have become one of China's most powerful tools of leverage amid its trade tensions with the U.S. Sign up here. India's foreign ministry spokesperson Randhir Jaiswal announced the licencing decision at a media briefing but did not provide details on the companies that got approval, the number of licences issued or the conditions attached. While rare earth elements are not scarce, China maintains a near-absolute dominance over the technology that processes the minerals into magnets. Beijing has tightened exports of these processed materials to major economies, including India, this year in an effort to reinforce its geopolitical influence. Earlier in the day, China agreed to delay the introduction of its latest round of rare earth export controls as part of a deal agreed between U.S. President Donald Trump and Chinese leader Xi Jinping, but previous restrictions remain in place. Beijing significantly expanded its rare earths export controls this month to include five new elements and added dozens of refining technologies to its control list. The rules also require foreign producers that use Chinese materials to comply with China's export-control system. China's export control announcements on October 9 also included new restrictions on electric battery equipment and industrial diamonds. The battery-related restrictions triggered a rush among global customers, including India's Reliance Industries (RELI.NS) , opens new tab, to accelerate shipments before the early-November deadline. China's export controls on rare earths have highlighted the risks of being dependent on one supplier. The curbs, introduced in April, triggered shortages that threatened to disrupt global car production. https://www.reuters.com/world/china/india-says-some-companies-have-got-license-import-rare-earth-magnets-china-2025-10-30/