2025-12-11 06:23

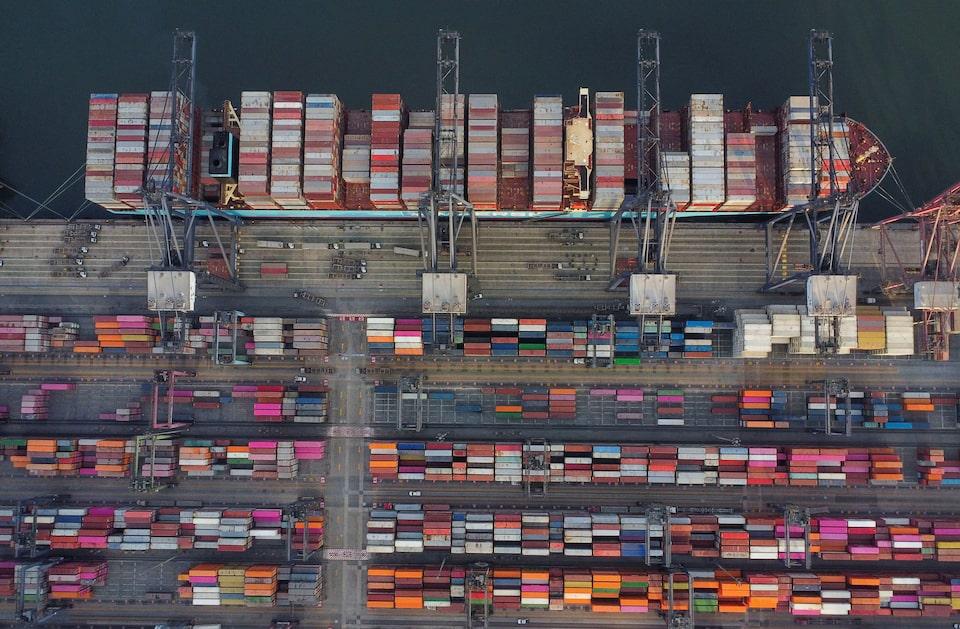

New duties of up to 50% will be imposed in 2026 on certain goods Majority of products will see tariffs of up to 35% China and some local business groups oppose the hike Move seen as appeasing US ahead of next USMCA review MEXICO CITY, Dec 10 (Reuters) - Mexico's Senate on Wednesday approved tariff hikes of up to 50% next year on imports from China and several other Asian countries, aiming to bolster local industry despite opposition from business groups and the governments of targeted countries. The proposal, passed earlier by the lower house, will raise or impose new duties of up to 50% from 2026 on certain goods such as autos, auto parts, textiles, clothing, plastics and steel from countries without trade deals with Mexico, including China, India, South Korea, Thailand and Indonesia. The majority of products will see tariffs of up to 35%. Sign up here. The Senate passed the bill, with 76 votes in favor, 5 against, and 35 abstentions. The approved bill is softer than one that stalled in the lower house this autumn, with tariffs on about 1,400 different product lines - mostly textiles, apparel, steel, auto parts, plastics and footwear - and reduced duties on roughly two-thirds of them compared with the original proposal. China's Ministry of Commerce responded on Thursday saying it would track Mexico's new tariff regime and weigh its impact, but warned that such measures would "substantially undermine" the interests of trade. "China has always opposed all forms of unilateral tariff increases and hopes Mexico will correct such unilateralist and protectionist practices as soon as possible," the commerce ministry said. China's Ministry of Foreign Affairs did not immediately comment on the higher tariffs. Analysts and the private sector say the move is aimed at appeasing the U.S. ahead of the next review of the United States-Mexico-Canada trade agreement (USMCA), and that it is also intended to generate $3.76 billion in additional revenue next year as Mexico seeks to reduce its fiscal deficit. "On the one hand, it protects certain local productive sectors that are at a disadvantage with respect to Chinese products. It also protects jobs," said Mario Vazquez, a senator for the opposition PAN party. But, also, "the tariff is an additional tax that citizens pay when they buy a product. And these are resources that go to the state. We would need to know what they are going to be used for. Hopefully, production chains in the country will be strengthened,” Vazquez said. Emmanuel Reyes, a senator from the ruling Morena party, defended the measure. "These adjustments will boost Mexican products in global supply chains and protect jobs in key sectors," said Reyes, who is chairman of the Senate Economy Committee. "This is not merely a revenue-raising tool, but rather a means of guiding economic and trade policy in the interest of general welfare," he said. Mexico had said in September that it would raise its tariff on automobiles and other goods from China and other Asian countries. The United States has been pushing countries in Latin America to limit their economic ties with China, with which it competes for influence in the region. https://www.reuters.com/business/retail-consumer/mexicos-senate-approves-tariff-hikes-chinese-other-asian-imports-2025-12-11/

2025-12-11 06:15

LONDON, Dec 11 (Reuters) - Nearly half of UK businesses surveyed by FX and cash management solutions provider MillTech say that they have lost money due to a volatile pound and plan to hedge more of their currency risk, and for longer, a report released on Thursday showed. The report surveyed over 250 chief financial officers and treasurers at UK companies in October about their hedging plans and costs. It showed 48% of those polled said they had lost money as a result of the big swings in sterling's value. Sign up here. WHY IT’S IMPORTANT Currency volatility has accelerated this year, as geopolitical uncertainty has picked up and global trade relations have become more unpredictable since U.S. President Donald Trump has pushed to enact his "America First" agenda. Hedging rates by UK corporates have risen for their third consecutive year to 78%, up from 76% in 2024 and 70% in 2023. Among firms not currently hedging, 68% are now considering doing so in response to market conditions, MillTech's survey showed. KEY QUOTE "Most CFOs treat FX like a slow-dripping tap. It’s something they can put off fixing while it’s only a nuisance. But this year, that drip turned into a full-on leak, and many UK firms have been scrambling with towels and buckets," Eric Huttman, chief executive of MillTech, said. CONTEXT Sterling hit four-year highs above $1.37 in July against a broadly weak dollar, then fell back as UK fiscal worries weighed on sentiment. It is set for its most volatile year since 2022, LSEG data shows. BY THE NUMBERS The mean hedge ratio, or the percentage of companies' foreign exchange exposure that they protect, is at 53%, up from 45% in 2024. Hedges in 2025 cover an average period of 5.52 months, versus 5.55 months in 2024, but well above the 4.04 months in 2023. https://www.reuters.com/world/uk/many-uk-firms-say-volatile-pound-triggered-losses-2025-need-hedge-grows-2025-12-11/

2025-12-11 06:05

BOJ keeping watchful eye on rising bond yields Policymakers set high hurdle for ramping up bond buying Japan not seeing panic selling considered prerequisite for action BOJ sticking to taper plan, eyes cut to super-long JGB buying TOKYO, Dec 11 (Reuters) - The Bank of Japan sees limited need for emergency intervention to restrain rising bond yields, a move that runs counter to its effort to roll back stimulus, three sources familiar with its thinking said. Growing market anticipation of an interest rate hike in December has pushed up the benchmark 10-year Japanese government bond (JGB) yield to an 18-year high this week, drawing attention to how the central bank could respond. Sign up here. BOJ Governor Kazuo Ueda, speaking in parliament on Tuesday, said recent increases in bond yields were "somewhat rapid" and reiterated the central bank's readiness to respond nimbly in exceptional circumstances. Policymakers are keeping a watchful eye on market moves but are reluctant to take action presently, such as ramping up bond purchases or conducting emergency market operations, the sources said, citing a high threshold for intervention. They also see no imminent need to tweak the BOJ's plan to steadily reduce bond purchases, including for super-long tenors that have recently led to yields rising to record highs, they said. "It would take a panicky sell-off that is out of sync with fundamentals, something Japan isn't seeing right now," said one of the sources on the high hurdle for the BOJ to ramp up bond buying, a view echoed by two other sources. Rather, the recent yield rises are due to investors taking a wait-and-see approach on uncertainty over how far the BOJ could eventually raise rates, and how much of bonds the government will sell to fund next fiscal year's budget, they said. Ueda has signalled the BOJ will offer some clarity on its future rate-hike path when the board decides to raise rates to 0.75% from 0.5% - a move markets expect at next week's policy meeting. Last year, the BOJ exited a decade-long, massive stimulus including by ditching its bond yield curve control and slowing the pace of JGB purchases. In laying out its taper plan, the BOJ said that while long-term rates should be determined by markets, it will respond "nimbly" if yields rise rapidly in a way out of sync with fundamentals. Ueda has repeated the language, whenever asked about yield moves at press briefings or in parliament, including on Tuesday. The 10-year JGB yield rose to an 18-year high of 1.97% on Monday, approaching the psychologically important 2% line that has not been breached for nearly two decades. The BOJ will focus on what is driving the moves rather than specific yield levels, and stay cautious on intervening as doing so would give a wrong signal to markets that it could discontinue efforts to normalise policy, the sources said. Intervening would also give markets the impression the BOJ has a line in the sand on where it would step in, running counter to its attempt to have market forces drive bond price moves, they said. Yields around the globe have been climbing in recent weeks, as many central banks signalled they are either at or near the end of their own easing cycles, while the BOJ is widely anticipated to hike rates at its policy meeting next week. JGB yields have also risen on expectations that Prime Minister Sanae Takaichi's expansionary fiscal policy would lead to a huge issuance of bonds, at a time the BOJ was reducing its presence in the market. https://www.reuters.com/world/asia-pacific/bank-japan-reluctant-intervene-rising-yields-sources-say-2025-12-11/

2025-12-11 06:05

LITTLETON, Colorado, Dec 11 (Reuters) - Major Asian economies including China, India, Japan and Vietnam have cleaned up their power generation systems by more than the United States and Europe in 2025, setting the stage for an East-West divergence in energy transition momentum heading into 2026. Over the first 10 months of 2025, the United States was the only major power market to increase the carbon intensity of power generation compared to the year before, according to data from energy think tank Ember. Sign up here. The chief driver of the rise in U.S. carbon intensity has been a roughly 13% increase in coal-fired power generation, which has lifted U.S. power sector emissions from fossil fuel use to three-year highs. European power firms have also lifted their collective CO2 emissions so far this year compared to 2024, while China, India, Japan and Vietnam have all registered year-to-date declines in CO2 output from fossil fuel power generation. With winter approaching in the Northern Hemisphere, higher generation from fossil fuels can be expected across Asia, Europe and North America in the coming months, which will lift the carbon intensity of all major power systems. But the U.S. is likely to continue leading the pack in terms of carbon emissions growth as power firms in the country opt to dial up output from coal plants ahead of cleaner natural gas plants following a steep rise in national natural gas prices. CARBON INTENSITY GLIDE PATHS All major power systems have reduced their carbon intensity - or the amount of carbon dioxide (CO2) released per kilowatt hour (KWh) of electricity production - over the past five years or so. However, only China has managed to register consistent annual declines in intensity since 2019, largely on the back of world-leading deployment of clean power sources that have allowed utilities to cut back on fossil fuel reliance. During January to October of 2025, China's carbon intensity of power output averaged 562 grams of CO2 per KWh, compared to nearly 670 grams of CO2/KWh in 2019, Ember data shows. Elsewhere, other major power systems have posted at least one annual rise in carbon intensity since 2019 as a mixture of rising power demand, patchy clean power supplies and power policy pivots have sparked shifts in generation mixes. However, only the U.S. system has posted an increase so far in 2025, with an average of 383.3 grams of CO2 emitted per KWh during January to October, compared to 381.2 grams during the same months in 2024. Europe's average carbon intensity is down around 2% so far this year from 2024, while India (down 5%), Japan (down 3%) and Vietnam (down 2%) have also registered reductions. COAL-HEAVY GROWTH Asian economies remain far more coal-reliant than major power networks in Europe and North America. India generates roughly 70% of its electricity from coal, China's coal share is 55%, Vietnam's is 48% and Japan's is around 27% so far this year. In contrast, Europe has generated less than 13% of its electricity supplies from coal-fired power plants this year, while the U.S. coal share is around 16%. However, the U.S. is the only major power market to register a steep rise in coal's share of the overall generation mix so far this year, which is why the U.S. carbon intensity path is out of whack with trends in other regions. The U.S. coal share of around 16.1% so far this year compares with a 14.6% coal share in 2024, and so marks an 11% rise in the share of utility electricity supplies coming from coal plants compared to the year before. Indeed, coal plants have been by far the largest source of electricity supply growth in the U.S. this year, and have accounted for around 73% of the increase in total electricity supplies during January to October, Ember data shows. In all other major power markets, coal's share of the supply growth has been far less, including in India where extra coal-fired output accounted for only half of the overall rise in electricity supplies. TRACKING TRENDS INTO 2026 In the U.S., the roughly 50% climb in average natural gas prices this year has been a major driver of higher coal-fired power generation, as utilities remain under pressure to keep energy prices in check for consumers. Natural gas prices are expected to remain firm through the coming winter thanks to record-large demand from LNG exporters, who can compete with utilities for gas in the U.S. gas market. That outlook for sustained strength in gas prices should keep coal-fired output levels elevated in the U.S. through well into 2026, and could ensure that the U.S. carbon intensity trend keeps climbing. In China and Europe, enduring economic woes have curbed overall industrial activity, and have thereby limited the demand from factories, steel and chemical plants and other major power consumers. Any improvement in economic activity in China and Europe will feed through to higher fossil fuel power generation, and in turn will lift the carbon intensity in those markets. Greater industrial production and demand in China will also boost the economies in the rest of Asia, and could result in a broad upturn in Asia's power sector carbon intensity in 2026. For 2025, however, the U.S. remains the main stand-out in terms of carbon intensity momentum, which continues to go against the global trend of steadily cleaner power networks. The opinions expressed here are those of the author, a columnist for Reuters. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/markets/commodities/us-coal-binge-helps-asia-pull-ahead-west-clean-power-push-2025-12-11/

2025-12-11 06:03

Fed's pause contrasts with market expectations for future rate cuts Economic data gaps due to government shutdown affect policy outlook Investors advised to stay the course amid financial noise and uncertainties NEW YORK, Dec 11 (Reuters) - After three consecutive interest rate cuts, investors now confront an uncertain U.S. monetary policy outlook for the year ahead, clouded by persistent inflation, data gaps, and an impending leadership change at the Federal Reserve. The U.S. Federal Reserve cut interest rates by a quarter-percentage point on Wednesday in an uncommonly divided vote, but signaled it would likely pause further reductions in borrowing costs as officials look for clearer signals about the direction of the job market and inflation that "remains somewhat elevated." Sign up here. The Fed's projection for a slower easing path contrasts with market expectations for two 0.25% cuts in 2026, which would bring the fed funds rate to about 3.0%. Policymakers see only one cut next year and one in 2027. Wednesday's cut brought the policy rate to a range of 3.50%-3.75%. The central bank's updated projections showed six policymakers preferring no rate cut this year, and seven anticipating no further cuts in 2026. How monetary policy evolves from here will hinge on economic data that is still lagging from the impact of the 43-day federal government shutdown in October and November. This comes as the U.S. heads into a midterm-election year likely to focus on economic performance, with President Donald Trump urging sharper rate reductions. "I think the guessing game of what the Fed does next is going to be getting a lot more difficult next year," said Art Hogan, chief market strategist at B Riley Wealth. FED FACES A DELICATE BALANCING ACT Investors face uncertainty over next year’s monetary policy as inflation trends and labor market strength remain unclear. The Fed’s dual mandate—employment and price stability—is fueling internal debate at the Fed. "To me, it just shows you the fine line the Fed is operating in, the fine line the economy is operating in, or I refer to it more as a delicate balance," said Brent Schutte, Chief Investment Officer at Northwestern Mutual Wealth Management Company. "It's highly unknowable where we are headed in the next six to nine months, just given all the changes that are out there in this historically kind of odd period where you have tensions on both sides of their mandate." The flow of economic data should gradually normalize after the recent government shutdown, but uncertainty remains. "The Fed's guidance probably tells us less than usual about the interest rate outlook, for two big reasons," Bill Adams, chief economist for Comerica Bank, said in a note. "First, they know less than usual about the current state of the economy because the shutdown delayed the release of economic statistics. Second, the Fed's guidance doesn't account for how its approach will change after Chair Powell's term ends in May," he said. White House economic adviser Kevin Hassett, seen as the front-runner to be the next Fed chair, told the WSJ CEO Council on Tuesday there is "plenty of room" to cut interest rates further though a rise in inflation could change that view. Trump said on Wednesday that the Federal Reserve's interest rate cut was small and that it could have been larger. "This one just feels to me, at least looking forward into 2026, that there are still lots of unanswered questions that are out there that pertain to the direction of the economy and the direction of interest rates in the future," Schutte said. IGNORE THE NOISE For some investors, the wisest move is to stay the course and avoid knee-jerk reactions. "You're about to get an awful lot of financial noise between now and the end of next year ..." said Alex Morris, chief investment officer at F/m Investments. While investors may still have to grapple with the possibility of better-than-expected growth or higher inflation in the year ahead, those scenarios were seen as unlikely to trigger a tightening in monetary policy, he said. "(It's) not so much that you need to be so worried that you should duck and cover," said Morris, who has been advocating for bond investors to extend duration. Powell on Wednesday said the Fed's next move is unlikely to be a rate hike, given that is not the base case reflected in new projections from central bank policymakers. Meanwhile, stock market investors don't appear too worried about the prospect of a pause in rate cuts. While lower rates have helped lift stocks to new highs, further easing, especially if driven by economic deterioration, may be unwelcome. "I hope there aren’t rate cuts in ’26 because that will mean the economy is weakening. I’d rather have a solid economy and no more cuts," Chris Grisanti, chief market strategist, MAI Capital Management, said. https://www.reuters.com/business/fed-signals-pause-rate-cuts-investors-navigate-data-darkness-leadership-change-2025-12-11/

2025-12-11 05:58

MOSCOW, Dec 11 (Reuters) - Russia said on Thursday that Ukraine had launched a major aerial attack with at least 287 drones downed over a number of regions including Moscow. Russia's defence ministry said at least 40 drones were shot down over the Moscow region, which along with the city itself has a population of more than 22 million. Sign up here. The extent of the damage was not immediately clear but flights were diverted from at all of Moscow main airports. Russia invaded Ukraine in February 2022 and currently controls a little under one fifth of Ukrainian territory. Russia has pummelled its smaller neighbour with missiles and drones, recently targeting its energy sector. Ukraine this year sought to knock out Russian oil refineries and oil terminals with drones. Ukrainian sea drones on Wednesday hit and disabled a tanker involved in trading Russian oil as it sailed through Ukraine's exclusive economic zone in the Black Sea to the Russian port of Novorossiysk, a Ukrainian official said. War insurance costs for ships sailing to the Black Sea have spiked, with insurers reviewing policies daily as the conflict in Ukraine spills into sea lanes. https://www.reuters.com/world/russian-air-defences-shoot-down-15-moscow-bound-drones-evening-mayor-says-2025-12-10/