2025-10-28 05:44

SINGAPORE, Oct 28 (Reuters) - Thailand has yet to approve transmission charges for an extension to a deal to send hydropower from Laos to Singapore, the country's deputy energy secretary said on Monday. The Lao PDR-Thailand-Malaysia-Singapore Power Integration Project, first unveiled in 2022, has been recognised as a precursor to an ASEAN Power Grid, an attempt to reduce Southeast Asia's growing reliance on fossil fuels for power generation. Sign up here. Earlier in October, Malaysia's energy minister said approval could come as early as next month. On the sidelines of an event in Singapore on Monday, Sompop Pattanariyankool, Thailand's deputy permanent secretary at the Ministry of Energy, said Thai authorities still needed to give their approval to the second phase of the power project. "Wheeling charges from Malaysia to Singapore is already done," Pattanariyankool said. "For Thailand, it needs to be approved." Pattanariyankool said he could not provide a timeline for the approval, which depends on a decision by the National Energy Policy Council. Its membership changed when a new government took office last month. Wheeling charges refer to costs imposed on the transmission of electricity through a grid. The lack of a wheeling agreement between Singapore and Thailand would block exports from Laos until a settlement is reached, as the power generated is transmitted through Thailand. Earlier this month, Malaysia's energy minister said political changes had delayed the resumption of power exports from Laos to Singapore. On Monday, Singapore said a resumption was expected soon, without providing further details. https://www.reuters.com/business/energy/thailand-has-yet-approve-transmission-charges-regional-power-deal-2025-10-28/

2025-10-28 05:28

China expands curbs on rare earths Rare earths, critical minerals are key electronic components Essential for items from cars to fighter jets U.S. presses Japan to curb Russian energy imports Japan steps up U.S. LNG investments TOKYO, Oct 28 (Reuters) - U.S. President Donald Trump and Japanese Prime Minister Sanae Takaichi signed a framework agreement on Tuesday for securing the supply of rare earths, as both countries aim to reduce China's dominance of some of the key electronic components. The leaders signed the documents, which included critical minerals, at the neo-Baroque-style Akasaka Palace in Tokyo, beneath three chandeliers decorated from top to bottom with gold ornamentation, as aides applauded. Sign up here. No direct mention was made publicly by the leaders about China, which processes over 90% of the world's rare earths, making it the source of each country's concern about its mineral supply chain. Beijing has recently expanded export curbs. Trump and Chinese President Xi Jinping are set to meet on Thursday on the sidelines of the Asia-Pacific Economic Cooperation in South Korea to discuss a deal that would pause steeper U.S. tariffs and Chinese rare earths export controls. Japan and the U.S. would use economic policy tools and coordinated investment to speed up the "development of diversified, liquid, and fair markets for critical minerals and rare earths", and aim to provide financial support to selected projects within the next six months, the White House said. Both countries would consider a mutually complementary stockpiling arrangement and cooperate with other international partners to ensure supply chain security, it added in a statement. While dominated by China, the U.S. and Myanmar control 12% and 8% of global rare earth extraction, according to Eurasia Group, and Malaysia and Vietnam cover another 4% and 1% of processing, respectively. U.S. ENERGY SUPPLIES Japan has pledged a $550 billion investment into the U.S. economy, part of the wider bilateral trade deal, which could include power generation and liquefied natural gas, among other areas, according to sources familiar with the talks. Ahead of Trump's Asia trip, the U.S. called on Russian energy buyers, including Japan, to cease imports, and imposed sanctions on Moscow's two biggest oil exporters - Rosneft (ROSN.MM) , opens new tab and Lukoil (LKOH.MM) , opens new tab - to push the Kremlin to the negotiation table to end the war in Ukraine. Japan has stepped up U.S. LNG purchases in the last few years as it tries to diversify away from its key supplier Australia and prepare for supply contract expirations from Russia's Sakhalin-2 LNG project, which Mitsui (8031.T) , opens new tab and Mitsubishi (8058.T) , opens new tab helped to launch in 2009. In June, JERA, Japan's top LNG buyer, agreed to buy up to 5.5 million metric tons per annum of U.S. LNG under 20-year contracts, with deliveries starting around 2030. This is roughly the same amount Japan imports annually from Sakhalin-2. Most supply from Sakhalin-2, which covers 9% of Japan's gas needs, ends in 2028-2033. Japan buys less than 1% of its oil imports from Russia under a sanctions waiver, with the bulk of its oil supply covered by the Middle East. Last week alone, Japan's biggest city gas supplier, Tokyo Gas (9531.T) , opens new tab, signed a preliminary deal to buy 1 million metric tons per annum of LNG from the Alaska LNG project, following a similar announcement from JERA in September. JERA pledged $1.5 billion for gas assets in Louisiana in its first foray into upstream production in the U.S., where Tokyo Gas and Mitsui are already present. To keep electricity prices in check, Japan wants to continue Sakhalin-2 LNG imports, a senior official has said, as it takes only a few days to deliver LNG to Japan compared to around a week from Alaska and roughly a month from the U.S. Gulf Coast. "The U.S. said it wants Japan to stop importing Russian energy - but this is Japan's closest LNG source and which is also cheap," said Nobuo Tanaka, chief executive with Tanaka Global, Inc. advisory. "I think the question should be framed this way: can the U.S. provide Japan with LNG as cheap as what currently comes from Russia? Can gas from Alaska be that affordable?" https://www.reuters.com/world/asia-pacific/trump-takaichi-agree-rare-earth-critical-minerals-supply-2025-10-28/

2025-10-28 05:09

Oct 27 (Reuters) - Citigroup (C.N) , opens new tab and cryptocurrency exchange Coinbase (COIN.O) , opens new tab plan to collaborate on digital asset payment solutions for the U.S. bank's institutional clients, to expand the offering to global clients in the future. The partnership will initially focus on enabling users to deposit and withdraw traditional currencies (commonly referred to as "fiat" in crypto) through Coinbase's services, marking a significant step as it allows smooth transitions between traditional money and digital assets like cryptocurrencies, the two companies said in a joint statement on Monday. Sign up here. Additionally, the collaboration will streamline payment operations, Citi said. "By combining their reach with Coinbase's leadership in digital assets, we're creating solutions that can simplify and expand access to digital asset payments," said Brian Foster, global head of Crypto as a Service at Coinbase. Citi said more details on specific features, including exploring ways to convert traditional currency into stablecoins, will be disclosed in the coming months. Stablecoins are digital tokens designed to keep a constant value. They are often backed by traditional assets such as the U.S. dollar or government debt. They have surged in popularity, and their demand is expected to increase further after the U.S. passed its GENIUS Act in July that sets federal rules for stablecoins. Dealmaking within the digital assets industry has picked up pace this year as a crypto-friendly Trump administration encourages companies to expand their business in the U.S., providing a favorable environment for growth and investment. Coinbase, one of the world's largest cryptocurrency exchanges, shelled out $375 million to buy investment platform Echo, while earlier this year it had struck a $2.9 billion deal for crypto options provider Deribit. https://www.reuters.com/business/finance/citi-tie-up-with-coinbase-boost-digital-payments-institutional-clients-2025-10-28/

2025-10-28 05:01

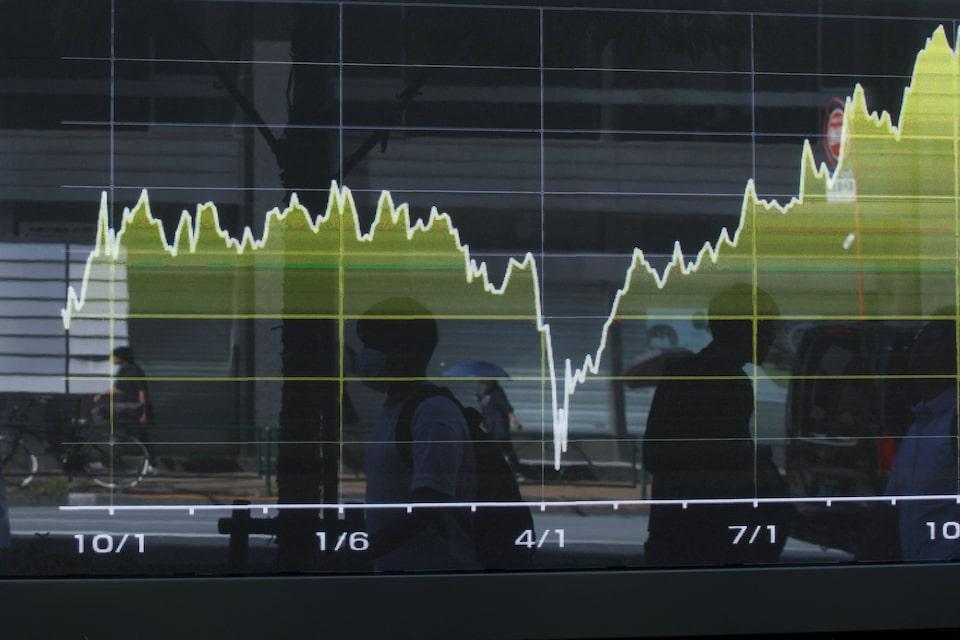

Megacap earnings due this week Policy announcement on tap from multiple central banks U.S. indexes end session with record closing levels NEW YORK, Oct 28 (Reuters) - Global shares ascended to an intraday record on Tuesday, buoyed by signs of cooling trade tensions between the U.S. and China and by gains in technology shares, while investors awaited a Federal Reserve policy decision and digested corporate earnings. The U.S. Federal Reserve on Wednesday will kick off a string of policy announcements this week by global central banks, including in Japan, Canada and Europe. Sign up here. The Fed is widely expected to cut interest rates at the meeting, with markets pricing in a 99.9% chance for a rate cut of 25 basis points, according to CME's FedWatch Tool , opens new tab. Expectations for a lower path of interest rates from the central bank, along with recent signs of easing trade tensions between the U.S. and China, have helped to boost the markets' risk appetite, sending stocks higher and keeping the 10-year U.S. Treasury yield moored near multi-month lows. In addition, the ongoing U.S. government shutdown has led to a shortage of economic data for investors to parse. CONTINUED RALLY SEEN IN RISKY ASSETS With the lack of government data, investors have looked to other sources to gauge the strength of the economy. On Tuesday, the ADP National Employment Report's inaugural weekly preliminary estimate showed U.S. private payrolls increased by an average of 14,250 jobs in the four weeks ending October 11. "Volatility has been extraordinarily low and in some respects, surprising, given all of the uncertainties ... but it seems to be very, very stable, and you're seeing the sort of continued rally in risky assets," said Subadra Rajappa, head of U.S. rates strategy at Societe Generale in New York. "So you have a combination, especially for the Fed meeting, of lower yields, easier financial conditions, inflation coming off, the job market remaining somewhat stable as well, so it's been a tough read on the economy." The European Central Bank and Bank of Japan are largely expected to keep rates unchanged at their policy meetings. DOW LEADS GAINS AMONG MAJOR INDEXES On Wall Street, U.S. stocks closed at another record, boosted in part by a 2% advance in Microsoft (MSFT.O) , opens new tab after it reached a deal that allows OpenAI to restructure into a public benefit corporation while giving the megacap company a 27% stake in the ChatGPT maker. Also providing a boost was a 5% jump in Nvidia (NVDA.O) , opens new tab after CEO Jensen Huang said the artificial-intelligence chip leader will build seven new supercomputers for the U.S. Department of Energy, and the company has $500 billion in bookings for its AI chips. The Dow Jones Industrial Average (.DJI) , opens new tab rose 161.78 points, or 0.34%, to 47,706.37, the S&P 500 (.SPX) , opens new tab rose 15.73 points, or 0.23%, to 6,890.89 and the Nasdaq Composite (.IXIC) , opens new tab rose 190.04 points, or 0.80%, to 23,827.49. "Momentum and earnings are pushing the market higher," said Peter Cardillo, chief market economist at Spartan Capital Securities in New York, adding that there is also "enthusiasm about Trump's Asian trip." Equities have rallied of late as U.S. President Donald Trump and his Chinese counterpart Xi Jinping are due to meet on Thursday to decide on a framework that could pause tougher U.S. tariffs and China's rare-earth export curbs, easing market worries about an escalating trade war. Earnings are expected this week from "Magnificent Seven" heavyweights Microsoft, Alphabet (GOOGL.O) , opens new tab, Apple (AAPL.O) , opens new tab, Amazon (AMZN.O) , opens new tab and Meta Platforms (META.O) , opens new tab. Investors will closely eye the results to see if they justify lofty valuations. MORE THAN FOUR IN FIVE S&P COMPANIES BEAT EXPECTATIONS Of the 180 S&P 500 companies that have reported earnings through Tuesday morning, 86.7% have topped analyst expectations, according to LSEG data. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab advanced 21.18 points, or 0.12%, to 1,013.68 after hitting a record 1,015.73 while the pan-European STOXX 600 (.STOXX) , opens new tab index closed down 0.22%. The yield on benchmark U.S. 10-year notes fell 2.1 basis points to 3.976%. The dollar index , which measures the greenback against a basket of currencies, fell 0.07% to 98.70, with the euro up 0.11% at $1.1656. Against the Japanese yen , the dollar weakened 0.52% to 152.07 after comments by a Japanese minister and U.S. Treasury Secretary Scott Bessent eased some concerns about more expansive fiscal and monetary policy in that country. Sterling weakened 0.45% to $1.3275. U.S. crude settled down 1.89% to $60.15 a barrel, and Brent fell to settle at $64.40 per barrel, down 1.86%, as investors assessed the effect of U.S. sanctions on Russia's two biggest oil companies along with a potential OPEC+ plan to raise output. https://www.reuters.com/world/china/global-markets-wrapup-1-2025-10-28/

2025-10-28 04:59

MUMBAI, Oct 28 (Reuters) - The Indian rupee closed little changed on Tuesday as lingering pressure on the currency was blunted by likely central bank intervention across the local spot and non-deliverable forward market, traders said. Worries about limited progress in U.S.-India trade negotiations have been a drag for the rupee since steep tariffs went into effect in late August, while importer dollar demand has also remained elevated. Sign up here. The rupee closed at 88.2650 against the U.S. dollar, nearly flat compared to its close at 88.2450 in the previous session. It had declined to a two-week low of 88.40 in early trading. The Reserve Bank of India likely intervened to support the rupee, five traders said, with two also pointing out that the central bank was active across the spot and NDF markets. The central bank's presence in NDF "appears to be quite strong but the upward pressure (on USD/INR) is likely to persist," a trader at a private bank said. In addition to dollar demand from local corporates, bids for the greenback related to maturity of NDF positions are also likely to be a sore spot for the rupee in the near term, the trader said. India's benchmark stock index Nifty 50 (.NSEI) , opens new tab closed down 0.1% on the day, tracking declines in regional stocks. The dollar index was steady on Tuesday while the onshore Chinese yuan ended its domestic trading session at the strongest level since November 2024. Investors are keeping their focus on U.S. President Donald Trump's Asia visit for signs of a breakthrough in trade talks with China as Trump and Chinese President Xi Jinping meet in South Korea on Thursday. "Optimism remains intact that President Trump and Xi can agree on a meaningful trade truce ... we remain very much focused on what happens to China's threat of stringent controls on rare earth exports," analysts at ING said in a note. https://www.reuters.com/world/india/weak-dollar-may-boost-rupee-open-after-hedging-fuelled-slide-past-88-2025-10-28/

2025-10-28 04:31

Oct 28 (Reuters) - A look at the day ahead in European and global markets from Wayne Cole. U.S. President Donald Trump is touring Tokyo today, and all the talk is of baseball, golf gifts and Nobel Peace Prizes, along with the odd deal on rare earths. Sign up here. The bonhomie is at least a relief from the usual trade war invective and keeps alive hopes for some sort of rapprochement with China later in the week. It's allowed Asian markets to consolidate most of the outsized gains made on Monday, with indexes in Japan, Taiwan and South Korea all near record highs. The latter got an added bump from data showing the economy outpaced forecasts in the third quarter, led by strength in consumption and exports. China's Shanghai index (.SSEC) , opens new tab also pushed past 4,000 for the first time since 2015 as Beijing signed an upgraded free-trade deal with Southeast Asian bloc ASEAN. European and Wall Street futures are mostly flat, no surprise given the who's who of mega-caps reporting this week have a lot to live up to. Expectations are high given that of the 30% of S&P 500 companies reporting so far, 85% have topped the Street on EPS. Options imply share price swings of 6% in either direction are possible depending on the results. Likewise, bonds and the dollar are waiting anxiously to see just how dovish the Federal Reserve might be on Wednesday. A cut of 25 basis points is baked in, and investors are looking for validation of bets for another in December, and two more next year. The long-end would also very much like for the Fed to stop running down its balance sheet, please. No more QT for thee. For the Bank of Japan, betting is very much for no move on Thursday, though there is a risk that two or more members vote for a rate hike given stubborn inflation. An actual hike would certainly trigger a violent sell-off in dollar/yen, suggesting the risk-averse BOJ might just lay the groundwork for a tightening in December or January. Key developments that could influence markets on Tuesday: - ECB bank lending survey - U.S. Conference Board Consumer Confidence, Richmond Fed October Manufacturing Index, Dallas Fed services survey, August house prices https://www.reuters.com/world/china/global-markets-view-europe-2025-10-28/