2025-12-11 07:06

HONG KONG, Dec 11 (Reuters) - Hong Kong's de-facto central bank lowered on Thursday its base interest rate by 25 basis points to 4.0%, in line with a cut by the U.S. Federal Reserve, but major lenders declined to pass on the reduction to customers. Hong Kong's monetary policy moves in lock-step with the United States as the city's currency is pegged to the greenback in a tight range of 7.75-7.85 per dollar. Sign up here. It was the third easing by the Hong Kong Monetary Authority (HKMA) this year and followed a similar cut late in October. After the cut announced on Thursday, HSBC and Bank of China (Hong Kong) said they would maintain their best lending rates in Hong Kong at 5%. Standard Chartered Bank said it would keep its Hong Kong dollar best lending rate unchanged at 5.25%. All three lenders kept their savings rates unchanged. The banks did not provide reasons, but HKMA CEO Eddie Yue told reporters that lenders would take into consideration factors including interbank rates and the cost of capital when making decisions on interest rates. "Many banks had mentioned in their rate cut last time that the current savings rates are getting close to zero," Yue said. The Federal Reserve lowered the benchmark policy rate by a quarter of a percentage point in a widely expected move, but indicated it would likely pause its easing cycle at the next policy meeting in January. "An interest rate cut always has a positive impact on the economy and housing market," Yue said. "However, the pace of future rate cuts remains quite uncertain, which may influence the interest rate environment in Hong Kong," he added, urging the public to carefully manage interest rate risks when making financial decisions. https://www.reuters.com/world/asia-pacific/hong-kong-central-bank-cuts-interest-rate-tracking-fed-move-2025-12-11/

2025-12-11 06:40

HANOI, Dec 11 (Reuters) - Vietnam's parliament on Thursday approved a revised law that restricts exports of refined rare earths and reaffirms a ban on ore exports, in a bid to support a domestic industry that has struggled for decades to exploit its substantial reserves. Vietnam has some of the world's largest deposits of rare earths, according to the U.S. Geological Survey, though the government agency earlier this year significantly lowered its estimate of the country's reserves to 3.5 million metric tonnes from 22 million tonnes. Sign up here. Changes to the existing law on minerals state that "deep processing of rare earths must be associated with building a modern industrial ecosystem to improve the domestic value chain and ensure autonomy," which indirectly restricts the export of refined rare earths. The West is scrambling for alternatives to China's refined rare earths, used in cars, renewable infrastructure and other sensitive industries. Beijing, which dominates global supplies, introduced export controls in April at the height of its trade war with the U.S. Vietnam's restrictions will have no immediate impact as the country has virtually no refining capacity at the moment. It has banned the export of rare earth ores since at least 2021. But regulatory hurdles have long prevented the exploitation of its reserves by local enterprises and foreign partners. The new law reaffirms the ban on exporting ores and stresses that "exploration, exploitation and processing activities must be strictly controlled." https://www.reuters.com/world/asia-pacific/vietnam-curbs-exports-refined-rare-earths-reaffirms-ban-ore-trade-2025-12-11/

2025-12-11 06:27

Indian rupee most shorted, bearish bets at 10-month high Long positions on Chinese yuan rise to nearly three-year high Bearish bets decline for rupiah, S.Korean won Dec 11 (Reuters) - Analysts ramped up long bets on most Asian currencies on stronger growth prospects and weakness in the greenback, a Reuters poll showed on Thursday, while short positions on the Indian rupee surged to a 10-month high. They turned bullish on the Singapore dollar , upped their long positions on the Thai baht , and pushed long bets on the Malaysian ringgit to their highest levels since mid-June, according to a fortnightly poll of 11 respondents. Sign up here. The ringgit has risen 8.8% so far this year, on track to notch its strongest performance since 2017. The Malaysian central bank's tight monetary stance, capped by just a modest quarter-point move in 2025, alongside brighter growth prospects have lifted the currency. The ringgit is likely to find support from fiscal reforms, strong domestic-led investment outlook, and narrowing yield differentials with the U.S., said Lloyd Chan, senior currency analyst with MUFG. Meanwhile, recent weakness in the dollar index on bets of further policy easing has also helped regional currencies. All poll responses were collected before the U.S. Federal Reserve cut rates by 25-basis-points on Wednesday. Long positions on the Chinese yuan also rose to their highest since late January 2023. The currency rose for a fourth straight month in November - its longest string of monthly gains in four years. A record export surplus in the first 11 months of the year has buoyed the yuan. At the same time, Beijing is planning to expand domestic demand and shore up the broader economy in 2026 with a more proactive policy push. Short bets on Indonesian rupiah , South Korean won and Taiwan dollar have decreased. Indonesia's domestic economy has proven resilient, powered by robust fiscal stimulus and a brighter growth outlook. In contrast, the sharp weakness in the won has forced government authorities to issue a stern warning to markets. The Indian rupee , on the other hand, had short bets surging to their highest levels in ten months. The currency is set to mark its eighth straight year of depreciation with a more than 5% loss. Analysts at Barclays see limited potential for USDINR to move lower, noting that the Reserve Bank of India does not appear to be particularly concerned about the fall, given the inflation gap between India and advanced economies. They expect the unit to reach 94 per dollar by end of 2026. "As long as the currency continues on its 'crawl', moving roughly along the path that forwards imply, it should not prompt major resistance from the RBI." Meanwhile, the Philippine central bank's aggressive rate‑cutting cycle has fuelled a clear tilt toward bearish bets on the peso . The Bangko Sentral ng Pilipinas is expected to cut rates for the fifth consecutive meeting later in the day. The Asian currency positioning poll is focused on what analysts and fund managers believe are the current market positions in nine Asian emerging market currencies: the Chinese yuan, South Korean won, Singapore dollar, Indonesian rupiah, Taiwan dollar, Indian rupee, Philippine peso, Malaysian ringgit and the Thai baht. The poll uses estimates of net long or short positions on a scale of minus 3 to plus 3. A score of plus 3 indicates the market is significantly long U.S. dollars. The figures include positions held through non-deliverable forwards (NDFs). The survey findings are provided below (positions in U.S. dollar versus each currency): https://www.reuters.com/world/china/bullish-views-rise-most-asia-currencies-indian-rupee-shorts-spike-2025-12-11/

2025-12-11 06:23

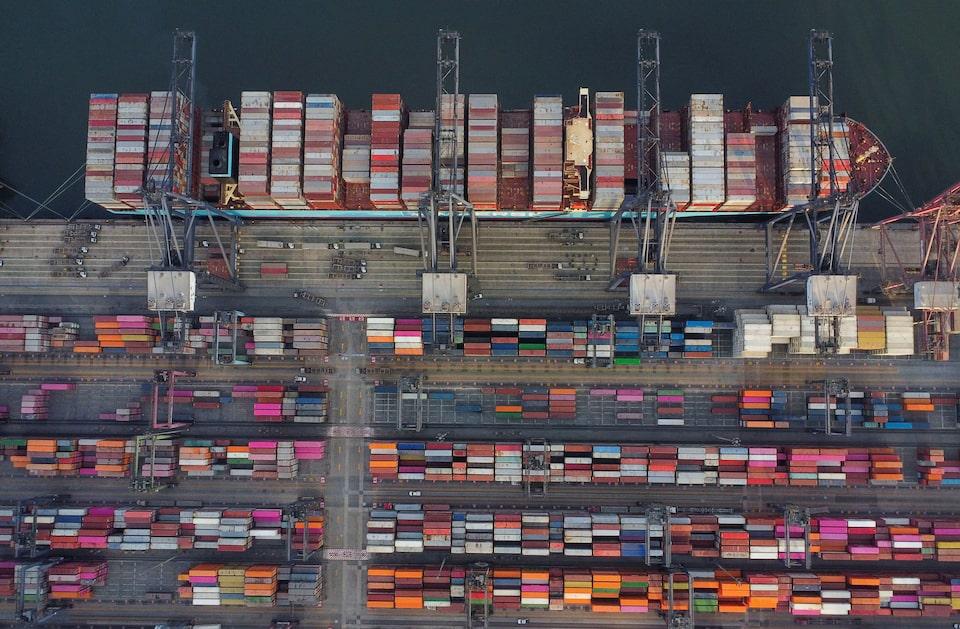

New duties of up to 50% will be imposed in 2026 on certain goods Majority of products will see tariffs of up to 35% China and some local business groups oppose the hike Move seen as appeasing US ahead of next USMCA review MEXICO CITY, Dec 10 (Reuters) - Mexico's Senate on Wednesday approved tariff hikes of up to 50% next year on imports from China and several other Asian countries, aiming to bolster local industry despite opposition from business groups and the governments of targeted countries. The proposal, passed earlier by the lower house, will raise or impose new duties of up to 50% from 2026 on certain goods such as autos, auto parts, textiles, clothing, plastics and steel from countries without trade deals with Mexico, including China, India, South Korea, Thailand and Indonesia. The majority of products will see tariffs of up to 35%. Sign up here. The Senate passed the bill, with 76 votes in favor, 5 against, and 35 abstentions. The approved bill is softer than one that stalled in the lower house this autumn, with tariffs on about 1,400 different product lines - mostly textiles, apparel, steel, auto parts, plastics and footwear - and reduced duties on roughly two-thirds of them compared with the original proposal. China's Ministry of Commerce responded on Thursday saying it would track Mexico's new tariff regime and weigh its impact, but warned that such measures would "substantially undermine" the interests of trade. "China has always opposed all forms of unilateral tariff increases and hopes Mexico will correct such unilateralist and protectionist practices as soon as possible," the commerce ministry said. China's Ministry of Foreign Affairs did not immediately comment on the higher tariffs. Analysts and the private sector say the move is aimed at appeasing the U.S. ahead of the next review of the United States-Mexico-Canada trade agreement (USMCA), and that it is also intended to generate $3.76 billion in additional revenue next year as Mexico seeks to reduce its fiscal deficit. "On the one hand, it protects certain local productive sectors that are at a disadvantage with respect to Chinese products. It also protects jobs," said Mario Vazquez, a senator for the opposition PAN party. But, also, "the tariff is an additional tax that citizens pay when they buy a product. And these are resources that go to the state. We would need to know what they are going to be used for. Hopefully, production chains in the country will be strengthened,” Vazquez said. Emmanuel Reyes, a senator from the ruling Morena party, defended the measure. "These adjustments will boost Mexican products in global supply chains and protect jobs in key sectors," said Reyes, who is chairman of the Senate Economy Committee. "This is not merely a revenue-raising tool, but rather a means of guiding economic and trade policy in the interest of general welfare," he said. Mexico had said in September that it would raise its tariff on automobiles and other goods from China and other Asian countries. The United States has been pushing countries in Latin America to limit their economic ties with China, with which it competes for influence in the region. https://www.reuters.com/business/retail-consumer/mexicos-senate-approves-tariff-hikes-chinese-other-asian-imports-2025-12-11/

2025-12-11 06:15

LONDON, Dec 11 (Reuters) - Nearly half of UK businesses surveyed by FX and cash management solutions provider MillTech say that they have lost money due to a volatile pound and plan to hedge more of their currency risk, and for longer, a report released on Thursday showed. The report surveyed over 250 chief financial officers and treasurers at UK companies in October about their hedging plans and costs. It showed 48% of those polled said they had lost money as a result of the big swings in sterling's value. Sign up here. WHY IT’S IMPORTANT Currency volatility has accelerated this year, as geopolitical uncertainty has picked up and global trade relations have become more unpredictable since U.S. President Donald Trump has pushed to enact his "America First" agenda. Hedging rates by UK corporates have risen for their third consecutive year to 78%, up from 76% in 2024 and 70% in 2023. Among firms not currently hedging, 68% are now considering doing so in response to market conditions, MillTech's survey showed. KEY QUOTE "Most CFOs treat FX like a slow-dripping tap. It’s something they can put off fixing while it’s only a nuisance. But this year, that drip turned into a full-on leak, and many UK firms have been scrambling with towels and buckets," Eric Huttman, chief executive of MillTech, said. CONTEXT Sterling hit four-year highs above $1.37 in July against a broadly weak dollar, then fell back as UK fiscal worries weighed on sentiment. It is set for its most volatile year since 2022, LSEG data shows. BY THE NUMBERS The mean hedge ratio, or the percentage of companies' foreign exchange exposure that they protect, is at 53%, up from 45% in 2024. Hedges in 2025 cover an average period of 5.52 months, versus 5.55 months in 2024, but well above the 4.04 months in 2023. https://www.reuters.com/world/uk/many-uk-firms-say-volatile-pound-triggered-losses-2025-need-hedge-grows-2025-12-11/

2025-12-11 06:05

BOJ keeping watchful eye on rising bond yields Policymakers set high hurdle for ramping up bond buying Japan not seeing panic selling considered prerequisite for action BOJ sticking to taper plan, eyes cut to super-long JGB buying TOKYO, Dec 11 (Reuters) - The Bank of Japan sees limited need for emergency intervention to restrain rising bond yields, a move that runs counter to its effort to roll back stimulus, three sources familiar with its thinking said. Growing market anticipation of an interest rate hike in December has pushed up the benchmark 10-year Japanese government bond (JGB) yield to an 18-year high this week, drawing attention to how the central bank could respond. Sign up here. BOJ Governor Kazuo Ueda, speaking in parliament on Tuesday, said recent increases in bond yields were "somewhat rapid" and reiterated the central bank's readiness to respond nimbly in exceptional circumstances. Policymakers are keeping a watchful eye on market moves but are reluctant to take action presently, such as ramping up bond purchases or conducting emergency market operations, the sources said, citing a high threshold for intervention. They also see no imminent need to tweak the BOJ's plan to steadily reduce bond purchases, including for super-long tenors that have recently led to yields rising to record highs, they said. "It would take a panicky sell-off that is out of sync with fundamentals, something Japan isn't seeing right now," said one of the sources on the high hurdle for the BOJ to ramp up bond buying, a view echoed by two other sources. Rather, the recent yield rises are due to investors taking a wait-and-see approach on uncertainty over how far the BOJ could eventually raise rates, and how much of bonds the government will sell to fund next fiscal year's budget, they said. Ueda has signalled the BOJ will offer some clarity on its future rate-hike path when the board decides to raise rates to 0.75% from 0.5% - a move markets expect at next week's policy meeting. Last year, the BOJ exited a decade-long, massive stimulus including by ditching its bond yield curve control and slowing the pace of JGB purchases. In laying out its taper plan, the BOJ said that while long-term rates should be determined by markets, it will respond "nimbly" if yields rise rapidly in a way out of sync with fundamentals. Ueda has repeated the language, whenever asked about yield moves at press briefings or in parliament, including on Tuesday. The 10-year JGB yield rose to an 18-year high of 1.97% on Monday, approaching the psychologically important 2% line that has not been breached for nearly two decades. The BOJ will focus on what is driving the moves rather than specific yield levels, and stay cautious on intervening as doing so would give a wrong signal to markets that it could discontinue efforts to normalise policy, the sources said. Intervening would also give markets the impression the BOJ has a line in the sand on where it would step in, running counter to its attempt to have market forces drive bond price moves, they said. Yields around the globe have been climbing in recent weeks, as many central banks signalled they are either at or near the end of their own easing cycles, while the BOJ is widely anticipated to hike rates at its policy meeting next week. JGB yields have also risen on expectations that Prime Minister Sanae Takaichi's expansionary fiscal policy would lead to a huge issuance of bonds, at a time the BOJ was reducing its presence in the market. https://www.reuters.com/world/asia-pacific/bank-japan-reluctant-intervene-rising-yields-sources-say-2025-12-11/