2025-10-27 11:13

Botswana also seeks controlling stake in De Beers Bidding war could test the Southern African states' ties Restructuring Anglo selling De Beers amid diamond price crash LONDON, Oct 24 (Reuters) - Angola has bid for a majority stake in Anglo American (AAL.L) , opens new tab unit De Beers, a source familiar with the matter told Reuters on Friday, setting up a potential standoff with neighbouring Botswana which is also seeking control of the diamond producer. De Beers, one of the world's leading diamond companies, operates in Botswana, Namibia, South Africa and Canada. Sign up here. The source said Angola's state-owned diamond company Endiama had submitted the offer, confirming a report by Bloomberg News. De Beers is jointly exploring for diamonds in Angola with Endiama and in August announced the country's first kimberlite field discovery in three decades. Kimberlite is an igneous rock that can contain the precious stones. DE BEERS UP FOR SALE AS DIAMOND PRICES DROP De Beers, put up for sale by Anglo amid falling diamond prices, had attracted interest from at least six consortia, according to a Reuters report in June. Anglo values De Beers at $4.9 billion after recording $3.5 billion in impairments over the past two years. Anglo American and Angola's mines ministry declined to comment. Endiama could not immediately be reached for comment. Botswana - which currently owns 15% of De Beers and contributes 70% of its annual rough diamond production - considers the company a strategic national asset, despite the slump in prices, which has badly hurt its economy. Its mining minister said in July that the Southern African country wanted to take full control of De Beers. Botswana's mines ministry also could not immediately be reached for comment. Angola said in September that it was seeking a minority stake in De Beers and thought it should be led by a private-sector firm. https://www.reuters.com/world/africa/angola-bids-majority-stake-de-beers-source-says-2025-10-24/

2025-10-27 11:03

LONDON, Oct 27 (Reuters) - British retailers reported another drop in sales in October and they expect a further fall in November as consumers worry about finance minister Rachel Reeves' budget in a month's time, a survey showed on Monday. The Confederation of British Industry said its gauge of how retail sales compared with a year earlier improved only marginally but remained negative at -27 this month from -29 in September. Sign up here. The CBI's gauge of expected sales for the month ahead slipped to -39 from -36. Martin Sartorius, CBI principal economist, said the 13th consecutive month of falling sales volumes reflected poor consumer confidence which had been compounded by caution ahead of the budget on November 26. "Persistent uncertainty ahead of the autumn budget is deepening the strain on retailers and other distribution firms that are still grappling with the effects of last year's fiscal decisions," Sartorius said. "To help rebuild confidence and encourage growth, the chancellor should reaffirm her commitment to no further business tax hikes in November." Retailers - who like other employers were hit by a hike in social security contributions in Reeves' first budget last year - were also nervous about planned employment rights legislation which could deter hiring, Sartorius said. Separate official data published on Friday showed a surprise increase in sales volumes in September, helped by tech sales - including Apple's (AAPL.O) , opens new tab new iPhone models - and demand for gold from online jewellers. The CBI's survey was conducted between September 26 and October 14. Of the 192 respondents, 81 were retailers and 86 were wholesalers. https://www.reuters.com/business/retail-consumer/uk-retailers-struggle-again-budget-fears-weigh-consumers-cbi-says-2025-10-27/

2025-10-27 10:39

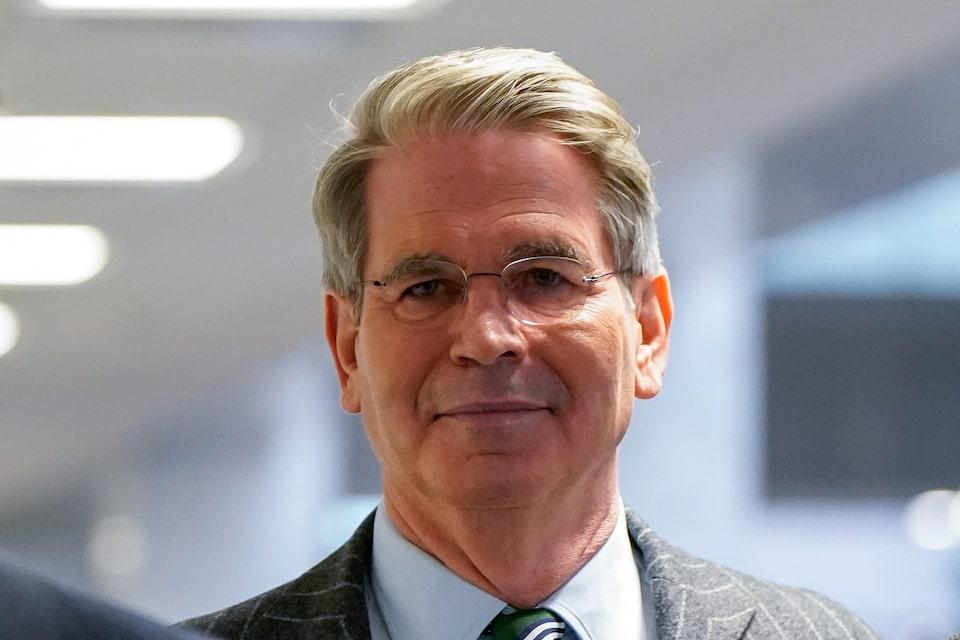

TOKYO, Oct 27 (Reuters) - U.S. Treasury Secretary Scott Bessent celebrated Japan's Nikkei share average (.N225) , opens new tab closing above the 50,000 level for the first time on Monday, in a meeting with Japanese finance minister Satsuki Katayama in Tokyo. "It's an honor to be here on the day it went over 50,000", Bessent told Katayama. "Congratulations," he added. Sign up here. "I've been coming since 1991," said Bessent, a former hedge fund manager known for having made hefty profits for betting against the yen in the 2010s. Bessent arrived in Japan on Monday evening as part of the Asia tour of top U.S. officials led by President Donald Trump and met Katayama for the first time in person since she took office last week. https://www.reuters.com/world/asia-pacific/bessent-celebrates-nikkei-milestone-meeting-with-japan-finmin-katayama-2025-10-27/

2025-10-27 09:47

CEO concerned over security officers shortage during shutdown Delta's joint venture with Aeromexico faces antitrust scrutiny No resolution timeline for Delta's Aeromexico joint venture issue RIYADH, Oct 27 (Reuters) - Delta Air Lines (DAL.N) , opens new tab is seeing a "small" impact from the U.S. government shutdown, costing it less than $1 million a day, and the shortage of airport security staff is of greater concern, the carrier's CEO said on Monday. "The more obvious concern is TSA (Transportation Security Administration) and ensuring that those checkpoints are staffed accordingly," Delta CEO Ed Bastian told Reuters on the sidelines of the Fortune Global Forum in Riyadh. Sign up here. There is also a shortage of air traffic controllers in the United States. Some 13,000 air traffic controllers and about 50,000 Transportation Security Administration officers must work without pay during the government shutdown. Controllers will miss their first full paycheck on Tuesday. "Air traffic control is something in the U.S. that is understaffed to begin with. So it's hard to sometimes identify what is attributable to the shutdown versus just understaffing in general," Bastian said. Delta is locked in a dispute with the U.S. government over its nearly nine-year-old joint venture with Aeromexico, which the U.S. Department of Transportation has ordered must end on January 1, as part of several actions aimed at Mexican aviation, citing competition concerns. "We believe that the dissolution of our joint venture, particularly because of (Antitrust Immunity) is not the right strategy and something that we have to ensure that we protect our interests here for the long term," Bastian said, adding that he sees no timeline for a resolution of the issue. "We've been in conversation (with the administration) for a long time," he said. The joint venture allows the two carriers to coordinate scheduling, pricing and capacity for U.S.–Mexico flights. https://www.reuters.com/business/delta-air-lines-seeing-small-impact-us-government-shutdown-ceo-says-2025-10-27/

2025-10-27 07:58

LISBON, Oct 27 (Reuters) - Portugal's Galp Energia (GALP.LS) , opens new tab reported an 11% increase in adjusted third-quarter core profit on Monday, beating analysts' estimates, driven by a jump in refining margins and robust gas trading. The energy firm reported adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) of 911 million euros ($1.06 billion), surpassing the company-provided consensus of 865 million euros. Sign up here. Galp said in a statement that it is "well positioned to surpass" its current guidance of a full-year adjusted EBITDA of 2.7 billion euros. Co-CEO Maria Joao Carioca said "the results show the strength of our investments," and Galp's performance and efficiency enable it "to navigate the unpredictability of today's world." The adjusted EBITDA of its refining and gas trading business soared to 315 million euros in the reported quarter from 165 million a year earlier, as the refining margin nearly doubled to $9.5 per barrel from $4.7 a year ago, Galp said in a statement. The start of LNG deliveries from Venture Global's (VG.N) , opens new tab Calcasieu Pass export facility in Louisiana also contributed positively, "supporting a 42% rise in natural gas volumes traded", it said. EBITDA from extracting crude oil from rich fields offshore Brazil, its main business, fell 14% to 464 million euros, despite the company signalling "good operational performance". Its share of oil and gas production from its projects in the third quarter increased by 2% to 115,000 barrels per day, but Brent crude prices fell to an average of $69.1 per barrel in the quarter from $80.3 last year. Galp is in advanced talks with a shortlist of preferred bidders to sell half of its 80% stake in its offshore Mopane field in Namibia, which has estimated oil-in-place of more than 10 billion barrels. It said negotiations are advancing "with discussions supportive of a value accretive partnership." Galp's adjusted net profit climbed 53% to 407 million euros in the quarter, beating the 321 million-euro estimate. ($1 = 0.8575 euros) https://www.reuters.com/business/energy/galp-energias-quarterly-core-profit-rises-11-surpassing-estimates-2025-10-27/

2025-10-27 07:53

KYOTO, Oct 27 (Reuters) - Gold refineries accredited by the London Bullion Market Association will be required to provide data to a digital platform from 2027 to increase transparency in the industry, the association's head said on Monday. The LBMA, which oversees London's over-the-counter gold trading hub, the world's largest, is pushing the market for more transparency as the gold price has risen 55% this year, and hit a record high of $4,381 a troy ounce on October 20, with broader concerns about U.S. tariffs adding to overall turbulence. Sign up here. "We will have voluntary periodic reporting from January next year, moving to mandatory in 2027," LBMA CEO Ruth Crowell told the association's precious metals conference in Kyoto, Japan. The association launched the Gold Bar Integrity Database in January for faster data collection and data processing from refiners, which are on its "good delivery" list. Being on the "good delivery" list provides access to the London market, requiring refineries to source the metal responsibly. As of now, refineries report data on the country of origin of the material they source to the LBMA once a year. "We want that to be an ongoing dialogue, but we also want to work with the refineries to make sure that it's practical, that we're not creating unnecessary burden for them," Crowell told reporters. The LBMA's "good delivery" list includes 66 gold refiners and 83 silver refiners around the globe. LBMA's publicly available monthly data on the amount of gold held in London vaults, which goes back to 2016, was a crucial source of information for the market early this year when U.S. tariff concerns caused metal outflows to the United States, adding to worries about the remaining liquidity in London. "It's this data that we need to build on, and the Gold Bar Integrity infrastructure and ecosystem is just that," Crowell said. "Markets are becoming more and more complicated. We need to have dialogue with the refineries when you start to source from new jurisdictions. We need to all have trust in the gold that is underpinning these markets." https://www.reuters.com/business/lbmas-new-database-gold-bars-will-be-mandatory-listed-refineries-2027-2025-10-27/