2025-10-27 05:01

ECB to stay on hold again on Thursday Inflation, growth risks still uncertain as tariff impact awaited Markets unsure whether the ECB will cut next year LONDON/MILAN, Oct 27 (Reuters) - The European Central Bank will likely keep rates on hold again on Thursday as traders waver on whether it will resume easing next year. Renewed U.S.-China trade tensionsprompted caution in markets earlier in October but strong data and signs of progress towards a deal mean traders have trimmed rate cut bets again. Sign up here. Here are five key questions for markets: 1/ What will the ECB do this week? Hold rates at 2% for the third meeting running. Not much has changed since September, when policymakers said the economy was in a "good place". They are yet to see the full impact of U.S. tariffs and the euro, whose 12% rise this year risks driving inflation down, has dropped. "This is just an interim meeting. The more significant one will be in mid-December," said UBS chief European economist Reinhard Cluse. 2/ Inflation is back above target. Is the ECB worried? No. Euro zone inflation rose to 2.2% in September, above target for the first time since April, as services prices rose and energy cost declines slowed. That was in line with expectations. The ECB sees inflation dropping to 1.7% next year and staying below target through mid-2027. Policymakers broadly see inflation risks as balanced, but more seem worried about the risk of weaker rather than stronger inflation, ECB September meeting minutes suggested. "Near-term inflation risks are to the downside, due to the stronger euro and the disinflationary impulse from Chinese exports," said Paul Hollingsworth, head of developed market economics at BNP Paribas, referring to risks of China dumping surplus exports into Europe. Upside risks on the back of German stimulus are more medium term, he added. 3/ Why are traders moving back and forth on 2026 rate cut bets? Markets were initially concerned about escalating trade risks after U.S. President Donald Trumpunveiled additional levies on Chinese imports earlier in October. So, traders priced in around an 80% chance of a 2026 rate cut, a big shift from September, when a hawkish-sounding ECB had led markets to price out such a move. But data last week suggesting the euro zone economy is gaining momentum and Trump saying he hoped to close a trade deal with China this week have led traders to dial back bets again. They now see just under a 50% chance of a cut by end-2026. 4/ Economic uncertainty remains high. What does that mean for ECB policy? It underscores why policymakers have not closed the door on further cuts. ECB chief economist Philip Lane says downside risks would strengthen the case for "slightly lower" rates and upside factors for staying on hold. Euro zone banks may come under pressure if dollar funding dries up, he has also warned. The impact of U.S. tariffs and the potential for trade tensions to escalate remain the main downside risks, economists said. Further euro strength and German stimulus kicking in slower than expected could also prompt another cut, UBS's Cluse said. The ECB also says AI-driven market valuations raise the risks of an abrupt repricing in global markets that could hurt the euro zone. France's budget uncertainty is unlikely to sway the ECB's thinking, but the Socialists on Friday renewed the risk of a government collapse. 5/ Where does the ECB stand in the debate around using frozen Russian assets to help Ukraine? It has no official say, but the ECB does not want the euro's credibility to be damaged at a time when there is an opportunity to boost the currency's global clout. Many EU governments want to invest Russian cash stuck at Belgium's Euroclear repository from matured Russian bond holdings into zero-coupon bonds issued by the bloc, then use the proceeds to lend to Ukraine. Russia would retain its claim over the assets, avoiding an outright confiscation - the most euro-negative scenario. Russia has said it would deliver a "painful response" to any such move. ECB chief Christine Lagarde says the EU must follow international law in the process and would prefer all countries holding Russian assets and cash to similarly lend to Ukraine. But the idea was put on hold on Thursday, to be revisited in December. Ultimately, factors such as defence capabilities and the limited depth of euro zone capital markets play a more decisive role in the euro's reserve currency position, said Morgan Stanley's chief Europe economist Jens Eisenschmidt. https://www.reuters.com/world/europe/still-good-place-five-questions-ecb-2025-10-27/

2025-10-27 04:47

SINGAPORE, Oct 27 (Reuters) - Targets for sustainable biofuels use and social aspects of the energy transition will be in focus at this year's United Nations climate summit, COP30, said Francesco La Camera, Director-General at the International Renewable Energy Agency (IRENA). COP30 will be held on November 10-21 in Belem, Brazil, where countries are due to present updated national climate commitments and assess progress on renewable energy targets agreed at previous summits. Sign up here. La Camera said he anticipates a biofuel pledge that could become a target in the final declaration, potentially calling for quadrupled production by 2035 or setting a share target for sustainable aviation fuel in the energy mix. "I think there will be more focus on the social aspect of the transition and also on the sustainable use of biomass," La Camera said on the sidelines of the Singapore International Energy Week event. IRENA has prepared a biofuel report for the conference and launched an agreement with the International Civil Aviation Organization to promote biofuel manufacturing, he said. La Camera said the conference will address how communities can participate in renewable energy projects. IRENA now expects a smaller shortfall in renewable energy installations by 2030 due to the accelerating pace of new additions, La Camera said. Global renewable capacity is now projected to fall 0.9 terawatts short of the COP28 target of 11.2 terawatt for 2030, an improvement from the 1.49 terawatt shortfall projected last year, he said. More than 100 countries at the COP28 climate summit in Dubai in 2023 agreed to triple renewable energy capacity by 2030 as part of efforts to meet global climate targets. Meeting the target by 2030 will require annual growth of 16.6% from 2025-2030, IRENA said in a report this month. https://www.reuters.com/sustainability/climate-energy/irena-chief-expects-sustainable-biofuels-feature-key-cop30-theme-2025-10-27/

2025-10-27 04:38

A look at the day ahead in European and global markets from Ankur Banerjee The mere prospect of a U.S.-China trade deal which looks more like a truce extension was enough to send stocks to record highs, weigh on gold prices and push up commodities including copper ahead of an action-packed week. Sign up here. First things first: There is no agreed deal yet; perhaps just a concept of a deal, and that is what has sparked a risk-on rally on Monday which is set to continue in Europe. U.S. and Chinese officials on Sunday hashed out the framework of a trade deal for U.S. President Donald Trump and Chinese President Xi Jinping to decide on later this week when they meet in South Korea. An agreement could pause steep U.S. tariffs on Chinese goods as well as stringent Chinese rare earths export controls, calming investor nerves. A lot of the positive noise has come from U.S. officials while their Chinese counterparts have been a bit more circumspect. Stocks, though, have galloped higher, with benchmark indices in Japan (.N225) , opens new tab, Taiwan (.TWII) , opens new tab and South Korea (.KS11) , opens new tab all setting records after gaining 2%. Chinese stocks (.CSI300) , opens new tab pushed up 0.86% while Nasdaq futures rose 1%. A lot of what has been laid out so far is within market expectations so there could be disappointment if any "deal" manages to just kick the can down the road. In the meantime, investor enthusiasm is likely to keep stocks aloft ahead of central bank meetings in Japan, Canada, Europe and the United States. The U.S. Federal Reserve will take the limelight when it will likely lower its policy interest rate by 25 basis points. The focus will immediately shift to what comes next considering the U.S. government shutdown and resultant dearth of economic data leaves little from which to take cues. The European Central Bank is widely expected to maintain its policy rate so investor attention will be more trained on the busiest week of this earnings season. Mega-cap earnings will yet again shape near-term sentiment. Key developments that could influence markets on Monday: https://www.reuters.com/world/china/global-markets-view-europe-2025-10-27/

2025-10-27 04:12

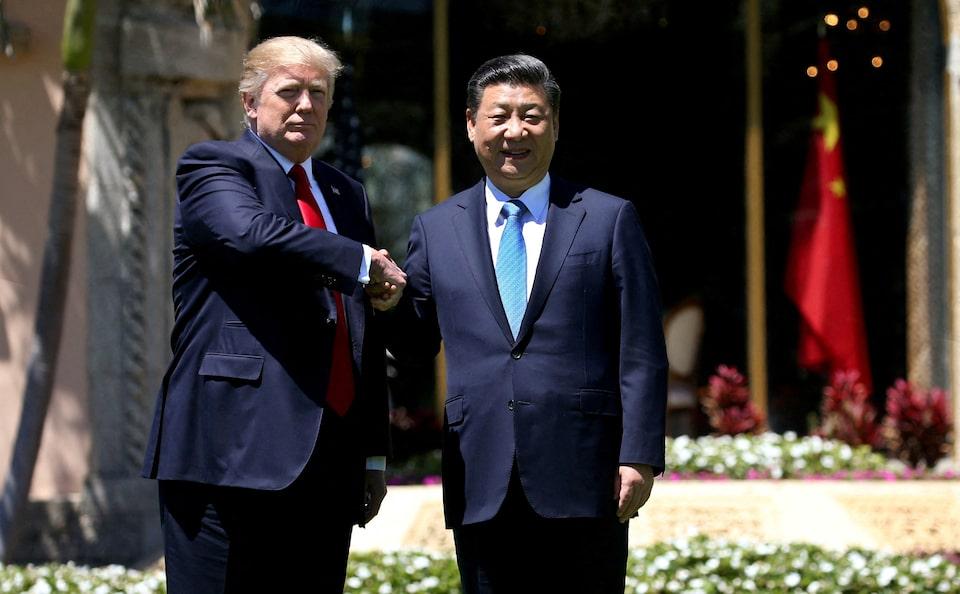

BEIJING, Oct 27 (Reuters) - U.S. President Donald Trump faces one of the toughest challenges of his second term when he meets Chinese President Xi Jinping in South Korea on Thursday, where the world's two largest economies will seek to avert an escalation of their trade war. Washington and Beijing have raised tariffs on each other's exports and threatened to halt trade involving critical minerals and technologies. Sign up here. Neither side expects a breakthrough that would restore terms of trade that existed before Trump's second-term inauguration in January. Talks between the two sides to prepare for the meeting focused on managing disagreements and modest improvements, before a visit by Trump to China that is expected to happen early next year. RARE EARTHS China has vastly expanded its rare earths export controls, including five new elements, placed extra scrutiny on semiconductor users, and added rules requiring compliance by foreign producers who use Chinese materials. China's earlier rare earths export curbs have roiled global producers reliant on Chinese supplies as it produces over 90% of the world's processed rare earths and rare earth magnets used in many modern technologies from smartphones to fighter jets. The U.S. has sought for China to abolish the restrictions and Treasury Secretary Scott Bessent said after weekend talks in Malaysia that China will delay its expanded licensing regime by a year and re-examine it. China did not discuss specific steps. FENTANYL Trump has imposed 20% tariffs on Chinese imports over what he described as Beijing's failure to curb the flow of precursor chemicalsused in the production of fentanyl, which has caused nearly 450,000 U.S. overdose deaths. Those tariffs have remained in effect despite a fragile trade truce reached by both sides in subsequent talks. Beijing has defended its drug control record and accused Washington of using fentanyl to "blackmail" China. Both sides have been in a stalemate over the issue for months and the issue of fentanyl was raised during the Kuala Lumpur talks. SHIPPING The U.S. has imposed port fees on ships built, owned or operated by Chinese entities in a move Trump said was aimed at helping pay for a revival of U.S. shipbuilding and expected to cost the top 10 carriers $3.2 billion next year. In response, China introduced port fees on U.S.-owned, operated, built, or flagged vessels and sanctioned five U.S.-linked subsidiaries of a South Korean shipbuilder. Measures from both sides are already disrupting flows and pushing up rates. AGRICULTURE Bessent told NBC on Sunday that China will make "substantial" purchases of U.S. soybeans under the proposed trade deal framework, after Beijing effectively boycotted U.S. soybean imports this year due to the trade war. As a result, U.S. soybean farmers have been cut off from their largest export market and are currently awaiting a bailout from the Trump administration. Analysts say Beijing is aware this is a pain point for Trump, as any damage to his rural support base could threaten his standing in the mid-term elections in 2026. China bought more than half of U.S.-grown soybeans in 2023 and 2024. U.S. exports to the country peaked in 2022 at a value of $17.92 billion. TIKTOK Bessent said on Sunday that both sides had "reached a final deal on TikTok" and "all the details are ironed out". The U.S. and China previously announced they had reached a "framework deal" to divest a majority stake in the Chinese-owned app to American investors - the only major outcome of last month’s trade talks in Madrid. However, the deal was not implemented. This time, Bessent said both leaders are expected to "consummate" the deal when they meet, but it is not known whether more recent changes were made to the original framework. TARIFFS Both sides discussed further extending the suspension period for U.S. reciprocal tariffs on China, currently capped at 30% on Chinese imports, which was due to expire November 10. Trump had threatened to levy an additional 100% tariff on Chinese goods from November 1 in retaliation for China’s expanded rare earth export controls, but Bessent said it was "effectively off the table" after this weekend's talks. MEASURES READIED BY U.S. The U.S. is developing new measures targeting China, including software-powered exports and extensive sectoral tariffs for semiconductors, pharmaceuticals and other key industries. Washington on Friday launched a new tariff investigation into China's "apparent failure" to comply with the "Phase One" U.S.-China trade deal signed during Trump's first term in 2020. https://www.reuters.com/world/china/key-issues-stake-trump-xi-talks-south-korea-2025-10-27/

2025-10-27 03:00

Milei victory boosts investor confidence in economic reforms Stocks traded in US exchanges soar over 30% Investors eye possible reform of currency framework NEW YORK/LONDON, Oct 27 (Reuters) - Argentina's bonds, stocks and currency rose sharply on Monday after President Javier Milei's party won a decisive victory in Sunday's midterm election, a key requisite to keep economic reforms on track and a U.S. financial backstop in place. International bonds rallied between 7 and 13 cents each, local stocks jumped 22% and the peso strengthened some 4% to the dollar, after an initial near 15% rally. Sign up here. Official election results showed voters strongly backed Milei's free-market reforms despite some painful austerity measures. Inflation has fallen sharply since he took office nearly two years ago. The unexpectedly strong showing came after the U.S. pledged a combined $40 billion to support Milei - a $20 billion central bank swap line and a potential $20 billion loan facility - and implied the backing was contingent on Milei continuing with his reform agenda. "His victory was so, so much larger than expected," said Thierry Larose, portfolio manager at Vontobel Asset Management. "Previously he was in a state of survival, and now he's ... in a very strong position to try to form tactical alliances and push some reforms that were completely out of reach." ARGENTINE ASSETS RALLY The president's party, La Libertad Avanza, received 41.5% of the vote in Buenos Aires province compared with 40.8% for the opposition Peronist coalition, a dramatic shift for a place that has long been a Peronist stronghold. Nationally, LLA took over 40% of the vote, a much better-than-expected result. "Critically, Milei’s victory speech was notably moderate and cooperative, signaling willingness to work with non-LLA legislators on reforms," Christine Reed, emerging market fixed income portfolio manager at Ninety One, said in a note. The country's international dollar bonds were pushing against historic highs posted earlier this year, with the 2038 maturity up 13 cents to 73 cents on the dollar. U.S.-listed shares of Argentine companies also surged, with financial shares rising up to 48% and the Global X MSCI Argentina ETF adding 19%, after falling 10% year-to-date through Friday. Stocks traded on U.S. exchanges (.BKAR) , opens new tab jumped 32%. The local stock benchmark (.MERV) , opens new tab posted its largest daily percentage gain since late November 2023, when investors were reacting to Milei's presidential victory. It ended the day up 21.8%. The interbank peso initially strengthened near 15% to the dollar at 1,300 per greenback and ended the day 4.3% stronger at 1,430 per greenback. The currency's strength makes sense, especially with the backdrop of U.S. support, according to Matthew Graves, portfolio manager for emerging market debt at PPM America. "The government has some breathing room now, and can take next steps from a position of relative strength," he said. "We still think the FX bands are better used as a tool to facilitate a transition to more of a true managed-float FX framework. Investors will be keen to understand what this path might look like, and how it will facilitate a more rapid accumulation and rebuild of FX reserves." FASTER REFORMS, CLEARER PATH The results could clear the way for Milei to speed up one of the most ambitious economic overhauls in the cash-strapped and inflation-ridden country's recent history. Argentina's assets have been on a rollercoaster ride since Milei's party suffered a wider-than-expected defeat in a provincial vote in Buenos Aires last month. The peso had weakened some 25% since mid-April's partial scrapping of foreign exchange controls, and close to 30% since the start of the year. On Friday, it touched a record closing low of 1,491.50 per dollar. Argentina's international dollar bonds were among the worst-performing emerging market high-yielders this year to Friday, after having returned over 100% to investors in 2024 (.JPMEGDARGR) , opens new tab. Now, the stronger position for Milei's party in the legislature will encourage more investment, investors have said, as electoral risk recedes. It also boosts hopes for reform-minded candidates in the next general ballot in 2027. "The midterms yesterday just give a longer horizon for potential foreign investments, both in financial assets and in real assets," said Graham Stock, senior sovereign strategist with RBC BlueBay Global Asset Management. While some still anticipate a reform to the foreign exchange framework that would encourage the accumulation of reserves, with a wider band or a free float of the peso among the options, confidence in Milei's reform outlook could naturally strengthen the currency, RBC's Stock said. Carmen Altenkirch, an emerging markets sovereign analyst at Aviva Investors, said the results could kick off a "virtuous cycle" in which locals begin selling dollars again. "I think a stronger exchange rate is feasible," Stock said, adding that depleted dollar reserves were a key weakness. "They need to take advantage of peso strength to buy up dollars and build those reserves up, which they can do with the current regime," he said. https://www.reuters.com/world/americas/argentine-markets-expected-rally-after-mileis-election-victory-2025-10-27/

2025-10-27 01:49

NEW YORK/LONDON, Oct 27 (Reuters) - Argentina's President Javier Milei won a surprise victory in legislative elections on Sunday, boosting the libertarian leader's free-market reforms and deep austerity efforts. The president's party, La Libertad Avanza, took 41.5% of the vote in Buenos Aires province compared with 40.8% for the Peronist coalition, according to official results. The province has long been a political stronghold for the Peronists and the election marked a dramatic political shift. Sign up here. COMMENTS: JPMORGAN "The breadth of his victory, coupled with expanded representation in Congress, places his administration in a prime position to capitalize on the political and financial backing extended by Washington." "This momentum sets the stage for ambitious macroeconomic reforms aimed at boosting private sector savings through tax and labor overhauls, unlocking direct investment, and accelerating stabilization efforts." MIKE MCGILL, CO-HEAD OF EM DEBT, AVIVA INVESTORS "In recent months, there has been a decent position reduction from investors across Argentine bonds, as concerns around Milei’s popularity raised questions around his ability to continue with much needed reforms. This result, along with the recently announced support from the US Treasury, should give investors a lot of confidence over the medium term. We expect money to flow back into the bond market post this result." KARL SCHAMOTTA, CHIEF MARKET STRATEGIST, CORPAY, TORONTO "Milei’s victory should insulate him against veto overrides and impeachment processes for now, but plunging approval ratings mean he could face difficulty in finding coalition partners to pass some of the most controversial planks of his agenda. Structural contradictions in the (Argentine) economy will continue to frustrate peso bulls for a long time to come." ALEJO CZERWONKO, CIO FOR EMERGING MARKETS AMERICAS, UBS GLOBAL WEALTH MANAGEMENT "Milei is now able to move forward with an ambitious deregulation agenda, pursue labor, tax, and potentially social security reforms in Congress, and implement changes to Argentina's FX regime." "From a financial markets perspective, this electoral outcome was far from priced in. Ahead of the vote, Argentina's "country risk" - the spread its U.S. dollar sovereign bonds pay over U.S. Treasuries - was at distressed levels, as investors were extrapolating Milei's weak performance in September's Buenos Aires province election. With this result, Argentine risk assets should now benefit from greater political stability, a renewed push for pro-market reforms, and robust support from the U.S." BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT "It was a surprisingly strong endorsement of Milei's policies. It's reasonable to expect that we could see an 'everything rally' given the resolution of the uncertainty. I'm expecting to see a return of the price levels on bonds to the pre-September levels if not better." "The currency is still overvalued, but this result could encourage policymakers to continue to move the trading band to allow the currency to depreciate." "This election result keeps the country in the 'nice' column of President Trump’s 'naughty and nice list.' The bulls can charge ahead." PATRICIA URBANO, EMERGING EQUITIES PORTFOLIO MANAGER AT EDMOND DE ROTHSCHILD ASSET MANAGEMENT "With the government and its allies now controlling over one-third of Congress, the victory increases the likelihood of structural reforms, spending control, strengthened US support, gradual easing of capital controls, and rebuilding USD reserves alongside a floating exchange rate." "The result removes a significant political overhang on the Argentine equity market." PAULO SALAZAR, HEAD OF EMERGING MARKETS EQUITIES AT CANDRIAM "It has been a rollercoaster ride for Argentine investors, but this weekend’s results represent a genuine inflection point. For those with exposure to Argentina through equity or multi-asset strategies, the outlook is improving rapidly. The country remains a high-risk, high-reward market, but the direction of travel is now firmly toward reform, normalisation, and growth. "After years of false dawns, there is a sense that this time could be different—and that belief alone may be enough to ignite a powerful new phase in the Argentine market story." https://www.reuters.com/world/americas/investor-reaction-mileis-victory-argentina-midterm-congressional-vote-2025-10-27/