2025-10-27 00:45

LAUNCESTON, Australia, Oct 27 (Reuters) - A common view in the crude oil market is that Western sanctions against Russia's exports are fairly pointless as the market quickly devises ways to keep cargoes flowing. This means that any new measures imposed only result in a fleeting boost to prices, which fades in the face of the reality of virtually uninterrupted flows. Sign up here. The same dynamic may be at play with U.S. President Donald Trump's latest sanctions, announced last week, which targeted Russia's two largest oil companies, Lukoil (LKOH.MM) , opens new tab and Rosneft. These two majors produce roughly 5% of the total global crude oil, about 5.3 million barrels per day (bpd), of which they export about 3.5 million bpd. Global benchmark Brent futures jumped as much as 8.9% after the new measures were announced, reaching a three-week high of $66.78 a barrel during trade on October 24. It was little changed at $66.37 in early Asian trade on Monday. While that seems like a fairly big spike in prices, it's well below what would have occurred if the crude market actually believed there was a serious risk that as much as 3.5 million bpd would be lost to the seaborne market. When Russia invaded Ukraine in February 2022, oil got to just under $140 a barrel on the threat of the loss of Russian exports. The expectation is that Russia's oil exporters will be able to circumvent any new sanctions by utilising the dark fleet of tankers and a myriad of middlemen and banking arrangements that avoid U.S. dollars. Past experience suggests this is indeed the most likely outcome, and that any disruption to Russia's crude exports will be short-lived and limited in scale. Does this mean that the sanctions are a wasted effort? It all depends on what you really want to achieve. If the aim is to prevent Russian oil from being exported by cutting off its remaining buyers in China and India, then these latest measures are likely to prove ineffectual. If the aim is to keep Russian barrels in the global market, but cut the revenue Moscow receives for selling its oil, then the sanctions may be somewhat more effective. The new sanctions make it riskier for refiners in China and India, who are the only major buyers for Russian oil, to do business with Moscow. They are likely to demand steeper discounts in order to keep importing Russian barrels. Additionally, using the dark fleet and middlemen trading companies also adds to the cost of shipping Russian crude. Shutting Russian oil companies out of the global U.S. dollar banking system also imposes costs on oil revenue, as routing money through complex shell companies and numerous offshore jurisdictions means every intermediary takes a cut. DO SANCTIONS WORK? Clearly Western sanctions against Russia aren't having much apparent impact on persuading President Vladimir Putin to end his war in Ukraine, and they are also unlikely to result in a significant reduction in export volumes. But they make it harder for Russia to sell crude, and the money received per barrel may decline. It also means that flows of Russian barrels are once again likely to be reshuffled as some buyers back away from the trade. India's Reliance Industries (RELI.NS) , opens new tab may be a case in point. The company operates a 1.24 million bpd refinery complex on India's west coast at Jamnagar, producing fuel for both the domestic and export markets. Reliance has said it will abide by Western sanctions, which means it may end its 500,000 bpd contract with Rosneft. Reliance also likely buys some Russian crude on spot terms and total imports of Russian oil through Sikka port, which supplies the Jamnagar complex, are forecast at 591,000 bpd in October, according to data compiled by commodity analysts Kpler. This is down from the average of 766,000 bpd in the second quarter, but in line with the 563,000 bpd in the first quarter. If Reliance does halt its imports from Russia, it implies around 500,000 bpd of crude will be available to other buyers. The question is whether India's state-controlled refiners will be willing to take the risk, or if Chinese refiners will be able to take more Russian crude. Much will depend on whether Trump is successful in reaching trade deals with India and China, and whether Russian oil forms part of these deals. It's likely that both New Delhi and Beijing will want significant concessions from Washington if they are to end or significantly reduce their imports of Russian oil. For now, Russian oil is likely to continue to flow, but the main risk for the market is that it becomes more of a political tool in the broader reshaping of global trade under Trump. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. The views expressed here are those of the author, a columnist for Reuters. https://www.reuters.com/markets/commodities/will-us-sanctions-russian-oil-work-it-depends-how-success-is-measured-2025-10-27/

2025-10-26 18:53

DOUALA, Oct 26 (Reuters) - At least four people were killed by gunshots in opposition protests in Cameroon's commercial capital Douala on Sunday, according to the campaign of presidential candidate Issa Tchiroma, who is seeking to oust veteran leader Paul Biya. Tchiroma called for the protests to demand that the results of an October 12 vote be respected, a day before the outcome is due to be announced. Sign up here. https://www.reuters.com/world/africa/four-killed-cameroon-protests-ahead-election-results-opposition-says-2025-10-26/

2025-10-26 17:50

European Union races to pass 2040 climate goal New draft proposals offer more flexible path Countries split over cost and speed of emissions cuts BRUSSELS, Oct 26 (Reuters) - European Union countries are negotiating proposals to give industries a more flexible path to meeting climate goals, a draft EU document showed, as the bloc attempts to win support from governments for a new 2040 emissions-cutting target. The EU is negotiating a legally-binding target to cut net greenhouse gas emissions 90% by 2040, and is racing to approve the goal before world leaders gather for the U.N.'s COP30 climate summit on November 6. Sign up here. However, months of negotiations have so far not yielded a deal, as some governments have pushed back on green measures, and raised concerns over how to finance the low-carbon transition alongside priorities like defence and revitalising industries. A draft EU compromise proposal, seen by Reuters, showed countries have drafted plans that would allow the EU to review the 2040 target every two years - potentially allowing Brussels to weaken the goal in future. The draft would also fix into law a commitment that if forests absorb less CO2 emissions than expected, or technologies to remove CO2 from the atmosphere develop slower than planned, other industries will not be forced to cut emissions faster to deliver the 2040 goal. "Possible shortfalls in one sector should not be at the expense of other sectors," said the draft, dated October 25. NO CHANGE ON CARBON CREDITS QUOTA The new compromise reflects demands made by EU government leaders at a summit last week, where they debated the "enabling conditions" needed to meet green goals while avoiding higher energy bills for citizens and supporting businesses grappling with cheap Chinese imports and U.S. tariffs. EU countries' ambassadors will negotiate the proposal next week, before their climate ministers attempt to approve the target on November 4. The draft proposal did not change the 90% emissions-cutting target, nor the 3% of the goal that can be met by buying foreign carbon credits, rather than domestic efforts - although countries are still debating this. French President Emmanuel Macron said last week credits could potentially cover up to 5%. In an attempt to win over sceptical governments, the European Commission has promised changes to other green measures, including price controls in an upcoming carbon market for transport fuels, as demanded by Poland and the Czech Republic. Brussels is also considering weakening its 2035 combustion engine car ban after pressure from Germany and Italy. A spokesperson for Denmark, which holds the rotating EU presidency and drafted the document, declined to comment. https://www.reuters.com/sustainability/cop/eu-considers-more-flexible-climate-target-hunt-deal-draft-shows-2025-10-26/

2025-10-26 17:31

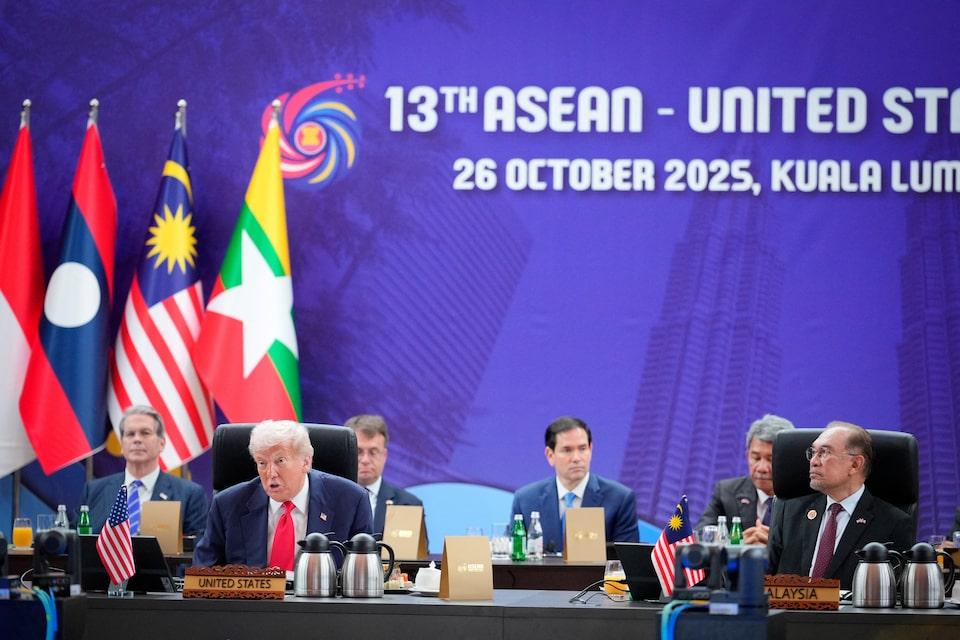

Trump optimistic of deal when he meets China's Xi Thursday Chinese official says 'preliminary consensus' reached Bessent says China to delay rare earths curbs for a year China to resume buying US soybeans, Bessent says KUALA LUMPUR, Oct 26 (Reuters) - Top Chinese and U.S. economic officials on Sunday hashed out the framework of a trade deal for U.S. President Donald Trump and Chinese President Xi Jinping to decide on later this week that would pause steeper American tariffs and Chinese rare earths export controls, U.S. officials said. U.S. Treasury Secretary Scott Bessent said talks on the sidelines of the ASEAN Summit in Kuala Lumpur had eliminated the threat of Trump's 100% tariffs on Chinese imports starting November 1. Bessent also said he expects China to delay implementation of its rare earth minerals and magnets licensing regime by a year while the policy is reconsidered. Sign up here. Chinese officials were more circumspect about the talks and offered no details about the outcome of the meetings. Trump and Xi are due to meet on Thursday on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju, South Korea, to sign off on the terms. While the White House has officially announced the highly anticipated Trump-Xi talks, China has yet to confirm that the two leaders will meet. "I think we have a very successful framework for the leaders to discuss on Thursday," Bessent told reporters after he and U.S. Trade Representative Jamieson Greer met with Chinese Vice Premier He Lifeng and top trade negotiator Li Chenggang for their fifth round of in-person discussions since May. Bessent said he anticipates that a tariff truce with China will be extended beyond its November 10 expiration date, and that China will revive substantial purchases of U.S. soybeans after buying none in September while favouring soybeans from Brazil and Argentina. U.S. soybean farmers "will feel very good about what's going on both for this season and the coming seasons for several years" once the deal's terms are announced, Bessent told the ABC program "This Week." Greer told the "Fox News Sunday" program that both sides agreed to pause some punitive actions and found "a path forward where we can have more access to rare earths from China, we can try to balance out our trade deficit with sales from the United States." TRUMP EXPECTS A DEAL, CHINESE SUGGEST CAUTION China's Li Chenggang said the two sides reached a "preliminary consensus" and will next go through their respective internal approval processes. "The U.S. position has been tough, whereas China has been firm in defending its own interests and rights," Li said through an interpreter. "We have experienced very intense consultations and engaged in constructive exchanges in exploring solutions and arrangements to address these concerns." Trump arrived in Malaysia on Sunday for a summit of the Association of Southeast Asian Nations, his first stop in a five-day Asia tour that is expected to culminate in Thursday's face-to-face with Xi in South Korea. After the weekend talks, Trump struck a positive tone, saying: "I think we're going to have a deal with China". Trump had threatened new 100% tariffs on Chinese goods and other trade curbs starting on November 1, in retaliation for China's expanded export controls on rare earth magnets and minerals. China controls more than 90% of the world's supply for the materials, which are essential for high-tech manufacturing from electric vehicles to semiconductors and missiles. The export controls and Trump's threatened retaliation would disrupt a delicate six-month truce under which China and the U.S. reduced tariffs that had quickly escalated to triple-digit rates on each side. The U.S. and Chinese officials said that, in addition to rare earths, they discussed trade expansion, the U.S. fentanyl crisis, U.S. port entrance fees and the transfer of TikTok to U.S. ownership control. Bessent told NBC's "Meet the Press" program that the two sides have to iron out details of the TikTok deal, allowing Trump and Xi to "consummate the transaction" in South Korea. TALKING POINTS WITH XI INCLUDE SOYBEANS, TAIWAN On the sidelines of the ASEAN Summit, Trump hinted at possible meetings with Xi in China and the United States. "We've agreed to meet. We're going to meet them later in China, and we're going to meet in the U.S., in either Washington or at Mar-a-Lago," Trump said. Among Trump's talking points with Xi are Chinese purchases of U.S. soybeans, concerns around democratically governed Taiwan, which China views as its own territory, and the release of jailed Hong Kong media tycoon Jimmy Lai. The detention of the founder of the now-defunct pro-democracy newspaper Apple Daily has become the most high-profile example of China's crackdown on rights in Hong Kong. Trump also said he will seek China's help in U.S. dealings with Moscow, as Russia's war in Ukraine grinds on. Tensions between the world's two largest economies flared in the past few weeks as a delicate trade truce, reached after a first round of trade talks in Geneva in May and extended in August, failed to prevent the United States and China from hitting each other with more sanctions, export curbs and threats of stronger retaliatory measures. China's expanded controls of rare earths exports have caused a global shortage. That has prompted the United States to consider a block on software-powered exports to China, from laptops to jet engines, according to a Reuters report. https://www.reuters.com/world/china/ustr-greer-says-trade-talks-with-china-moving-toward-agreement-leaders-review-2025-10-26/

2025-10-26 15:44

WINDHOEK, Oct 26 (Reuters) - Namibia's President Netumbo Nandi-Ndaitwah has removed Natangwe Ithete from his posts as deputy prime minister and minister of industry, mines and energy, the presidency said in a statement on Sunday. "In the interest of ensuring continuity and effective coordination within this key sector, President Nandi-Ndaitwah will assume responsibility for the Ministry of Industry, Mines and Energy, effective immediately," the statement said. Sign up here. It did not give a reason. Ithete was appointed to the posts in March as part of Nandi-Ndaitwah's new administration. He remains a member of parliament, the statement said. Resource-rich Namibia is aiming for its first crude oil production by 2030 after several major discoveries in recent years. It mines commodities like uranium and diamonds. https://www.reuters.com/world/africa/namibian-president-takes-over-ministry-mines-energy-industry-2025-10-26/

2025-10-26 15:02

CAPE TOWN, Oct 26 (Reuters) - TotalEnergies (TTEF.PA) , opens new tab has told Mozambique that the costs of its liquefied natural gas (LNG) project in the country have risen by $4.5 billion in the four years it was on hold, and it wants its production agreement extended by a decade, a letter from its chief executive showed. The French oil major had confirmed on Saturday that together with its partners it had decided to lift force majeure on the project, which was halted in 2021 by an Islamist militant attack and was previously estimated to cost $20 billion. Sign up here. But before construction can restart, Mozambique's council of ministers needs to approve an updated budget and schedule. "This revised budget's approval shall cover the incremental costs incurred by the project due to the force majeure, which amount to $4.5 billion," the letter from TotalEnergies CEO Patrick Pouyanne to Mozambique President Daniel Chapo showed. EXPECTED FIRST PRODUCTION IN FIRST HALF OF 2029 The Southern African country's oil and gas regulator is coming up with its own estimate of the project's additional costs and has not said when that will be ready. Pouyanne's letter, dated October 24 and seen by Reuters, said the prolonged halt to the project's development had pushed out the expected first LNG cargo to the first half of 2029, from an initial target of July 2024. "To compensate partially (for) the economic impact of the extended force majeure ... the concessionaire respectfully requires the government to grant an extension of the term of the Golfinho-Atum development and production period ... by a duration of 10 years." WORK TO CONTINUE IN 'CONTAINMENT MODE' TotalEnergies declined to comment. A spokesperson for the Mozambique president did not immediately respond to a request for comment. The LNG project is 40% complete, although insurgent attacks have shown little sign of abating despite Mozambique signing a new security pact with Rwanda, whose military has helped secure the area where the plant is being developed. Exxon Mobil (XOM.N) , opens new tab is developing a separate project nearby. The remaining work will take place in "containment mode", with workers only allowed in by air or sea, TotalEnergies told a September 29 investor day. Mozambique LNG is owned by TotalEnergies (26.5%), Japan's Mitsui (20%), ENH (15%), Bharat Petroleum (10%), Oil India (10%), ONGC Videsh (10%) and Thailand's PTTEP (8.5%). https://www.reuters.com/business/energy/totalenergies-tells-mozambique-lng-project-costs-have-risen-by-45-billion-2025-10-26/