2025-10-24 11:00

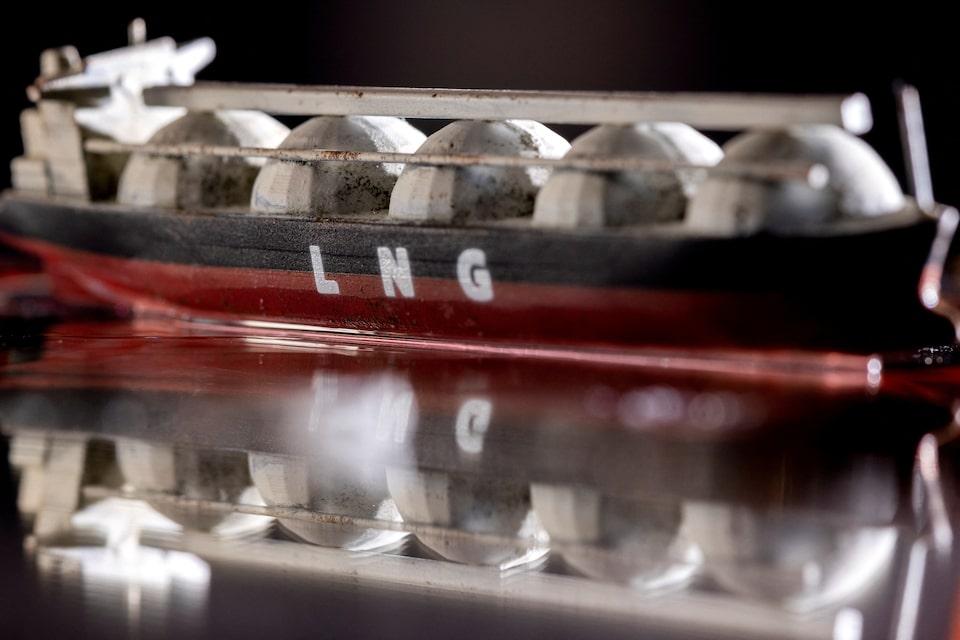

LITTLETON, Colorado, Oct 24 (Reuters) - It's not just the U.S., Qatar and Australia that are vying for a share of the lucrative LNG export market. Malaysia wants a cut too, and is retooling its own power generation system to do it. So far in 2025, Malaysia has lifted its imports of thermal coal to a record and boosted coal-fired electricity generation to all-time highs, data from Kpler and Ember shows. Sign up here. Malaysia's coal binge allows the country - the world's 11th largest natural gas producer - to free up gas supplies for export in the form of liquefied natural gas, and generate valuable trade revenues in the process. The coal-for-gas adjustment comes at a cost, as the country needs to import a majority of its coal supplies, and it has resulted in a surge in power sector emissions to the highest on record this year. But the coal use boom is justified by the fact that the country rakes in roughly twice as much income from LNG exports as it spends on coal imports. On economic grounds alone, Malaysia's LNG export drive looks set to persist, even though the additional LNG volumes the country is looking to sell may add to already oversupplied global markets in the years ahead. IMPORT BOOM Malaysia produces between 3 million and 4 million metric tons of thermal coal a year, according to the U.S. Energy Information Administration (EIA), but imports around 30 million to 35 million tons a year, Kpler data shows. Those coal imports - mainly from neighbour Indonesia - cost around $5 billion to $6 billion a year, according to customs data. The burning of that coal - which generates roughly half of Malaysia's electricity - yields around 72 million tons of carbon dioxide (CO2) emissions each year, according to Ember. Yet by steadily increasing coal's share of its electricity generation mix from under 10% at the start of this century, Malaysia has been able to sharply cut natural gas' share of electricity production. Natural gas generated around 80% of the country's electricity in the early 2000s, but only accounts for around 30% of Malaysia's electricity supplies so far in 2025, Ember data shows. FREEDOM (TO SELL) GAS Reduced use of gas for domestic power generation has allowed Malaysia to boost gas supplies for export, which the country recognized was a valuable revenue earner decades ago. Indeed, for a brief spell in the early 2000s, Malaysia was the world's largest exporter of LNG, and since then it has consistently ranked in the top five suppliers of the super-chilled fuel. Until about a decade ago, Malaysia's energy firms relied on domestic gas supplies as both the primary source of domestic electricity and one of the country's most lucrative export items. Since then, however, authorities have worked to slow the growth of domestic gas use for power generation so that more of it could be diverted to LNG export hubs and then onto high-paying end-use markets such as Japan and South Korea. A key driver of Malaysia's decision to conserve gas was the realization that its domestic gas reserves have peaked and are now in terminal decline. Malaysia's proven gas reserves were estimated at around 1.15 trillion cubic meters around 20 years ago, but were last estimated at 910 billion cubic meters, according to Energy Institute data. MONEY MATTERS To extract maximum value from those reserves, Malaysia's national oil and gas company Petronas remains committed to boosting LNG export volumes, and plans to bring on a third floating LNG export facility in 2027, per company filings. While the exact terms of its LNG export deals are not reported, industry estimates put the country's annual earnings from LNG exports at around $12 billion. As those export receipts are roughly twice what it costs the country to import the coal it needs, the economic case to continue exporting LNG over the long term seems solid. That said, Malaysia's enduring need for gas as a key part of its overall energy mix means it is also an occasional importer of LNG, when the price is right and its power needs dictate. Malaysia has also agreed to make purchases of U.S. LNG as part of trade talks aimed at avoiding U.S. tariffs on Malaysian goods exports. Overall, however, Malaysia looks set to remain a regular net exporter of LNG for the foreseeable future. And given its closer proximity to key Asian buyers compared to the U.S. and Australia, the country's planned growth in LNG export volumes may pose a fresh headache for rivals as they try to map out how to profitably boost sales in the years ahead. The opinions expressed here are those of the author, a columnist for Reuters. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/markets/commodities/malaysias-coal-binge-shows-what-nations-do-cash-lng-boom-2025-10-24/

2025-10-24 10:41

PRAGUE, Oct 24 (Reuters) - Czech populist party ANO, on track to form the next government after winning an election this month, said on Friday it could keep the outgoing cabinet's proposed 2026 deficit target in order to pass a budget before year-end. The outgoing centre-right government of Prime Minister Petr Fiala has brought public finances back within European Union rules. However, analysts expect fiscal loosening under ANO, which is led by billionaire former Prime Minister Andrej Babis. Sign up here. The outgoing government has submitted a central state budget draft with a deficit of 286 billion crowns ($13.74 billion), up from 241 billion seen in 2025. The next government could use that as a foundation to move the legislation ahead without delays, ANO official Alena Schillerova told reporters on Friday. The country would face a provisional budget limiting spending at the start of 2026 if lawmakers fail to approve a budget law by the end of December, which could hurt investments. FIGHT OVER BUDGET Fiala's budget bill fell through when parliament ended its term following an election on October 3 and 4, and ANO has pressed his government to re-submit the draft to avoid delays if the next administration has to start from scratch. Fiala has said he would consider this. Parliament would have to approve the re-submitted deficit target without changes to move the legislative process forward. ANO is in talks on forming a ruling coalition with the far-right SPD party and the right-wing Motorists that will have a majority in parliament. Babis is due to update the president on Monday on the talks. The new parliament first meets on November 3, and Babis's potential government is likely to be in place by December, perhaps sooner. CHANGES ONLY AFTER DEFICIT TARGET FIXED Schillerova said changes to the budget draft would be made in the bill's second reading, when money can be shifted among chapters, but overall revenue and spending figures cannot change. "We will definitely change (the current draft) in a second reading so that it is approved by the end of the year and we don't have to go into a provisional budget," she said. Approved budgets can still be amended later in the year. Fiala's government has cut the overall fiscal gap to around 2% of gross domestic product, below an EU ceiling of 3%. ANO campaigned on promises to cut taxes, lift wages and pensions, and spend on benefits such as mortgage subsidies. However, the Motorists back fiscal discipline and may temper some of ANO's spending aims. ($1=20.8210 Czech crowns) https://www.reuters.com/business/czech-2026-deficit-target-can-stay-unchanged-pass-budget-quickly-poll-winner-2025-10-24/

2025-10-24 10:33

LONDON, Oct 24 (Reuters) - Everything Mike Dolan and the ROI team are excited to read, watch and listen to over the weekend. From the Editor Sign up here. Hello Morning Bid readers! Expectations of a thaw in U.S.-China relations gave Asian equities a boost on Friday, after the White House said on Thursday that President Donald Trump would meet with Chinese President Xi Jinping next week during the U.S. leader's Asia trip. Negotiations with another large U.S. trading partner, Canada, took a somewhat strange turn on Thursday, with Trump writing on Truth Social that trade talks between the North American nations were “TERMINATED,” because of what he deemed to be a “fraudulent” ad showing former President Ronald Reagan criticizing tariffs. In other trade news this week, the U.S. and Australia signed a deal on Monday that will see up to $8.5 billion invested in projects to develop and refine metals vital to industries including defence, advanced manufacturing and the energy transition. ROI Asia Commodities Columnist Clyde Russell argues that this deal is far from a game-changer, but it is a decent first step as the U.S. and its allies seek to reduce their reliance on China. On the domestic front, investors, starved of data during the government shutdown, will finally get some official economic information today: CPI inflation for September. The consensus expectation is that it will remain steady at 3.1% year-over-year. But, as ROI editor-at-large Mike Dolan writes, markets are likely to meet the announcement with a shrug, as almost no one seems to care about inflation anymore. What matters instead is the job market, or at least that’s the steer Federal Reserve Chair Jay Powell gave investors at the September FOMC meeting. ROI markets columnist Jamie McGeever argues that the drop in Treasury yields this month – the 10-Year yield fell below 4% earlier this week – shows that investors are hearing Powell loud and clear. Third quarter earnings season continued, with strong reports from Intel and many other firms, alongside disappointing results from Netflix and Tesla. Jamie McGeever suggests that maybe, just maybe, we could be seeing signs that the equity rally is about to broaden. Over in energy markets, geopolitics were once again center stage this week, as President Trump slapped sanctions on two Russian oil giants, Rosneft and Lukoil on Wednesday, in an effort to pressure Russian President Vladimir Putin to agree to a ceasefire deal in Ukraine. ROI Energy Columnist Ron Bousso argues that the effectiveness of these measures will hinge on Trump's willingness to enforce secondary sanctions and risk an energy price spike. The announcement sent Brent crude prices up over 5% on Thursday, but this jump may be short-lived, as the global oil market is widely believed to be oversupplied. Ron Bousso notes that any selloff should be limited, however, by the uncertainty surrounding OPEC+ production. Staying on fossil fuels, ROI Energy Transition Columnist Gavin Maguire pointed out that natural gas consumption by U.S. LNG firms looks set to overtake gas use by U.S. households for the first time in 2025, stoking tensions between the export-oriented LNG sector and domestic gas consumers. Over in metals, ROI Columnist Andy Home gives his key takeaways from the recent London Metal Exchange week. Spoiler alert, everyone loves Doctor Copper. And, finally, the most famous metal of all, gold, took a tumble on Tuesday, with prices dipping the most in five years. Of course, gold fell from a record-high above $4,300 and is still up more than 50% this year, so no one needs to pity the poor gold trader. As we head into the weekend, check out the ROI team’s recommendations for what you should read, listen to, and watch to stay informed and ready for the week ahead. This weekend, we're reading... CLYDE RUSSELL, ROI Asia Commodities and Energy Columnist: My suggestion this week is an OECD report on Australia's green iron potential. It outlines the scale of the opportunity but also the massive challenge in funding and coordinating such a massive shift for the world's biggest iron ore producer. , opens new tab MIKE DOLAN, ROI Financial Markets Editor-at-Large: This thought-provoking column by Jacob Funk Kirkegaard of the Peterson Institute considers whether a fiscal crisis in France, the EU's only nuclear power, might result in transferring France's nuclear deterrent costs to the EU level. , opens new tab RON BOUSSO, ROI Energy Columnist: This fascinating Reuters investigation shows that dark fleet tankers are no longer just for dodgy Iranian and Russian oil trading. The vessels are also being used by Mexican drug cartels in a flourishing market of illegal oil trading and tax evasion. ANDY HOME, ROI Metals Columnist: My most interesting read of the week is about the underground marathon that will take place in Boliden's Garpenberg zinc mine in Sweden. Participants will endure temperatures of up to 30°C as well as total silence and will be running in complete darkness with only their head torches for light. , opens new tab We're listening to... GAVIN MAGUIRE, ROI Global Energy Transition Columnist: This is a fascinating podcast about what’s possible with EV battery recycling. In short, the plan is "to turn a massive wave of incoming used batteries into a key resource for the grid." , opens new tab And we're watching... ANNA SZYMANSKI, ROI Editor-in-Charge: Yes, I did recommend the Reuters World News vodcast last week, but I'm doing it again just to make sure you don't miss the new video version of Reuters flagship podcast. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab https://www.reuters.com/business/finance/global-markets-view-usa-2025-10-24/

2025-10-24 10:21

Sterling set for weekly loss against dollar and euro Upbeat UK retail sales and consumer confidence data BoE rate cut expectations influenced by inflation data LONDON, Oct 24 (Reuters) - The British pound was steady on Friday but still headed for a weekly loss against the dollar and the euro as softer-than-forecast inflation data offset Friday's upbeat retail sales, consumer confidence and business activity figures. While another rate cut from the Bank of England in 2025 is not a foregone conclusion, the week's data has left the door ajar for the central bank to lower borrowing costs again by the end of the year. Sign up here. Sterling was little changed against the dollar on Friday at $1.3319, but was set for a weekly drop of 0.9%. Against the euro, the pound was little changed at 87.17 pence , but was set to have its first weekly fall against the single currency in four weeks. UPBEAT DATA Data on Friday painted a slightly rosier picture of the economy heading towards the end of the year. British retail sales unexpectedly rose in September, boosted by technology sales and demand for gold from online jewellers, official figures showed; meanwhile British consumer sentiment rose in October to its joint-highest level since August 2024. Separately, business activity showed tentative signs of a recovery, the preliminary UK Composite Purchasing Managers' Index published by S&P Global showed on Friday. "We tend to be of the view that consumer confidence and retail sales, both of which were stronger today, are secondary or even tertiary indicators, to some extent," said Dominic Bunning, head of G10 FX strategy at Nomura. "We're still looking for some underperformance (in the pound), in general," Bunning added, citing the recent weak labour market report and inflation figures. TO CUT OR NOT TO CUT? Investor expectations for BoE rate cuts have swung around this week, although markets still see a greater chance of a cut this year than the central bank keeping rates unchanged. Markets had earlier this week raised their bets on further BoE easing in 2025 after British inflation unexpectedly held steady, coming in below expectations from a Reuters poll of economists and the central bank itself. Futures markets now imply about a 65% chance of a quarter-point rate cut from the BoE by the end of the year, although that is down slightly from around a 75% chance before Friday's data. "Markets have rightly priced in a greater degree of easing from the central bank after softer-than-expected inflation and rumours of a more disinflationary Budget than previously expected," said Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics. "But the growth picture still suggests that the neutral rate is high and that rates are only modestly restrictive." https://www.reuters.com/world/uk/sterling-steady-after-upbeat-data-still-set-weekly-loss-2025-10-24/

2025-10-24 09:06

Oct 27 (Reuters) - Trade talks between Washington, Beijing and Canada will dominate a week headlined by central bank decisions in the United States, Canada and Europe, while Argentina's markets digest a decisive midterm election win for President Javier Milei. Here's all you need to know about the week ahead in world markets by Dhara Ranasinghe in London, Rodrigo Campos, Alden Bentley and Lewis Krauskopf in New York, and Kevin Buckland in Tokyo. Sign up here. 1/ A MID-TERM DRAMA Argentina's bonds and stocks are expected to rally on Monday after President Javier Milei's party won an overwhelming victory in Sunday's crucial midterm election, a key requisite to keep economic reforms on track and a U.S. financial backstop in place. Right-wing President Javier Milei now looks set to strengthen his minority position after his inflation-crushing economic reform programme and deepening ties with Washington have delivered some of the best returns for emerging market investors since he took over in December 2023. Yet U.S. President Donald Trump's unprecedented backing, including direct intervention in FX markets, a $20 billion central bank swap line and the prospect of another $20 billion loan to shore up government bonds haven't stopped the peso's slide to record lows. The peso has weakened some 25% since mid-April's partial scrapping of foreign exchange controls, and close to 30% since the start of the year. 2/IT'S AI, STUPID Megacap tech and growth company earnings reports headline a massive week of U.S. corporate results that could shed light on the state of the effervescent "AI trade". Microsoft (MSFT.O) , opens new tab, Apple (AAPL.O) , opens new tab, Alphabet (GOOGL.O) , opens new tab, Amazon (AMZN.O) , opens new tab and Meta Platforms (META.O) , opens new tab - five of the "Magnificent Seven" megacap companies that dominate equity indexes - all report earnings. One-third of S&P 500 constituents are set to report this week alone, including drugmaker Eli Lilly (LLY.N) , opens new tab, oil majors Exxon (XOM.N) , opens new tab and Chevron (CVX.N) , opens new tab and payment firms Visa (V.N) , opens new tab and Mastercard (MA.N) , opens new tab. Investors will also be scouring data for signs of the costs and impact of shifting U.S. trade policy. S&P 500 companies are estimated to have increased Q3 earnings by 9.2% from the prior year, with a greater-than-typical number of companies beating profit estimates so far, according to LSEG IBES data. 3/COUNTING ON A CUT Markets are all but certain that the U.S. Federal Reserve will cut interest rates by a quarter-point when it concludes its meeting on Wednesday, and they are showing similar conviction for another trim in December. Still, that year-end cut might be less clear if the government shutdown doesn't end, leaving data-guided policymakers driving blind without official economic indicators. Meanwhile, Trump is expected to meet with Chinese President Xi Jinping on Thursday as part of a trip to Asia and on the sidelines of the Asia-Pacific Economic Cooperation CEO Summit. Trump said on Monday the U.S. and China are set to "come away with" a trade deal. A recent escalation in trade tensions and a standoff over China's restrictions on rare earth exports, as well as U.S. curbs on technology exports amid Trump's threat to impose 100% tariffs, remain a market vexation - and a consideration for the Fed. 4/ IT'S NOT ALL ABOUT THE FED That's right, the Bank of Canada is also expected to cut rates for a second month running on Wednesday with a pick-up in inflation not expected to stand in its way, although Trump's announcement that all trade talks with the country are terminated will cast a cloud. And the European Central Bank meets on Thursday, although it appears to be in "nothing to see here" mode, with a Reuters poll of economists predicting it is likely to leave rates unchanged at 2% for a third straight meeting and remain on hold until the end of the year. Traders see a roughly 65% chance of a quarter-point cut by mid-2026 given the downside risks to economic growth. Headwinds are looming, however. Apart from trade tensions, there is still French political turbulence and an election in the Netherlands on Wednesday dominated by populist cross-currents. So ECB chief Christine Lagarde may be pressed on whether the bloc remains in a "good place." 5/HIKE ON HOLD? The Bank of Japan is likely to forgo a rate hike next Thursday in favour of a move in December or January, but not due to pressure from the country's dovish new premier. Two-thirds of analysts polled by Reuters say fiscal and monetary dove Sanae Takaichi, who ascended to the top job on Tuesday, won't delay monetary tightening, although her oft-repeated view is that the central bank should be aligned with government policies. Instead, analysts and traders point to BOJ Governor Kazuo Ueda's consistently cautious tone, particularly on potential tariff fallout, even with his board performing a conspicuously hawkish pivot last month. And his desire to see more data - including U.S. Christmas shopping trends - has most analysts eyeing a December hike at the earliest. https://www.reuters.com/business/take-five/global-markets-themes-graphic-2025-10-24/

2025-10-24 07:55

MADRID, Oct 23 (Reuters) - The body of a 56-year-old man has been found buried in mud a year after he was swept away in deadly flash floods in southeastern Spain, authorities said on Thursday. Nearly 240 people died when floodwaters swamped homes, underground car parks and vehicles on the outskirts of Valencia, Spain's third-largest city, on October 29 last year. Sign up here. The man was one of three people still unaccounted for and had already been officially declared dead, said a local court in Catarroja - one of the towns most affected by the floods. He was discovered on Tuesday during earth-moving operations in the town of Manises, about 40 km (25 miles) downstream from Pedralba, where he went missing, it added. Under Spanish procedure, judges are called in when bodies are discovered. The same court, overseen by Judge Nuria Ruiz, is carrying out a judicial investigation into the delayed emergency response to the floods, which rank among Spain's worst natural catastrophes in modern history. A text alert sent by Valencia's regional government warning people to take shelter arrived when buildings were already under water and many people were drowning. On Thursday, the court summoned a local journalist who had lunch with Valencia's conservative regional leader, Carlos Mazon, on the day of the floods. https://www.reuters.com/sustainability/climate-energy/one-year-victim-valencia-floods-found-buried-mud-2025-10-23/