2025-10-24 05:27

MUMBAI, Oct 24 (Reuters) - The Indian rupee surrendered all of its intraday gains to end little changed on Friday as optimism over trade talks faded after an Indian minister signalled caution over ongoing negotiations. The rupee had earlier risen to 87.6350 per dollar, its highest level since late August, breaking past the key resistance level of 87.70 on likely inflows and the lingering impact of the central bank's persistent dollar sales near the 88 mark. Sign up here. The currency ended at 87.8450, little changed from 87.8400 on Thursday. However, things took a turn after Trade Minister Piyush Goyal said India will not rush into signing any trade agreements and will reject conditions from countries that restrict its trading choices. "The first half of the session belonged to rupee bulls on the back of foreign inflows, but the second half saw dollar bulls claw back," a dealer at state-run bank said. India is negotiating a long-pending free trade agreement with the European Union, while trade talks with the U.S., which has imposed 50% tariffs on domestic goods, are also underway. "The rupee opened higher as we head for a deal with U.S. with expectations of reducing tariffs. But with Piyush Goyal commenting that India will not accept conditions or rush through trade deals, the rupee lost most of its gains," said Anil Bhansali, head of treasury at Finrex Treasury Advisors. Traders also said that a pickup in equity inflows have supported the rupee in last few days. Foreign investors are net buyers of Indian shares so far in October. Meanwhile, Asian currencies were mixed on Friday, with traders awaiting the release of September U.S. inflation data later in the day. The report was originally scheduled for October 15 and has been delayed due to a U.S. government shutdown. Markets have fully priced in a 25 basis-point rate cut by the Federal Reserve next week, with the data expected to shape expectations for another reduction in December. https://www.reuters.com/world/india/rupee-inch-up-before-us-inflation-remains-hemmed-by-rbi-importer-flows-2025-10-24/

2025-10-24 05:18

Oct 24 (Reuters) - Norwegian aluminium producer Norsk Hydro (NHY.OL) , opens new tab reported an 18.6% fall in third-quarter core profit on Friday, hit by lower alumina prices and a stronger Norwegian crown, partly offset by higher production volumes. Adjusted earnings before interest, taxes, depreciation and amortisation fell to 6.0 billion crowns in the July–September period from 7.4 billion crowns a year earlier. Sign up here. Analysts on average had expected it to report a core profit of 6.36 billion crowns, according to a company-compiled consensus , opens new tab. The return of U.S. tariffs on aluminium has upended trade flows, lifting regional premiums and amplifying costs for American buyers. Canada, the main supplier to the U.S. market, has diverted part of its output to Europe after Washington doubled tariffs to 50% in June, while the higher U.S. Midwest premium has lifted costs for American buyers but supported prices elsewhere. With Chinese smelters churning out near-record volumes of aluminium and looking to offload surplus abroad, barriers in the West have offered short-term relief to companies like Hydro by lifting regional premiums and curbing low-cost competition. UBS and J.P. Morgan said the miss was mainly due to weaker performance in the aluminium metal division, while noting that Hydro's near-term outlook remained softer than expected. High energy costs and an uncertain trade backdrop continue to weigh on producers, many of which are urging Brussels to curb scrap exports amid strong U.S. demand. Analysts say aluminium markets are gradually tightening after years of oversupply and sanctions, raising the prospect of firmer prices in the medium term. Prices need to stay above $3,000 a ton to prevent shortages, Citi said last month. Hydro CFO Trond Olaf Christophersen told analysts that current prices could force high-cost Chinese refiners to curtail output, tightening the alumina market. Hydro shares were down 1% at 0715 GMT after falling as much as 3.7% in early trading, underperforming Oslo's benchmark index (.OSEBX) , opens new tab. https://www.reuters.com/business/aluminium-producer-norsk-hydros-q3-core-profit-lags-expectations-2025-10-24/

2025-10-24 05:14

JAKARTA, Oct 24 (Reuters) - The Indonesian government has started relocating residents living in areas surrounding the Modern Cikande Industrial Estate, a site found to have been contaminated with radioactive Caesium-137, a spokesman told Reuters on Friday. The effort was initiated after Indonesia detected high levels of Caesium-137, a man-made radionuclide, at the sprawling industrial zone near the capital Jakarta. Sign up here. "At this first stage, we are allocating 19 families with a total of 63 individuals. Why now? Because it's time to clean up their houses from contamination," said Bara Hasibuan, spokesman for the special task force set up to handle the issue. In the next stage, the task force aims to move another eight families with a total of 28 people by next week, he added. The task force also said it had finished the decontamination process at 20 out of the 22 facilities at the industrial estate that contained traces of Caesium-137. The contamination was first detected in a batch of shrimp shipped to the United States in August by a local company. The United States has imposed new certification requirements for imports of shrimp and spices from Indonesia. Caesium-137 enters the environment as a result of past nuclear tests or accidents like Chernobyl and Fukushima, but it is also used in some industrial applications like oil well logging. Indonesia has no nuclear weapons or nuclear power plants. https://www.reuters.com/business/healthcare-pharmaceuticals/indonesia-moves-residents-near-site-contaminated-with-caesium-137-task-force-2025-10-24/

2025-10-24 04:39

A look at the day ahead in European and global markets from Rocky Swift Friday brings a moment of calm before the storm. A host of summits, earnings and central bank events loom next week. Sign up here. The focus before the weekend will be U.S. consumer price data for September, a lone economic light shining through the darkness of the second-longest U.S. government shutdown. So far. Coming in from furlough, Bureau of Labor officials are expected to say that the U.S. core consumer price index held steady at 3.1%, a reading that's unlikely to impact a widely anticipated rate cut from the Federal Reserve next week. Then begins a whirlwind of leaders' meetings centred around the Asia-Pacific Economic Cooperation (APEC) CEO Summit, including a planned face-to-face between U.S. President Donald Trump and Chinese President Xi Jinping in South Korea. Markets were soothed by a White House announcement of the meeting, amid escalating tensions between the economic superpowers and a Nov. 1 deadline for an additional 100% U.S. tariff to be imposed on Chinese imports. But proving every silver lining has a cloud, Trump took to social media to pick another fight with Canada, declaring that trade negotiations with America's northern neighbour were "TERMINATED." European equity futures signal a steady start to markets. Oil and gold settled down after a volatile week. Asian stocks gained following an earnings beat by Intel (INTC.O) , opens new tab and a positive Wall Street close. The earnings calendar is light today, but next week brings a deluge, with five of the Magnificent Seven reporting results, including Apple (AAPL.O) , opens new tab and Microsoft (MSFT.O) , opens new tab. Newly elected Japanese Prime Minister Sanae Takaichi is due to speak later in the session as her government reportedly considers a sizable stimulus package and just days away from her first meeting with Trump. Friday data showed Japan's core consumer prices remained above the central bank's 2% target, keeping alive expectations of a near-term interest rate hike ahead of a Bank of Japan policy meeting next week. Key developments that could influence markets on Friday: - U.S. earnings: Procter & Gamble, HCA Healthcare, General Dynamics - Europe earnings: Saab AB, Sanofi - U.S. data: core CPI for September, S&P Global flash PMIs for October, University of Michigan final print of October consumer sentiment - Europe data: Britain retail sales for September, France consumer confidence for October - Flash PMIs for Euro Zone, France, Germany, and Britain https://www.reuters.com/world/china/global-markets-view-europe-2025-10-24/

2025-10-24 04:03

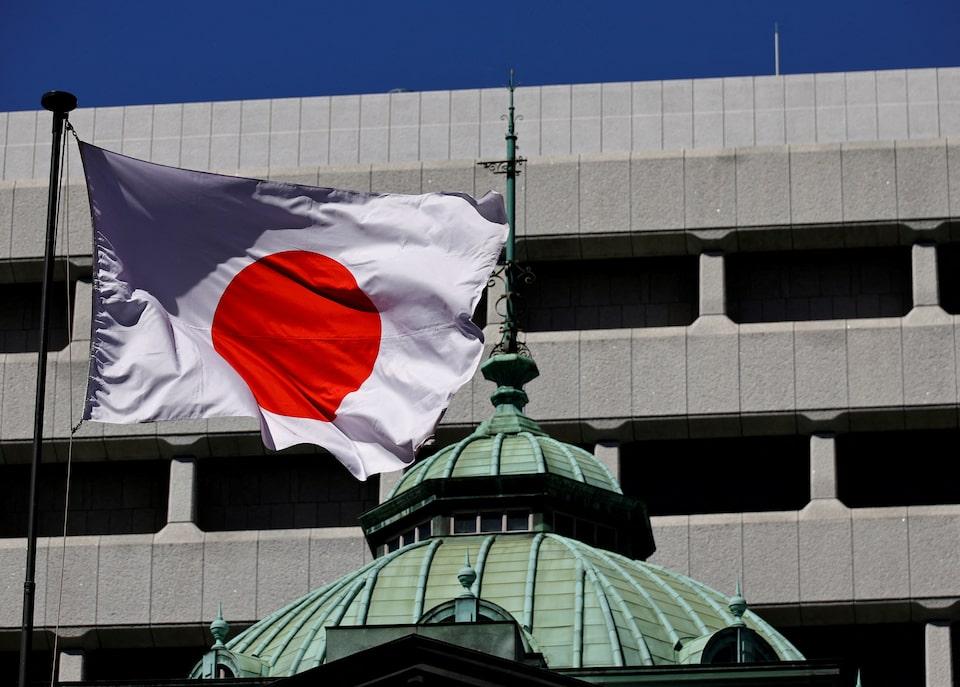

BOJ decision due 0330-0500 GMT October 30 Many analysts expect BOJ to keep rate steady at 0.5% Hawkish board members to repeat proposal for hike to 0.75% Board seen revising up this year's growth forecast Governor Ueda to brief media 0630 GMT TOKYO, Oct 24 (Reuters) - The Bank of Japan is likely to debate next week whether conditions are ripe to resume rate hikes as worries about a tariff-induced recession ease, though political complications may keep it on hold for now. Data so far has shown little evidence that higher U.S. levies were hurting the economy with exports rising in September, business confidence improving in the third quarter and companies maintaining bullish spending plans. Sign up here. But most analysts expect the central bank to keep interest rates steady at 0.5% at the October 29-30 meeting given jabs from new Prime Minister Sanae Takaichi, who has called for BOJ cooperation in achieving inflation driven more by wage gains. In a speech earlier this month, BOJ Governor Kazuo Ueda also warned of risks clouding the outlook, such as uncertainty over the U.S. economy and the hit to growth from tariffs that is seen intensifying ahead. "With U.S. economic data not coming out due to the government shutdown, I don't think Ueda's concerns would be dispelled by next week's meeting," said Naomi Muguruma, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities. "It's also hard to believe the inauguration of Takaichi's administration won't have any impact on the BOJ's rate-hike timing," she said. But Ueda may face growing calls from within his board to pull the trigger with stubbornly high food prices, prospects of sustained wage gains and receding fears of U.S. recession convincing some that conditions for a hike are falling into place. Two hawkish members, Naoki Tamura and Hajime Takata, are likely to repeat their proposals made in September - and voted down by the nine-member board - to hike rates to 0.75%. Accounts of the BOJ's July and September meetings showed the board leaning toward a near-term rate hike with discussions focused on broadening inflationary pressure. "The BOJ may already be somewhat behind the curve in addressing inflationary risks, which is causing some distortions in the economy," former BOJ executive Eiji Maeda told Reuters. Another complication could come from recent yen declines, driven partly by market expectations that pressure from Takaichi will slow the pace of BOJ rate hikes. Some analysts bet the BOJ could hike rates if yen falls accelerate, as such moves would push up import prices and accelerate inflation. U.S. President Donald Trump will visit Tokyo next week accompanied by Treasury Secretary Scott Bessent, who has repeatedly signaled his preference for a stronger yen and tighter monetary policy in Japan. Japan's new finance minister Satsuki Katayama said on Friday she plans to meet Bessent during his stay in Tokyo next week. The BOJ last year exited a decade-long, massive stimulus programme and raised short-term interest rates to 0.5% in January on the view Japan was close to durably hitting its 2% inflation target. It has kept policy steady since then. A majority of economists polled by Reuters expect the BOJ to raise rates in the fourth quarter, while nearly 96% of them expect borrowing costs to increase by end-March. In a quarterly outlook report due on October 30, the BOJ is likely to slightly revise up its economic growth forecast for the current fiscal year and maintain its view the economy is on course for a moderate recovery, sources have told Reuters. The board may discuss changing language on the course and timing for when underlying inflation is likely to approach its target reflecting the views of hawkish members Tamura and Takata. In the current report issued in July, the BOJ said it expects underlying inflation to hit 2% in the latter half of the three-year projection period through March 2027. Tamura said last week the target could be achieved earlier at around the latter half of fiscal 2025, while Takata said Japan has already roughly achieved the BOJ's inflation target. https://www.reuters.com/world/asia-pacific/bank-japan-consider-best-timing-next-rate-hike-2025-10-24/

2025-10-24 02:49

All 10 analysts expect SBP to stand pat on rate on Monday Flood, border disruptions likely to fuel food inflation Base-effect pressures offset easing flood risks, low oil prices KARACHI, Oct 24 (Reuters) - Pakistan's central bank is expected to keep its key interest rate unchanged at 11% on Monday, a Reuters poll showed, as analysts said flood-driven food inflation and a low base effect are likely to limit the scope for further monetary easing. All 10 analysts surveyed expect the State Bank of Pakistan (SBP) to keep the policy rate unchanged, extending its pause as recent floods ravaged farmland and border closures with Afghanistan drove up prices of staples like tomatoes and apples. Sign up here. "An elevated inflation reading in September, incorporating the impact of the recent floods, is likely to incline the MPC to keep the policy rate at the same level," said Fawad Basir, head of research at KTrade, adding that the next cut was likely in the last quarter of FY26, starting July 2026. FOOD PRESSURES, BASE EFFECT WEIGH ON OUTLOOK Since October 11, border closures with Afghanistan following clashes have disrupted trade and deepened food shortages, intensifying inflationary pressures. The SBP last held rates in September, warning floods could push inflation above its 5%–7% target. Pakistan's headline inflation rate accelerated to 5.6% on a year-on-year basis, up 2% from the previous month. Floods, in August, swamped Punjab's farmland and industrial hubs, killing more than 1,000 people, displacing 2.5 million and damaging crops and factories. CAUTIOUS POLICY PATH AHEAD The central bank has room to stay on hold as real interest rates remain comfortably positive after inflation eased earlier this year, analysts said. "While receding flood risks and lower global oil prices have improved the near-term inflation outlook, last year's low base is expected to push monthly readings higher," said Amreen Soorani of Al Meezan Investments. "Given the central bank's preference to keep a real interest margin of around 300 basis points, there is little room for a rate cut," she added. The central bank has lowered rates by 1,100 basis points since June 2024, when they peaked at 22% after inflation neared 40% the year before. Its last 100-bps cut came in May, followed by holds in June, July, and September amid uncertainty over energy and food prices. https://www.reuters.com/world/asia-pacific/pakistans-central-bank-likely-hold-rate-11-cautious-inflation-outlook-2025-10-24/