2025-10-21 07:22

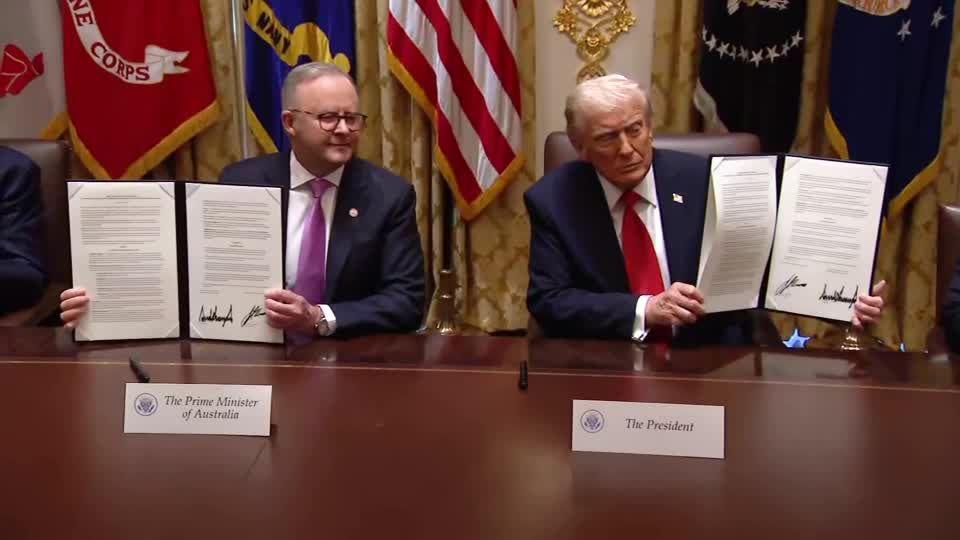

U.S., Australia sign critical minerals agreement Both countries combined commit $3 bln to critical projects Deal aimed at countering China's dominance of the sector Industry welcomes support; doubts if time frame is achievable SYDNEY, Oct 21 (Reuters) - Donald Trump's backing of Australia's critical minerals will bring much-needed financial support to the industry, but experts say the U.S. president will have to wait longer to shift the supply chain away from China and weaken its market dominance. In a wide-ranging agreement signed on Monday, U.S. and Australia committed a combined $3 billion to mining and processing projects, and to a price floor for critical minerals, a step long sought by Western miners. The countries will also sign off on financing that includes offtake rights. Sign up here. The White House said U.S. investments into Australia would unlock deposits of critical minerals worth $53 billion, without offering many details. Trump said in a year they would have "so much critical mineral and rare earths that you won't know what to do with them." "They will be worth about $2," Trump told reporters in a news conference later. Global mining industry experts gathered at a conference in Sydney on Tuesday welcomed the news, which they said would open up investment opportunities, but they were sceptical of Trump's time horizon. "The time frame for various projects to be ready even for 2027 would be heroic, and unachievable in the case of many projects," Barrenjoey analyst Dan Morgan told Reuters. "In general in the rare earths industry nothing can happen quickly. I don’t think we are going to be swamped with supply growth and there’s no way we will be swamped in a year. We might have supply growth in 5-7 years," he said. China accounts for 90% of the world's refining capacity for rare earths which have crucial uses in sectors such as clean energy, defence and automobiles. In a note on Monday flagging risks of supply disruptions, Goldman Sachs noted China also controls 69% of global rare earth mining, and 98% of magnet manufacturing. While rare earths are common in the Earth's crust, China has mastered the technically difficult and environmentally-harmful refining process, comparatively cheaply. With trade tensions and security concerns rising, the U.S. and its Western allies have been looking to loosen China's grip. In April and May, Beijing squeezed global automakers with export curbs on a range of rare earths items and related magnets, and earlier this month expanded its export controls. Benchmark prices in China for the most popular type of processed rare earths, NdPr oxide rallied by 40% to $88 a kilogram in August, after several years of weakness. They have since tailed back to $71, but western world developers are calling for governments to support a higher floor price that will enable them to build production. It's unrealistic to expect prices to drop further and the market to be swamped with supply in the short term, said Dylan Kelly, head analyst at fund Terra Capital. "Prices right now aren’t necessarily reflective of a market dynamic that can see prices fall any further," Kelly said, adding that Monday's announcement had increased the investment allure of Australian projects. "There’s lot out there to sink our teeth into that could really shift the gear on a number of different projects for us." BOOST TO MINERS However, there were some clear winners from the announcement. The U.S. Export-Import Bank (EXIM) sent seven Letters of Interest (LOIs) totalling more than $2.2 billion to miners in Australia, including Arafura Rare Earths (ARU.AX) , opens new tab. Arafura CEO Daryl Cuzzubbo said earlier this month that it need $800 million in equity funding to develop its Nolans project in Western Australia, and he expected about 60% of that would come from cornerstone investors by the end of the year. "It's good for us, and it's good for our industry counterparts," said Arafura CFO Peter Sherrington, speaking at the Imarc mining event. "The big thing it does is derisk raising money from an equity perspective." Full funding is expected by the end of the first quarter next year and Arafura aims to start production in 2029, Cuzzubbo earlier told Reuters. Arafura's biggest shareholder is Australian mining magnate Gina Rinehart, a vocal Trump supporter who attended the president’s inauguration party in Mar-a-Lago in January. However, new critical minerals projects will not be viable without a change in buying priorities from customers, said Syrah Resources (SYR.AX) , opens new tab CEO Shaun Verner. "I would say that if customers don't cure their addiction to lowest possible cost supply from China, then there will be no inducement of projects anywhere else." https://www.reuters.com/world/china/us-australia-rare-earths-deal-is-start-wont-shake-china-dominance-any-time-soon-2025-10-21/

2025-10-21 07:16

OSLO, Oct 21 (Reuters) - Norwegian oil firm Vaar Energi (VAR.OL) , opens new tab reported on Tuesday a stronger-than-expected operating profit for the third quarter and reiterated its production and dividend guidance. Vaar's earnings before interest and tax for the July to September quarter rose to $1.07 billion from $740 million a year earlier, beating the average $906 million forecast in a company-compiled poll of 12 analysts. Sign up here. The company's shares rose 1.7% by 0716 GMT. "With our major projects on stream, the company has never been a better position in terms of its outlook and sustaining the dividend," CEO Nick Walker told reporters. Vaar said it expected to meet its full year production guidance range of 330,000 to 360,000 barrels of oil equivalent per day (boed) as it ramped up new projects, with the fourth quarter output seen at 430,000 boed. Vaar, majority owned by Eni (ENI.MI) , opens new tab, also maintained its previous full-year dividend guidance of $1.2 billion for 2025 and 2026. RBC analysts, however, said in note that investors remained concerned about a dividend cut if oil prices continue to fall. Walker said he saw $60 per barrel as an oil price "floor" as lower levels would lead to curtailment of U.S. shale oil production, while Vaar could adjust its spending if needed. In July, the company said it planned to cut spending by $500 million over the period of 2025-2026. https://www.reuters.com/business/energy/norways-vaar-energi-q3-operating-profit-beats-forecasts-2025-10-21/

2025-10-21 07:06

MADRID, Oct 21 (Reuters) - Spain keeps burning more gas to produce electricity and help keep its power grids stable after a major blackout on April 28, gas grid operator Enagas (ENAG.MC) , opens new tab said on Tuesday, boosting the country's overall gas demand. Conventional power plants like gas-fired combined cycle plants provide more stability to the grid's voltage than renewable sources such as wind farms and photovoltaic panels. Sign up here. Gas demand to generate electricity soared almost 37% in the first nine months of the year. In addition, Spain exported more natural gas, in particular to neighbouring France, which needed more gas to fill its underground storages and maintain its regasification terminals, the company said. Overall, Spain's gas demand rose 6.6% from the same period last year, reaching the equivalent of 267.6 terawatt-hours. https://www.reuters.com/sustainability/boards-policy-regulation/spains-power-plants-are-burning-more-gas-since-blackout-sending-gas-demand-up-2025-10-21/

2025-10-21 06:58

Katayama appointed as Japan's first female finance minister Katayama said yen's real value is closer to 120-130 per dollar A former finance bureaucrat, she has knack for FX diplomacy Her experience drafting budget may help Takaichi do big spending Economic reality may ease pressure on BOJ to delay rate hike TOKYO, Oct 21 (Reuters) - The appointment of Satsuki Katayama as Japan's next finance minister on Tuesday could give markets cause to pause before pushing the yen too low, but it might also help the country's new prime minister, Sanae Takaichi, find fresh ways to fund bold economic stimulus plans, analysts said. Takaichi's appointment of Katayama as her finance minister - overseeing currency policy, debt management and the budget - means Japan now has its first female premier as well as its first woman in the top financial job. Sign up here. In an interview with Reuters in March, Katayama, a 66-year-old veteran upper house lawmaker and former finance ministry bureaucrat, said Japan's economic fundamentals suggest the yen's real value is closer to 120-130 per dollar. Those comments were made when the yen had fallen to around 150 against the dollar on market expectations that the Bank of Japan would go slow on monetary tightening. The dollar briefly fell to around 150.50 yen on a local media report that Katayama will get the job, before recouped losses to climb above 151 yen. "Given her past remarks, it seems Katayama favours reversing a weak yen. Markets may have seen that as similar to the views of U.S. Treasury Secretary Scott Bessent," said Akira Moroga, chief market strategist at Aozora Bank. Speaking to reporters after her appointment, Katayama said it was desirable for foreign exchange rates to move stably reflecting fundamentals. She declined to comment on BOJ policy. Takaichi was voted in as Japan's first female prime minister on Tuesday, breaking the glass ceiling for women in a country where men still wield most power - before breaking some more glass with her appointment of Katayama. The yen and bond yields fell after the parliamentary vote on market expectations that Takaichi, a proponent of expansionary fiscal and monetary policy, would deliver big spending and push back against an early BOJ rate hike. KATAYAMA AN OUTSPOKEN AND DECISIVE INSIDER A former finance ministry bureaucrat well-versed in fiscal affairs, Katayama has a knack for currency diplomacy, and has befriended former and incumbent executives alike at the ministry overseeing exchange-rate policy. She is known for being outspoken and for her punchy decision-making, which contrasts with incumbent finance minister Katsunobu Kato, who rarely goes off script and keeps a low profile. In the March interview, Katayama had said U.S. President Donald Trump's administration did not want excessive yen weakness versus the dollar. Indeed, Bessent said last week the yen would find its own level if the central bank follows "proper monetary policy" in his latest swipe at the slow pace of BOJ rate hikes. The appointment of Katayama comes at a time of rising living costs, blamed in part on higher import prices caused by a weak yen. Those factors have hurt households and the ruling party's approval ratings. As a former bureaucrat, Katayama knows well the inner workings of the finance ministry's budget drafting. While her background at the finance ministry could prod her to call for fiscal discipline, some analysts say she could use her expertise to help Takaichi find ways to fund her bold spending plans. "She'll know how to find sources of revenue if Takaichi wants to expand fiscal spending," said Hiroyuki Machida, director of Japan FX and commodities sales at ANZ. "Personally, I think this appointment will accelerate 'Takaichi-trade'." Katayama said she would focus on revitalising the economy with expansionary fiscal policy. She will also be heading the ministry that oversees official communication with the central bank, although little is known about her stance on BOJ rate hikes. Economic and political reality could prevail as Japan faces challenges different from a decade ago, when former premier Shinzo Abe deployed the "Abenomics" mix of fiscal and monetary stimulus that Takaichi still praises. With inflation exceeding its 2% target, the BOJ's exit last year from a decade-long stimulus and its two rate hikes since then came amid political pressure to combat yen falls. "Japan's current problem is not deflation and a strong yen, but inflation and a weak yen. There's also pressure from Washington for the BOJ to raise interest rates," said Yuichi Kodama, chief economist at Meiji Yasuda Research Institute. "It would be hard for Takaichi's administration to exert strong pressure on the BOJ to delay rate hikes," he said, predicting the chance of a rate increase in December. Markets will focus on Katayama's views on whether the BOJ should keep raising interest rates, which could increase Japan's debt-servicing costs but help keep sharp yen falls in check. "Katayama is a former finance minister bureaucrat and so well informed on the ministry's affairs," said Eiji Douke, chief fixed income strategist of SBI Securities. "She's likely neutral on fiscal and monetary policy." https://www.reuters.com/world/asia-pacific/japans-next-finance-minister-could-unsettle-yen-bears-2025-10-21/

2025-10-21 06:58

UK borrowing 99.8 billion pounds in April-September period Shortfall grows by 13% from a year earlier Deficit also overshoots official forecasts Reeves planning tax increases in November 26 budget LONDON, Oct 21 (Reuters) - Britain's borrowing in the first half of the financial year was the highest on record except during the height of the coronavirus pandemic, keeping up the pressure on finance minister Rachel Reeves as she prepares next month's key budget. The overshoot in the April to September period ran above official forecasts, although Reeves was able to take a crumb of comfort from a cut to the overshoot in recent months. Sign up here. Government borrowing in the first six months of the tax year totalled 99.8 billion pounds ($133.94 billion), up 13% from a year earlier and 7.2 billion pounds more than forecast by Britain's budget watchdog. In September alone, the government borrowed 20.2 billion pounds, pushed up by the costs of debt interest and providing public services which more than offset a rise in tax receipts including Reeves' from the social security hike for employers. The September shortfall was only slightly above the projection from the Office for Budget Responsibility whose forecasts underpin government budgets. It was lower than a median forecast of a 20.8 billion pound deficit in a Reuters poll of economists. The borrowing in the first six months of the year was the second highest for the period since records began in 1993 and was only bigger in 2020 at the height of the COVID-19 pandemic. However, the Office for National Statistics revised down government borrowing in the first five months of the financial year by 4.2 billion pounds, around half of which it had previously announced. Reeves has said she is looking at tax increases and spending cuts in her budget on November 26 to show investors that she can remain on track to meet her fiscal rules. "The chancellor faces an increasingly difficult balancing act ahead of the autumn budget, with her fiscal headroom all but exhausted by a mix of weaker growth prospects, higher borrowing costs and rising spending pressures," Nabil Taleb, economist at PwC UK, said. Reeves wants to balance day-to-day spending with tax revenues by the end of the decade. Tuesday's data showed the current budget was 71.8 billion pounds in deficit in the April-to-September period, 17% higher than a year earlier. Reeves said last week she would like a bigger fiscal buffer for meeting her targets than the 9.9 billion pounds of headroom that she previously gave herself, but creating one would involve tough trade-offs on tax and spending. Sterling was little changed against the U.S. dollar and the euro after the borrowing figures were released. ($1 = 0.7451 pounds) https://www.reuters.com/world/uk/uk-borrowing-outstrips-forecasts-again-first-half-tax-year-2025-10-21/

2025-10-21 06:47

Gold hit record high of $4,381.21/oz on Monday Gold prices are poised to rise further, analyst says Focus on US inflation data due on Friday Silver down over 4% Oct 21 (Reuters) - Gold prices fell 2% on Tuesday as investors booked profits after the metal hit another record high in the previous session, driven by expectations of U.S. interest rate cuts and strong safe-haven demand. Spot gold was down 2.1% at $4,264.91 per ounce, as of 1119 GMT, having hit an all-time high of $4,381.21 on Monday. U.S. gold futures for December delivery fell 1.9% to $4,278.50 per ounce. Sign up here. The dollar index (.DXY) , opens new tab rose 0.3%, making bullion more expensive for holders of other currencies. "Gold prices are still yet to go much higher, but the speed is being a bit aggressive and as a result of that, we will get pullbacks each time we hit those fresh highs," said Nitesh Shah, commodities strategist at WisdomTree. A combination of geopolitical and economic uncertainty, sustained central bank buying, strong investment demand and expected U.S. interest rate cuts has pushed gold 63% higher this year. Investors' focus is now on the U.S. consumer price index (CPI) data, due on Friday. The data is expected to show a 3.1% year-over-year increase for September, reinforcing market expectations for the Federal Reserve to lower interest rates by 25 basis points at its meeting next week.FEDWATCH Gold, a non-yielding asset, tends to benefit from a low-rate environment. Asian equities gained on Tuesday, buoyed by hopes of easing trade tensions between the U.S. and China, while Japan's Nikkei advanced as Sanae Takaichi prepared to become the nation's next prime minister, pressuring the yen. "There are still many market participants that did not participate in (gold's) rally and are looking to get exposure if there is a price setback, limiting the downside for now, in my view," said UBS analyst Giovanni Staunovo. Elsewhere, spot silver dropped nearly 4.3% to $50.19 per ounce, platinum shed 2.8% to $1,592.65 and palladium lost 4% to $1,440.73. Increased silver flows from the U.S. and China to London's spot market have eased liquidity constraints in the world's largest over-the-counter precious metals hub, according to traders and analysts. https://www.reuters.com/world/india/golds-record-run-pauses-investors-book-profits-2025-10-21/