2025-10-17 18:09

Fed's Musalem supports rate cut if labor market risks emerge Musalem cautious about creating accommodative monetary policy Musalem sees tariffs seen driving inflation into next year Oct 17 (Reuters) - Federal Reserve Bank of St. Louis President Alberto Musalem suggested Friday he will support a central bank interest rate cut at the end of the month, while warning it's important for the Fed not to go too far with easing the cost of credit amid still unsettled inflation risks. Responding to a question about lowering rates at the next Fed meeting, the official said “I could support a path with an additional reduction in the policy rate if there are further risks to the labor market that emerge, and provided that inflation, the risk to persistence of inflation above target is contained, and provided inflation expectations are expected to remain anchored.” He spoke at the Institute of International Finance Annual Membership Meeting. Sign up here. Musalem was addressing the outlook for monetary policy at the central bank’s next Federal Open Market Committee meeting scheduled for Oct. 28-29, where officials are broadly expected to follow September’s rate cut with another quarter percentage point easing in what is now a 4% to 4.25% federal funds target rate range. The Fed is cutting rates to buoy a listing job market, while keeping rates high enough to help lower high levels of inflation back to 2%. The Fed is also expected to cut rates again at the end of the year, but Musalem, who holds a vote on the FOMC this year, indicated it is too soon to say what will happen then. He noted Fed officials should “tread with caution,” because “I perceive limited space for easing before monetary policy could become overly accommodative, and we haven't finished the job on inflation.” It is important “that we continue to lean against any potential persistence in inflation, whether that persistence comes from tariffs, from lower supply of labor, or lower labor supply growth, from sticky services, or for whatever other reason.” TARIFF RISKS Musalem is the last Fed official scheduled to speak before policymakers go into their customary quiet period ahead of a policy meeting. Comments by officials over recent weeks have pointed to a solid probability the Fed will lower short-term borrowing costs, even as officials have been deprived of top-level data tied due to the government shutdown. Fed Governor Christopher Waller, who is on the short list of possible successors to Fed Chair Jerome Powell, whose term ends next year, said in a speech Thursday that “based on all of the data we have on the labor market, I believe that the FOMC should reduce the policy rate another 25 basis points" at month’s end. Some Fed officials have been more gun-shy about rate cuts given the ongoing risk that President Donald Trump’s large and mercurial trade tariff regime will drive up inflation. Musalem said tariffs are driving up price pressures now and that will accelerate before the process wanes. “My own expectation is that tariffs will work through the economy for the next two to three quarters, and by the second half of 2026 that will have finished, and inflation will then return to a convergence path towards 2%,” he said. Musalem also warned that job markets may face more stress. “So I look at the labor market very broadly, at all the indicators that I can” and “the story I'm telling myself right now is broadly the labor market is around full employment,” he said. But changes in things like immigration mean the number of jobs that must be created each month to keep the unemployment rate stable has likely fallen, to between 30,000 to 80,000 per month. “We could see negative payroll prints just because of the shuffle of the data,” Musalem said, but “that doesn't necessarily mean to me that the unemployment rate needs to shoot up.” https://www.reuters.com/business/feds-musalem-leans-toward-supporting-october-interest-rate-cut-2025-10-17/

2025-10-17 17:39

WASHINGTON, Oct 17 (Reuters) - The chances of further interest rate cuts from the European Central Bank are declining given the economy's resilience and inflation holding around the 2% target, Belgian central bank Governor Pierre Wunsch said on Friday. The ECB cut rates by a combined 2 percentage points in the year to June but has been on hold ever since as policymakers contemplate if further easing may be needed due to the potential for consumer prices to rise too slowly. Sign up here. "Given that the economy is proving resilient, the chance that further rate cuts will be needed is receding," Wunsch told Reuters on the sidelines of the IMF's annual meeting. "I’m quite comfortable where we are today, though I remain open." Still, risks are skewed towards interest rates going lower, since the impact of tariffs is yet to fully play out, the dollar is weak and there is the risk of China dumping surplus goods, Wunsch added. Inflation is set to dip to 1.7% next year before rising back to target in subsequent years, fuelling concern among some policymakers, particularly around the bloc's southern edge, that price growth could get stuck below target. "I don’t see any major risks for inflation either on the upside or downside," Wunsch said. "But I also don’t get nervous about numbers like 1.8% or 2.2%," he added. Wunsch also said that not all deviations from the target required the same policy response and the ECB needed to study the underlying fundamentals in determining the intensity of its policy action. "If we’re growing at potential, the labour market is healthy, but inflation is still below target, I would support a mildly supportive stance but definitely not aggressive accommodation," he said. Wunsch also said he was comfortable with market pricing for interest rates, which sees close to no chance of a rate cut this year and see a one in two probability of a move by next June. https://www.reuters.com/markets/us/chances-further-ecb-rate-cuts-declining-wunsch-says-2025-10-17/

2025-10-17 17:05

Governments urged to stabilize debt and improve fiscal policies Coordination between fiscal and monetary policies is crucial, IMF says Potential growth in region lags behind other emerging markets Oct 17 (Reuters) - Latin America and the Caribbean face slower growth and lingering inflation pressures as the global economy adjusts to major policy shifts and persistent geopolitical tension, the International Monetary Fund said on Friday in its latest Regional Economic Outlook. The IMF said earlier this week it expects the region to grow 2.4% in 2025, slowing to 2.3% in 2026 as the post-pandemic rebound fades and global trade tensions weigh. Despite a slowdown in inflation, several countries are still expected to miss their targets. In its World Economic Outlook released on Tuesday, the IMF upgraded its forecast for global growth this year because of milder-than-expected effects of tariff shocks and more benign financial conditions. Sign up here. The fund said governments in the region should put debt on a stable path, coordinate fiscal and monetary policy, and make it easier for businesses to grow. Delays, it warns, could make even these modest growth forecasts harder to achieve. Debt is again near highs reached during the COVID pandemic and the fund estimates that for Brazil, Chile, Colombia, Mexico, Paraguay, Peru and Uruguay, the region’s largest economies excluding Argentina, governments need to raise primary balances by about 1.5 percentage points of GDP compared with 2024 to stop debt ratios from worsening. “Whether it’s spending or revenues … those things matter almost everywhere in the region,” said Rodrigo Valdes, the IMF’s outgoing director for the Western Hemisphere. “There’s a lot of deductions in the tax codes … the base of taxes is smaller than it should be.” CREDIBILITY AND POLITICS The fund called for credible, multiyear fiscal plans, better tax collection and more efficient spending. The goal, it said, should be to stabilize debt without cutting investment or core social programs. Valdes, who will become director of the IMF’s fiscal affairs department on October 27, said “it is always politically super difficult, but it’s never too late to deploy a plan that is credible.” Such credibility, Valdes said, can help attract investment. “If you believe that the economy will be growing faster in two, three years’ time, you invest today,” he said. “The critical point is how to make a package that is a sequence of things that make tangible or credible that this will happen.” COORDINATION AT RISK The IMF warned of the risk of conflicting signals from fiscal and monetary authorities. It highlighted Brazil and Mexico as key countries where this could matter. “Lack of coordination is a problem, like driving one car with two drivers, one braking and the other accelerating. That’s not great,” Valdes said. The fund stressed that central banks work best when public finances are stable. High debt and weak fiscal signals can limit the impact of interest rate moves and undermine confidence in the policy mix. The fund sees potential growth stuck around 2.5%, well below other emerging markets. It pointed to weak productivity, too much red tape and not enough regional trade. “I think in the region, the predictability, rule of law, crime … that is very unique in the region, and we need to improve much more so that investment can come fast,” Valdes said. “The second thing is to have more regional trade integration.” https://www.reuters.com/markets/us/stable-debt-policy-coordination-are-key-latam-caribbean-growth-imf-says-2025-10-17/

2025-10-17 15:13

Italian hedge fund executives embroiled in London legal battle Discrimination, whistleblowing claims dismissed Claimant awarded reduced 1,286 pounds for unfair dismissal Hedge fund secures 49,000 pounds in costs LONDON, Oct 17 (Reuters) - Hedge fund founder Davide Leone and his eponymous firm have successfully defended themselves against allegations of bullying, victimisation and discrimination in a London lawsuit brought by a former director. However, while the Central London Employment Tribunal ruled that former senior director Jacopo Moretti had been fired after a protracted period of ill-health, it accepted his claim of unfair dismissal, partly because a disciplinary letter had been too unspecific. Sign up here. He won 1,286 pounds ($1,725), sharply reduced from a basic award the judge set at 2,572 pounds because of his conduct before his dismissal. Moretti was dismissed by Davide Leone & Partners Investment Company (DLP) in 2023 after an absence of around 13 months. The dispute offered a rare glimpse into the often-secretive world of hedge funds, which manage more than $4 trillion. The tribunal rejected whistleblowing and harassment claims brought by Moretti related to issues such as race, religious belief, sex and disability. Claims that he was dismissed for making health and safety disclosures and that the hedge fund failed to make reasonable adjustments for his deteriorating mental health were also rejected. Moretti was ordered to pay just over 49,000 pounds for his share of translating 72 hours of covert Italian-language recordings of what the judge described as sometimes "emotionally charged" conversations with Leone and others that he had entered in evidence. The sum included DLP's costs for pursuing him for non-payment of those translation and transcription fees. In a 119-page judgment published on Tuesday, Judge Richard Nicolle said Moretti was at least partly motivated by a desire to cause "maximum embarrassment and potential reputational damage" to Leone. The judge questioned whether all Moretti's discrimination and whistleblowing claims were made in good faith, saying in one example that Moretti had effectively "induced" Leone to speak of a colleague who he had "obvious antipathy" towards, while secretly recording him. However, language used by Leone in the taped conversations with Moretti was "wholly inappropriate, misogynistic and discriminatory" and did not meet the standards expected of a senior executive in financial services, Nicolle said. Leone expressed regret for his vocabulary during what he thought were private conversations, the judgment said. Moretti's lawyer declined to comment on his client's behalf. DLP told Reuters that as well as rejecting Moretti's claims, the judge had found an independent internal investigation at the hedge fund into Moretti's allegations to be fair and impartial. The judgment can be appealed. ($1 = 0.7453 pounds) https://www.reuters.com/sustainability/boards-policy-regulation/hedge-fund-founder-leone-successfully-defends-london-harassment-case-2025-10-17/

2025-10-17 14:09

WASHINGTON, Oct 17 (Reuters) - French politicians agree that public finances need to be shored up and this consensus keeps financial markets calm despite the political instability France has been experiencing since mid 2024, the head of the IMF's European department Alfred Kammer said. Kammer said French fundamentals were sound, the country had no liquidity problems, French bond spreads over German paper were contained and France had a draft budget proposal with a lower budget deficit for 2026. Sign up here. "In terms of these short-term risks, they haven't risen to a level where one would need to be exceptionally concerned," Kammer told Reuters. "What makes us positive is that we expect the 2026 budget is submitted in line with the French commitments under European fiscal rules, in order to lower the budget deficit next to 4.7% of GDP," Kammer said. French public debt rose to 114.1% of GDP in the first quarter of the year from 113.2% at the end of 2024, well above the 88% of GDP for the whole of the euro zone, making France the third-most indebted EU country after Greece and Italy. Kammer said that while French political parties would hotly debate the measures to reduce the deficit, the direction of the discussion -- further consolidation -- was clear and undisputed. "What happens sometimes is that recognition is missing, and then the reminder comes by markets acting," Kammer said. "One reason why markets stay relatively calm is that the political class and members of parliament have clearly understood that this is a problem they need to tackle," he said, adding the understanding did not exclude a difference of views on how the consolidation should be achieved. https://www.reuters.com/business/france-knows-it-must-cut-deficit-that-calms-markets-imf-says-2025-10-17/

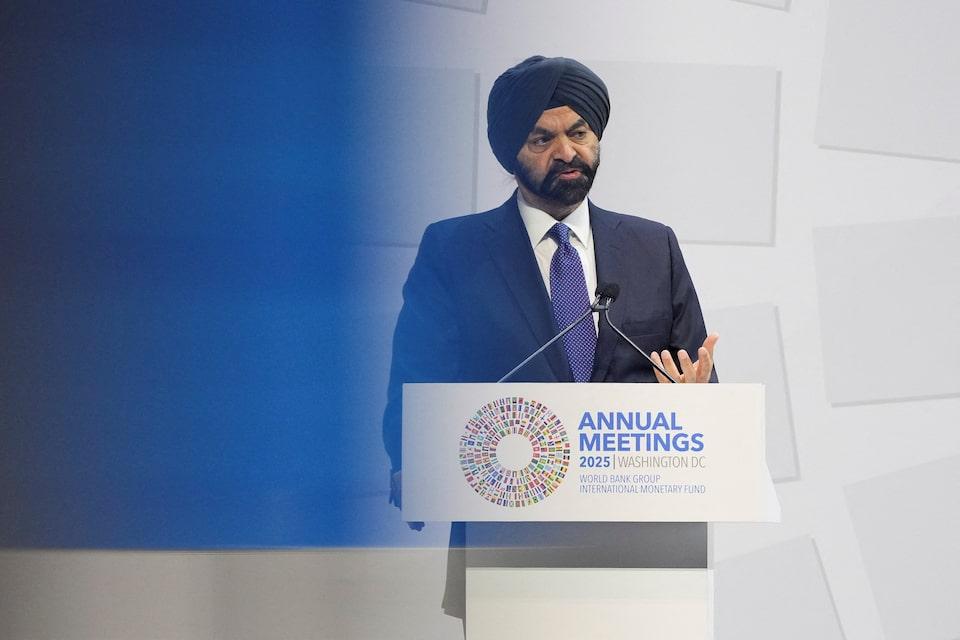

2025-10-17 14:09

WASHINGTON, Oct 17 (Reuters) - World Bank President Ajay Banga on Friday stressed the need to increase transparency in debt restructuring processes to give greater clarity to all parties involved, including by expanding the debtor reporting system to all Group of 20 major economies. Banga said the World Bank was working very closely with the International Monetary Fund and others to accelerate debt restructuring under the G20 Common Framework for Debt Treatments, while advancing domestic revenue reforms, expanding financing and supporting liability management. Sign up here. https://www.reuters.com/sustainability/boards-policy-regulation/world-banks-banga-calls-more-transparency-debt-restructuring-process-2025-10-17/