2025-10-17 06:17

Local appetite for sparkling wine levelling off More vines being planted, international firms snapping up land Producers eye markets like Norway for growth Warmest summer means higher quality wines produced WEST CHILTINGTON, England/OSLO, Oct 17 (Reuters) - English winemakers are betting that surging exports can sustain their once novelty product after domestic sales growth slowed, hoping for a boost from Britain's warmest summer on record this year as climate change optimised conditions. Days before pickers started to harvest this year's crop, sparkling wine from southern England beat French Champagne to win one of the industry's most prestigious awards, lifting its prospects in markets like Norway, Japan and China. Sign up here. Foreign sales have become more important as a subdued economy at home weighs on demand for a premium product. International producers are snapping up the country's increasingly attractive land to produce wine to sell home and abroad. "Export is where the real growth is in the coming period," said Brad Greatrix, senior winemaker at Nyetimber, the English company which became the first non-French winner of the International Wine Challenge sparkling wine award in September. FROM FAIRWAYS TO VINEYARDS English wineries started to emerge in the 1990s as adventurous landowners took advantage of warmer summers. Now, on chalky slopes across southern England, vines are being planted on land once used for crops, apple orchards and golf courses. Since 2000, English wine production has risen by an average 7% per year, and is set to keep growing after land dedicated to vines jumped by 30% between 2020 and 2024. However, while British demand has driven growth so far, last year sparkling wine sales - which at 6.2 million bottles accounted for 70% of total wine sales - were flat, down from 11% growth the previous year. In September, Chapel Down, Britain's biggest wine producer, cancelled plans to build a new winery. Nicola Bates, CEO of industry body WineGB, said steady sales were an achievement when restaurants and bars were struggling, and when Champagne shipments to Britain fell 13% last year. For many consumers English fizz is a luxury product, with the biggest brands Chapel Down and Nyetimber costing 30 pounds ($40) and 42 pounds respectively per bottle, similar to Champagnes. With more vines being planted, Bates said, "we need to be growing sales at a faster pace for mid- to long-term health". NORWEGIANS REQUESTING ENGLISH WINE Though some winemakers will not sell this year's prized vintage for several years, exports are a bright spot they hope to build on. Export volumes grew 35% to account for 9% of total sales of English wine in 2024, and Bates said she was targeting doubling that figure by 2030. Norway tops the list of buyers by volume. Its imports of English sparkling wine jumped to 111,639 litres last year from 451 litres in 2015, according to its wine monopoly, the single state body allowed to import wine and spirits. That growth is far ahead of rises from other countries, said Arnt Egil Nordlien, the monopoly's head of product. Aleksander Iversen, a sommelier at Brasserie Coucou in Oslo, says Norwegians are open-minded and curious about wine. Some customers specifically request English wines while others discover it on recommendation. "Most are surprised by the quality, they often remark that it rivals top Champagne, but with its own unique character," he said. MORE UNPREDICTABLE WEATHER This year, English vineyards have experienced "almost perfect growing season conditions", said Alistair Nesbitt, chief executive at Vinescapes, a viticulture consultancy. The average temperature in southern England during the spring to autumn grape growing season has increased by 1 to 1.5 degrees Celsius over the last 40 to 50 years, he said, but it's not always straightforward. Climate change means more unpredictable weather events and that is also affecting England. Persistent wet weather in 2024, for example, hit the grape harvest, cutting production by half compared to the previous year. While climate change means more variability for wine producers globally, Nesbitt said cooler climates like England have the advantage over areas in southern Europe, which are being hit by more frequent droughts and heatwaves. Wine producers from the U.S., France and Australia started buying English land around a decade ago, with French Champagne house Taittinger acquiring a site in 2015 and California's Jackson Family Wines establishing a presence in 2023. "If you're in a real climate-stressed area of the world, and you want to keep your wine production enterprise going, you look to cooler areas like the UK," he said. ($1 = 0.7493 pounds) https://www.reuters.com/business/english-winemakers-hope-export-boost-as-they-toast-warmest-summer-2025-10-17/

2025-10-17 06:07

CNPC and Niger government have yet to agree on localisation push Negotiations under way to tackle disputes after expulsion of CNPC executives in March CNPC has exported 32 million bbls of oil from new development of Agadem field Oct 17 (Reuters) - China's CNPC has continued to export crude from a newly expanded oilfield in Niger that has generated more than $2 billion in revenue despite disputes with government officials over hiring more local workers and improving their benefits, sources with knowledge of the situation said. The Chinese state oil giant has been negotiating with the Nigerien government for months to tackle those issues, the sources said, after three of its senior executives were expelled in March due to disputes over a pay gap between local workers and Chinese expatriates. Sign up here. CNPC's crude sales and the status of the negotiations have not been previously reported. CNPC and a Niger government spokesperson did not respond to requests for comment. The expulsions, which were followed by government letters in May ordering experienced Chinese expatriates to leave Niger, dealt a blow to CNPC. Niger is a showcase of CNPC's ability to build an oil industry from scratch in an impoverished nation. It invested more than $5 billion there, developing an oilfield, building a refinery and a 1,950-km (1,212-mile) pipeline, Africa's longest. Oil minister Sahabi Oumarou initially asked CNPC and its refinery, SORAZ, to terminate the contracts of expatriates who had been working in Niger for more than four years, but that action has not been carried out, three Niamey-based sources told Reuters. Among the key disputes was the Nigerien government's request to increase local hires at CNPC-led projects to 80% versus less than 30% at present, a goal that CNPC believed to be unrealistic due to a lack of trained, skilled local staff, the people said. The sources spoke on the condition of anonymity due to the sensitivity of the matter. MELECK CRUDE EXPORTS Despite the dispute, CNPC has made progress in marketing new production from the phase-2 development of the Agadem oilfield, which is now pumping at a full capacity of 90,000 barrels a day. The crude is exported via a CNPC-built pipeline linking the oilfield with the Cotonou port in Benin. CNPC holds a 65% stake in the Agadem field, Taiwanese state firm CPC owns 20% and the Nigerien government holds the remaining 15%. So far, CNPC has exported 32 million barrels of Meleck crude, ideal for making low-sulphur marine fuel, to customers in Europe and Asia, according to one of the sources and a separate trading executive. Priced at $65 to $70 a barrel, with buyers including global trading houses and CNPC's trading arm Chinaoil, the exports have generated revenue of more than $2 billion, the sources estimated. CNPC began producing oil at Agadem, in southeastern Niger, in 2011 under a phase-1 development with agreement from the then-civilian government. The 20,000 bpd production feeds the Soraz refinery in southern Niger, which was built and is 60% owned by CNPC, which supplies fuel to Niger. Niger's current junta government came to power in 2023 in a military coup and has, like several other governments in the Sahel region of north-central Africa, been seeking greater control over its natural resources. https://www.reuters.com/business/energy/cnpc-keeps-oil-flowing-niger-negotiations-seek-tackle-disputes-sources-say-2025-10-17/

2025-10-17 06:06

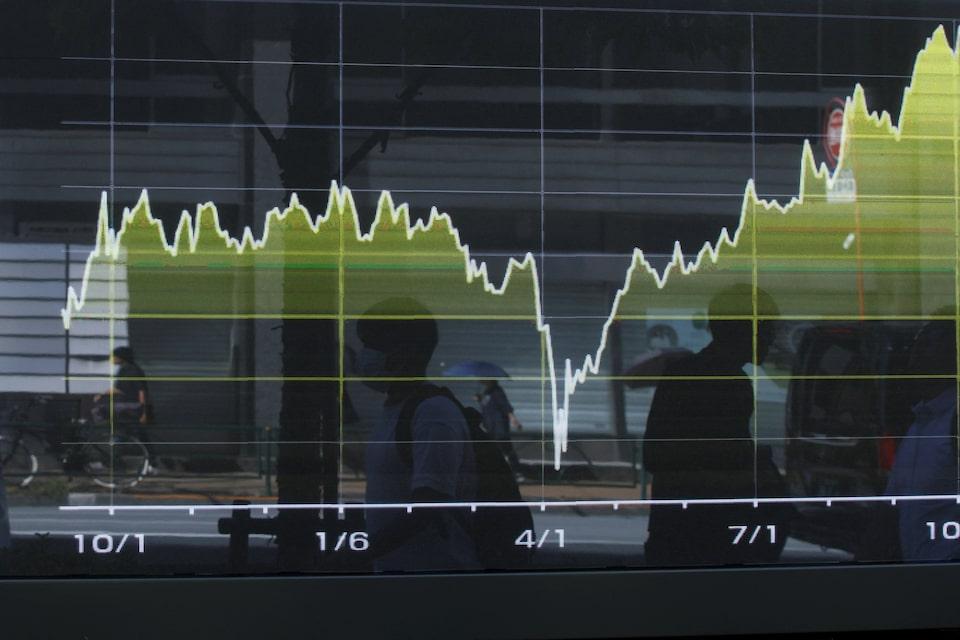

All three major US stock indexes gain on the week Trump confirms meeting with President Xi Jinping Gold presses pause on record-breaking run Treasury yields gain, dollar strengthens NEW YORK, Oct 17 (Reuters) - Wall Street stocks advanced and U.S. Treasury yields rebounded on Friday as investors assessed the health of regional banks and President Donald Trump said his face-to-face trade talks with Chinese President Xi Jinping were still on. All three major U.S. stock indexes closed in positive territory after struggling for direction in early trading, and all three notched weekly gains. Sign up here. Benchmark Treasury yields and the dollar turned higher, while gold pulled back after a record run sent the precious metal to all-time highs. Worries over potential systemic credit problems in the banking sector abated the day after Zions (ZION.O) , opens new tab disclosed it would take a $50 million loan loss in the third quarter and Western Alliance (WAL.N) , opens new tab initiated a lawsuit alleging fraud by an investment firm. The KBW Regional Banking index (.KRX) , opens new tab advanced 1.7% in a partial recovery from Thursday's 5.0% plunge. "It took a night to sleep on it, but some calm has come in over the probably overblown worries in the regional bank area," said Ryan Detrick, chief market strategist at Carson Group in Omaha. "The truth is the financial sector is likely still on firm footing; just a couple companies had some bad news, but it's not systemic." Trade tensions between Washington and Beijing were calmed by Trump's assurances that his proposed 100% tariff on Chinese imports would not be sustainable. He confirmed he would meet with Chinese President Xi Jinping in two weeks in South Korea. "We've seen this movie before," Detrick added. "A week ago, President Trump was talking 100% tariffs and the market had its worst selloff in months and now today he's clearly putting some water on that fire, saying he and President Xi have a good relationship." The first official week of the third-quarter earnings season is in the books, with 58% of companies in the S&P 500 having reported. Of those, 86% have delivered stronger-than-expected results. Analysts now expect third-quarter S&P 500 earnings growth of 9.3% year-on-year, up from 8.8% as of October 1, according to LSEG data. The Dow Jones Industrial Average (.DJI) , opens new tab rose 238.37 points, or 0.52%, to 46,190.61, the S&P 500 (.SPX) , opens new tab rose 34.94 points, or 0.53%, to 6,664.01 and the Nasdaq Composite (.IXIC) , opens new tab rose 117.44 points, or 0.52%, to 22,679.98. European stocks closed lower as signs of credit stress in U.S. regional banks dampened investor risk appetite, driving them to safe-haven assets. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab fell 0.21 points, or 0.02%, to 984.18. The pan-European STOXX 600 (.STOXX) , opens new tab index fell 0.95%, while Europe's broad FTSEurofirst 300 index (.FTEU3) , opens new tab fell 20.72 points, or 0.91%. Emerging market stocks (.MSCIEF) , opens new tab fell 16.86 points, or 1.22%, to 1,362.10. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab closed lower by 1.24%, to 706.04, while Japan's Nikkei (.N225) , opens new tab fell 695.59 points, or 1.44%, to 47,582.15. U.S. Treasury yields rose and the dollar strengthened as worries stemming from the escalating trade war and regional banks' credit quality ebbed. The greenback, however, remained on track for a weekly loss. The yield on benchmark U.S. 10-year notes rose 2.9 basis points to 4.005%, from 3.976% late on Thursday. The 30-year bond yield rose 1.7 basis points to 4.6005% from 4.583% late on Thursday. The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, rose 3.3 basis points to 3.459%, from 3.426% late on Thursday. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, rose 0.16% to 98.42, with the euro down 0.15% at $1.1669. Against the Japanese yen , the dollar strengthened 0.04% to 150.48. Oil prices inched higher but lost ground on the week amid the fog of global supply uncertainty. U.S. crude rose 0.14% to settle at $57.54 per barrel, while Brent settled at $61.29 per barrel, up 0.38% on the day. Gold prices pulled back from record highs, pressured by a firmer dollar. Spot gold fell 2.19% to $4,230.60 an ounce. U.S. gold futures fell 1.3% to $4,224.60 an ounce. https://www.reuters.com/world/china/global-markets-wrapup-1-2025-10-17/

2025-10-17 05:56

MUMBAI, Oct 17 (Reuters) - A pre-open push from the Reserve Bank of India helped the rupee start on a firmer footing on Friday, although importer hedging and a weak tone across Asia tempered the support. The rupee was last quoted at 87.8550 against the U.S. dollar, having hit an intraday high of 87.75. The currency had briefly weakened past 88.00 mark in pre-open trade ahead of the Indian central bank's likely U.S. dollar sales through state-run banks. Sign up here. The rupee has rallied more than 1% in the last two sessions, in what is being seen a deliberate attempt by the RBI to push the currency pair down. The central bank is estimated to have sold $3 billion to $5 billion in spot and non-deliverable forward markets to support the rupee on Wednesday, marking its largest intervention in months, according to traders. While the RBI is "showing resolve in backing the rupee, importers are not holding back in their hedges - which is what you would expect at these levels," a FX salesperson at a private sector bank said. Meanwhile, Asian currencies were mostly lower on Friday, weighed by tepid risk appetite. Regional units struggled to find support despite a more dovish tilt in the Federal Reserve's rate outlook. Futures now imply a small probability that the Fed could cut rates by a cumulative 50 basis points over its next two meetings this year. Fed Governor Christopher Waller said he supports another rate cut this month, citing mixed signals from the labour market. https://www.reuters.com/world/india/rupee-rally-set-hit-speed-bump-soggy-asia-fx-risk-off-tone-2025-10-17/

2025-10-17 05:15

Dollar index set for weekly loss Bank stocks rebound after losses unnerve investors Safe-haven Swiss franc gain and yen flat Euro set for biggest weekly gain against dollar in nine weeks NEW YORK/LONDON, Oct 17 (Reuters) - The U.S. dollar was headed for a weekly loss against the Swiss franc and yen on Friday, amid concern about trade tensions and unease among some regional American banks. The U.S. federal government shutdown has also choked off the release of key macroeconomic data, leaving investors with less certainty than usual about what is happening in the economy. Sign up here. U.S. President Donald Trump said his proposed 100% tariff on goods from China would not be sustainable, but blamed Beijing for the latest impasse in trade talks that began with Chinese authorities tightening control over rare earth exports. Trump also confirmed he would meet with Chinese President Xi Jinping in two weeks in South Korea in an attempt to ease trade tensions. "There's a bit of safe-haven selling of the dollar," said Steve Englander, Standard Chartered's global head of G10 FX research. "I think there's the news on China, which has been partly but not fully walked back, and the news on regional banks and credit more broadly are sort of hurting the dollar." The U.S. dollar fell to its weakest level against the Swiss franc in a month while the yen erased earlier gains following Bank of Japan Governor Kazuo Ueda's discussion of factors that could lead to a rate increase this month. The dollar fell 0.08% to 0.7925 against the Swiss franc , dropping to its lowest level since mid-September and was set for the biggest weekly loss since June. "The market is responding to a week where we are now 17 days into a U.S. government shutdown and we're missing initial claims and the jobs data - we are flying with limited visibility and the Fed also feels like that," said Amo Sahota, director at Klarity FX in San Francisco. "And then we had the trade tension that escalated although Trump did try to calm things down . . . I believe this is all game theory and negotiating tactics," Sahota added. Fed Governor Christopher Waller said he is on board for another interest rate cut at the U.S. central bank's meeting later this month because of the mixed readings on the state of the job market. The euro was down 0.17% at $1.16678. It was on course for its biggest weekly gain against the dollar in nine weeks. The dollar index , which tracks the U.S. currency against six of its counterparts, headed for a 0.43% slide this week, although it was up 0.17% on the day to 98.43. Japan's lower house scheduling committee board has agreed to hold a parliamentary vote to select the next prime minister on October 21. The yen has been on the defensive since fiscal dove Sanae Takaichi was elected to head Japan's ruling Liberal Democratic Party this month. But a vote to install her as prime minister was delayed after a split with the LDP's coalition partner. Against the Japanese yen , the U.S. dollar was flat at 150.49, on track to notch a weekly loss. Meanwhile, BOJ Governor Ueda said in Washington on Thursday that the central bank remains ready to increase its key policy rate if the likelihood of its growth and price forecasts materializing increases. Sterling was down 0.02% at $1.3433, heading for a weekly gain. https://www.reuters.com/world/asia-pacific/dollar-set-weekly-slide-trade-shutdown-concerns-weigh-2025-10-17/

2025-10-17 05:14

MUMBAI, Oct 17 (Reuters) - The Reserve Bank of India sold U.S. dollars through state-run banks before the spot market opened on Friday, traders said, repeating its midweek pre-market intervention and underscoring its intent to support the rupee. The RBI's intervention helped the rupee open firmer against the U.S. dollar despite pre-market signals of weakness. Quotes in the interbank order-matching system had pointed to a possible dip past the 88 level before state-run banks stepped in to sell dollars on the central bank's behalf. Sign up here. The rupee climbed to a high of 87.75 on the back of the intervention, after settling at 87.82 on Thursday. The currency has rallied more than 1% over the last two sessions. The RBI had intervened in a similar way on Wednesday, surprising the market with aggressive dollar sales, which helped squeeze out speculative long-dollar positions. Bankers said Friday’s move builds on that momentum, reinforcing the view that the central bank will stay active in supporting the rupee. "Would it be fair to say the RBI is signalling that 88 is now the floor (for rupee), or are they just emphasizing intent by following up on Wednesday’s move?", a currency trader at a mid-sized private sector bank said. Until this week, the RBI's interventions were largely aimed at defending the 88.80 level. The latest pre-market actions mark a shift - intervening with the intent of pulling dollar/rupee lower and intervening before the market opens to set the tone, bankers said. The RBI’s move was probably a reaction to what it saw as speculative pressure building on the rupee, HDFC Bank said in a note. The lender expects USD/INR to trade in the 87.50–89.00 range in the near term, and said that a favourable outcome on the U.S.-India trade deal could help the rupee appreciate, and push the pair below the lower side of that band. https://www.reuters.com/world/india/india-central-bank-repeats-pre-market-dollar-sales-reinforcing-support-rupee-2025-10-17/