2025-10-15 21:31

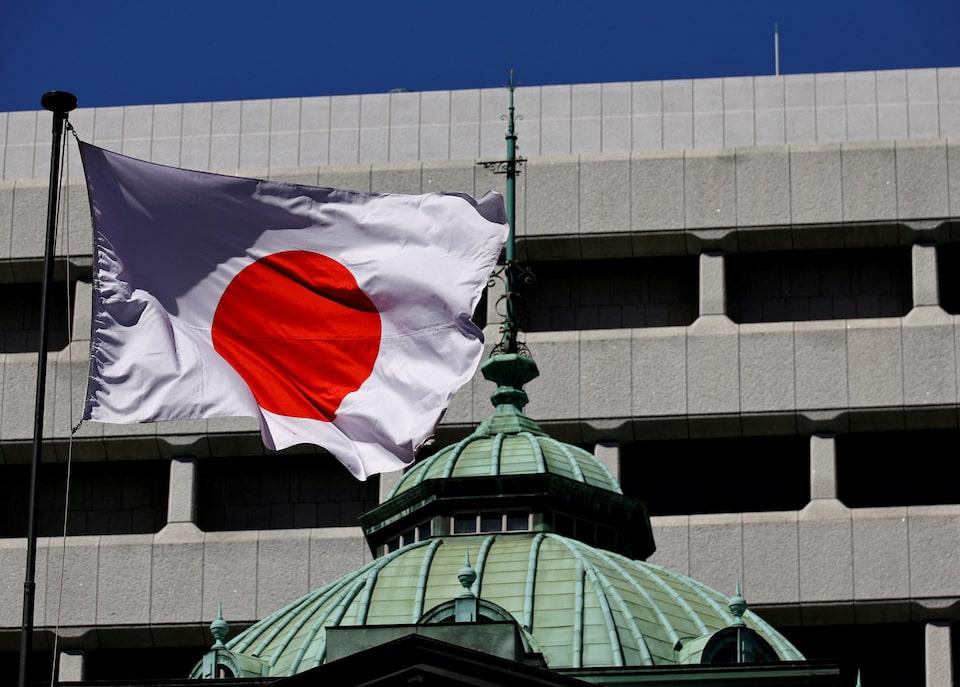

Japan's growth risks skewed to downside due to trade uncertainty, IMF's Choueiri says She says BOJ not behind the curve, risks to inflation balanced Any spending plan must be temporary and targeted, Choueiri says WASHINGTON, Oct 15 (Reuters) - The Bank of Japan must keep monetary policy loose and move very gradually in raising interest rates as global trade uncertainty clouds the economic outlook, a senior International Monetary Fund official said on Wednesday. Japan's economy has performed better than expected so far this year on robust consumption and exports, with Tokyo's trade deal with Washington easing some uncertainty, said Nada Choueiri, deputy director of the IMF's Asia and Pacific Department. Sign up here. But risks to growth are skewed to the downside on lingering uncertainty over the fate of U.S.-China trade talks, and the possibility of a reversal in loose global financial conditions, she said. There is also uncertainty on whether domestic wages will continue to increase and underpin consumption enough to keep inflation sustainably around the BOJ's 2% target, Choueiri said. "Going forward, gradualism is very important because of the degree of uncertainty," she told Reuters in an interview during the IMF and World Bank annual meetings in Washington. "It's important to be gradual, very gradual, and look at all the data that is coming through," she said, when asked about dominant market views that the BOJ will likely raise rates again by next January. POLITICAL UNCERTAINTY CLOUDS ECONOMIC OUTLOOK The BOJ will hold its next monetary policy meeting on October 29-30, followed by meetings in December and January. Japan's central bank exited a decade-long, massive stimulus program last year and raised its key interest rate to 0.5% in January on the view that the country was on the cusp of durably hitting its 2% inflation target. While BOJ Governor Kazuo Ueda has signaled the central bank's readiness to keep raising rates, he has stressed the need to tread cautiously to scrutinize the economic impact of U.S. tariffs. But sticky food inflation, blamed in part on rising import costs from a weak yen, has complicated the BOJ's decision on how soon to raise rates. Two of its nine-member board unsuccessfully proposed a rate hike in September, in a sign of policymakers' growing focus on broadening inflationary pressure. Choueiri said risks to the price outlook were balanced, adding that the weak yen's pass-through on inflation was limited. "We have not seen worrisome signs of overheating in terms of consumption and underlying inflation," Choueiri said. "I would disagree that they are behind the curve." Political uncertainty has added to the risks for the fragile Japanese economy. New ruling party leader Sanae Takaichi's bid to become Japan's first female prime minister was thrown into doubt last week when her ruling party's junior coalition partner quit. The ruling party also suffered a defeat in an upper house election in July amid public discontent over rising inflation. Ruling and opposition parties alike have proposed ramping up spending to cushion the blow to households. Given its already huge public debt, Japan must come up with a fiscal consolidation plan and ensure any spending plans are temporary and targeted to low-income households, Choueiri said. "Once food prices stabilize and there is no more inflation, you should start withdrawing the support," she said. "The kind of proposals made like VAT (value-added tax) cuts, or blanket subsidies that are not targeted would not serve Japan well at this juncture, because it would put a lot of burden on the deficit." https://www.reuters.com/world/asia-pacific/imf-urges-bank-japan-move-very-gradually-with-rate-hikes-2025-10-15/

2025-10-15 21:23

NEW YORK, Oct 15 (Reuters) - Making sense of the forces driving global markets By Alden Bentley, Editor in Charge, Americas Finance and Markets Sign up here. Jamie McGeever is enjoying some well-deserved time off, but the Reuters markets team will still keep you up to date on what's happening in markets. I'd love to hear from you, so please reach out to me with comments at [email protected] , opens new tab Today's Key Reads 1. US officials blast China's actions on rare earths, urge Beijing to back down 2. Data darkness in US spreads a global shadow 3. Investors on guard for risks that could derail the AI gravy train 4. Morgan Stanley profit beats estimates on dealmaking boost, shares soar 5. Gold extends record run past $4,200 on rate-cut hopes, safe-haven fervor Today's Key Market Moves *STOCKS: The S&P 500 (.SPX) , opens new tab closed up 0.4% and Nasdaq (.IXIC) , opens new tab was 0.6% higher. The Dow (.DJI) , opens new tab was about flat. *SHARES/SECTORS: Morgan Stanley (MS.N) , opens new tab shares hit a record high, while Bank of America (BAC.N) , opens new tab also rose sharply after the top lenders beat Wall Street estimates for third-quarter profit on dealmaking strength. But financials overall were one of four S&P 500 sectors to show a decline. Real Estate was the biggest winner and tech was also up. *FX: The U.S. dollar weakened on the continuing trade standoff between the U.S. and China. *BONDS: U.S. Treasury yields were choppy. The benchmark 10-year was last 1.8 bp higher at 4.0397% *COMMODITIES: U.S. oil futures eased and the price of gold bullion jumped 1.65% to $4,208.49 an ounce. *CRYPTO: Bitcoin was down 1.35% at $111,530 Today's Key Talking Points *Shaking off trade jitters Wall Street shares rose on the back of solid earnings from Morgan Stanley and Bank of America that concluded a two-day run of strong bank results and raised hopes for company third-quarter reporting over the coming weeks. The S&P 500 banking index (.SPXBK) , opens new tab was set to log its first three-day winning streak in more than three weeks. Earnings have only partially overshadowed trade as a focus, with the resurfacing of tensions between the two largest economies roiling the market in recent days. A day after U.S. President Donald Trump said cutting some trade ties with China was under consideration, notably related to cooking oil, while the rivals began imposing port fees on each other, Treasury Secretary on Wednesday told CNBC that there was no desire to escalate a trade conflict with China. The release of the Federal Reserve's Beige Book did not give the data-starved market much to think about, noting that across the Fed's 12 districts economic activity was little changed. Fed Governor Stephen Miran at a CNBC event said "two more cuts this year sounds realistic", noting that the labor market has clearly weakened. Fed Chair Jerome Powell had also left the door open to rate cuts on Tuesday. *But safe havens still in play While stocks had a risk-on tilt through much of the session, bonds and gold traded like safe havens in an uncertain world of trade blow-ups and government shutdowns. Benchmark 10-year Treasury yields initially dipped below 4% on doubts about prospects for an agreement with China, before the bond market retreated in choppy trading. U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent both took China to task over its restrictions on exports of rare earth minerals. Bessent did soften the tone, saying he doesn't believe Beijing wants to be an "agent of chaos." Gold looked like an over crowded trade, extending its record-breaking rally above $4,200 on the specter of further U.S. easing and the U.S./China trade row. *While crude is in decline Meanwhile, oil prices are at their lowest levels since May. While the tit-for-tat trade moves could disrupt global shipping, they could also impact global growth at the same time as the International Energy Agency is predicting a supply surplus next year. Graphics What could move markets tomorrow? *No major U.S. corporate earnings or economic data Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also sign up here. https://www.reuters.com/world/china/global-markets-trading-day-2025-10-15/

2025-10-15 21:18

SYDNEY, Oct 16 (Reuters) - Australia's central bank is seeing signs that financial conditions are loosening after three interest rate cuts this year and credit is readily available to households and businesses. In a speech in Sydney on Thursday, Reserve Bank of Australia Assistant Governor Christopher Kent said the central bank's forecasts in August had been based on market pricing for more policy easing, but that outlook was subject to considerable uncertainty. Sign up here. "We will continue to reassess it in light of what the incoming data mean for the economic outlook and evolving risks," Kent said. The RBA has cut interest rates three times this year to 3.6% but recent data has surprised on the strong side with disinflationary pulses stalling and consumers continuing to spend. Housing prices, in particular, have surged to new record highs. Kent downplayed the concept of a neutral rate - where policy is neither restrictive or stimulatory - arguing that it was not a suitable guide to monetary policy with estimates ranging widely from 1% to 4%. "We can have some confidence that cash rates well above the range of central estimates would constrain aggregate demand. But we can be less certain for rates closer to or within that range, as is currently the case," said Kent. Given those limitations, the central bank is also looking at financial indicators such as banks' funding costs, household credit and business debt, which showed early signs of responding to the rate cuts this year. https://www.reuters.com/business/finance/australias-central-bank-sees-signs-financial-conditions-loosening-after-rate-2025-10-15/

2025-10-15 21:00

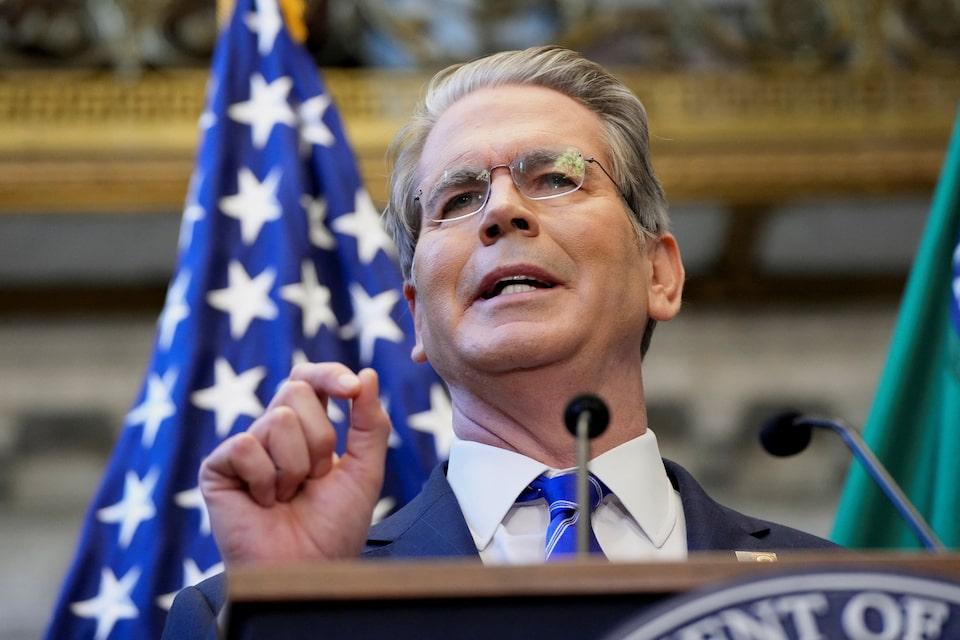

Bessent says new Argentina debt facility would bring US support to $40 billion US purchased pesos on Wednesday morning, US Treasury chief says Bessent says IMF SDRs to back $20 billion swap line from Exchange Stabilization Fund WASHINGTON, Oct 15 (Reuters) - The U.S. again purchased Argentine pesos in the open market on Wednesday, Treasury Secretary Scott Bessent told reporters, adding that the department was working with banks and investment funds to create a $20 billion facility to invest in the South American country's sovereign debt. Bessent said during a press conference that the facility would sit alongside a new $20 billion U.S. currency swap line for Argentina, providing a total of $40 billion in support for Latin America's third-largest economy. Sign up here. Bessent did not provide details of the peso operation, which follows an initial U.S. purchase on October 9. The action contributed to recovery in Argentine stocks after U.S. President Donald Trump's comment on Tuesday that appeared to call U.S. support for Argentina into question. Local stocks ended up 1.7% after rising more than 4% earlier, while international dollar bonds ticked up after selling off on Tuesday. But the peso weakened after Bessent's announcement, declining 1.7% to 1,378 per dollar. Trump said on Tuesday that the U.S. would not "waste our time" with Argentina if President Javier Milei's party loses in parliamentary elections on October 26. But Bessent clarified that the U.S. would continue to support Argentina financially as long as Milei's government pursues "good policies," regardless of the election outcome. Bessent said the Trump administration's support for Argentina "is not election-specific," but a win for Milei's La Libertad Avanza party would ensure that the right-wing Argentine president has a sufficient majority to veto policies aimed at ending his libertarian fiscal austerity agenda and free-market overhaul of the country's crisis-prone economy. "It is policy-specific. So as long as Argentina continues enacting good policy, they will have U.S. support," Bessent said. Asked if the peso operation would be accompanied by U.S. purchases of Argentine debt, Bessent said, "We could," without elaborating. Work on the private-sector debt investment facility has been underway for weeks, but Bessent did not provide a timeline for any debt purchases. "So it is a private-sector solution to Argentina's upcoming debt payments," Bessent said. "Many banks are interested in it, and many sovereign funds have expressed interest in being part of it." ARGENTINA PROMISES POLICY CONTINUITY In Buenos Aires, Argentina's Economy Minister Luis Caputo said on Wednesday that he hopes "very soon" to execute the terms of the $20 billion U.S. currency swap, ideally before the October 26 vote. Despite Trump's support for ideological ally Milei, a key local election in Buenos Aires recently handed a resounding victory to his socially focused opposition. Caputo said that regardless of the outcome of the vote, the policies of the Milei administration would remain the same. He added that the Argentine administration was working on additional financial options it could not yet disclose, and that some U.S. businesses had informally pledged billions of dollars in investment during recent meetings. The Trump administration has disclosed few details about the swap line arrangement, aimed at improving Argentina's market liquidity. Bessent confirmed it would be backed by International Monetary Fund Special Drawing Rights assets that are held in the Treasury's Exchange Stabilization Fund and would be converted to dollars. Asked whether the U.S. would assume a preferred creditor status ahead of the IMF or private-sector lenders, Bessent said: "No, that's what China does, we don't do that." Milei said the government is in talks with the U.S. over a potential agreement that would grant the South American country trade advantages. "There is an issue of trade advantages that the United States would be giving us; the U.S. has strongly favored Argentina," Milei said in a television interview. ECONOMIC 'MONROE DOCTRINE' Bessent said the Trump administration was motivated not by any systemic risk emanating from Argentina, but views the country as the centerpiece of an "Economic Monroe Doctrine," a reference to the 1823 U.S. foreign policy doctrine aimed at ensuring U.S. influence over the Americas. China has gained influence in Latin America in recent years, and maintains its own $18 billion swap line with Argentina. Bessent said Milei's government is a "beacon" for resisting past socialist policies and its success could help shift other governments in the region to the right. https://www.reuters.com/world/americas/bessent-says-us-buys-more-argentine-pesos-working-20-billion-debt-facility-2025-10-15/

2025-10-15 20:59

TSX ends up 0.9%, at 30,637.12 Eclipses October 6 record closing high Materials group rises 3.2% as gold climbs Technology adds 0.9% TORONTO, Oct 15 (Reuters) - Canada's main stock index rose to a record high on Wednesday, with technology and metal mining shares leading gains as investors bet the Federal Reserve and the Bank of Canada would continue to cut interest rates. The S&P/TSX composite index (.GSPTSE) , opens new tab ended up 283.51 points, or 0.9%, at 30,637.12, eclipsing the record closing high on October 6. Sign up here. U.S. benchmark the S&P 500 also ended higher, with Morgan Stanley and Bank of America rallying after solid quarterly results. "It's been strong right across the board," said Robert Gill, a portfolio manager at Fairbank Investment Management. "Canada in particular is strong. It's been considerably stronger than the other North American markets this year, predominantly driven by metals and mining, and the precious metals in particular." The TSX has advanced 23.9% this year, substantially beating the S&P 500's gain of 13.4%. "It looks like we're going to have more interest rate cuts coming which continue to fuel the market, continue to fuel cheaper capital," Gill said. On Tuesday, Fed Chair Jerome Powell left the door open to interest rate cuts at the U.S. central bank's final two meetings this year. Bank of Canada Governor Tiff Macklem is due on Thursday to speak on Canada's economic outlook. Investors see a roughly 60% chance that the central bank will ease rates at a policy decision on October 29. 0#CADIRPR , opens new tab The materials group, which includes fertilizer companies and metal mining shares, rose 3.2% as the price of gold traded above $4,200 an ounce for the first time. Technology (.SPTTTK) , opens new tab added 0.9%, with shares of electronic equipment company Celestica Inc (CLS.TO) , opens new tab jumping 9%. Energy was the only one of the 10 major sectors to end lower, dipping 0.2%. The price of oil settled 0.7% lower at $58.27 a barrel, pressured by escalating U.S.-China trade tensions. https://www.reuters.com/business/tsx-futures-rise-fed-rate-cut-optimism-surging-metal-prices-2025-10-15/

2025-10-15 20:50

Lawsuit argued Trump's energy policies would cause a litany of harms Judge say lawsuit would have him overstep his powers, was unworkable Our Children’s Trust lawyers say to appeal ruling Trump administration says activists should seek redress through the political process Oct 15 (Reuters) - A federal judge in Montana on Wednesday threw out a lawsuit by youth activists seeking to block U.S. President Donald Trump’s pro-fossil fuel energy policies, saying it asked the court to take on a sweeping role overseeing potentially hundreds of government rules and regulations. A group of young people represented by the nonprofit Our Children’s Trust sued in May, arguing Trump’s executive orders aimed at “unleashing” American energy were unconstitutional. Their lawyers said they would appeal Wednesday's ruling. Sign up here. U.S. District Judge Dana L. Christensen said in an order that while the activists had shown they would be harmed by Trump's policies, they asked him to assume a sweeping role in climate regulation that would overstep his powers as a judge. "This court would be required to monitor an untold number of federal agency actions to determine whether they contravene its injunction. This is, quite simply, an unworkable request for which plaintiffs provide no precedent," Christensen said. Our Children’s Trust chief legal counsel Julia Olson said in a statement that Trump's energy policies are causing irreparable harm to the health, safety and future of the 22 young people who brought the case. "We will appeal — because courts cannot offer more protection to fossil fuel companies seeking to preserve their profits than to young Americans seeking to preserve their right," Olson said. Adam Gustafson of the Justice Department's Environment and Natural Resources Division praised the ruling in a statement on Wednesday, saying the lawsuit was a baseless attack on Trump’s energy agenda. Trump, a Republican, unveiled executive orders in January aimed at maximizing oil and gas production, rolling back environmental protections and withdrawing the U.S. from an international pact to fight climate change. The United Nations has said scientific evidence clearly shows greenhouse gas emissions from fossil fuels are responsible for rising temperatures and destructive changes to earth’s climate. In their lawsuit, the activists said Trump's policies would cause them a litany of harms, including life-threatening health conditions stemming from rising temperatures, air pollution from wildfires and flooding from increasingly powerful storms. They asked the court to declare Trump’s orders illegal, block their implementation and roll back all policy changes stemming from them. The Trump administration said the activists had no right to dictate climate policy through litigation and should instead seek redress through the political process. “A self-designated group of children and young plaintiffs claim they are better positioned to set national energy policy than the President of the United States," U.S. Department of Justice lawyers said in a court filing. https://www.reuters.com/legal/litigation/us-judge-dismisses-youth-activists-lawsuit-challenging-trumps-pro-fossil-fuel-2025-10-15/