2025-10-15 07:08

ABIDJAN, Oct 15 (Reuters) - Following are details of the main opposition challengers to Ivory Coast's President Alassane Ouattara, who is running for a fourth term in an election scheduled for October 25. The West African nation is the world's biggest cocoa producer. SIMONE GBAGBO Gbagbo, 76, was Ivory Coast's first lady during the tumultuous tenure of her then-husband Laurent Gbagbo, who led the country during a civil war between 2002 and 2007. After losing to Ouattara in the 2010 election, he refused to step down, triggering another conflict. Sign up here. Four months later, in early April 2011, Laurent and Simone Gbagbo were arrested together at their Abidjan residence, ending the post-election fighting that had killed around 3,000 people. Simone Gbagbo was charged at the International Criminal Court in The Hague for alleged crimes related to the conflict, but Ouattara's government refused to transfer her. Instead she went on trial at home and in 2015 received a 20-year sentence for crimes against the state. Ouattara granted her an amnesty in 2018. Simone and Laurent Gbagbo divorced in 2023, formally ending a political alliance that dated back to the era of Felix Houphouet-Boigny, Ivory Coast's founding president. Gbagbo is now head of the Movement of Skilled Generations party formed in 2022. At her first election rally on Saturday, she said infrastructure projects under Ouattara were positive but that Ivorians were clamouring for better health care and job opportunities. JEAN-LOUIS BILLON Billon, 60, is representing the Democratic Congress, a new grouping of 18 parties and political movements. A former trade minister, Billon had sought unsuccessfully to become the standard-bearer for the main opposition PDCI party this year after its leader, former Credit Suisse CEO Tidjane Thiam, was barred from running. Analysts say Thiam would have posed the biggest threat to Ouattara, but a court ruled in April that he should be removed from the electoral roll because he was a French national when he registered. Ivory Coast law states that candidates must be Ivorian citizens and cannot hold another nationality. In an interview with Reuters in June, Billon said that if elected he would endorse a law to lift restrictions on dual nationality. He also said he would trim the civil service, crack down on corruption, promote private sector investment and move more government offices to Yamoussoukro, the political capital. Billon has said it is time for Ouattara, 83, and other politicians of his generation to leave the scene. AHOUA DON MELLO A former protege of Laurent Gbagbo who served as his spokesperson during the 2010-11 election crisis, Don Mello is running this year as an independent. Gbagbo's political party, the African People's Party of Ivory Coast (PPA-CI), kicked Don Mello out after he decided to run for president. Laurent Gbagbo himself is barred from running because of a prior conviction, and his party does not have a candidate in the October 25 contest. Don Mello, 67, has argued that it is important to formally participate in the election to avoid a repeat of 2020, when the opposition boycotted the presidential poll and Ouattara won with 94% of the vote. He has called for abandoning the euro-pegged CFA franc and for revising Ivory Coast's defence agreements including with former colonial power France. Critics accuse him of pushing a pro-Russia agenda, but in an interview with France 24 this month he denied he was "Vladimir Putin's man". HENRIETTE LAGOU ADJOUA A former minister of social affairs and of women, families and children, Adjoua, 66, also ran against Ouattara in the 2015 election, earning less than 1% of the vote. She has pitched herself as a champion of "centrist" values emphasising peace and reconciliation, saying at a campaign event on Monday that "the wounds of the past have not disappeared". Adjoua represents the Group of Political Partners for Peace, a collection of centrist parties, and is a vocal campaigner for more women in politics including in a book published this year titled "Why Not a Woman?" https://www.reuters.com/world/africa/election-challengers-ivory-coast-ouattara-seeks-fourth-term-2025-10-15/

2025-10-15 06:43

KUALA LUMPUR, Oct 15 (Reuters) - The Asian Development Bank and the World Bank have launched the ASEAN Power Grid (APG) Financing Initiative to support the development and integration of national power grids across the region, Malaysian state news agency Bernama reported on Wednesday. The ADB is set to commit $10 billion to finance Southeast Asian grids connected to the APG, along with other clean energy projects, the report said, citing the bank's South Asia Development Director General Winfried F. Wicklein. Sign up here. https://www.reuters.com/sustainability/climate-energy/adb-world-bank-launch-asean-power-grid-financing-programme-report-says-2025-10-15/

2025-10-15 06:42

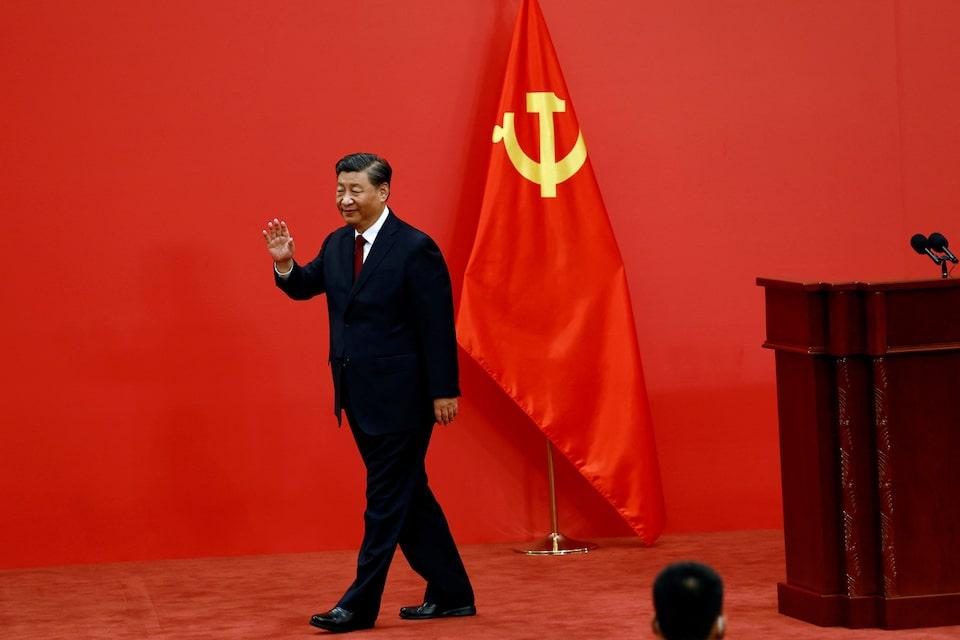

China's Communist Party holds key plenum Oct 20-23 Plenum deliberates on policy plans for next five years Supply-driven economic model under scrutiny But rivalry with the U.S. makes it hard for Beijing to pivot Big consumption pledges expected, actual support seen limited SINGAPORE/BEIJING, Oct 15 (Reuters) - China's Communist Party meets this month to map a five-year vision that prioritises high-tech manufacturing in its quest to upgrade its sprawling industries and project global power as its rivalry with the U.S. intensifies, analysts say. Known as a plenum, the meeting is also likely to pledge strong measures to lift household consumption and curb deep, historical supply-demand imbalances that threaten long-term growth in the world's second-largest economy. Sign up here. The two goals are decades old and pull in opposite directions, a policy challenge that has become acute now with U.S.-China tensions worsening, making it hard for Beijing to pivot to demand-side policies, analysts say. Industrial prowess demands maintaining the status quo of channelling state resources to producers, while boosting consumption requires funds be redirected to households, leaving less for business and government investment. FACTORIES VS CONSUMERS China's growth over the past decade was driven by the pursuit of the first goal at the expense of the second. But this action is now fanning deflationary pressures and creating unsustainable debts. The intensifying rivalry between the U.S. and China, underlined by U.S. President Donald Trump's renewed threats of triple-digit tariffs last week, has complicated matters for policymakers in Beijing, analysts say. It's a choice to prioritise great power competition over the compelling need to address domestic growth imbalances. China's next five-year plan, the closely watched policy document that the October 20-23 plenum will produce for parliamentary approval in March, will "definitely emphasise, and re-emphasise, support for high-tech research and industrial development," said Chen Bo, senior research fellow at the National University of Singapore's East Asian Institute. "In terms of a country's hard power, manufacturing is still a top priority," Chen said. "When conflict arises, what ultimately matters is manufacturing, not services." A speech by President Xi Jinping published by Communist Party magazine Qiushi in July said the world was going through changes not seen in a century, which made "technological revolution and major-country competition increasingly intertwined." Xi called on the nation to secure the "strategic high ground" in the global tech race. China now leads in industries such as electric vehicles, solar or wind and is leveraging its dominance of rare earths production with export controls before potential trade talks between Trump and Xi later in October. Apart from a few high-end sectors, such as aircraft or advanced semiconductors, its supply chains are largely domestic. With the West aiming to re-industrialise and re-arm after Russia's invasion of Ukraine and amid growing tensions over Taiwan and the South China Sea, the stakes are too high for Beijing to even contemplate slowing down on that front. "If you do not develop high-end industries, you will be subject to others in the future," said Guo Tianyong, professor at the Central University of Finance and Economics in Beijing, warning, however, that China needed a better policy balance. CRACKS ARE EMERGING Morgan Stanley analysts said they expect post-plenum statements to deliver a "tech- and supply-driven framework, with incremental focus on social welfare." Consequently, "decisive reflation remains elusive in 2026," they added. Beneath the envy-worthy headline growth, the past five-year cycle has been anything but smooth sailing for the economy - factory gate deflation is becoming entrenched, adding to a property crisis, a municipal debt scare, endemic industrial overcapacity, and record youth unemployment , opens new tab. A generation who studied for highly skilled and well-paid service sector jobs, which a consumption-driven growth model had better chances of creating, faces limited opportunities. "If you only rely on external demand and domestic demand is not working, then you will have unemployment problems and also deflation," said Larry Hu, chief China economist at Macquarie. "If it continues like this for one or two years, it's still okay. But in the long run, it will definitely be a problem." Hu expects China to get serious about stimulating consumption if and when external demand shrinks enough to threaten growth targets. EMPTY PROMISES ON CONSUMPTION? The 2026-2030 blueprint will be China's 15th five-year plan since it adopted Soviet-style quinquennial policy formulation cycles in the 1950s. The 14th promised to "fully leverage the fundamental role of consumption in stimulating economic development." The 13th pledged that "the contribution of consumption to economic growth will continue to grow." Yet Chinese households - their wealth eroded by the property crisis and confidence shattered by strict pandemic curbs - still prefer saving over spending, prompting calls to reform labour markets, taxes, state firms, land rights and welfare. Analysts say China can muddle along with its contradictory goals by tilting industrial support toward tech research and away from capacity expansion, while gradually building on its incipient efforts to strengthen the welfare system. Over the past year, Beijing has rolled out consumer goods subsidies, childcare benefits, and small pension increases. A recent top court ruling that makes social insurance contributions mandatory for both employers and workers lays the groundwork for stronger welfare over the longer term. One policy adviser, asking for anonymity to discuss sensitive topics, said benefits will likely rise further in the next five years, with lower pensions increasing faster than higher ones. But improvements "won't be particularly substantial," even though "everyone recognises the issue of insufficient demand," the adviser said, adding that the small social security budget and tight local government finances limit policy options. After the property sector's downturn, the adviser added, "we are unable to find new demand drivers." Dan Wang, China director at Eurasia Group, expects the five-year plan to "focus more on people's livelihood, including social security, healthcare systems, and possibly more support and protection for low-income groups." But, she says, such language should "absolutely not" be read as a paradigm shift. "In a now very typical Marxist country," Wang said, "it's all about production." https://www.reuters.com/world/asia-pacific/china-keep-its-all-about-production-economic-playbook-rivalry-with-us-2025-10-15/

2025-10-15 06:40

TotalEnergies sees improved results despite lower oil prices and LNG output European refining margins rise over 300% due to diesel demand and EU ban on Russian oil Total's gearing ratio to improve by end of Q2 2025 Oct 15 (Reuters) - French oil major TotalEnergies (TTEF.PA) , opens new tab expects to report an increase in third-quarter results as higher upstream production and improving crude refining margins offset lower oil prices, the group said on Wednesday. "Despite a $10 per barrel drop in oil price year-on-year, the results and cash flow from business segments should increase within a range of 0-5% thanks to accretive hydrocarbon production growth and the improved results of the downstream," it said in a trading update. Sign up here. The group's shares were up 2.3% at 0723 GMT. Total is under pressure to reduce debt this year after about $3.5 billion in acquisitions in the first half and in July CEO Patrick Pouyanne promised higher income from asset disposals, retail power and gas sales, and stronger refining margins. Total's gearing ratio should improve by between 0.5 and 1 percentage points compared to the end of the second quarter 2025, when gearing hit 17.9%, the company said. European refining margins averaged $63.0 per ton in the third quarter, a more than 300% rise from the same period last year, buoyed by higher diesel demand during driving season and reduced supply caused by the European Union's ban on importing fuels made from Russian oil. Downstream results will rise by between $400 million and $600 million year-on-year as a result. Upstream oil and gas output is expected to rise 4% year-on-year to 2.5 million barrels of oil equivalent for the third quarter, above Total's annual guidance. Integrated LNG results will be down due to planned maintenance on two liquefaction units at the Ichthys LNG plant in Australia. Integrated Power results are expected in line with the second quarter's $574 million, which would be an 18% increase year-on-year. Brent crude oil prices averaged $69.1 a barrel during the July-September quarter, down 14% from the same period last year. Analysts expect that price to fall further next year, prompting Total and other majors to cut share buybacks and trim spending in preparation for lower earnings. Total expects its net investments to be around $3 billion in the third quarter, benefiting from around $500 million in divestments net of acquisitions. https://www.reuters.com/business/energy/total-flags-lower-lng-sales-rising-refining-margins-third-quarter-trading-update-2025-10-15/

2025-10-15 06:28

Gold breaches $4,200/oz for the first time Trump mulls ending some trade ties with China Fed's Powell says economy may be on firmer footing, but job market weak Analyst expects the bull run in gold to continue Oct 15 (Reuters) - Gold extended its rally to breach $4,200-per-ounce for the first time on Wednesday on expectations of more U.S. interest rate cuts, while broader economic and geopolitical uncertainty also led investors to buy the safe-haven metal. Spot gold was up 1.4% at $4,200.12 per ounce as of 1202 GMT, after touching a record high of $4,217.95 earlier in the session. U.S. gold futures for December delivery gained 1.3% to $4,216.20. Sign up here. Gold has risen about 59% so far this year, fuelled by geopolitical and economic uncertainties, expectations of U.S. rate cuts, strong central bank buying, a broader de-dollarisation trend and robust exchange-traded fund inflows. "Prolongation of the U.S. government shutdown, more dovish comments from Fed officials, and the continued escalation of trade tensions between the U.S. and China are likely to support further gains in gold prices," said ActivTrades analyst Ricardo Evangelista. "Reaching the $5,000 level does not seem impossible in the medium to long term." The U.S. dollar dropped against a basket of peers on Wednesday after comments from Federal Reserve Chair Jerome Powell bolstered bets on a series of rate cuts in coming months. Traders are pricing in a 25 basis-point cut in October with another in December, seen as 96% and 93% chances respectively. Meanwhile, U.S. President Donald Trump said Washington was considering cutting some trade ties with China, after both countries began imposing tit-for-tat port fees on Tuesday. Markets are also closely monitoring the risks related to the ongoing government shutdown in the United States. The shutdown, which has turned off the official flow of data, could begin clouding the view for policymakers in Japan and other countries. Gold, traditionally seen as a hedge against political and economic uncertainty and inflation, also tends to do well in low-interest rate environments. "We are expecting the bull run in gold to continue," said Soni Kumari, a commodity strategist at ANZ. Silver rose 2.9% to $52.99, after having hit a record high of $53.60 on Tuesday, tracking gold's rally and amid tightening supply in the spot market. Elsewhere, platinum climbed 1.7% to $1,658.76 and palladium rose 2.6% to $1,564.65. https://www.reuters.com/world/china/gold-hits-record-high-fed-rate-cut-bets-us-china-trade-woes-2025-10-15/

2025-10-15 06:24

US officials blast China as trade tensions continue Dollar weakens against yen and Swiss franc Dollar index on track for second straight session of losses New Zealand dollar, Aussie strengthen NEW YORK, Oct 15 (Reuters) - The U.S. dollar fell against the euro and yen on Wednesday with market sentiment weakened by the continuing trade tensions between the U.S. and China. Traders analyzed comments from Federal Reserve Chair Jerome Powell for cues on upcoming rate cuts amid a U.S. government shutdown, which has hampered the timely release of key data. Sign up here. The dollar weakened 0.39% to 151.24 against the Japanese yen and was down 0.49% to 0.797 against the Swiss franc , on track for the second straight session of losses against both safe-haven currencies. Top U.S. officials, including Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, blasted China's major expansion of rare earths export controls as a threat to global supply chains. Greer described China's , opens new tab export controls as a complete repudiation of U.S.-Chinese trade agreements over the past six months although he and Bessent stressed that Washington did not want to escalate the conflict. President Donald Trump had threatened to impose tariffs on China last week in retaliation. The Chinese commerce ministry defended the rare-earths controls, pointing to a series of U.S. measures on Chinese goods and companies and calling it hypocritical. "The market is showing an impressive ability to shrug off trade-related headlines and there's a firm belief that the U.S. and China will find a way to move forward and will make an agreement," said Adam Button, chief currency analyst at ForexLive. "The headlines continued to be inflammatory, including today from Bessent and Greer. But the market saw how Trump quickly de-escalated over the weekend and doesn't yet believe he wants a real fight." The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.32% to 98.72, on track for the second consecutive session of losses. The Fed's Beige Book showed that U.S. economic activity was little changed and employment was largely stable in recent weeks, although there were emerging signs of weakness including more layoffs and middle- and lower-income households pulling back on spending. Powell, in a speech on Tuesday, left the door open to rate cuts by saying the U.S. labor market remained mired in low-hiring, low-firing doldrums. He said the absence of official economic data due to the government shutdown has not prevented policymakers from being able to assess the economic outlook, at least for now. Markets are currently priced for a quarter-point cut at the October 28-29 Fed gathering and another at the following meeting in December, followed by three more cuts next year, according to LSEG data. The yield on benchmark U.S. 10-year notes fell 1.6 basis points to 4.038%. Wall Street stocks finished mostly higher as companies continued to report strong results as the quarterly earnings season kicked off. The Dow Jones Industrial Average (.DJI) , opens new tab fell 0.04%, the S&P 500 (.SPX) , opens new tab rose 0.40% and the Nasdaq Composite (.IXIC) , opens new tab rose 0.66%. The euro rose 0.35% to $1.1646 after gaining 0.3% in the previous session, supported by the French government's proposal to suspend landmark pension reforms. "Even if the French political upheaval has started to moderate, outright bullish catalysts are lacking for the euro at this stage," TS Lombard analysts led by Daniel von Ahlen wrote in an investor note. "Meanwhile, the recent performance of the EUR/USD is now on par with the past rallies following maor policy announcements in the euro area, which adds to our tactical caution on the common currency." The New Zealand dollar edged up only 0.1% to $0.5721, after dipping to a six-month low of $0.56839 on Tuesday. The Aussie climbed 0.39% to $0.651, after falling 0.5% a day earlier, when it touched the lowest since August 22 at $0.64405. https://www.reuters.com/world/china/dollar-under-pressure-fed-rate-cut-bets-china-trade-tensions-2025-10-15/