2025-10-14 13:13

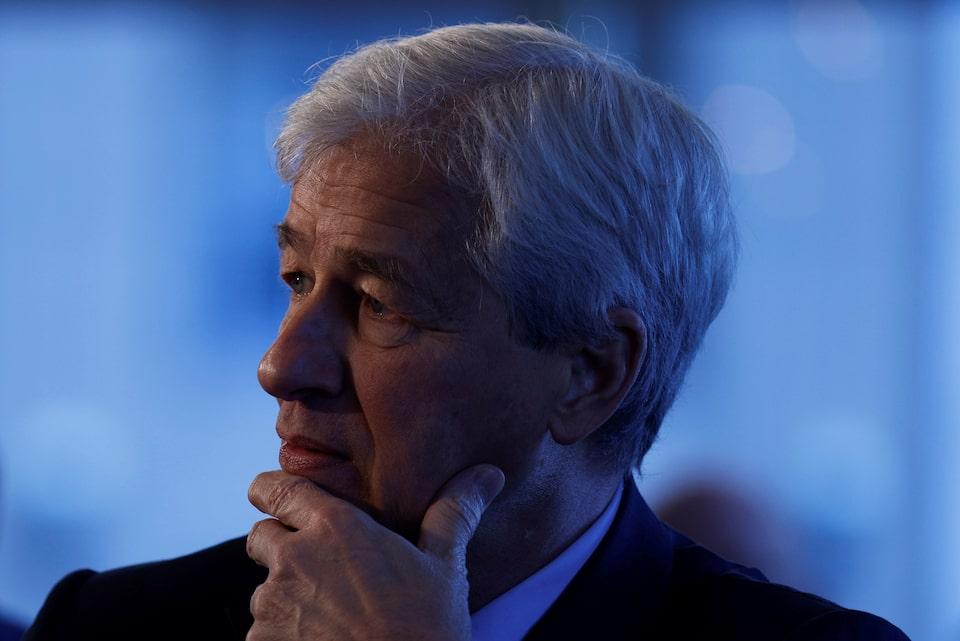

NEW YORK, Oct 14 (Reuters) - JPMorgan Chase's exposure to bankrupt auto dealer Tricolor is "not our finest moment," the bank's CEO Jamie Dimon told reporters on a conference call on Tuesday. JPMorgan charged off $170 million in the third quarter related to the situation, and the bank is reviewing its controls, Chief Financial Officer Jeremy Barnum said. Sign up here. The bankruptcies of automotive-related Tricolor and companies First Brands, along with potential losses at banks and investment funds, are raising new concerns about hidden risks in parts of the credit market — prompting investors to take a closer look at risky debt. https://www.reuters.com/business/finance/jpmorgan-ceo-says-its-exposure-collapsed-auto-dealer-tricolor-not-our-finest-2025-10-14/

2025-10-14 12:56

LONDON, Oct 14 (Reuters) - Bank of England policymaker Alan Taylor said on Tuesday that he saw an increasingly likely risk of a "bumpy landing" for Britain's economy with inflation falling too low, in part due to the impact of U.S. President Donald Trump's trade tariffs. Taylor said in a speech at the King's College University that the rise in British inflation should fade in 2026 and Trump's tariffs were more likely to hurt growth than push up prices as exports unable to enter the United States sought other markets. Sign up here. In his speech about trade tariffs, Taylor said his "bumpy landing" scenario for the British economy featured inflation falling below the BoE's 2% target in late 2026 and the economy slipping into a weakened state for a sustained period. "Part of this scenario, in my mind, could end up resulting from some of the trade diversion pressures that I have described today: if we underestimate the forces of trade diversion washing up on our shores in the next year or two, our inflation forecast will miss the mark," he said. Taylor and one other member of the nine-strong Monetary Policy Committee voted unsuccessfully to cut interest rates by 25 basis points at last month's meeting. In August, Taylor initially called for a big reduction in Bank Rate to 3.75% before changing his vote to ensure a majority for a cut to 4%. https://www.reuters.com/world/uk/bank-englands-taylor-says-he-fears-bumpy-landing-uk-economy-2025-10-14/

2025-10-14 12:22

PARIS, Oct 14 (Reuters) - French luxury group LVMH (LVMH.PA) , opens new tab on Tuesday said it named Maria Grazia Chiuri, the former Dior women's designer, the new creative director of Italian fashion label Fendi with a first collection to be presented in February. Chiuri this May showed her last Dior runway show in Rome, her home town. Jonathan Anderson took over the creative leadership of the French house in June. Sign up here. Her move is the latest in a string of high-profile designer appointments, with new creative directors also appointed at brands including Gucci, Balenciaga and Chanel. The Italian, 61, will take over the charge from Silvia Venturini Fendi, a granddaughter of the house's founders. At Dior, Chiuri often added feminist messages to her fashion shows. https://www.reuters.com/business/retail-consumer/lvmh-names-maria-grazia-chiuri-chief-designer-fendi-2025-10-14/

2025-10-14 12:20

Tariffs raise costs for energy companies, CEOs say TotalEnergies, Baker Hughes cite financial impacts from US trade policies Exxon says it focuses on long-term fundamentals, not political cycles LONDON, Oct 14 (Reuters) - The executives of two oil companies warned this week that tariffs resulting from the U.S. administration's trade policies were driving up costs across the energy production chain and affecting investment decisions. TotalEnergies (TTEF.PA) , opens new tab CEO Patrick Pouyanne told the Energy Intelligence Forum in London on Tuesday that tariffs on steel were pushing up costs for liquefied natural gas (LNG) projects. Sign up here. In June, Trump an executive proclamation hiking tariffs on steel and aluminium imports to 50%. Lorenzo Simonelli, chief executive of energy services company Baker Hughes (BKR.O) , opens new tab, told the same conference on Monday that tariffs would add between $100 million and $200 million to the company's costs this year, though probably closer to the lower end of that range. “It is an incremental pressure point, but it’s something that we have to manage through,” he said. However, Darren Woods, chief executive of U.S. major ExxonMobil (XOM.N) , opens new tab downplayed the impact of policies pursued by any single administration, saying the group's long-term investments were not affected by one political cycle. Instead, he flagged Europe's environmental regulations as a factor driving away investment. "The challenge in Europe is that they try to micromanage and instruct the industry on how to achieve (decarbonisation)," Woods told the conference on Monday. "Frankly, they don't have the expertise." https://www.reuters.com/sustainability/sustainable-finance-reporting/oil-executives-flag-increased-costs-trumps-tariffs-2025-10-14/

2025-10-14 11:48

Oct 14 (Reuters) - Titan Mining (TI.TO) , opens new tab said on Tuesday it will begin production of graphite concentrate at its Empire State Mines in New York, days after China expanded export limits on rare earth minerals. The Canadian miner is targeting ramp-up to a 40,000-tonne-per-year commercial graphite facility, which the company said would be capable of supplying about half of current U.S. natural graphite demand. Sign up here. "China's decision to tighten graphite exports underscores the importance of having a secure domestic supply of natural graphite," said Titan CEO Rita Adiani. China already tightly controlled its exports of rare earths, but last week added five new elements, bringing the total that are subject to restrictions to 12. It also limited the export of dozens of pieces of equipment and material used to mine and refine rare earths, processes in which it is the world leader. In March, U.S. President Donald Trump invoked emergency powers to accelerate domestic production of critical minerals such as aluminum, cobalt, lithium, graphite, neodymium and dysprosium. Titan said the facility will produce natural flake graphite in micronized and high-purity forms sourced from the company's Kilbourne deposit. https://www.reuters.com/business/titan-mining-produce-graphite-concentrate-new-york-facility-2025-10-14/

2025-10-14 11:39

LONDON, Oct 14 (Reuters) - Commodity trader Radiant World has appointed Liam Brown and Louis McCauley as part of a hiring spree in Europe aimed at expanding its industrial and precious metals trading business after years of trading iron ore. Brown previously worked at Mercuria, Goldman Sachs and hedge fund Millenium and is trading industrial metals at Radiant, while McCauley was at Citi and Credit Agricole and is trading precious metals. Sign up here. Neither Brown nor McCauley responded to a request for comment. Radiant in response to a request for comment confirmed Brown and McCauley had recently joined the company and that both were based in London. It declined to say what they would be doing or where they had previously worked. Since Radiant hired former IXM co-head of metals trading, Adhitya Sethaputra, last June, the company has made seven hires in Europe, including one metals trader and one freight trader. Radiant also hired a metal trader in the U.S. and another in Singapore. Radiant declined to give detail, but said "the company has made several hires in Europe, Singapore and the United States". Sethaputra is based in Switzerland. Commodity trader IXM is owned by Chinese miner CMOC Group (603993.SS) , opens new tab. UK-based Radiant is one of the world’s largest physical traders of iron ore, according to market sources. Headquartered in the UK, Radiant is owned by Indian-born Pinkesh Nahar and has offices in Singapore, London, Geneva, Dubai, Shanghai and Stamford. (This story has been corrected to fix the name to Pinkesh Nahar in paragraph 9) https://www.reuters.com/world/china/radiant-world-expands-beyond-iron-ore-trading-into-metals-2025-10-14/