2025-10-13 11:49

Oct 13 (Reuters) - Algeria's state-owned energy company Sonatrach said on Monday it signed a contract worth around $5.4 billion with Saudi Arabia's Midad Energy for oil and gas exploration and development in Algeria's Illizi Basin. The production-sharing contract spans 30 years with an option to extend for an additional 10 years and includes a seven-year exploration period. Sign up here. Midad Energy North Africa will fully fund the investment, including $288 million allocated to exploration. The Illizi South perimeter lies about 100 km (62 miles) south of the Algerian town of In Amenas, near the Libyan border. The deal was first announced by Ennahar TV. Overall production by the end of the contractual period is estimated to reach around 993 million barrels of oil equivalent, including 125 billion cubic meters of natural gas, Saudi state news agency SPA reported later on Monday. Sonatrach is Algeria's largest oil and gas producer and has been actively seeking foreign partnerships to boost output and modernize infrastructure. The company has previously signed deals with international partners, including a recent $850 million contract with China's Sinopec for hydrocarbon development and exploration. Earlier this month, Algeria's energy minister said the country plans to invest $60 billion in its energy sector over the next five years, with a focus on upstream exploration and production. The North African nation, a member of the Organization of the Petroleum Exporting Countries, aims to strengthen its role as a key supplier of energy to international markets while meeting domestic demand and making a transition to more sustainable sources. https://www.reuters.com/business/energy/algeria-signs-54-billion-oil-gas-deal-with-saudi-firm-midad-energy-2025-10-13/

2025-10-13 11:46

SINGAPORE, Oct 13 (Reuters) - (This Oct 13 story has been corrected to remove reference to Sublime China Information research note) The latest U.S. sanctions on a major Chinese crude oil terminal have forced refining group Sinopec to divert a supertanker and ask some plants to cut crude processing rates, according to ship tracking data and Chinese consultancies. Sign up here. A supertanker carrying oil to the Chinese port of Rizhao in Shandong province changed its destination over the weekend after the U.S. imposed sanctions on an import terminal at the port on Friday, LSEG data showed. Consultancy, JLC, estimated on Saturday that Sinopec's October runs may drop 3.36% from earlier plans to about 5.16 million barrels per day. Sinopec did not immediately respond to requests for comment. LSEG data showed the supertanker New Vista, chartered by Sinopec's trading arm Unipec and originally scheduled to discharge at Rizhao on Sunday, had switched its destination to the ports of Ningbo and Zhoushan for arrival on October 15. The New Vista can carry 2 million barrels of crude and is currently carrying Abu Dhabi's Upper Zakum crude grade. The Rizhao Shihua Crude Oil Terminal, half-owned by a Sinopec logistics unit, was among the entities listed by the U.S. Treasury in a round of sanctions that also includes ships transporting Iranian crude oil and liquefied petroleum gas. The terminal, in the city of Lanshan in Shandong province, a major Chinese oil refining hub, was sanctioned for receiving Iranian oil on board sanctioned vessels, the U.S. said. One-fifth of Sinopec's crude oil imports pass through the Rizhao terminal, according to industry executives and analysts. https://www.reuters.com/business/energy/unipec-diverts-supertanker-shandong-port-after-us-sanctions-2025-10-13/

2025-10-13 11:40

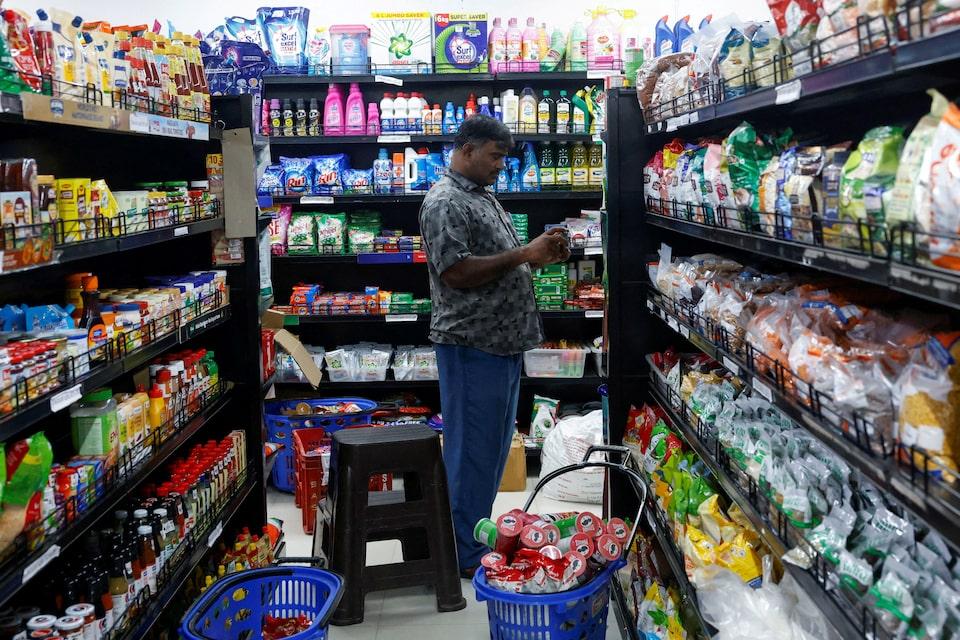

Retail inflation lowest since June 2017 Food prices drop 2.28% Y/Y in September vs 0.64% decline in August Softer food prices have prompted the RBI to trim inflation forecast for current year Economists expect central bank to cut interest rates by 25 bps in December NEW DELHI, Oct 13 (Reuters) - India's annual retail inflation (INCPIY=ECI) , opens new tab slowed to an eight-year low of 1.54% in September, government data showed on Monday, as food prices eased, leaving room for the central bank to cut rates one more time when it meets in December. Retail inflation was below a Reuters poll of 1.7% and the lowest since June 2017, when it stood at 1.46%. Sign up here. It was at 2.07% in August. The figure has also dropped below the Reserve Bank of India's 2%-6% tolerance band for a second time in three months. It had eased below 2% in July. The RBI is mandated to not let inflation overshoot its tolerance range of 2%-6% for more than three quarters in a row. The central bank is expected to reduce interest rates by 25 basis points in its December review, said Aditi Nayar, Chief Economist at ICRA, adding that the timing of rate cuts is contingent on the previous rate cuts passing through and the growth implications of the tax cuts and U.S. tariffs. The RBI has reduced interest rates by 100 basis points so far this year. It left the policy rate unchanged at 5.5% at its October monetary policy review, but signalled scope for a rate cut in December. The decline in inflation in September is mainly attributed to a favourable base effect and to a decline in the inflation of vegetables, oil and fats, fruits, pulses, cereal, and eggs, the government said in its statement. Food prices fell 2.28% year-on-year in September versus a revised 0.64% drop in August. Vegetable prices declined 21.38% after a 15.92% fall in the previous month. Softer food prices prompted the RBI this month to trim its inflation forecast for the current financial year to 2.6% from 3.1%. Core inflation, which excludes volatile items such as food and energy and is an indicator of demand in the economy, was at 4.5% in September compared with 4.1% in August, according to two economists. Higher gold prices and housing costs pushed up core inflation, economists said. A cut in consumer taxes, which took effect from September 22, will bring down core inflation starting October, said Madan Sabnavis, chief economist at Bank of Baroda. The U.S. has imposed tariffs of up to 50% on Indian goods, but Prime Minister Narendra Modi's tax cuts on everything from soaps to cars are expected to offset the impact on growth and ease inflation during the September–December festival season. The central bank this month raised its economic growth forecast to 6.8% from 6.5%, putting it at the upper end of the government's 6.3%–6.8% estimate. At this pace, India would continue to grow at the fastest pace among major economies. https://www.reuters.com/world/india/indias-retail-inflation-slows-154-september-2025-10-13/

2025-10-13 11:17

FTSE 100 up 0.7%, FTSE 250 UP 1.15% Miners drive gains Big Yellow soars as Blackstone considers buyout Oct 13 (Reuters) - London shares made a modest recovery on Monday, led by miners, as U.S. President Donald Trump softened his rhetoric on trade tensions with China, worries about which had sparked a sharp selloff on Friday. The blue-chip FTSE 100 (.FTSE) , opens new tab was up 0.07% as of 1012 GMT, having dropped 0.9% in the previous session after Trump threatened 100% tariffs on Chinese imports, reigniting fears of a trade war between the world's two largest economies. Sign up here. The mid-cap focused FTSE 250 (.FTMC) , opens new tab gained 1.15%. Over the weekend, Trump struck a more conciliatory tone, posting that "it will all be fine" and that the U.S. had no intention to "hurt" China. In the market, precious metal miners (.FTNMX551030) , opens new tab led gains with 7% rise as gold prices hit another record high. Gold miners Fresnillo (FRES.L) , opens new tab and Endeavour (EDV.L) , opens new tab gained the most in the FTSE 100 with 7.6% and 6.4% rise, respectively. In the latest round of mergers and acquisitions, U.S. private equity giant Blackstone (BX.N) , opens new tab said it was in the early stages of considering a cash offer for Big Yellow Group (BYG.L) , opens new tab, lifting the self-storage firm's shares 18.3%. Rival Safestore (SAFE.L) , opens new tab also jumped 11.2% on the news. Tritax Big Box (BBOXT.L) , opens new tab gained nearly 3% after Blackstone agreed to buy a 9% stake in the UK real estate investment trust. Tritax agreed to buy Blackstone's UK logistics assets for 1.04 billion pounds ($1.39 billion). The broader real estate sector (.FTUB3510) , opens new tab advanced 2.5%. An index of industrial metal miners (.FTNMX551020) , opens new tab rose 2.2%, tracking gains in copper prices. Mining heavyweights Anglo American (AAL.L) , opens new tab, Glencore (GLEN.L) , opens new tab and Rio Tinto (RIO.L) , opens new tab rose between 1.5% and 2.8%, helping lift the blue chip index. Among other individual stocks, Oxford Instruments (OXIG.L) , opens new tab shed 11.4% as the company expects H1 revenue to drop and said the shortfall is unlikely to be recovered. Lloyds Banking Group (LLOY.L) , opens new tab gained 1% after a motor finance charge came in lower than anticipated. https://www.reuters.com/world/uk/uk-stocks-steady-trump-eases-tone-china-tariff-gold-miners-shine-2025-10-13/

2025-10-13 11:14

India trade delegation to visit Washington later this week Both sides aim to sign first tranche of trade deal next month India to boost U.S energy purchases to address concerns NEW DELHI, Oct 13 (Reuters) - India and the United States are set to hold trade talks this week, with New Delhi pledging to import U.S. energy and gas as it aims to address Washington's concerns over its Russian oil purchases, an official said. Talks were suspended briefly in August after the Trump administration announced tariff hikes of up to 50% on Indian goods, accusing India of financing Russia's war in Ukraine by continuing to buy Moscow's oil despite western sanctions. Sign up here. However, discussions resumed in September after U.S. President Donald Trump struck a conciliatory tone in public remarks and spoke to Prime Minister Narendra Modi on the phone, raising hopes for a breakthrough. The official, speaking on condition of anonymity, due to the sensitivity of the issue, said India was looking to increase purchases of energy and gas from the U.S. The move follows U.S. ambassador-designate Sergio Gor's meetings over the weekend with Modi and later with Commerce Secretary Rajesh Agrawal on strengthening bilateral trade and investment. "During my visit to India, I met with Commerce Secretary Agrawal and discussed US-India economic ties, including increased investment in the United States," Gor said on 'X' on Sunday. Indian officials held "constructive" talks with U.S. counterparts in Washington last month, the government said, adding that both sides agreed to push for an early conclusion of a mutually beneficial trade deal. The U.S. tariff hikes have hurt Indian exports of textiles, leather goods, gems & jewellery, and food products, prompting the government to diversify markets and offer incentives to exporters. India's exports to the United States fell to $6.86 billion in August from $8.01 billion in July, trade ministry data showed, with exporters reporting further declines in September. Negotiations began in February 2025, targeting a deal to double bilateral trade to $500 billion by 2030. The two sides have held five rounds of trade talks, with the sixth - postponed in August - now expected to lead to the first phase of the deal next month, as agreed by Trump and Modi. India is seeking greater participation from private players, including U.S. firms, in its renewable and nuclear energy sectors. "Investments coming into our renewable energy sectors are an important area of our relationship (with the U.S.)," the official said, noting that New Delhi was open to buying more Liquefied Natural Gas (LNG) from the United States. When asked about the Trump administration's calls for greater Indian investment in the U.S., the source said New Delhi was not opposed and viewed overseas investments by Indian firms positively, similar to China’s approach. https://www.reuters.com/world/india/india-us-hold-trade-talks-this-week-washington-source-says-2025-10-13/

2025-10-13 11:13

IMO to meet Oct 14-17 to decide on formal adoption of carbon levy US threatens retaliation against countries backing measure Preliminary deal reached in April after US pulled out of talks Levy could collect $11 billion-12 billion in 2028-2030 LONDON, Oct 13 (Reuters) - The International Maritime Organization will meet this week to formally decide whether to impose a carbon emissions price on global shipping, a move supported by an EU-led bloc including Britain, China and Japan but strongly opposed by the U.S. The IMO struck a preliminary deal to charge the global shipping industry for emissions in April after the U.S. pulled out of associated talks, prompting Washington to threaten "reciprocal measures" against any fees charged on U.S. ships. Sign up here. The April deal is now tabled for adoption at a meeting of the IMO's environmental committee scheduled for October 14-17, which is expected to include the U.S. Washington has continued its efforts to derail the measure since April, threatening port fees and visa restrictions against countries that support it. "The United States will be moving to levy these remedies against nations that sponsor this European-led neocolonial export of global climate regulations," the U.S. State Department said in a statement on October 11. European Union states, meanwhile, have called for the IMO measure to be adopted, the European Commission said in an October 12 statement. The IMO's proposed marine fuel emissions standard would impose a fee on ships bigger than 5,000 tons that breach a threshold of emissions, and reward vessels burning cleaner fuels. Ships will either buy remedial units or pay a penalty if they emit more than the threshold. Ships emitting less than a separate threshold will receive surplus units. Revenues from the measure would be collected by an IMO Net-Zero Fund to be created by the IMO Secretariat, according to the draft rules. Details of revenue distribution have yet to be decided. According to research from University College London, the IMO fuel standard would generate $11 billion-12 billion per year between 2028-2030, as most ships would likely pay the penalty in the early years of implementation. https://www.reuters.com/sustainability/boards-policy-regulation/un-shipping-emissions-deal-pit-us-against-eu-led-bloc-2025-10-13/