2025-12-12 11:59

Inflation below RBI's target band for third straight month Food prices fall 3.91% Core inflation at 4.2% to 4.3% Economists expect another rate cut by RBI in Feb NEW DELHI, Dec 12 (Reuters) - India's retail inflation rose in November from a record low in the prior month but stayed below the central bank's target range for the third straight month, data showed on Friday, leaving scope for another interest rate cut. The print suggests that retail price rise may undershoot the Reserve Bank of India's 2% inflation forecast for this fiscal year by about 15 to 20 basis points, opening space for another 25 basis point rate cut, economists said. Sign up here. Annual inflation (INCPIY=ECI) , opens new tab quickened to 0.71% in November from 0.25% a month ago as the pace of decline in food prices slowed. The print was in line with a Reuters poll of economists. The Reserve Bank of India cut interest rates by 25 basis points earlier this month, saying the Indian economy is in a "rare goldilocks" phase of strong economic growth and moderate inflation. In 2025, the RBI's rate-setting panel has lowered rates by 125 bps. Whether growth slows in the second half of the fiscal year due to steep U.S. tariffs will be the focus for the central bank going forward, Paras Jasrai, an economist at India Ratings and Research, said. Indian Prime Minister Narendra Modi's policies, including consumer tax cuts and labour reforms, are expected to limit the impact of U.S. tariffs on the South Asian economy. Earlier this month, the RBI lowered its inflation projection for the fiscal year ending March 31 to 2% from 2.6% earlier and raised the growth forecast to 7.3% from 6.8%. In November, food prices fell 3.91% year-on-year after a decline of 5.02% a month ago. Vegetable prices fell 22.20% after a 27.57% decline in the previous month. Core inflation, which excludes volatile items such as food and energy and is an indicator of demand in the economy, was at 4.2%-4.3% in November compared with 4.4% in October, according to two economists. Core inflation stayed elevated partly because of firm gold prices, they said. Cereal prices increased 0.1% in November against a 0.92% rise in October, while prices of pulses dropped 15.86% after a decline of 16.2% in the previous month. The impact of consumer tax cuts and ample food supply could lead to inflation averaging below 3% in the remaining part of the fiscal, said Sakshi Gupta, principal economist at HDFC Bank. "This should provide room for the RBI to deliver another rate cut in the February policy if growth shows signs of losing momentum post the festive season," Gupta said. The RBI's next policy meeting is on February 4-6. India will start publishing retail inflation data based on new base year, with updated data sources, from February 2026, which is expected to lower the weight of food, and raise it for non-food components. Currently, food and beverages have a weight of 46% on the index. https://www.reuters.com/world/india/indias-november-retail-inflation-rises-071-stays-below-central-bank-target-range-2025-12-12/

2025-12-12 11:41

MUMBAI, Dec 12 (Reuters) - India needs to be cautious towards stablecoins, as they pose significant macroeconomic risk while serving no purpose that fiat money cannot, the Reserve Bank of India Deputy Governor, T. Rabi Sankar, said on Friday. Stablecoins gained global prominence after the U.S. passed a law to create a regulatory framework for dollar-pegged cryptocurrency tokens, boosting their popularity and pushing the global market cap of such tokens above $300 billion. Sign up here. India has diverged from large global and regional economies, including Japan and the European Union, in framing laws around cryptocurrencies, fearing that bringing the digital assets into its mainstream financial system could raise systemic risks. "Beyond the facilitation of illicit payments and circumvention of capital measures, stablecoins raise significant concerns for monetary stability, fiscal policy, banking intermediation, and systemic resilience," Sankar said in a speech in Mumbai. "Stablecoins do not serve any purpose fiat money cannot," he said. Such tokens are yet to establish the benefits their proponents claim and remain inferior to fiat money, he said, adding India will continue to approach these innovations with caution. REGULATING CRYPTO At present, crypto exchanges can operate in India after registering locally with a government agency tasked with due diligence to check money laundering risks. Taxes are imposed on gains from cryptocurrencies. Despite the regulatory caution, crypto trading has gained popularity in India, with crypto exchanges pointing to increased participation from users outside major urban centres. "Cryptocurrencies have no intrinsic value. Since they do not have any underlying cash flows, they are not financial assets as well," Sankar said in his speech, in which he argued in favour of central bank digital currencies. "CBDCs are inherently superior to stablecoins," Sankar said. India is currently running a retail and wholsesale pilot for its central bank digital currency, which has about 7 million users. When asked why the central bank and the government do not bar trading in cryptocurrencies altogether, Sankar said that the views of different stakeholders need to be taken into account. "It is under consideration and (a decision) will be taken. We have to all finalise our approaches and actions based on what that decision is," he said. https://www.reuters.com/world/india/india-central-bank-deputy-warns-stablecoin-risks-dismisses-claims-utility-2025-12-12/

2025-12-12 11:38

Dec 12 (Reuters) - SolGold (SOLG.L) , opens new tab said on Friday it was "minded to recommend" an improved offer from its top shareholder, Jiangxi Copper (600362.SS) , opens new tab that values the gold and copper miner at about 842 million pounds ($1.13 billion), amid a global race for copper assets. Jiangxi Copper's increased offer of 28 pence per share marks the Chinese company's third proposal to acquire SolGold and a 7.7% increase from its previous 26-pence-per-share bid that was rejected last month. Sign up here. Ecuador-focused SolGold said its board would tell shareholders to accept if Jiangxi Copper (JCC) makes a firm offer on those terms. JCC's pursuit of SolGold is part of a global scramble for copper assets, with miners investing billions into acquisitions as copper demand is expected to rise on the back of investments in artificial intelligence and electric vehicles. Miners are racing to secure copper supplies, with Anglo American (AAL.L) , opens new tab and Canada's Teck Resources (TECKb.TO) , opens new tab still awaiting regulatory approval for their proposed $53 billion merger to create the world's fifth-largest copper company. SHARES FALL AS INVESTORS WEIGH DEAL Despite the sweetened proposal, SolGold's shares fell more than 10% to 25.1 pence on Friday, trading below the bid price amid broader investor scepticism over big-ticket mining takeovers. JCC's bid requires Chinese regulatory approval for outbound investment, a process the state-backed miner has already begun, though such approvals have become more complex as Beijing scrutinises overseas acquisitions. The acquisition would give JCC control of SolGold's flagship Cascabel project in Imbabura Province, home to one of the world's largest undeveloped copper-gold deposits in South America. JCC, whose footprint extends beyond China and Hong Kong to regions such as Peru, Kazakhstan and Zambia, holds a 12.2% stake in SolGold. It has won support from other top shareholders BHP (BHP.AX) , opens new tab, Newmont (NEM.N) , opens new tab, and Maxit Capital, collectively representing 40.7% of shares. https://www.reuters.com/world/china/jiangxi-copper-raises-takeover-bid-solgold-113-billion-2025-12-12/

2025-12-12 11:36

NEW DELHI, Dec 12 (Reuters) - India's federal cabinet approved sweeping changes to its atomic energy laws and fully opened the insurance sector to foreign investors, two government sources said on Friday, key policy moves aimed at attracting billions of dollars in two critical sectors. India, which plans to expand nuclear power capacity 12-fold by 2047, is relaxing rules to end a decades-old state monopoly and overcome a stringent liability provision to allow private participation and attract foreign technology suppliers. The changes in the nuclear sector are a part of a larger push to boost nuclear capacity to 100 gigawatts by 2047, as the country looks to cut coal dependence and meet its climate commitments. In the insurance sector, the government has proposed increasing foreign direct investment to 100% from the existing 74%. Both changes to laws are listed for approval in the ongoing winter session of parliament. Sign up here. https://www.reuters.com/sustainability/boards-policy-regulation/india-cabinet-approves-opening-nuclear-insurance-sectors-private-investment-2025-12-12/

2025-12-12 11:35

LONDON, December 12 (Reuters) - Everything Mike Dolan and the ROI team are excited to read, watch and listen to over the weekend. From the Editor Sign up here. Hello Morning Bid readers! Federal Reserve Chair Jay Powell buoyed markets by executing that most rare of monetary policy moves: the dovish ‘hawkish cut’. But the spectre of AI anxiety threatens to hold off a “Santa Claus” rally. The Fed hogged most of the spotlight this week, delivering a widely expected 25 basis point rate cut. But Chair Powell also announced a Treasury bill buying program, starting at $40 billion per month, a “surprise” that ROI markets columnist Jamie McGeever suggested might be coming. The Chair also touted U.S. productivity growth, hinting that it could be the trick to squaring the circle of solid growth, sticky inflation and a soft jobs market. It wasn’t a total dove-fest, though. The Fed indicated that we’ll only see one 25 bps rate cut next year followed by another in 2027, while markets had been expecting two in 2026. This speaks to a larger issue: the global easing cycle appears to be over. The Bank of Canada kept rates on hold this week, the Reserve Bank of Australia made it clear rate cuts are done, and European Central Bank hawks hinted that the next move – whenever that may be – could be a hike. Then, of course, there’s the Bank of Japan. Governor Kazuo Ueda has essentially announced that the BoJ will raise rates next week. He’s now also expected to pledge to keep hiking. This global shift has major implications for currencies and the debt market. That’s just one more reason investors are worried about the increasingly debt-financed AI capex binge. Look at Oracle. Not only did the cloud-computing company’s shares fall 13% on Thursday, after it released underwhelming earnings and upped its projected 2026 spending, but credit-default swaps (CDS), which offer bondholders a hedge against default, for Oracle hit at least a five-year high the same day. Meanwhile, in energy markets, the U.S. seizure of a sanctioned Venezuelan tanker – and the threat to take more – has caused some modest ripples in crude prices. Spiking tensions between Washington and Caracas are raising the question of what could happen to Venezuela’s oil industry if President Nicolas Maduro’s regime were to fall. One thing appears clear, no matter what happens, Venezuela will not be leaving OPEC. Speaking of rising geopolitical tensions, the G7 late last week proposed a plan to bar tankers from hauling Russian oil, intensifying the West’s economic stand-off with Moscow. But the unknown now is whether governments will actually ratchet up punishments on those skirting sanctions. Over in India, tightening Russian sanctions don't appear to be having a major impact - at least not yet. India’s crude oil imports from Russia are on track to climb to a six-month high in December. Meanwhile, the U.S. shale industry is facing a watershed moment this month, with oil production in the Permian basin poised to peak, according to a U.S. Energy Information Administration report. Yet drilling innovations mean output in America’s most prolific oil patch should hold steady for years to come. In the renewables market, Texas' main power system looks set to generate more energy from solar farms than coal plants during the 2025 calendar year, marking a key energy transition milestone for the America’s largest power network. But, despite this, the U.S. has still lost ground to Asia in the clean energy race this year, with Europe also falling behind, setting the stage for an East-West divergence in energy transition momentum going into 2026. As we head into the weekend, check out the ROI team’s recommendations for what you should read, listen to, and watch to stay informed and ready for the week ahead.Also, check out thelatest episode of the new Morning Bid daily podcast. Subscribe to hear Reuters journalists discuss the biggest news in markets and finance seven days a week. I’d love to hear from you, so please reach out to me at [email protected] , opens new tab . , opens new tab This weekend, we're reading... MIKE DOLAN, ROI Financial Markets Editor-at-Large: This piece from Boston University Professor Laurence Kotlikoff, long an advocate of so-called “fiscal gap and generational accounting” – which considers all government spending and revenue, whether or not it’s on the books – reckons the United States is in worse fiscal shape than Italy. , opens new tab JAMIE MCGEEVER, ROI Finance Columnist: This is an excellent deep-dive into the US-China economic and strategic rivalry by Louis-Vincent Gave, founding partner and CEO of Gavekal. China has been playing the long game, while the US has gone for short-term fixes. The consequences of that may be about to play out. , opens new tab GAVIN MAGUIRE, ROI Global Energy Transition Columnist: This excellent report from Wired describes the spectacular rise and fall of a carbon offsetting company that convinced U.S. tech giants it could help balance their carbon footprints by dumping woodchips into the ocean. It's fascinating and infuriating in equal measure, and well worth the read. , opens new tab We're listening to... RON BOUSSO, ROI Markets Columnist: The latest episode of the Cleaning Up podcast , opens new tab features former BP CEO and now energy transition guru John Browne, who argues the world needs to adapt to climate change and develop new technologies. JAMIE MCGEEVER, ROI Finance Columnist: This is an excellent deep-dive into the US-China economic and strategic rivalry by Louis-Vincent Gave, founding partner and CEO of Gavekal. China has been playing the long game, while the US has gone for short-term fixes. The consequences of that may be about to play out. , opens new tab And we're watching... CLYDE RUSSELL, Commodities and Energy Columnist, ROI: Former Rystad head oil analyst Mukesh Sahdev has started doing some great interviews on his YouTube channel,and this is one , opens new tab. He discusses biofuels with XAnalysts Mukesh Sahdeve and former Shell executive Michael Pope, focusing on the challenge of scaling production. Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the authors. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-12-12/

2025-12-12 11:32

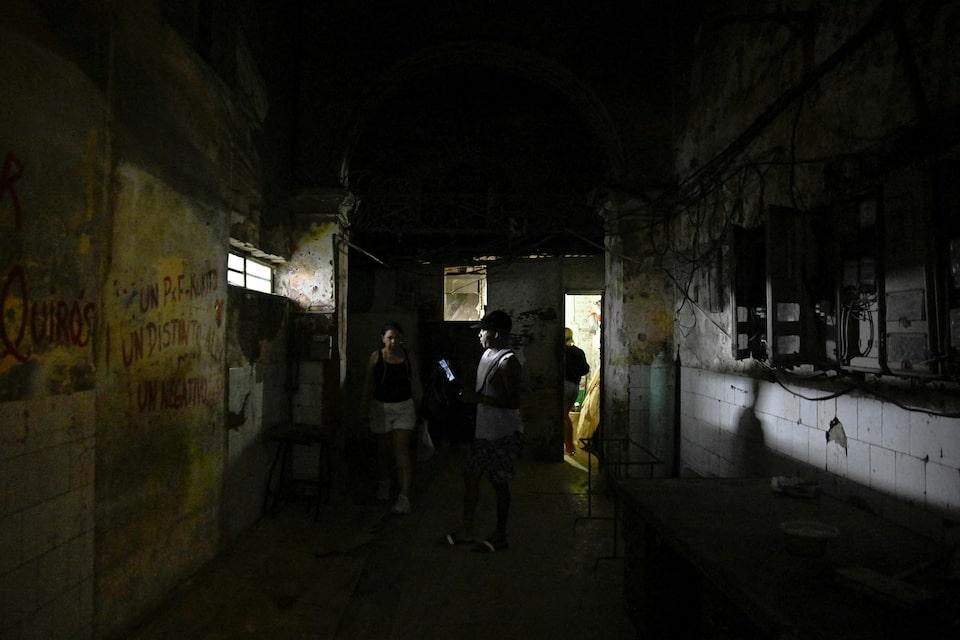

Seizure threatens Cuba's oil supply from Venezuela, may worsen economic crisis Venezuela's oil covers about 50% of Cuba's deficit, loss may strain energy infrastructure Diaz-Canel calls US tanker seizure 'piracy' Cuba to fast-track the building of solar parks HAVANA/HOUSTON, Dec 12 (Reuters) - A U.S. move this week to seize an oil tanker out of Venezuela is poised to make a bad situation worse for a crisis-stricken Cuba already struggling to source enough oil to power its ailing economy and electrical grid. The Communist-run nation, a nearby neighbor and long-time foe of the United States, suffers daily, hours-long rolling blackouts that have decimated productivity and tested the patience of its exhausted residents. Sign up here. Cuba depends on Venezuela's crude and refined products - transported to the island by small vessels and a shadow fleet of sanctioned tankers - for a large portion of its consumption, according to shipping data and analysts. That supply chain could be severely curtailed if the single tanker seizure this week turns into a pattern of interceptions, coupled with more sanctions. Washington, which on Thursday imposed fresh sanctions on six Venezuela-related vessels, in coming weeks is planning more interceptions of tankers carrying Venezuelan oil, sources familiar with the matter said this week. Between January and November, Venezuela sent 27,000 barrels per day of crude and fuel to Cuba, below the 32,000 bpd of last year, according to shipping data and internal documents from state oil company PDVSA. That covers about 50% of Cuba's oil deficit, or around one quarter of total demand, according to Jorge Pinon, who studies Cuba's energy infrastructure at the University of Texas at Austin. Without Venezuela's contribution, Cuba's oil imports, which have also been hit by lower supply from Mexico this year, would tumble, he said, leaving Cuba in dire straits. "Now that Mexico is sending less oil and Russian supply in large quantities has not materialized, I just don't see any other alternatives," Pinon said. "Times are tough and are going to get tougher." The Cuban and Venezuelan governments and PDVSA did not reply to requests for comment on this story. The U.S. action, as U.S. President Donald Trump ratchets up pressure on Venezuelan President Nicolas Maduro, is putting many vessel owners, operators and shipping agencies on alert, and many are reconsidering whether to set sail from Venezuela in coming days as planned, sources have told Reuters. Cuban President Miguel Diaz-Canel joined Venezuela late on Wednesday in condemning the U.S. tanker seizure. "This constitutes an act of piracy, a violation of International Law and an escalation of aggression against that sister country," Diaz-Canel said on X. Cuba has for decades worked to outwit a Cold War-era U.S. trade embargo and related financial restrictions that complicate its fuel purchases on the global market. The vessel seized this week, the Skipper, transferred a small portion of its Venezuelan oil cargo near Curacao to another tanker bound for Cuba, according to satellite images analyzed by TankerTrackers.com. That matched a pattern that started early this year, in which third-party-owned supertankers load oil under shared charterers departing from Venezuelan ports, make a brief stop in the Caribbean to transfer a portion of cargo to another vessel bound for Cuba, and then continue to China to deliver the remainder of the oil, the shipping data and documents showed. The terms between Venezuela and Cuba on those cargoes remain unclear. As part of a long-standing collaboration, Cuba provides security and intelligence services to Maduro. Some Russian naphtha cargoes have also been shared by Cuba and Venezuela this year, with tankers delivering parcels to the countries in turn to make more efficient use of the available fleet. Cuba has also announced a drive to fast-track the building of solar parks, though officials have cautioned that the island's aging oil-fired power plants will still need fuel. https://www.reuters.com/business/energy/cuba-edge-us-seizure-oil-tanker-puts-supply-risk-2025-12-12/