2025-10-07 14:34

August merchandise trade deficit widened to C$6.32 billion Total exports dropped by 3% while imports increased 0.9% Trade surplus with the U.S. falls to C$6.43 bln in Aug OTTAWA, Oct 7 (Reuters) - Canada's merchandise trade deficit widened in August to C$6.32 billion ($4.53 billion), its second highest on record, as exports both to the U.S. and the rest of the world fell, data showed on Tuesday. The August data had been expected to show a more permanent impact of U.S. President Donald Trump's tariffs on Canada, after exports increased earlier in the year to beat the tariffs and then dropped off sharply. Sign up here. Total exports dropped by 3% in August from July while imports increased 0.9%, Statistics Canada said. It was the first decrease in total exports since April. In volume terms exports fell 2.8% in August. "This was not a good report. It was a pretty rough month," said Stuart Bergman, chief economist at Export Development Canada. "What we are starting to see is the impact of tariffs coming into full view," he said, adding that as the volatility of the fist few months have passed, the more normalized impact on trade was visible. Analysts polled by Reuters had forecast the August trade deficit at C$5.55 billion, up from a upwardly revised C$3.82 billion in the prior month. Trump imposed sectoral tariffs on Canada early this year, forcing businesses to reorient supply chain from its biggest trading partner. But the shift has been volatile, erratic and difficult. Overall, exports dropped in eight of the 11 product sections in August with forestry, industrial machinery and metals leading the charge. Exports to the U.S. were at C$44.18 billion, down 3.4% from July, StatsCan said, adding it was primarily led by unwrought gold exports. But other product categories contributed to the decline, including lumber, machinery and equipment. Canada's share of exports to the U.S. fell below 70% a few months ago before recovering to 73% in August, compared with 75% during the same period last year. Prime Minister Mark Carney will be meeting with Trump on Tuesday as he comes under pressure to address the impacts of U.S. tariffs on critical sectors such as steel, cars and lumber. Imports from the U.S. were down 1.4% in August on a monthly basis, shrinking the total trade surplus with its southern neighbor to C$6.43 billion from C$7.42 billion in July. Exports to countries other than the United States were down 2% in August, a third consecutive monthly decline, Statscan said. Lower exports of crude oil and nuclear fuel contributed the most to the monthly decrease. However, Canada's imports from the rest of the world barring the U.S. rose 4.2%, reaching a record in August, StatsCan's data showed, pushing Canada's trade deficit with countries other than the United States to a record high of C$12.8 billion in August from C$11.2 billion in July, StatsCan said. The Canadian dollar was slightly weaker after the trade data, down 0.13% to 1.3960 to the U.S. dollar, or 71.63 U.S. cents. Yields on the two-year government bonds were up 0.2 basis points to 2.469%. ($1 = 1.3958 Canadian dollars) https://www.reuters.com/world/americas/canadas-august-trade-deficit-widens-more-than-forecast-exports-drop-2025-10-07/

2025-10-07 14:25

TORONTO, Oct 7 (Reuters) - Canadian economic activity expanded at its fastest pace in 15 months in September as a measure of employment rebounded, Ivey Purchasing Managers Index (PMI) data showed on Tuesday. The seasonally adjusted index rose to 59.8 last month from 50.1 in August, marking its highest level since June 2024. Sign up here. The Ivey PMI measures the month to month variation in economic activity as indicated by a panel of purchasing managers from across Canada. A reading above 50 indicates an increase in activity. The gauge of employment increased to an adjusted 50.2 from 46.0 in August, while the prices index was at 63.2, down from 65.1. The unadjusted PMI rose to 61.6 from 50.0. https://www.reuters.com/world/americas/canadas-ivey-pmi-rises-15-month-high-september-2025-10-07/

2025-10-07 12:53

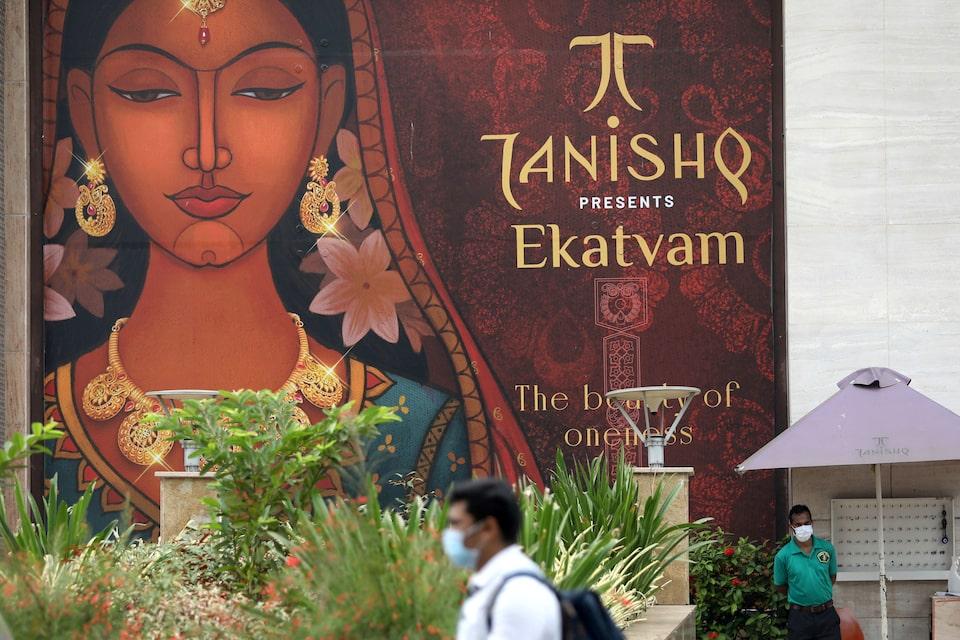

Oct 7 (Reuters) - India's Titan Company (TITN.NS) , opens new tab reported an 18% rise in domestic sales in the second quarter on Tuesday, slower than the 25% it registered during the same period last year, as soaring gold prices stunted demand for higher carat jewellery. The jewellery business, which contributes close to 90% of overall revenue, grew 19% year-on-year, the Bengaluru-based company said in its business update for the quarter ended September 30. Sign up here. Spot gold prices rose 16.4% in the quarter as investors fled to the safe-haven commodity amid global economic volatility. Higher gold prices have led to a "marginal year-on-year decline" in buyer count, the company said, even as ticket prices rose as fewer customers bought more expensive items. Studded jewellery in Titan's Tanishq, Mia and Zoya portfolio collectively grew in the mid-teens, outpacing growth in plain gold jewellery, the company said. Investment-grade gold coins continued their strong run for the quarter, the company said, as Indians chose to invest in the bullion as a store of value. However, since coins yield lower profit margins than jewellery, the shift has constrained overall margin growth in recent quarters. The company's watches business, second-largest by revenue, clocked sales growth of 12%. The analog segment grew by 17%. The international business grew 86% year-on-year, led by Tanishq more than doubling its business in the United States, the company added. https://www.reuters.com/world/india/indian-jeweller-titan-posts-slower-sales-surge-gold-prices-dent-demand-2025-10-07/

2025-10-07 12:36

DAKAR, Oct 7 (Reuters) - Ivanhoe Mines (IVN.TO) , opens new tab produced 71,226 metric tons of copper and a record 57,200 tons of zinc in the third quarter from its flagship Kamoa-Kakula and Kipushi mines in the Democratic Republic of Congo, the company said on Tuesday. The Vancouver-based miner said robust copper output kept it on track to meet full-year production guidance of 370,000 to 420,000 tons, as mining shifts to higher-grade zones in Kakula’s western section. Sign up here. Zinc production at Kipushi surged 37% quarter-on-quarter, driven by a programme to remove processing bottlenecks and boost throughput, positioning the mine among the world’s top producers, the company said. ADDRESSING CHALLENGES AT KAKULA Ivanhoe faced significant production setbacks earlier this year due to seismic activity at the Kakula Mine that disrupted underground operations and lowered copper grades. The company has since ramped up efforts to address the challenges, including securing $500 million from Qatar's sovereign wealth fund to expand operations and position Kamoa-Kakula as a top-tier global copper producer. Reuters reported in September that the company was in constant dialogue with sovereign wealth funds for potential investments to boost production of copper and other critical minerals. Ivanhoe confirmed the start-up of Africa's largest copper smelter in early November, supported by a newly installed 60-megawatt uninterruptible power supply and 60 MW of diesel backup. The smelter will process all concentrate from Kamoa-Kakula’s three concentrators and produce up to 700,000 tons of sulphuric acid annually, a key reagent in the copperbelt. At Kipushi, Ivanhoe maintained its 2025 zinc production guidance of 180,000 to 240,000 tons. https://www.reuters.com/world/africa/ivanhoe-mines-hits-record-zinc-output-congos-kipushi-mine-2025-10-07/

2025-10-07 12:25

PARIS, Oct 7 (Reuters) - Commodity broker StoneX has partnered with price reporting agency Expana to launch over-the-counter dairy contracts based on Expana's European dairy price benchmarks, the companies said on Tuesday. The initial contracts will cover fat-filled milk powder and high-protein whey, with plans to expand to other dairy products over time. Sign up here. The partnership aims to meet growing demand for new tools to manage risk and volatility in the dairy market, the companies said. Financial operator Euronext last month said it would launch cash-settled European dairy contracts based on European butter and skimmed milk power next year. https://www.reuters.com/business/stonex-expana-launch-otc-dairy-derivatives-2025-10-07/

2025-10-07 12:24

JAKARTA, Oct 7 (Reuters) - Indonesia is considering setting a mandatory bioethanol content level for gasoline of 10% in a bid to lower carbon emissions and reduce the country's dependence on fuel imports, state news agency Antara reported on Tuesday, citing the energy minister. Indonesia's government is seeking to expand the use of biofuels made from palm oil and sugar cane as President Prabowo Subianto pushes the world's fourth-most populous nation to become more energy self-sufficient. However, a mandatory bioethanol mix for gasoline has faced implementation delays due to limited ethanol supplies. Sign up here. "We had a meeting with the president yesterday evening. The president had agreed over the 10% bioethanol mandatory plan," energy minister Bahlil Lahadalia was quoted as saying. State energy firm Pertamina's CEO Simon Aloysius Mantiri said the company was ready to help implement the plan, according to the Antara report. Indonesia had the capacity to produce 303,325 kilolitres of bioethanol per year in 2024, but output stood at 160,946 kL with imports at 11,829 kL, according to data from Apsendo, an association of Indonesian methylated spirits and ethanol producers. Domestic demand for bioethanol stood at 125,937 kL last year while exports reached 46,839 kL. https://www.reuters.com/sustainability/climate-energy/indonesia-considering-bioethanol-blended-fuel-mandate-state-media-reports-2025-10-07/