2025-10-07 14:25

TORONTO, Oct 7 (Reuters) - Canadian economic activity expanded at its fastest pace in 15 months in September as a measure of employment rebounded, Ivey Purchasing Managers Index (PMI) data showed on Tuesday. The seasonally adjusted index rose to 59.8 last month from 50.1 in August, marking its highest level since June 2024. Sign up here. The Ivey PMI measures the month to month variation in economic activity as indicated by a panel of purchasing managers from across Canada. A reading above 50 indicates an increase in activity. The gauge of employment increased to an adjusted 50.2 from 46.0 in August, while the prices index was at 63.2, down from 65.1. The unadjusted PMI rose to 61.6 from 50.0. https://www.reuters.com/world/americas/canadas-ivey-pmi-rises-15-month-high-september-2025-10-07/

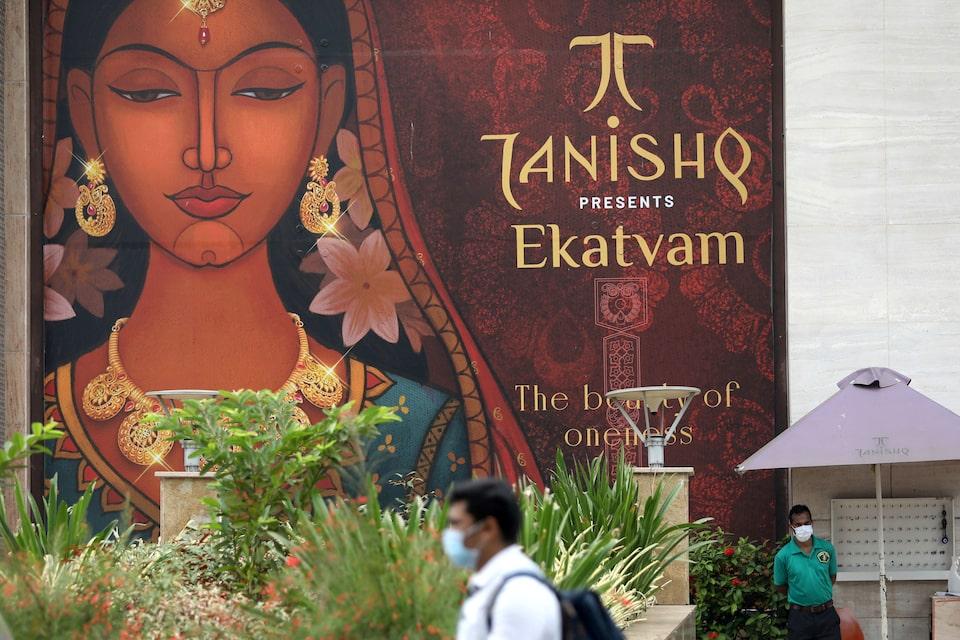

2025-10-07 12:53

Oct 7 (Reuters) - India's Titan Company (TITN.NS) , opens new tab reported an 18% rise in domestic sales in the second quarter on Tuesday, slower than the 25% it registered during the same period last year, as soaring gold prices stunted demand for higher carat jewellery. The jewellery business, which contributes close to 90% of overall revenue, grew 19% year-on-year, the Bengaluru-based company said in its business update for the quarter ended September 30. Sign up here. Spot gold prices rose 16.4% in the quarter as investors fled to the safe-haven commodity amid global economic volatility. Higher gold prices have led to a "marginal year-on-year decline" in buyer count, the company said, even as ticket prices rose as fewer customers bought more expensive items. Studded jewellery in Titan's Tanishq, Mia and Zoya portfolio collectively grew in the mid-teens, outpacing growth in plain gold jewellery, the company said. Investment-grade gold coins continued their strong run for the quarter, the company said, as Indians chose to invest in the bullion as a store of value. However, since coins yield lower profit margins than jewellery, the shift has constrained overall margin growth in recent quarters. The company's watches business, second-largest by revenue, clocked sales growth of 12%. The analog segment grew by 17%. The international business grew 86% year-on-year, led by Tanishq more than doubling its business in the United States, the company added. https://www.reuters.com/world/india/indian-jeweller-titan-posts-slower-sales-surge-gold-prices-dent-demand-2025-10-07/

2025-10-07 12:36

DAKAR, Oct 7 (Reuters) - Ivanhoe Mines (IVN.TO) , opens new tab produced 71,226 metric tons of copper and a record 57,200 tons of zinc in the third quarter from its flagship Kamoa-Kakula and Kipushi mines in the Democratic Republic of Congo, the company said on Tuesday. The Vancouver-based miner said robust copper output kept it on track to meet full-year production guidance of 370,000 to 420,000 tons, as mining shifts to higher-grade zones in Kakula’s western section. Sign up here. Zinc production at Kipushi surged 37% quarter-on-quarter, driven by a programme to remove processing bottlenecks and boost throughput, positioning the mine among the world’s top producers, the company said. ADDRESSING CHALLENGES AT KAKULA Ivanhoe faced significant production setbacks earlier this year due to seismic activity at the Kakula Mine that disrupted underground operations and lowered copper grades. The company has since ramped up efforts to address the challenges, including securing $500 million from Qatar's sovereign wealth fund to expand operations and position Kamoa-Kakula as a top-tier global copper producer. Reuters reported in September that the company was in constant dialogue with sovereign wealth funds for potential investments to boost production of copper and other critical minerals. Ivanhoe confirmed the start-up of Africa's largest copper smelter in early November, supported by a newly installed 60-megawatt uninterruptible power supply and 60 MW of diesel backup. The smelter will process all concentrate from Kamoa-Kakula’s three concentrators and produce up to 700,000 tons of sulphuric acid annually, a key reagent in the copperbelt. At Kipushi, Ivanhoe maintained its 2025 zinc production guidance of 180,000 to 240,000 tons. https://www.reuters.com/world/africa/ivanhoe-mines-hits-record-zinc-output-congos-kipushi-mine-2025-10-07/

2025-10-07 12:25

PARIS, Oct 7 (Reuters) - Commodity broker StoneX has partnered with price reporting agency Expana to launch over-the-counter dairy contracts based on Expana's European dairy price benchmarks, the companies said on Tuesday. The initial contracts will cover fat-filled milk powder and high-protein whey, with plans to expand to other dairy products over time. Sign up here. The partnership aims to meet growing demand for new tools to manage risk and volatility in the dairy market, the companies said. Financial operator Euronext last month said it would launch cash-settled European dairy contracts based on European butter and skimmed milk power next year. https://www.reuters.com/business/stonex-expana-launch-otc-dairy-derivatives-2025-10-07/

2025-10-07 12:24

JAKARTA, Oct 7 (Reuters) - Indonesia is considering setting a mandatory bioethanol content level for gasoline of 10% in a bid to lower carbon emissions and reduce the country's dependence on fuel imports, state news agency Antara reported on Tuesday, citing the energy minister. Indonesia's government is seeking to expand the use of biofuels made from palm oil and sugar cane as President Prabowo Subianto pushes the world's fourth-most populous nation to become more energy self-sufficient. However, a mandatory bioethanol mix for gasoline has faced implementation delays due to limited ethanol supplies. Sign up here. "We had a meeting with the president yesterday evening. The president had agreed over the 10% bioethanol mandatory plan," energy minister Bahlil Lahadalia was quoted as saying. State energy firm Pertamina's CEO Simon Aloysius Mantiri said the company was ready to help implement the plan, according to the Antara report. Indonesia had the capacity to produce 303,325 kilolitres of bioethanol per year in 2024, but output stood at 160,946 kL with imports at 11,829 kL, according to data from Apsendo, an association of Indonesian methylated spirits and ethanol producers. Domestic demand for bioethanol stood at 125,937 kL last year while exports reached 46,839 kL. https://www.reuters.com/sustainability/climate-energy/indonesia-considering-bioethanol-blended-fuel-mandate-state-media-reports-2025-10-07/

2025-10-07 11:54

Oct 7 (Reuters) - Companies looking to sidestep disruptions caused by the U.S. government shutdown to their initial public offerings can tap a provision that allows them to press ahead with their listing plans without the need for regulatory approvals. Biotech startup MapLight became the first company to file for a listing under the provision late on Monday. Sign up here. The U.S. market regulator has halted IPO reviews as the shutdown enters its second week. WHAT HAPPENS TO THE SEC DURING A GOVERNMENT SHUTDOWN? According to its contingency plan, the U.S. Securities and Exchange Commission has furloughed over 90% of its staff, retaining around 390 employees to handle critical enforcement actions and market monitoring. The agency, which oversees the public markets, will not process IPO filings during the shutdown, a move analysts say could stall momentum in a market recovering from a years-long slump. However, a provision under federal securities law allows companies to move ahead with IPOs without SEC review during the shutdown. WHAT IS THE 20-DAY REGISTRATION RULE FOR IPOS? While companies typically wait for the SEC's approval before launching their IPOs, the rules provide a mechanism that allows issuers to declare their own registrations "effective." Issuers are required to set their IPO price 20 days before the listing, instead of finalizing it the night before, as is customary. During the 2018 U.S. government shutdown, which lasted 35 days and was during Donald Trump's first presidential term, several issuers attempted this option, including biotechnology firm Gossamer Bio and energy company New Fortress Energy. It was also a popular option among so-called special purpose acquisition companies. SPACs raise money through an IPO to fund future acquisitions. At the time of listing, they are blank-check companies with no existing operations or assets. Their valuation is tied entirely to the cash raised, which allows them to set an IPO price in advance without deterring investors. WHAT ARE THE RISKS FOR ISSUERS AND INVESTORS? While the 20-day rule provides a way for companies to go public during a shutdown, bypassing the SEC review carries risks for both issuers and investors. Without the agency's oversight, registration statements are more prone to errors or missing disclosures, which could expose companies to legal action or investor complaints after listing. Companies may face greater scrutiny from investors, who often rely on the SEC's review to verify the accuracy and completeness of disclosures. To reduce that risk, many issuers work closely with legal and financial advisers to carry out detailed internal reviews of their filings. Skipping regulatory reviews can also alienate investors, who may view the lack of regulatory vetting as a sign of higher risk or insufficient transparency. WILL MORE COMPANIES TAKE THIS ROUTE? Analysts say companies could rely on the 20-day registration rule if the shutdown looks set to drag on amid the ongoing deadlock in Congress. "Biotech companies are prime candidates for this unconventional but valid way to go public during a shutdown as their high cash-burn rates often create an urgent need for funding," said Lukas Muehlbauer, research analyst at IPO research firm IPOX. Some firms may also withdraw IPO filings and seek capital in private markets while waiting for the SEC to resume reviews. https://www.reuters.com/legal/government/how-companies-are-steering-ipo-plans-amid-us-government-shutdown-2025-10-07/