2025-10-06 00:41

Takaichi set to become Japan's first female prime minister Takaichi's policies may delay BOJ's rate hike plans Euro highest against yen since euro introduction in 1999 Euro down vs dollar and sterling after new French PM quits Fed funds futures imply over 95% chance of October US rate cut NEW YORK, Oct 6 (Reuters) - The Japanese yen and euro weakened against the dollar on Monday on fiscal and political stability concerns after Japan's ruling Liberal Democratic Party elected a new leader and France's new government quit. The yen declined after Japan's ruling party picked conservative Sanae Takaichi, an advocate of late premier Shinzo Abe's "Abenomics" strategy to boost the economy with aggressive spending and easy monetary policy, as its head on Saturday. Sign up here. Her victory caused traders to reduce bets that the Bank of Japan will hike interest rates this month. "It was unexpected that it was going to be Takaichi," said Sarah Ying, head of FX strategy, FICC Strategy at CIBC Capital Markets in Toronto. "There's a little bit more focus on the back end of the curve now, just given that Takaichi is generally seen as a follower of Abenomics. The market expects a little bit more fiscal stimulus there." The dollar at one point rose more than 2% to 150.47 yen, the highest since August 1. It was last up 1.87% at 150.2, and if sustained, that would be its biggest daily gain since May 12. The Bank of Japan maintained on Monday its cautiously optimistic economic outlook but warned of nagging uncertainty over the impact of U.S. tariffs on corporate profits, suggesting its preference to wait for more data before raising interest rates. The euro reached 176.25 yen, the highest since the single currency was introduced in 1999. The euro slid against the dollar and the pound, however, after France's new Prime Minister Sebastien Lecornu and his government resigned on Monday, hours after announcing his cabinet line-up, making it the shortest-lived administration in modern French history. "It's not really too much of an existential crisis, it doesn't look great domestically given especially what's going on with the budget," said Ying. "The biggest risk is really if (President) Macron resigns, but it doesn't seem to be a high-risk scenario." The euro was last down 0.26% at $1.171. It earlier reached $1.1649, the lowest since September 25 . It also dipped against the pound to its lowest since September 18. The European Central Bank may need to reduce borrowing costs slightly if the risk of inflation going too low increases, but interest rates are appropriate now, the ECB's top brass said on Monday. The dollar index rose 0.4% to 98.11. Traders are waiting for signs that the U.S. federal government will reopen, with Congress so far unable to pass a bill to continue funding operations. The shutdown is leaving a void of U.S. economic data, with last Friday's closely watched monthly jobs report for September delayed along with other key releases until the government reopens. That has also resulted in lower market volatility. "Financial market volatility has dropped significantly since the start of the US government shutdown. Risks to US economic activity and the labour market from furloughing, or even terminating employment of, federal workers will not be apparent for a while," Barclays analysts led by Themistoklis Fiotakis said in a report. The Federal Reserve is widely expected to cut rates by 25 basis points at its October 28-29 meeting, following data that shows a weakening labor market. Traders are also pricing in 83% odds of an additional cut in December, according to the CME Group's FedWatch Tool, though this will likely depend on data released before then. In cryptocurrencies, bitcoin was last up 2.24% at $125,530, after hitting a record high of $125,835.92. https://www.reuters.com/world/asia-pacific/yen-sinks-takaichi-win-spurs-bets-fiscal-easing-2025-10-06/

2025-10-06 00:13

Nikkei surges past 48,000 after Takaichi's election Market bets for BOJ rate hike fall Yen weakens, bond yields fluctuate amid policy expectations TOKYO, Oct 6 (Reuters) - Japanese shares surged to a record high on Monday, while the yen and long-term bonds tumbled as Sanae Takaichi was all but confirmed to become the country's next premier, stoking bets on a revival in big spending and loose monetary policy. The Nikkei 225 Index (.N225) , opens new tab soared 4.75% to close at 47,944.76. It traded as high as 48,150.04, breaking through three psychologically key thousand-point barriers for the first time ever. The broader Topix gauge (.TOPX) , opens new tab jumped 3.1%. Sign up here. The 30-year Japanese government bond (JGB) plunged, sending the yield to a record high. Meanwhile, the yield on the two-year note slid, reflecting expectations of later rate hikes by the Bank of Japan. The yen tumbled nearly 2% against the dollar and traded at an all-time low versus the euro. Takaichi was considered to have the most expansionist fiscal and monetary agenda among five candidates in the Liberal Democratic Party race to replace hawkish Prime Minister Shigeru Ishiba. "The Nikkei was on course to reach as high as 48,000 by year-end, but because Takaichi was chosen as the LDP leader, it shot up toward that level already," said Hitoshi Asaoka, the chief strategist at Asset Management One. "The market welcomes her spending policy, but whether she can achieve that goal is not certain, as the LDP is still a minority party. The Nikkei may retreat once before year-end." NEW POLICY DYNAMICS Takaichi began eyeing cabinet posts on Monday, with media reporting she planned to install former defence minister Minoru Kihara as chief cabinet secretary and bring back ex-foreign minister Toshimitsu Motegi as the country's top diplomat. Her pick for finance minister, which will be closely watched by investors, was unclear. In the lead-up to the LDP race, a "Takaichi trade" emerged - long on stocks and bearish on Japanese government bonds, particularly longer maturities - positioning for a win by the veteran lawmaker who is a devotee of the "Abenomics" stimulus policies of the late Shinzo Abe. Yields on two-, five-, and 10-year JGBs had all reached levels not seen since the financial crisis in 2008 in the run up to the LDP election on bets the BOJ could raise rates as early as this month's meeting. Long-term JGB yields had fallen, flattening the so-called yield curve. In a run-off vote on Saturday, Takaichi beat farm minister Shinjiro Koizumi, who was seen as more laissez-faire on monetary policy. "The market had bet that Koizumi would win, and they were positioned for curve flattening," said Miki Den, the senior Japan rate strategist at SMBC Nikko Securities. "But because the bet on Koizumi was so strong, it will take time to unwind the flattening positions." The yen sank 1.8% to 150.13 yen versus the dollar and weakened to 176.22 against the euro , an all-time low. The yen swaps market on Monday indicated a 41% likelihood of a rate hike by December, down from 68% on Friday. As a candidate, Takaichi proposed boosting investment in strategic business sectors, including artificial intelligence, semiconductors, nuclear fusion and defence. Shares in those sectors were among the biggest gainers in Tokyo trading. Mitsubishi Heavy Industries (7011.T) , opens new tab, a major military contractor, jumped 11%, and Japan Steel Works (5631.T) , opens new tab, a supplier of nuclear energy machinery, soared more than 15%. Yields on long-term debt face upward pressure on expectations Takaichi will push for more deficit spending, adding to concerns about Japan's creditworthiness. The yield on the 40-year JGB , the longest tenor, soared 12.5 basis points to 3.505%. The 30-year yield briefly reached 3.29%, an all-time high. An auction of 30-year JGBs on Tuesday will be closely watched for signs of concerns about Japan's finances and debt management under Takaichi. Despite a modest issuance amount, the debt sale "is expected to be weak because investors —wary of higher term-premia after Ms. Takaichi's ascent and possible fiscal stimulus— are reluctant to add long-duration risk," Shoki Omori, the chief desk strategist at Mizuho Securities, wrote in a note. After her LDP victory, Takaichi told a press conference the government and central bank must work closely to ensure Japan's economy achieves demand-driven inflation backed by rising wages and corporate profits. https://www.reuters.com/world/asia-pacific/japans-nikkei-surges-record-after-election-win-by-fiscal-dove-takaichi-2025-10-06/

2025-10-06 00:04

Oct 6 (Reuters) - Gold surged past $3,900 an ounce for the first time in early Asian trade on Monday, as safe-haven demand from a U.S. government shutdown added to the momentum from expectations of more Federal Reserve rate cuts. Spot gold gained 0.6% to $3,910.09 per ounce by 23:53 GMT on Sunday, while U.S. gold futures for December delivery gained 0.7% to $3,935. Sign up here. https://www.reuters.com/world/india/gold-smashes-through-3900oz-notch-record-high-2025-10-06/

2025-10-05 23:25

OPEC+ November supply hike stable from October at 137,000 bpd Refinery maintenance to limit oil demand in Q4, analysts say Weak demand outlooks in Q4 to also cap near-term gains NEW YORK, Oct 6 (Reuters) - Oil prices gained about 1% on Monday after the OPEC+ production increase planned for November was more modest than expected, tempering some concerns about supply additions, though a soft outlook for demand is likely to cap near-term gains. Brent crude futures settled 94 cents, or 1.46%, higher at $65.47 a barrel, while U.S. West Texas Intermediate crude was at $61.69, up 81 cents, or 1.33%. Sign up here. "The market feel that the actual amount of oil that is going to hit the market is far less than what they announced, given that some of the OPEC+ members are already producing at capacity," said Andrew Lipow, president of Lipow Oil Associates. On Sunday, the Organization of the Petroleum Exporting Countries, plus Russia and some smaller producers, said it would raise production from November by 137,000 barrels per day, matching October's figure, amid persistent concern over a looming supply glut. In the run-up to the meeting, sources said although Russia was advocating for an increase of 137,000 bpd to avoid pressuring prices, Saudi Arabia would have preferred double, triple or even four times that to quickly regain market share. The modest production update also comes at a time of rising Venezuelan exports, the resumption of Kurdish oil flows via Turkey, and the presence of unsold Middle Eastern barrels for November loading, PVM Oil Associates analyst Tamas Varga said. Saudi Arabia kept unchanged the official selling price for the Arab Light crude it sells to Asia. While refining sources in Asia surveyed by Reuters had expected a slight increase, those expectations diminished as concerns about rising Middle Eastern crude supply felled the premium to a 22-month low last week. In the near term, some analysts expect the refinery maintenance season starting soon in the Middle East will help to cap prices. The Kirishi oil refinery, one of Russia's largest, halted its most productive crude unit following a drone attack and subsequent fire on October 4, with its recovery expected to take about a month, two industry sources said on Monday. Expectations of weak demand fundamentals in the fourth quarter are another factor limiting the market's upside. U.S. crude oil, gasoline and distillate inventories rose more than expected in the week ended September 26 as refining activity and demand softened, the Energy Information Administration said last week. "If we see a steadier rise in production then the downside in oil prices may be contained. Much now depends on whether the U.S. economy can reaccelerate over the rest of 2025 and into 2026, which would help demand immensely," said Chris Beauchamp, chief market analyst at IG Group. https://www.reuters.com/business/energy/oil-prices-open-up-around-1-after-modest-opec-output-hike-2025-10-05/

2025-10-05 23:06

OPEC+ agrees to increase output by another 137,000 bpd in November As production increases, group's spare capacity dwindles But OPEC+ might not have as much spare capacity as thought LONDON, Oct 6 (Reuters) - OPEC+'s continued oil output increases are eroding the group's spare production capacity, a vital cushion that has helped to mitigate volatility in recent years. Energy traders may therefore face rockier days ahead. The prevailing belief in oil markets over the past three years has been that any supply shortfalls could be swiftly met by OPEC+, the group of producers and allied nations including Russia, after they jointly cut output in 2022, ultimately slashing production by as much as 5.85 million bpd, or around 5.5% of global demand. Sign up here. This resulted in an increase in global “spare capacity,” what the International Energy Agency defines as "capacity levels that can be reached within 90 days and sustained for an extended period." In other words, the amount of additional supply that could be quickly and sustainably injected into global markets. SHOCK ABSORBER RAPIDLY THINS The existence of this buffer likely helped mitigate spikes in oil prices during the Israel-Iran war last June and has probably tamped down volatility as the war in Ukraine has escalated. If OPEC+ could ramp up production rapidly, markets had no reason to panic in the face of any potential supply disruption. But that shock absorber has rapidly thinned since OPEC+'s core eight members started unwinding those cuts in April. The group on Sunday agreed to increase production by a further 137,000 bpd in November, which would bring total targeted production increases since April to more than 2.7 million bpd. As the group increases output, its spare capacity naturally diminishes. And by some estimates, that buffer might already be smaller than previously assumed. CHALLENGES IN RAMPING UP PRODUCTION OPEC+'s estimated total spare capacity stood at 4.1 million bpd as of August, with almost 60% held by Saudi Arabia and another 20% by the United Arab Emirates, according to data from the IEA. That might sound like a lot. But the challenges countries have faced in ramping up production since April suggest that some members are finding it hard to rapidly and sustainably tap this supposed excess capacity. OPEC+ delivered between April and August only 75% of production increases on average, according to a Reuters analysis, undershooting the 1.92 million bpd targeted production increase by around 500,000 bpd. This indicates that the level of spare capacity may have declined in the past three years, likely because oil wells that are shut for extended periods take significant time and investment to revive – potentially more than expected. Of course, part of the shortfall since April was due to members like Iraq deliberately scaling back production to compensate for past excesses. Additionally, OPEC+ actually exceeded its target by 760,000 bpd in August, primarily due to Iraq's overproduction, according to IEA data. However, moving forward, most producers appear to have limited scope to ramp up production sustainably. Kazakhstan, which far exceeded its production quota at the start of the year, today has little to no room to raise output. Algeria and Oman also appear to be producing at full capacity. Russia, whose oil and gas industry faces heavy Western sanctions, has struggled to raise output, and Ukrainian drone attacks on its infrastructure in recent months risk further reducing its output. WHAT IS SAUDI'S TRUE CAPACITY? What the market really wants to know, however, is the true capacity of Saudi Arabia. The world's top crude exporter – which has access to vast oil reserves with low break-even prices – produced 9.69 million bpd in August, which, when combined with its estimated spare capacity, means it could theoretically ramp up output to above 12 million bpd. Saudi is set to increase its production to 10.06 million bpd in November under the new OPEC+ agreement. But recent history shows that the Kingdom has only breached the 12 million bpd threshold once, for one month in April 2020. Production quickly plummeted to 7.5 million bpd as global consumption collapsed due to COVID-19 lockdowns, according to the Joint Organizations Data Initiative. Moreover, Saudi production has only hit 11 million bpd in two brief periods in 2018 and 2023. And it has only breached the 10 million bpd threshold a handful of times, with the longest periods between March 2015 and December 2016, when production averaged 10.4 million bpd. It also boosted output above 10 million bpd between December 2021 and April 2023 as the global economy recovered from the pandemic. What’s more, Saudi Arabia's energy ministry in January 2024 instructed its national oil company Aramco to target maximum sustainable capacity of 12 million bpd, abandoning plans to ramp it up to 13 million bpd. It is therefore likely that Saudi Arabia currently only has between 600,000 and 1 million bpd of true spare capacity, based on historic precedents. BUFFER AT THE LOW END HISTORICALLY Where does that leave OPEC+ overall? When combining the 1.3 million bpd estimated combined spare capacity of the UAE, Kuwait and Iraq with the revised Saudi figure, OPEC+ is left with a buffer of around 2 million bpd, around 2% of global demand. That is at the low end of the historical average. So even though the group’s decision to flood the market with oil is currently weighing on crude prices, the struggles it faces in actually doing so could potentially result in upward pressure ahead. Either way, at a time when the world faces growing geopolitical tensions in Ukraine, Russia and the Middle East, the energy market could use a shock absorber. And OPEC+ appears to be rapidly exhausting its own. The opinions expressed here are those of the author, a columnist for Reuters. Want to receive my column in your inbox every Monday and Thursday, along with additional energy insights and links to trending stories? Sign up for my Power Up newsletter here. Enjoying this column? Check out Reuters Open Interest (ROI), , opens new tabyour essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis. Markets are moving faster than ever. ROI , opens new tab can help you keep up. Follow ROI on LinkedIn , opens new tab and X. , opens new tab https://www.reuters.com/markets/commodities/surging-opec-oil-output-leaves-market-with-shrinking-shock-absorbers-2025-10-05/

2025-10-05 16:38

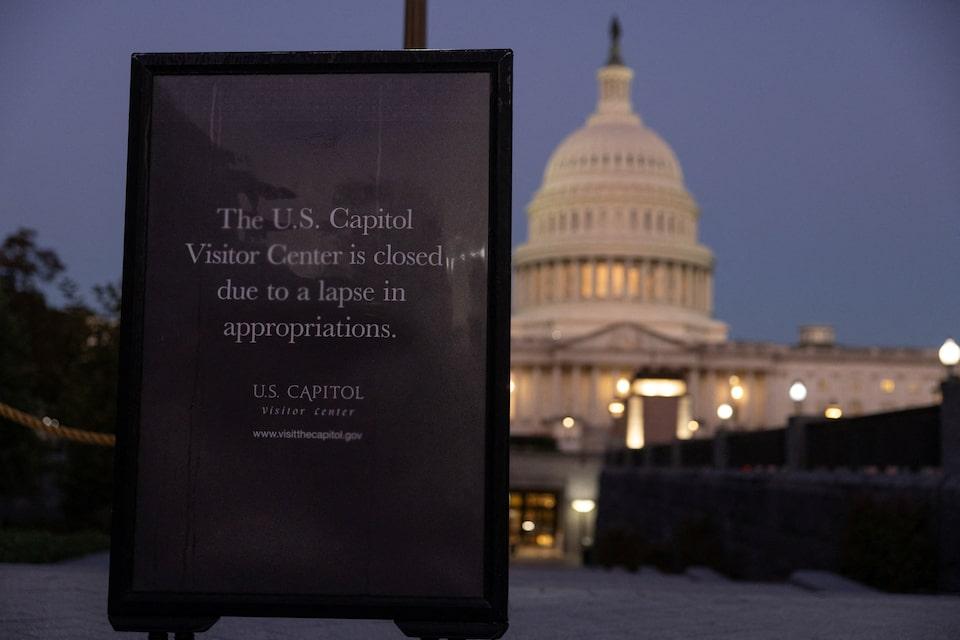

Layoffs depend on shutdown negotiations with Democrats Democrats demand healthcare assurances in shutdown talks Next Senate vote on funding bill unlikely to pass WASHINGTON, Oct 5 (Reuters) - The Trump administration will start mass layoffs of federal workers if President Donald Trump decides negotiations with congressional Democrats to end a partial government shutdown are "absolutely going nowhere," a senior White House official said on Sunday. As the shutdown entered its fifth day, White House National Economic Council Director Kevin Hassett told CNN's "State of the Union" program he still saw a chance that Democrats would back down, averting a costly shutdown and federal employee layoffs that have been threatened by White House budget director Russell Vought. Sign up here. "President Trump and Russ Vought are lining things up and getting ready to act if they have to, but hoping that they don't," Hassett said. Later on Sunday, Trump was asked by reporters when the administration would begin laying off federal workers. Trump responded, without elaborating: "It's taking place right now." The White House's Office of Management and Budget, which has played a key role in Trump's campaign to sharply scale back the size of the federal government, did not immediately respond to a request for comment. NO SIGN OF TALKS No tangible signs of negotiations have emerged between congressional leaders since Trump met with them last week. The shutdown began on October 1, the start of federal fiscal 2026, after Senate Democrats rejected a short-term funding measure that would keep federal agencies open through November 21. "They've refused to talk with us," Senate Democratic leader Chuck Schumer told CBS' "Face the Nation" program, saying the impasse could be solved only by further talks between Trump and the four congressional leaders. Democrats are demanding a permanent extension of enhanced premium tax credits to help Americans purchase private health insurance through the Affordable Care Act and assurances that the White House will not try to unilaterally cancel spending agreed to in any deal. Senate Majority Leader John Thune has said he is willing to address Democrats' concerns but that they must first agree to reopen the federal government. Trump also expressed an interest in the healthcare question while emphasizing Republican interests in reforming the ACA, also known as Obamacare. "We want to fix it so it works. Obamacare has been a disaster for the people, so we want to have it fixed so it works," the president said. SENATE VOTE MONDAY Rank-and-file Senate Democrats and Republicans have held informal talks aimed at finding common ground on healthcare and other issues in hopes of reaching a deal to reopen the government. Asked if the lawmakers are any closer to a deal, Democratic Senator Ruben Gallego told CNN: "At this point, no." On Monday, the Senate is due to vote for a fifth time on the stopgap funding bill that has already passed the Republican-controlled House of Representatives and on a Democratic alternative. Neither measure is expected to receive the 60 votes needed to advance. With a 53-47-seat majority and one Republican opposed to the House funding bill, Republican leaders need at least eight Democrats to support the measure but have seen only three cross the aisle so far. "It's open up the government or else," John Thune told the Fox News program "Sunday Morning Futures." "That's really the choice that's in front of them right now," the South Dakota Republican said. https://www.reuters.com/world/us/white-house-says-layoffs-will-start-if-trump-sees-shutdown-talks-going-nowhere-2025-10-05/