2025-10-02 16:34

TORONTO, Oct 2 (Reuters) - The Canadian dollar is set to strengthen over the coming year against its U.S. counterpart as expected Federal Reserve interest rate cuts weigh on the greenback, but uncertain prospects for the United States-Mexico-Canada trade agreement could put that forecast at risk, a Reuters poll found. The median forecast of 38 foreign exchange analysts in the September 26-October 1 poll predicted the loonie would strengthen 2.8% to 1.36 per U.S. dollar, or 73.53 U.S. cents, in three months, matching the level expected in a survey last month. Sign up here. In 12 months, the currency was forecast to gain 3.5% to 1.35, versus 1.3415 seen previously. The currency was trading on Thursday at a four-month low. "Weakness on the USD leg should spill over onto the CAD leg and cause USD-CAD to move lower," said Sarah Ying, head of foreign exchange strategy at CIBC Capital Markets, who expects continued deterioration of the U.S. labor market to drive further interest rate cuts from the Fed in 2026 and the Bank of Canada to soon end its more advanced easing campaign. Investors are fully discounting just one more rate cut from the Canadian central bank, which last month lowered its benchmark rate to 2.50%. . Canadian gross domestic product declined at an annualized rate of 1.6% in the second quarter but recent data has suggested the economy avoided a second straight quarterly contraction. "The output gap in Canada is expected to get less negative as peak tariff uncertainty is behind us," Ying said. "We are wrong if (U.S. President Donald) Trump starts to challenge USMCA, as trade negotiations remain ongoing." The USMCA , opens new tab, which has shielded much of Canada's exports from U.S. tariffs, is up for joint review in 2026. Separate public consultations by the U.S., Canada and Mexico on the trade pact kicked off in recent weeks. (Other stories from the October foreign exchange poll) https://www.reuters.com/world/americas/canadian-dollar-set-rebound-if-fed-rate-cuts-weaken-us-counterpart-2025-10-02/

2025-10-02 16:21

Oct 2 (Reuters) - The International Monetary Fund's staff expects discussions on a new fund-supported program with Senegal to begin this month, the IMF communications director said on Thursday. "Our staff is ready to move to the next phase of our engagement, which of course would be program discussions, and we expect to be able to start those discussions during the annual meetings," Julie Kozack told a scheduled press briefing. Annual meetings of the IMF and World Bank kick off the week after next in Washington. Sign up here. Bond prices rallied, with the 2028 maturity gaining 2 cents to be bid at 88.80 cents on the dollar. Kozack said the IMF board will meet this Friday to discuss the Senegal situation, including a debt misreporting issue that put an original program on hold and threatened to derail more support. "We are very appreciative of the time and the energy that the Senegalese authorities have invested in producing these detailed (audit) reports and for granting our staff full access to the findings," Kozack said. She added that the IMF was likely to communicate the outcome of its board discussion on Friday, but did not say whether the board would consider or approve the debt misreporting waiver needed for Senegal to secure a new program at the meeting. https://www.reuters.com/world/africa/imf-expects-discuss-new-senegal-program-later-this-month-official-says-2025-10-02/

2025-10-02 13:28

BRASILIA/SAO PAULO, Oct 2 (Reuters) - Brazil's government said it was confident the Senate would pass a bill expanding income tax exemptions for the middle class, after the measure cleared the Lower House late Wednesday. The proposal, a key initiative of President Luiz Inacio Lula da Silva, could boost his prospects ahead of next year's general election. Sign up here. Finance Minister Fernando Haddad told reporters he did not expect any hurdles in the Senate. "The bill is based on fiscal balance and seeks tax justice," Haddad told reporters on Thursday, hailing its unanimous passage by lawmakers. "I am certain the proposal will also enjoy broad support in the Senate," Lula wrote on X late Wednesday, adding that the measure would benefit 15 million Brazilian workers. Under the approved legislation, the monthly income tax exemption threshold would rise next year to 5,000 reais ($940), above three minimum wages, from the current 3,036 reais. To offset the revenue loss, the bill introduces a progressive minimum tax on monthly incomes above 50,000 reais and imposes a 10% withholding tax on dividends sent abroad, regardless of whether the recipient is an individual or a company. Beyond exempting monthly incomes up to 5,000 reais, the bill also eases the tax burden for earners up to 7,350 reais, covering much of Brazil's middle class, a key voter bloc that has turned conservative in recent years and that Lula's Workers Party hopes to lure back. The bill further mandates that, beginning in January, any dividend payment exceeding 50,000 reais in a single month from the same company to the same individual will be subject to a 10% withholding tax. Arthur Lira, the bill's sponsor in the Lower House, estimated that the expansion of tax exemptions would reduce revenue by 31.3 billion reais next year, offset by new income tax collections of 25.2 billion reais and 8.9 billion reais from foreign-sent dividend taxation. ($1 = 5.3203 reais) https://www.reuters.com/world/americas/brazil-confident-senate-will-back-taxing-wealthy-offset-middle-class-exemptions-2025-10-02/

2025-10-02 12:48

LONDON, Oct 2 (Reuters) - The pound steadied on Thursday, struggling to rise against a weakening dollar, as traders have started to assess the impact the UK November budget will have on the economy and sterling. While the dollar came under broad pressure after the U.S. government shut down over funding, adding to investor caution around U.S. assets, sterling steadied against the greenback at 1.3478, after touching a one-month low on Wednesday. Sign up here. It fell 0.13% against the euro to 87.15 pence. UK finance minister Rachel Reeves' annual budget is due in eight weeks and she will try to stay on course for her fiscal targets although higher taxes would weigh on an already fragile economy. There is "a signal of markets starting to price in some GBP risk premium ahead of the UK budget. While the (budget) announcement is only on 26 November, it’s widely expected that many bits of the budget will be released to the media in the weeks before," said ING strategist Francesco Pesole. Reeves is expected to raise taxes again, having ordered employers to pay around 25 billion pounds ($33.38 billion) more in social security contributions in her first budget last year. "Sterling looks set to consolidate near 1.35, but conviction is weaker. UK fiscal dynamics are front and centre as the Autumn Budget looms," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. "Higher borrowing costs are narrowing fiscal headroom, raising the risk of tax hikes, spending cuts — or both. That prospect doesn’t exactly bolster appetite for the pound," she said. In the meantime, a Bank of England monthly survey on Thursday said British businesses have the weakest hiring intentions since 2020 and expect the fastest consumer price inflation since early 2024. Investors are also focused on how the central bank will react to inflation fears. Money markets are pricing in two BoE rate cuts next year. Britain's inflation rate had become persistently high, although that did not mean further interest rate cuts were completely off the table, said interest rate-setter Catherine Mann. https://www.reuters.com/world/uk/sterling-pauses-traders-already-second-guessing-november-budget-2025-10-02/

2025-10-02 12:48

DUBAI, Oct 2 (Reuters) - Raising funds from oil and gas infrastructure assets, while retaining control, is now firmly part of the playbook of Gulf Arab national oil companies, helping them raise billions of dollars. Below are key facts about such deals. Sign up here. UAE'S ADNOC In 2019, ADNOC created a new subsidiary, ADNOC Oil Pipelines, and leased its interest in 18 pipelines for 23 years to a consortium including BlackRock and KKR, raising $4 billion. The investors acquired a 40% stake in the entity, with ADNOC retaining 60% and full operational control. The following year, in 2020, ADNOC formed ADNOC Gas Pipelines and sold a 49% stake to a group of six investors: Global Infrastructure Partners (GIP), Brookfield Asset Management, Singapore’s sovereign wealth fund GIC, Ontario Teachers’ Pension Plan Board, NH Investment & Securities, and Italy's Snam. This deal raised $10.1 billion. In April 2024, Abu Dhabi's Lunate acquired the 40% oil pipeline stake from BlackRock and KKR. Snam, which held an indirect stake in the gas pipeline entity, announced in January 2024 that it had sold its share to Lunate as well. Lunate is an Abu Dhabi-based alternative investment manager and is part of a business empire overseen by Sheikh Tahnoun bin Zayed Al Nahyan, the UAE's national security adviser. KKR on Tuesday bought a minority stake in ADNOC Gas Pipeline. SAUDI ARAMCO In 2021, Aramco created Aramco Oil Pipelines Co. and sold a 49% stake to a consortium led by EIG Global Energy Partners for $12.4 billion under a 25-year lease. Later that year, it formed Aramco Gas Pipelines Co. and sold a 49% stake to a group led by BlackRock and Hassana Investment Co. for $15.5 billion. In 2025, Aramco signed an $11 billion lease-and-leaseback deal for infrastructure around its Jafurah gas project with a consortium led by Global Infrastructure Partners, which BlackRock bought in 2024. Aramco retained majority ownership and operational control in all deals. Reuters reported in July that Aramco is looking to sell up to five gas-fired power plants that could raise around $4 billion, part of a broader effort to free up funds that could generate tens of billions of dollars. OMAN'S OQ In 2023, Oman sold a 49% stake in its gas pipeline unit, OQ Gas Networks, via an IPO, raising about $750 million. Cornerstone investors included Saudi Arabia's Public Investment Fund, Qatar Investment Authority and Belgium's Fluxys. OQ retained 51% ownership and operational control. BAHRAIN'S BAPCO Last year, Bapco Energies sold a minority stake in the Saudi-Bahrain oil pipeline to BlackRock's infrastructure fund. The deal marked Bahrain's first infrastructure monetization. Its value was not disclosed. Bapco retained majority ownership and operational control. KUWAIT PETROLEUM CORPORATION (KPC) KPC is exploring a lease-leaseback deal for its oil pipeline network in a deal that would mirror monetization models used by ADNOC and Aramco, KPC CEO Sheikh Nawaf Saud Nasir Al-Sabah has said. He did not disclose figures. Bloomberg had reported the deal involves 13 pipelines and could raise $5 billion to $7 billion and Centerview Partners is advising on the potential transaction, citing people familiar with the matter. KPC is expected to retain operational control. BlackRock will open an office in Kuwait and has appointed Ali AlQadhi to lead operations in the country, Kuwait's state news agency said in September. It was not immediately clear if BlackRock would be involved in KPC's potential deal and the fund previously declined to comment. https://www.reuters.com/business/energy/gulf-oil-giants-raise-billions-infrastructure-deals-2025-10-02/

2025-10-02 12:43

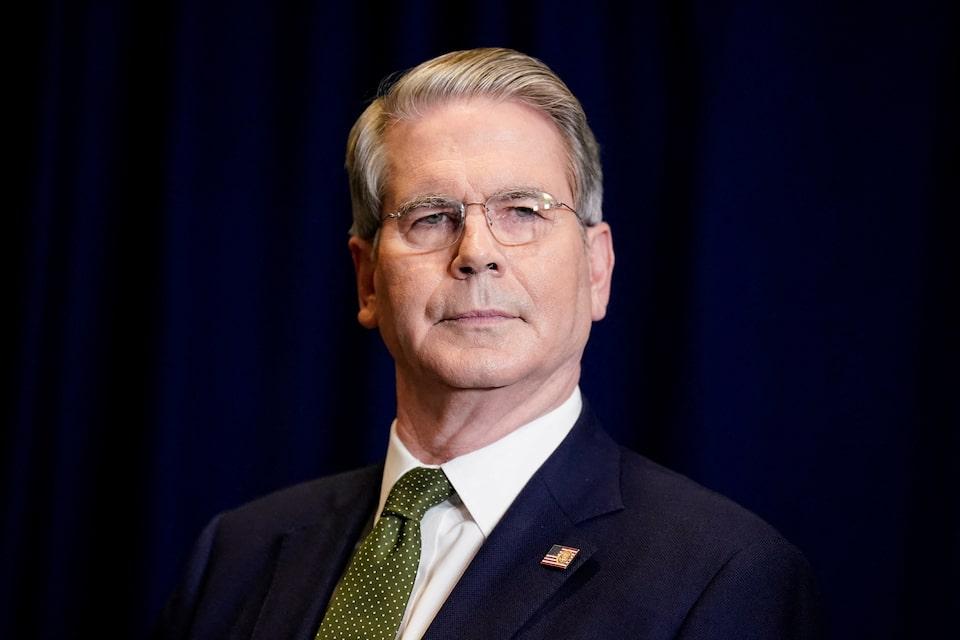

WASHINGTON, Oct 2 (Reuters) - The United States is not putting money into Argentina but only providing a credit swap line, Treasury Secretary Scott Bessent said on Thursday. "What the U.S. is doing, just to be clear: We are giving them a swap line. We are not putting money into Argentina, OK?" Bessent said in an interview with CNBC. Sign up here. U.S. President Donald Trump will meet , opens new tab with Argentina's President Javier Milei in two weeks, Argentina said on Tuesday, as Milei seeks to secure the credit swap line from the U.S. that has rankled some Republicans as the South American nation offloaded billions of dollars in soy to China. Earlier, Bessent said in an X post that he was looking forward to meeting Argentine Economy Minister Luis Caputo's team in Washington to advance discussions on options for financial support. "The @USTreasury is fully prepared to do what is necessary, and we will continue to watch developments closely," Bessent said in his post. The United States did not maintain strategic interests in the Western Hemisphere in recent decades and now has a chance to support Argentina, Bessent said. He praised Milei as having done a "fantastic job" and said he was sure the right-wing leader would do well in upcoming elections. "Now Argentina is a beacon down there. And there's a chance now for many other countries to come along - Bolivia, Ecuador, I think Colombia - after the elections. So what you don't want are these failed economic models," Bessent said. Argentina votes on October 26 in legislative midterm elections, in which Milei's party aims to gain seats to strengthen its minority position. https://www.reuters.com/world/americas/argentina-is-beacon-western-hemisphere-uss-bessent-says-2025-10-02/