2025-10-01 06:24

LONDON, Oct 1 (Reuters) - The zinc market has just woken up to the fact that London Metal Exchange inventory is now so depleted it would cover less than a day's worth of global consumption. LME time-spreads have turned volatile and the cash premium over the three-month price flared out to $60 per metric ton last week, a level last exceeded in 2022. Sign up here. Everything suggests a market that is in acute supply deficit. Yet, the International Lead and Zinc Study Group estimates a global surplus of 72,000 tons over the first seven months of the year. The bad news for LME short position holders is that the excess metal appears to be in China. The good news is that a widening arbitrage window with the Shanghai market may facilitate a global rebalance. DISAPPEARING ZINC LME registered zinc stocks have collapsed from 230,000 tons to 40,850 tons since the beginning of the year. Available tonnage, excluding metal awaiting physical load-out, stands at just 30,625 tons, which is a drop in the 13.5-million-ton global zinc ocean. The LME off-warrant cupboard is equally bare at 12,087 tons of deliverable metal scattered through the warehouse network. The zinc market is no stranger to stocks churn, but this time around, much of what has been drawn out of LME warehouses appears to have left the system entirely. Exports of zinc from Singapore, which has held most of the LME inventory for the last couple of years, have been accelerating since the fourth quarter of 2024. The pace quickened to over 50,000 tons in August, bringing year-to-date exports to 240,000 tons. The metal has been shipped to a wide range of Asian destinations but the August tally also included 20,000 tons heading for the United States. Singapore's imports, meanwhile, have dropped to minimal levels, suggesting there is little left even in off-market storage that could be delivered against LME positions. SMELTER BOTTLENECK LME stocks appear to have been drawn down to fill gaps in the Western supply chain caused by a string of smelter problems. Although global mined zinc production rose by a robust 6.3% year-on-year in the first half of 2025, refined production fell by 2.1%, according to the International Lead and Zinc Study Group. The group attributed the decline to lower smelter output in Brazil, Kazakhstan and Japan, the latter due to the closure of Toho Zinc's (5707.T) , opens new tab Annaka plant. There have also been production curtailments at South Korea's Seokpo smelter, Nyrstar's (NYR.BR) , opens new tab Hobart plant in Australia and Glencore's (GLEN.L) , opens new tab Italian operations. Chinese smelters, by contrast, have been ramping up production since the second quarter of the year as treatment charges rise on the back of improved raw materials availability. The country's imports of zinc concentrates jumped by 43% year-on-year over January-August and are on track to break all previous annual records. Treatment charges for imported material turned negative toward the end of last year but have risen to $87.50 per ton, according to local data provider Shanghai Metal Market. Improved profitability has seen China's national output of refined production rise by 7% year-on-year through August, according to SMM. IMBALANCED MARKET The contrast between China and the rest of the world is currently a stark one in the zinc market. While LME stocks have been whittled away, Shanghai Futures Exchange inventory has been steadily rising. Deliverable stocks of 100,544 tons are up by 70,300 tons on the start of the year and have reached their highest level since August 2024. The imbalance between East and West is manifest in a widening pricing gap between Shanghai and London prices. Shanghai is currently trading at a spot discount of over $330 per ton to the LME, the widest gap since 2022-2023, when China last turned net exporter of refined zinc. Analysts at BNP Paribas argue that the arbitrage window needs to open a bit further to make exports profitable, but the direction of travel is clear and the bank expects "a growing export incentive over the next two to three months". Those running short positions on the LME won't care where the extra units come from but right now it looks as if it is Chinese producers who will be coming to their rescue. The opinions expressed here are those of the author, a columnist for Reuters. https://www.reuters.com/markets/commodities/depleted-lme-zinc-stocks-may-need-chinese-booster-2025-10-01/

2025-10-01 06:09

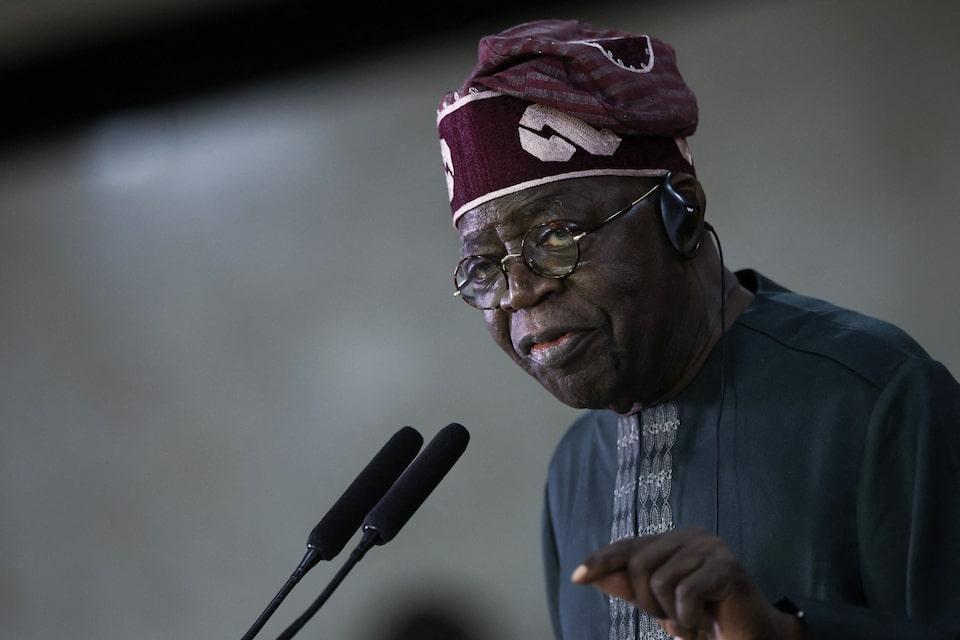

LAGOS, Oct 1 (Reuters) - Nigerian President Bola Tinubu declared on Wednesday that the “worst is over” following a series of painful economic reforms that have left millions struggling with rising costs and deepening poverty. In a national address marking Nigeria’s 65th Independence Day, Tinubu defended his administration’s decision to scrap fuel subsidies and unify the foreign exchange rate - moves that triggered inflation and widespread public anger but, he said, were necessary to “reset” the economy. Sign up here. “Less than three years later, the seeds of those difficult but necessary decisions are bearing fruit,” Tinubu said. He cited second-quarter GDP growth of 4.23% - the fastest in four years - and a decline in inflation to 20.12% in August, the lowest in three years. Tinubu also pointed to five consecutive quarters of trade surpluses, a rebound in oil production to 1.68 million barrels per day, and a rise in external reserves to $42.03 billion - the highest since 2019. The president said the government had disbursed 330 billion naira ($222.90 million) to eight million vulnerable households under its social investment programme and was expanding infrastructure across rail, roads, airports, and seaports. However, critics questioned the transparency of the cash transfer scheme. Two weeks ago, the finance minister announced the disbursement, sparking calls for a public register of beneficiaries. Despite Tinubu’s upbeat tone, the IMF’s most recent Article IV assessment warned of persistently high inflation and worsening poverty. Over 129 million Nigerians - more than half the population - live below the poverty line, while funding cuts by international donors have forced the World Food Programme to shut down 150 nutrition centres in the conflict-hit northeast. “We are racing against time,” Tinubu said, even as critics including opposition party leader Peter Obi argue that his spending priorities have not matched the scale of the country’s humanitarian and economic challenges. The speech comes amid growing labour unrest over the recent dismissal of 800 workers at the privately owned Dangote Oil Refinery for unionising. The dispute has disrupted power supply and could threaten the oil production gains touted by Tinubu. ($1=1,480.4900 naira) https://www.reuters.com/world/africa/nigerias-president-says-worst-is-over-independence-day-amid-worsening-hardship-2025-10-01/

2025-10-01 06:07

Oct 1 (Reuters) - Rescuers worked through the night, battling havoc from severe weather and floods in Ukraine's southern city of Odesa and the surrounding district that killed nine people, a child among them, the state emergency service said on Wednesday. The workers helped evacuate people from water traps, shift cars, pump water from buildings, and trace a missing girl who was found in the early hours, the service said on the Telegram messaging app. Sign up here. It posted pictures of passengers being taken off a flooded bus and cars pulled from the water. "In just seven hours, almost two months’ worth of rain fell in Odesa," Mayor Hennadiy Trukhanov said on Telegram earlier. "No stormwater drainage system can withstand such a load." A total of 362 people were rescued in the continuing effort, the emergency service added. https://www.reuters.com/business/environment/ukraine-rescuers-battle-weather-havoc-that-kills-nine-odesa-2025-10-01/

2025-10-01 06:02

US stocks gains, Europe outperforms Healthcare stocks rise Dollar slips for fourth day, gold hits record high NEW YORK/LONDON, Oct 1 (Reuters) - U.S. stocks and the dollar treaded water in choppy trade on Wednesday, while gold struck a record high as the U.S. government shut down much of its operations, delaying the release of crucial jobs data which could muddy the interest rate outlook. U.S. private payrolls data that showed employment fell by 32,000 last month, bucking expectations for a 50,000 gain, fueled concerns that the U.S. labor market might be weakening. Sign up here. While weak employment data would typically add to bets on interest rate cuts that could support equity markets, the outlook became less clear with this week's government shutdown. The U.S. Labor Department's more comprehensive and closely followed September employment report will not be published on Friday due to the shutdown. That would complicate the Federal Reserve's ability to assess U.S. economic health as it weighs potential rate cuts. "However you want to look at it ... it's a weakening labor market and the Fed is likely to continue on their cutting path through year-end in our view," said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments in Boston. "Not having other data points does make this harder for the Fed." With no clear path out of the impasse over a funding deal, agencies warned the government shutdown would lead to the furlough of 750,000 federal workers at a daily cost of $400 million. The S&P 500 (.SPX) , opens new tab finished 0.3% higher after a choppy session, the Nasdaq Composite (.IXIC) , opens new tab also flipped into a gain of 0.4%, while the Dow Jones Industrial Average (.DJI) , opens new tab was flat. Moderate gains on Wall Street helped the MSCI All-World index .MIWD00000PUS , opens new tab to gain 0.4%. Gold prices climbed to $3,895 an ounce, hitting a record high for a third straight session, while the benchmark U.S. 10-year Treasury yield fell 5 basis points to 4.1%. European shares bucked the global trend, with the pan-continental STOXX 600 (.STOXX) , opens new tab rising 1.2% to hover near a record high. Britain's FTSE 100 and Switzerland's SMI (.SSMI) , opens new tab outperformed, boosted by healthcare stocks which jumped on expectations they could avoid excessive U.S. import tariffs after President Donald Trump struck a deal with Pfizer (PFE.N) , opens new tab on prescription drug prices. The healthcare sector has the third largest weighting in the STOXX 600. "There's a lot of political risk in the healthcare sector, but as you see this risk ease, investors will be buying," said Lars Skovgaard, senior investment strategist at Danske Bank. "I think this could give some support to European shares over the next couple of days." SHUTDOWN TO DELAY DATA Without Friday's nonfarm payrolls report, investors may place greater weight on the ADP National Employment Report. "The general idea is that these things have a short-term impact, not a long-term one, and markets know it," said George Lagarias, chief economist at Forvis Mazars. "The lack of data will mean we assume the trend we have will continue. If there is no evidence of a strong economic rebound, then the chances are that the Fed will continue on its present course." Futures now imply a 95% chance of a Fed rate cut in October, up from 90% from a day earlier, with around a 75% probability of another move in December. Anthony Saglimbene, chief market strategist at Ameriprise, said that if the shutdown persists, September inflation reports in mid-October could also be affected. "An extended period where the U.S. Bureau of Labor Statistics is not operating at full strength could affect data collection efforts for other reports, which may impact the quality of the data," he said in a note. Japan's Nikkei (.N225) , opens new tab dropped 0.9% on Wednesday after an 11% surge the previous quarter. South Korea's shares (.KS11) , opens new tab rose 0.9%, adding to the 11.5% gain in the last quarter, after data showed its exports rose at the fastest pace in 14 months in September. DOLLAR FALLS In foreign exchange markets, the dollar index slipped for a fourth straight day and was last down 0.1% to 97.78. The euro was unchanged at $1.1729, while sterling was up 0.2% at $1.3478. The dollar was off 0.6% at 147.12 yen , after a Bank of Japan survey showed confidence among big Japanese manufacturers improved for a second quarter, heightening the chance of an interest rate hike as soon as this month. Oil prices fell further after two consecutive days of losses as investors weighed potential OPEC+ plans for a larger output hike next month. U.S. crude was down about 0.7% at $61.93 a barrel, while Brent was 0.8% lower at $65.5. https://www.reuters.com/world/china/global-markets-wrapup-1-2025-10-01/

2025-10-01 05:58

African Growth and Opportunities Act expired on Tuesday Law lapsed despite support for renewal from lawmakers and White House Low-margin businesses like apparel to struggle to cope AGOA's benefits to exporters blunted by Trump tariffs NAIROBI/JOHANNESBURG, Oct 1 (Reuters) - The lapse of a flagship U.S. trade initiative with Africa that expired overnight is putting scores of businesses on the continent and hundreds of thousands of jobs at risk, raising fears that even a promised extension may come too late. There is bipartisan support in Washington for a renewal of the African Growth and Opportunity Act (AGOA), which waived U.S. duties on thousands of goods from sub-Saharan African countries for the past 25 years. Sign up here. But companies that invested in factories and farms to take advantage of duty-free access say even a temporary lapse will harm operations they built over many years, especially as they already face country-specific tariffs Trump imposed in August. Pankaj Bedi, chairman of Nairobi-based apparel company United Aryan, which supplies Target (TGT.N) , opens new tab and Walmart (WMT.N) , opens new tab, predicted some immediate layoffs as tariffs as high as a third of the value of textiles exports snap back into place. "Companies do not have the sustainability to take any kind of losses," Bedi told Reuters. He said some "responsible buyers" have agreed to absorb temporary losses in hopes that AGOA would be renewed retroactively but that if an extension is not agreed by November, "such support will no longer be possible". FEARS CHINA WILL 'TAKE OUR PLACE' In 2023, the last year for which data is available, Africa exported $9.7 billion in goods to the U.S. under the act. Hundreds of thousands of African jobs are estimated to depend on it. Some analyses question the initiative's effectiveness, noting beneficiary countries' share of U.S. imports has fallen since it was enacted in 2000, but it continues to enjoy political support. Republican and Democratic lawmakers describe it as a pillar of U.S. diplomatic relations and a counterweight to Africa's main trade partner, China, which announced in June it would remove all tariffs on 53 out of 54 African states. Adrian Smith, a Republican on the House Ways and Means Committee that oversees AGOA, told Reuters the law countered China's influence, and demonstrated "America's commitment to Africa's young, growing population". The U.S. Chamber of Commerce also told Congress in a letter last month that renewal would encourage businesses to diversify supply chains away from China. Democratic Senator Chris Coons, who co-sponsored a bipartisan bill in 2024 to extend it by 16 years, said: "If we fail to re-authorise AGOA, China will not hesitate to take our place." That bill, however, was overshadowed by other priorities in the final months of Joe Biden's Democratic administration, while the Trump administration has focused on leveraging tariffs in bilateral trade deals, raising doubts about the pact's future. Attaching a renewal proposal to other legislation would be the fastest way to secure an extension, but the Trump administration has opposed adding "extraneous" provisions to larger bills, according to two sources involved in the discussions. The administration, after a long silence on the matter, said this week it supported a one-year extension. Responding to Reuters' questions about AGOA, the White House said it backed a temporary extension, without elaborating. The Office of the U.S. Trade Representative did not respond to requests for comment. FOR SOME COUNTRIES, TRUMP TARIFFS NEGATE MUCH OF AGOA IMPACT The bilateral U.S. tariffs in place since August mean the impact of AGOA will vary highly from country to country. For example, South Africa, the continent's most advanced economy accounting for half of exports under AGOA, was hit with a 30% across-the-board tariff. That means that even with the pact's waivers, many goods - especially wine, citrus and cars - became too expensive to export to the U.S., rendering renewal a moot point. "These tariffs have pretty much changed the narrative completely," said Maryna Calow, Wines of South Africa spokesperson. She said the industry was now looking to increase sales to Canada to exploit a 25% retaliatory tariff the country has placed on the U.S., as well as to China and Japan. For automakers, export volumes to the United States have tumbled by 83% so far this year, National Association of Automobile Manufacturers of South Africa chief economist Paulina Mamogobo told Reuters. "Any benefits the industry previously derived from AGOA have essentially been nullified," she said. However, for countries such as Kenya, which has the minimum 10% tariff, or Madagascar and Mauritius, which have 15%, otherwise exportable goods become unprofitable without AGOA, jeopardising tens of thousands of jobs. In aggregate, AGOA is projected to have limited mitigating effect on Trump's tariffs, data from the U.N.-backed International Trade Centre shows. An ITC analysis shows that without AGOA bilateral tariffs will slash exports from the 32 AGOA-eligible countries to the U.S. by 8.7% by 2029, a figure which only decreases to 8% with the pact back in place. Moreover, experts say AGOA needs major reforms to live up to its promise. Some companies flag the requirement that eligible countries be re-certified each year as a source of uncertainty that deters long-term investments. "The question for me is not whether AGOA should be simply renewed," said Aude Darnal, a researcher on U.S. foreign policy. "It's ... what are the steps that are being taken to actually address the challenges?" https://www.reuters.com/sustainability/african-exports-face-immediate-damage-lapse-us-trade-initiative-2025-10-01/

2025-10-01 05:47

MUMBAI, Oct 1 (Reuters) - India's central bank on Wednesday proposed steps to boost the Indian rupee’s , global use, including allowing local banks to lend in rupees to businesses in neighboring countries and setting official reference exchange rates for major trading partner's currencies. Reserve Bank of India Governor Sanjay Malhotra announced the measures alongside the central bank's monetary policy decision on Wednesday wherein India's rate-setting panel decided to keep rates unchanged, along expected lines. Sign up here. "We have been making steady process in this regard," Malhotra said, referring to the rupee's internationalization, and said that under the proposed changes, authorized Indian banks will be permitted to make rupee-denominated loans to non-residents from Bhutan, Nepal and Sri Lanka, for cross-border trade transactions. Malhotra also said that transparent reference rates for currencies of India's major trading partners would be established, to facilitate rupee-based transactions. "The objective is to minimizes the use of crossing currencies to get rates. That'll help both our currency and the other currency," RBI Deputy Governor T Rabi Sankar said in a press-conference post the announcement of the central bank's policy decision. The Indonesian rupiah and the United Arab Emriates dirham are among the currencies the central bank is looking to establish reference rates for, Sankar said. "This is a case where the reference rate has to be shown first and the market has to pick up from there," he said. The RBI currently publishes reference rates for the U.S. dollar, euro, Japanese yen and sterling. The central bank also proposed to allow foreign entities to invest surplus rupee balances in their so-called vostro accounts into corporate bonds and commercial papers. The move would widen the permitted uses for funds kept in these accounts. Vostro accounts are typically held by a domestic bank on behalf of a foreign bank for trading partners to hold rupee-denominated balances from trade transactions. In August, the central bank had allowed foreign investors to invest their surplus vostro balances into central government securities. https://www.reuters.com/world/india/indias-central-bank-proposes-boost-international-usage-rupee-2025-10-01/