2025-09-30 12:31

Sept 30 (Reuters) - OPEC+ is considering accelerating output hikes by 500,000 barrels a day over the next three months, Bloomberg News reported on Tuesday, citing a delegate. Reuters could not immediately verify the report. Sign up here. https://www.reuters.com/business/energy/opec-considers-boosting-pace-its-oil-output-hikes-bloomberg-news-reports-2025-09-30/

2025-09-30 12:31

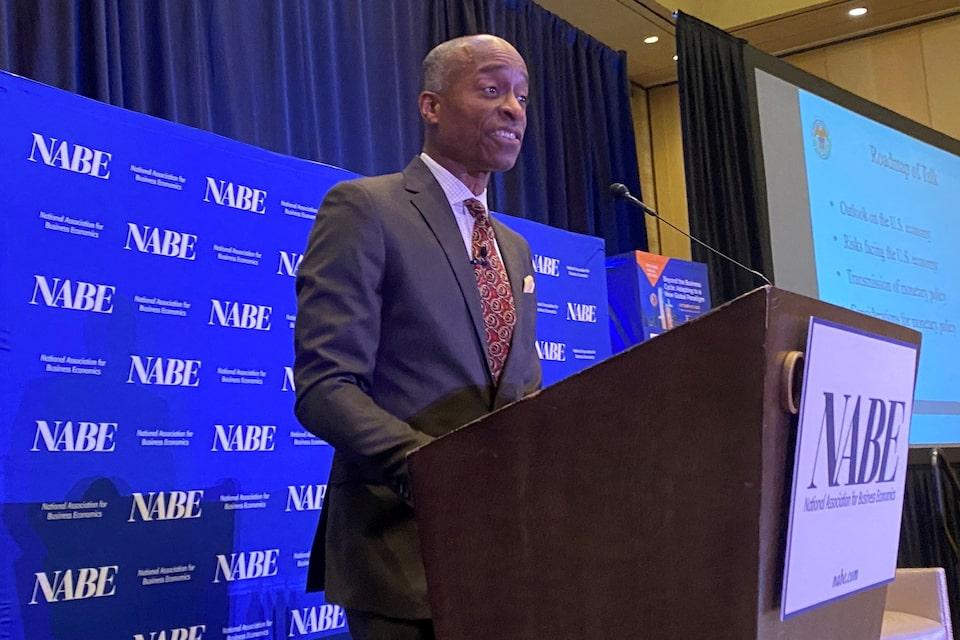

Jefferson's VC term ends in 2027, governor term not until 2036 Biden appointee says decision is one for the future Trump could wait as late as 2028 for a fourth Fed appointee HELSINKI, Sept 30 (Reuters) - U.S. Federal Reserve vice chair Philip Jefferson, a potentially pivotal figure in President Donald Trump's effort to appoint a majority of the Fed's 7-member Board of Governors, said on Tuesday he has not yet considered whether to keep his board seat after his vice chair term ends in September 2027. Separate from his 4-year stint as vice chair, Jefferson holds a board seat with a term that runs until 2036, well after Trump's term ends following the 2028 presidential election. Sign up here. "I have not given thought to that at all. My focus is to do the job that I currently have right now to the best of my ability," Jefferson, an appointee of former President Joe Biden, said at an economics conference in Finland. Asked about his plans, he said that "pertains to something that is far in the future, and it is not something that I think about when I come to work every day." TRUMP SEEKING INFLUENCE AT FED Trump since his January inauguration has tried to gain influence at the central bank, initially with demands for lower interest rates and threats to fire Fed chair Jerome Powell, then with more overt moves including an attempt to fire Governor Lisa Cook. Rebuffed by federal judges so far, Cook's firing is pending before the U.S. Supreme Court. The Fed's structure is an impediment to Trump's aims. To limit the influence of electoral politics on monetary policy, the Fed board is set up with seven, staggered, 14-year appointments, one expiring every two years, so no U.S. president can appoint a majority in a single four-year presidential term. TRUMP COULD WAIT AS LATE AS 2028 TO GET A FED MAJORITY Three of the seven current governors were appointed by Trump either in his first or current term. Depending on the outcome of Cook's case and on Jefferson's decision, the president may have to wait as late as January of 2028, his last full year in office, to get a fourth opening. That is when Powell's term as a governor expires, though his term as chair ends in May. https://www.reuters.com/business/feds-jefferson-says-he-has-not-considered-whether-remain-governor-after-vice-2025-09-30/

2025-09-30 12:27

FRANKFURT, Sept 30 (Reuters) - ABO Energy (AB9.DE) , opens new tab has mandated private bank Metzler to advise it on a deal that could see the German renewables firm's founders cede control to an outside investor, a spokesperson for the company said on Tuesday. ABO Energy, which builds solar and wind farms, on Friday said that it wanted to also become an operator of renewable energy assets, adding it was in discussions with potential investors and that talks could include a capital increase. Sign up here. As a result, a possible deal could result in the families of the group's two founders reducing their combined stake to less than 25% from 52% currently, and also reverse a change in its legal form that was carried out last year, it said. ABO Energy, which has a development pipeline of 34 gigawatts and is also 10%-owned by utility Mainova (MNVG.F) , opens new tab, is currently valued at around 329 million euro ($386 million). Activist investor and ABO Energy shareholder Enkraft last year sought to appoint a special auditor to examine whether the company informed shareholders too late about the legal form change, which effectively consolidated power among its main owners. Enkraft said that the application was still with the Frankfurt district court and had not yet been decided upon. ($1 = 0.8524 euros) https://www.reuters.com/sustainability/climate-energy/abo-energy-works-with-metzler-potential-controlling-stake-sale-2025-09-30/

2025-09-30 12:17

WINDHOEK, Sept 30 (Reuters) - Namibia will carefully consider whether or not to acquire a stake in De Beers as the diamond price slump persists, local media reported on Monday, citing the country's deputy prime minister. The diamond giant has been put up for sale by Anglo American (AAL.L) , opens new tab as the parent company restructures its portfolio to focus on copper and iron ore. Anglo said on September 9 that it was pursuing a merger with Canada's Teck Resources (TECKb.TO) , opens new tab to create a copper heavyweight. Sign up here. De Beers had by June attracted interest from at least six prospective investors, while Angola's state diamond company Endiama announced on September 24 it had bid for a minority stake in the company. Angola has said it wants a broad ownership structure for De Beers, which would include Botswana, South Africa and Namibia - countries where the company operates. The Namibian government and De Beers each own 50% of Namdeb Holdings, which produced 2.2 million carats of rough diamonds in 2024, about 9% of De Beers' group output last year. Namibia's Deputy Prime Minister Natangwe Ithete, who is also responsible for mines, told online financial news outlet The Brief that the country needed to assess the diamond industry, whose prospects have been dimmed by synthetic diamonds and weak demand. "To be honest, the diamond industry is going down. It is not a secret that the industry is under pressure and affected by the so-called lab diamonds, the synthetic diamonds," Ithete said. "So this is something we need to study very carefully, to determine whether it is worth pursuing or not," he added. Neighbouring Botswana, which holds a 15% stake in De Beers, is also pursuing a controlling interest in the company. Anglo American values De Beers at about $4.9 billion, after recording $3.5 billion in impairments over the past two years, but current market pressures may lead to lower offers. https://www.reuters.com/world/africa/namibia-cautious-about-taking-up-stake-de-beers-local-media-report-2025-09-30/

2025-09-30 12:13

BRASILIA, Sept 30 (Reuters) - Brazil's public finances performed better than expected in August, with debt levels remaining stable and the primary deficit coming in below forecasts, central bank data showed on Tuesday. The gross public sector debt of Latin America's largest economy stood at 77.5% of gross domestic product (GDP), unchanged from the previous month, while economists polled by Reuters had expected the ratio to rise to 78.0%. Sign up here. According to the central bank, the heavy interest bill for the month - typically a factor pushing debt higher - was offset by nominal GDP growth, net debt redemptions and the impact of currency appreciation. The public sector posted a primary deficit of 17.26 billion reais ($3.24 billion) in August, narrower than the 21 billion reais shortfall projected in the Reuters poll, and below the 21.43 billion reais deficit recorded a year earlier. As a result, the 12-month rolling primary deficit fell to 0.19% of GDP in August from 0.22% in July. The nominal budget balance, which includes interest payments, showed a deficit of 91.52 billion reais for the month, also smaller than the 95 billion reais projected by economists in the poll. Over 12 months, the nominal deficit reached 7.81% of GDP, down from 7.85% in the previous month. ($1 = 5.3219 reais) https://www.reuters.com/world/americas/brazils-public-finances-outperform-expectations-august-2025-09-30/

2025-09-30 11:59

FRANKFURT, Sept 30 (Reuters) - The European Commission is going too far in easing securitisation rules for banks, particularly for more complex and potentially riskier transactions, European Central Bank supervisor Pedro Machado said on Tuesday. Securitisations, whereby a bank packages loans to companies or households and sells them to investors as securities, were at the heart of the global financial crisis of 2007-08. Europe has yet to fully recover from that crash. Sign up here. The European Commission proposed streamlining the rules governing securitisation in June to try to release capital for lending and help Europe compete financially with the United States. 'INHERENT RISKS' FROM SECURITISATION But the ECB, which supervises the euro zone's largest banks, says some of the proposed changes are raising risks. "We must remember that the practice of securitisation entails inherent risks to financial stability, such as agency and model risks, which are more difficult to capture in more complex securitisation structures," Machado, a member of the ECB's Supervisory Board, said at a financial event. He said there was "no intrinsic link between securitisation and additional lending". He also said that, although the securitisation market is smaller in Europe than in the United States, that did not capture the rapid growth of synthetic securitisations in the EU. These are essentially a guarantee sold on several tranches of a loan portfolio in return for a fee. As securitised loans remain on the balance sheet of the bank, these transactions do not provide any fresh funding. The Commission's proposed changes include investors no longer needing to double-check from their side if the bank issuing the security fulfilled all the necessary requirements. Due diligence would also be more proportionate to the level of risk. There would also be less paperwork, fewer details required to be disclosed and a lighter transparency regime for private deals compared to transactions with public entities. Machado warned against inviting "complex securitisations and opaque structures" and said the new rules should support "simpler, more standardised and more resilient transactions". https://www.reuters.com/sustainability/boards-policy-regulation/ecb-says-eu-going-too-far-easing-bank-securitisation-rules-2025-09-30/