2025-09-30 10:38

MUMBAI, Sept 30 (Reuters) - The Indian rupee posted its fifth consecutive monthly fall against the U.S. dollar, and hit a record low on Tuesday, as trade tensions between India and the United States escalated, pushing up dollar demand. The rupee settled at 88.7875 against the U.S. dollar, its weakest ever closing level, and down slightly from its close of 88.7600 on Monday. Sign up here. Earlier in the day, the currency declined to an all-time low of 88.8000. The currency fell 0.7% in September, posting its fifth consecutive monthly decline, and is down a cumulative 5% in last five months. "The rise in the trade deficit, coupled with limited intervention from the central bank, has weighed on the rupee in recent months, despite its trade-weighted valuation suggesting it is undervalued," said Dilip Parmar, a foreign exchange research analyst at HDFC Securities. The future trajectory of the rupee will be highly dependent on foreign fund flows, developments in the U.S.-India trade agreements, and the dollar's reaction to the U.S. government shutdown, he added. "From a technical perspective, the outlook for the pair remains bullish, with 89.10 acting as immediate resistance and 88.20 as a key support level." Trade frictions between India and the U.S. has persistently strained the rupee in recent weeks. Washington's 50% punitive tariffs on Indian goods and the hike in H-1B visa fees, which is expected to hit India harder than any other country, have driven foreign investors to pull money out of equities. Analysts warn this U.S. decision could weigh on revenues in India's technology sector and trigger renewed equity outflows and further hurt the local currency. Foreign investors have accelerated their selling of Indian stocks following the visa fee increase, pulling more than $2 billion from the market over the past six sessions. The Reserve Bank of India has been stepping in to slow the rupee's slide without which the currency would have fallen much more, bankers said. https://www.reuters.com/world/india/india-rupee-slides-fifth-month-rising-trade-tension-with-us-hurts-2025-09-30/

2025-09-30 10:37

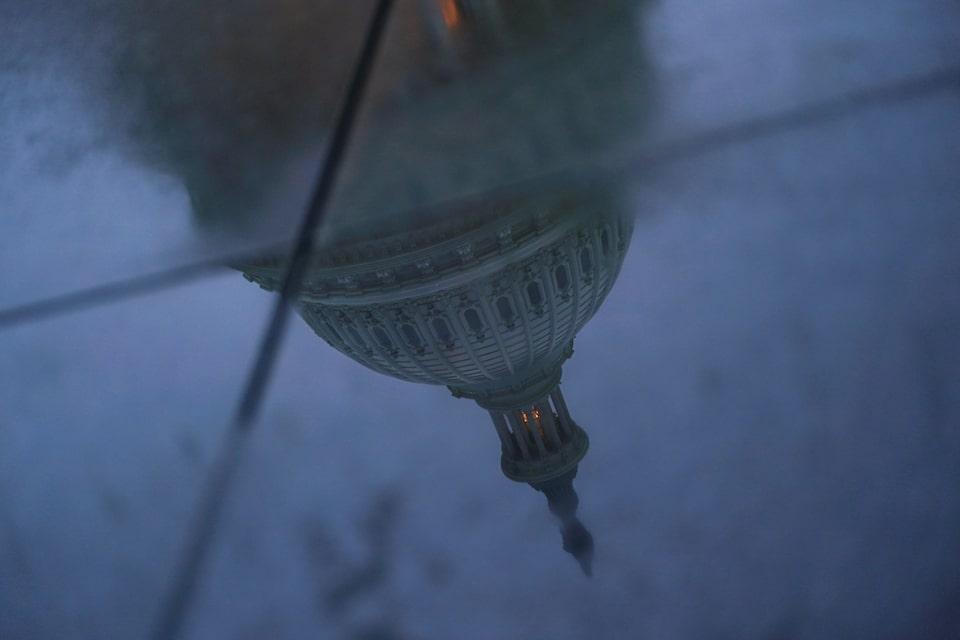

LONDON, Sept 30 (Reuters) - What matters in U.S. and global markets today By Mike Dolan , opens new tab, Editor-At-Large, Finance and Markets Sign up here. A looming U.S. government shutdown , opens new tab is casting a shadow over the final day of a stellar third quarter for most world markets. However, there appears to be little trepidation apart from fretting over a data vacuum that could be left by the likely postponement of the monthly jobs report , opens new tab. U.S. President Donald Trump and his Democratic opponents appeared to make little progress at a White House meeting aimed at heading off a government shutdown that could disrupt a wide range of services as soon as Wednesday - with Trump also sidetracked by the announcement of a peace plan for Gaza. "I think we're headed to a shutdown," Vice President JD Vance said. Budget standoffs have become relatively routine in Washington over the past 15 years and are often resolved at the last minute. But Trump's willingness to override or ignore spending laws passed by Congress has injected more uncertainty. After another record high on Monday, Wall Street stock futures pulled back a little ahead of Tuesday's bell and Treasury yields drifted lower as a funding hiatus undercuts government spending at the margin and Fed easing hopes rest on other labor market data this week. The dollar edged down, but gold fell back too. Quarter-end book squaring may have as much to do with the day's moves, with Japan's yen a big gainer ahead of October's possible interest rate rise and the Aussie dollar up as the Reserve Bank of Australia left rates unchanged. In today’s column, I discuss how the U.S. economy is estimated to be growing at nearly 4% even though job creation appears to be waning - and whether AI is the missing link. Today's Market Minute * Trump and his Democratic opponents appeared to make little progress at a White House meeting aimed at heading off a government shutdown that could disrupt a wide range of services as soon as Wednesday. * Trump said on Monday he would impose a 100% tariff on all films produced overseas that are then sent into the U.S., repeating a threat made in May that would upend Hollywood's global business model. * China's manufacturing activity shrank for a sixth month in September, an official survey showed on Tuesday, suggesting producers are waiting for further stimulus to boost domestic demand, as well as clarity on a U.S. trade deal. * While energy companies are retrenching in the face of a bleak near-term outlook for oil and gas, their investment plans suggest they believe the environment will shift dramatically by the end of the decade, writes ROI energy columnist Ron Bousso. * How often should companies report their financial performance? This debate is back in the headlines, but Income Securities Advisor , opens new tab publisher Marty Fridson argues that the current discussion fails to highlight one key problem that reducing the frequency of reporting could magnify. Chart of the day The combination of Federal worker cuts and this week's possible government shutdown make for a rough year for public sector employees, but their share of the overall workforce has been waning for decades. Today's events to watch * U.S. July house prices (9:00 AM EDT) Chicago September business surveys (09:45 AM EDT) US Sept consumer confidence (10:00 AM EDT) August job openings (10:00 AM EDT) Dallas Federal Reserve September service sector survey (10:30 AM EDT) * Federal Reserve Vice Chair Philip Jefferson, Dallas President Lorie Logan, Chicago Fed boss Austan Goolsbee and Boston Fed chief Susan Collins all speak; European Central Bank board members Piero Cipollone and Frank Elderson speak; Bank of England Deputy Governors Clare Lombardelli and Sarah Breeden and BoE policymaker Catherine Mann all speak * U.S. corporate earnings: Nike, Paychex, Lamb Weston Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-09-30/

2025-09-30 10:33

Brazil's energy surplus due to wind and solar investments outpacing infrastructure Renova plans $200 mln crypto mining project in Bahia Penguin, Enegix and Bitmain explore crypto opportunities in Brazil Concerns over water use and lack of regulations for crypto mining in Brazil SAO PAULO, Sept 30 (Reuters) - (This Sept. 30 story has been corrected to clarify that Auren Energia is controlled by two different companies, not a joint venture, in paragraph 14) Crypto mining companies are actively negotiating contracts with Brazilian electricity providers, such as Renova Energia (RNEW3.SA) , opens new tab, that would benefit from the South American country's surplus renewable power without burdening the grid during peak times. Sign up here. Following crypto heavyweight Tether, which announced in July an investment in the South American country, there are at least six negotiations for small and medium-sized enterprises, as well as one for a larger project of up to 400 megawatts (MW), people from six different companies told Reuters. Mining machines that solve complex mathematical problems to back crypto transactions have overloaded grids in multiple countries. However, in Brazil, where crypto mining hardly exists today, they could help address a chronic clean electricity oversupply problem, which has cost energy companies almost $1 billion in the last two years, according to wind and solar industry groups ABEEolica and Absolar. Tether, the world's largest digital assets company, said it is leveraging its recent acquisition of Adecoagro (AGRO.N) , opens new tab to tap its renewable energy, such as the electricity coming from sugarcane mills, to power a bitcoin mining operation in Brazil. Renewable energy supplier Renova told Reuters it is making one of the first major investments in the crypto sector, a $200 million mining project for an undisclosed client in the state of Bahia in the northeast of Brazil. The 100-MW venture consists of six data centers that will draw power from a wind farm. "We aim to expand the company and enter new markets," Renova CEO Sergio Brasil said. "We realized that by providing all the infrastructure (for crypto mining), we were one step ahead of our competitors." Crypto miners can rapidly scale operations up or down based on energy availability, providing a flexible consumer base for excess energy without straining the grid during peak demand periods. Brazil’s energy oversupply stems from years of government incentives that spurred a boom in wind and solar investments. But the pace of development has outstripped the expansion of transmission infrastructure, and some plants now waste as much as 70% of the power they generate. “There's tons of potential,” John Blount, one of the founders of Enegix, a crypto miner based in Kazakhstan, told Reuters. “We will try somehow to elaborate mobile data centers,” he added, that would be plugged directly into power plants. Enegix is looking into deals in Brazil's northeast, the region suffering from the biggest energy surplus, including tapping into solar and wind power in the state of Piaui. Penguin, which is based in Paraguay, one of the world's biggest crypto hubs, said it is negotiating projects too, but declined to share any details. And China's Bitmain, one of the largest manufacturers of mining equipment, is also exploring opportunities, according to an executive who asked not to be named. MINERS SEEN AS 'DIAMONDS' Energy providers have also expressed an interest in crypto projects. Casa dos Ventos, which partners with France's TotalEnergies (TTEF.PA) , opens new tab on wind power, and U.S.-based investment firm Global Infrastructure Partners' (GIP) Atlas Renewable Energy confirmed their intentions to Reuters. French utility Engie's subsidiary in Brazil (EGIE3.SA) , opens new tab and Auren Energia, a company that is controlled by Votorantim Energia and CPP Investments, Canada Pension Plan's global investment arm, are also looking into projects to monetize their unused energy, three sources told Reuters. The companies declined to comment. Providers look “at consumers like this as if they were diamonds,” said Raphael Gomes, a lawyer who has been working on several crypto projects. Companies are assessing different models, including buying equipment to mine on their own. In Bahia, electricity provider Eletrobras , the biggest in the country, is installing ASIC mining machines, along with a microgrid fed by a wind turbine, solar panels and batteries, for a pilot project. "We want to understand how this industry works," said Juliano Dantas, Eletrobras' vice president for innovation. The work could help energy providers prepare to enter the data center industry, which the Brazilian government , opens new tab is trying to attract as a strategy to grow the clean energy economy. There are concerns about the industry's water use, as some of the regions with the biggest amount of unused energy also suffer from droughts. Brazil also has infrastructure problems and lacks regulations for cryptocurrency mining. "We went after 400 MW — it was like a Sisyphean journey, a bit difficult," said Bruno Vaccotti, an executive at Penguin. "We're still exploring Brazil, but it's not that easy." https://www.reuters.com/business/energy/clean-energy-glut-draws-cryptocurrency-miners-brazil-2025-09-30/

2025-09-30 10:32

Sept 30 (Reuters) - India's financial crime fighting agency is conducting searches at six premises of Reliance Infrastructure (RLIN.NS) , opens new tab over alleged violation of foreign exchange laws, a source told Reuters on Tuesday. Reliance Infrastructure did not immediately respond to a Reuters request for comment. Sign up here. https://www.reuters.com/world/india/indias-financial-crime-agency-searches-six-premises-reliance-infrastructure-2025-09-30/

2025-09-30 10:25

MUMBAI, Sept 30 (Reuters) - India's imports of gold and silver nearly doubled in September from August, defying record high prices, as banks and jewellers rushed to build inventories ahead of festivals and escape higher taxes on imports, trade and government sources said. Higher imports by India, the world's second-biggest consumer of the precious metal, are set to support gold prices that hit records this week, even as demand languishes in top buyer China. Sign up here. The surge in imports could widen India's trade deficit and weigh on the weaker rupee , however. "Jewellers and banks have been clearing a lot of gold from customs over the past two weeks," said a government official, who sought anonymity as he was not authorised to talk to the media. "We haven't seen such a rush in years." Customs authorities have cleared a much larger volume of imports in September compared to August, he said, with even higher clearance expected on the last day of the month, ahead of a likely increase in the base import price of gold and silver. The base import price is used to calculate import duty, and the Indian government revises it every 15 days. Banks and bullion dealers are rushing to clear imports before the new base price takes effect on Wednesday, as it is likely to be higher after the recent global rally in prices, said Chirag Thakkar, chief executive of Amrapali Group, a leading precious metal importer in the western state of Gujarat. "Even with gold and silver hitting record highs, buyers kept chasing them, and investment demand surged," said Thakkar, whose company more than doubled its gold and silver purchases in September from the previous month. India spent $5.4 billion to import 64.17 tons of gold and $451.6 million for 410.8 tons of silver in August, trade ministry data shows. The government will release trade data for September in mid-October. Indian gold futures hit a record high of 116,900 rupees per 10 grams on Tuesday, while silver futures climbed to an all-time high of 144,330 rupees per kg. Jewellers, who had stayed away from gold and silver in recent months awaiting a price correction, are now paying a premium to stock up ahead of the festival season as prices hit fresh highs, said a Mumbai-based dealer at a private bullion-importing bank. In October, Indians will celebrate Diwali, the festival of lights, when it is considered auspicious to buy gold. Indian dealers this week quoted a premium of up to $8 per ounce over official domestic prices, inclusive of 6% import and 3% sales levies. "Strong buying from India is surprising the market, especially as China remains inactive at these levels," said a Singapore-based bullion dealer. In China, dealers widened discounts this month to $31 to $71 per ounce against global benchmark prices, the highest in several years. https://www.reuters.com/world/china/indias-september-gold-silver-imports-nearly-double-despite-record-prices-sources-2025-09-30/

2025-09-30 10:10

Foreign banks' cash declines in latest week Fed funds rate pinned at higher level of 4.09% Fed funds futures hit record open interest last week NEW YORK, Sept 30 (Reuters) - The effective federal funds rate - the interest banks charge each other for overnight loans to meet reserve requirements - rose unexpectedly last week ahead of quarter end, mainly on the back of shrinking cash balances at foreign banks, according to market participants. The latest fed funds rate of 4.09% was one basis point higher than the 4.08% seen after the Fed cut interest rates at the September 16-17 meeting. It's still within the Fed's range of 4.00% to 4.25% though. Sign up here. So-called foreign banking organizations or FBOs are major players in the roughly $100 billion fed funds market. The fed funds rate is central to the financial system as the official policy reference that the Federal Reserve sets a target range for each time it meets. The uptick in the fed funds rate comes shortly after the Federal Reserve lowered the range by 25 basis points, even as the market grows cautious over a potential liquidity crunch as September comes to a close, along with the quarter. The modest increase was the first outside of a Fed rate move since 2023. The effective fed funds rate is market driven and in recent years usually hovered 8 bps above the lower end of the fed's target range. Analysts noted that the ongoing buildup in the U.S. Treasury's cash balance has siphoned off reserves from the banking system, including those from FBOs. That cash effectively reduces bank reserves as it grows. The latest data showed total bank reserves, which include those from FBOs, have fallen to $3 trillion as of September 24, from $3.3 trillion a few weeks ago. FBO reserves represent about 38% of total reserves at the Fed, while U.S. banks hold 57% and credit unions have 5%, according to the New York Fed's Liberty Street Economics. FBO cash holdings, a proxy for reserves, fell to $1.176 trillion as of the latest Fed data from September 17, down $28 billion from a week earlier. Since August 20, their cash has declined by $255 billion. FBOs are major borrowers in the fed funds market, a source of liquidity that also provides opportunities for arbitrage. Foreign banks borrow at a lower rate of 4.09% from Federal Home Loan Banks (FHLBs) in the fed funds sector and then park the cash as reserves at the Fed earning an interest of 4.15%. That rate is called the interest on reserve balances (IORB. The decline in foreign bank reserves has tightened liquidity in the fed funds market, while reducing trading volume, analysts said. After averaging $113 billion per day from late April until September 12, the fed funds volume fell to an average of just $94 billion. On Friday, that volume was $95 billion. "If you look at the distribution of those reserves, they have come down, particularly from non-U.S. banks," said Joseph Abate, head of rates at SMBC Nikko Securities. "They don't have access to FHLB advances and they don't have an insured deposit base so their funding tends to be less stable and therefore they like to maintain thicker liquidity cushions." Domestic banks typically don't engage in this arbitrage because it increases their balance sheet size and triggers leverage ratio and liquidity coverage ratio (LCR) costs, analysts said. Those regulatory costs often eat up or exceed any spread between fed funds and IORB. BANK RESERVES AND QUARTER-ENDS There are obvious explanations for the decline in FBO holdings, analysts said, with such moves coinciding with the end of financial reporting periods, but they usually recover after that. The latest decline, however, began well before the end-August date and continued into September. Lou Crandall, chief economist at money market research firm Wrightson ICAP noted that "while some of this decline reflects a shift into alternative front-end investments like repos," the bulk could be attributed to deleveraging in the balance sheets of foreign banks. That said, the tick higher in the fed funds rate, while unexpected, did not surprise some analysts given that overnight repurchase (repo) rates are also trending firmer ahead of the end of the quarter. Repo rates, or the cost of borrowing overnight cash secured by Treasuries or other debt securities as collateral, tend to spike at the end of a quarter or year as primary dealers, mostly large banks, reduce their activity as middlemen in money market transactions due to higher balance sheet costs. FED FUNDS AND FUTURES MARKET The fed funds move has spurred selling of futures tied to it, analysts said, leading to record open interest at the CME, suggesting possibly tighter funding conditions in repos at the end of the quarter. Futures open interest hit a record last Tuesday, surpassing three million, CME data showed. It was at 2.9 million last Friday. There was also a massive block trade of 30,000 October contracts on fed funds futures seen on Wednesday, the equivalent of $1.25 million per basis point in risk. In the end, Josh Barone, wealth manager at Savvy Advisors, said the fed funds blip was all about plumbing, not policy, echoing other people's view that it likely reflects balance-sheet constraints at the end of the quarter. https://www.reuters.com/markets/us/foreign-bank-cash-decline-lifts-fed-funds-rate-ahead-quarter-end-2025-09-30/