2025-09-29 13:23

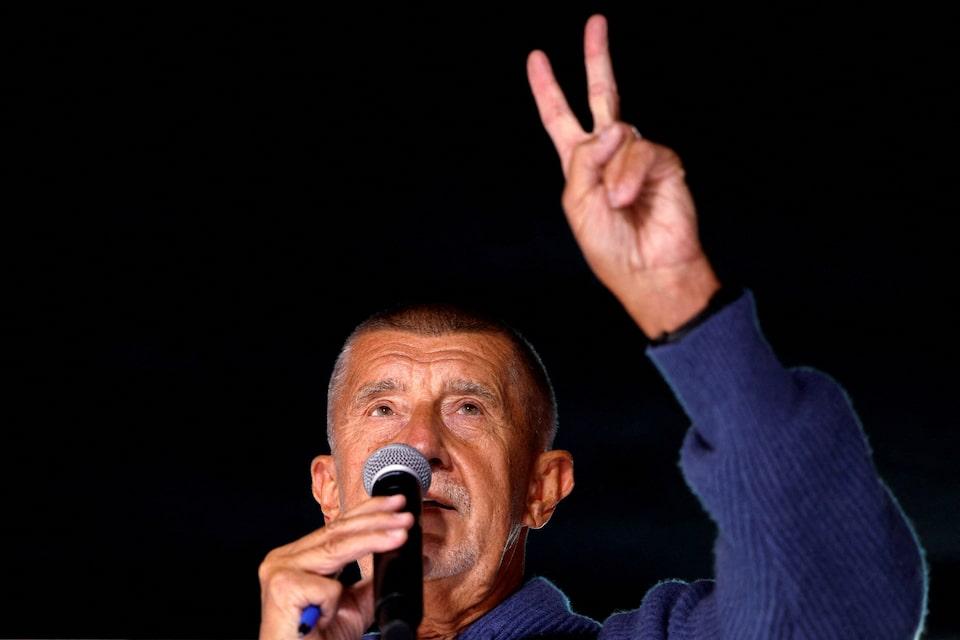

Babis's ANO party favourite to win Oct 3-4 election ANO promises spending, tax cuts worth billions of euros Czech deficit first in region back below 3% of GDP Fiscal reversal would push up borrowing, raise bond yields PRAGUE, Sept 29 (Reuters) - Czech billionaire Andrej Babis's ANO party, the favourite in an October 3-4 election, is banking on populist pledges that will cost billions of euros, end austerity and test the country's frugal mindset. The incumbent centre-right government of Prime Minister Petr Fiala has cut the deficit and reformed pensions in the past four years, making it a fiscal standout. Sign up here. Last year, the Czech Republic was the first among central European neighbours to return its fiscal gap below the EU's intended ceiling of 3% of gross domestic product. It forecasts a smaller gap of 1.9% this year. In Babis' previous term from 2017 to 2021, budgets went from surpluses to record deficits of over 5% of GDP as the coronavirus pandemic hit, higher pensions came in, and income tax was cut. With fiscal room again and voters frustrated by slow wage growth, ANO has sought to reclaim power with promises that economists expect will widen deficits and raise debt costs. It wants to raise public sector salaries, reduce corporate income tax, lower some taxes in restaurants, boost pensions and provide mortgage support to young families and various professions like nurses. It could saddle future governments by capping the retirement age at 65, after Fiala's government moved to gradually lift the age in coming decades. Oxford Economics estimated on average budget deficits could be 150 billion crowns - or 1.9% of GDP - higher each year during a four-year term led by ANO in downside scenarios. "There is a good sort of fiscal spending and there is fiscal spending that does not bring much in the long term," said Tomas Dvorak, a senior economist with Oxford Economics. "100% ... we are talking about wasteful spending," he said of ANO's plans, using mortgage subsidies as an example. PRUDENCE STILL POSSIBLE Ratings agencies are not yet sounding alarms and forecast still prudent policy, but will be watching for any reversal. "If we see that looser fiscal policy leads to a sharper increase in debt, then that would be a key negative sensitivity," Fitch analyst Malgorzata Krzywicka said. If ANO kept to rules limiting deficits to 3% of GDP, it still has room to work. Societe Generale said potential consumption-oriented loosening shifted risks to a more bearish outlook on government bonds and the crown currency. The extent of loosening will depend on coalition partners as ANO is unlikely to win an outright majority. Pairing with a party from the existing ruling coalition - something officials on both sides have so far ruled out - could temper any loosening by ANO, whose programme implies easing of around 1.2% of GDP, Dvorak said. But in a scenario where ANO may team with fringe parties on the far-right or far-left, deficits would widen by almost 2 percentage points annually, according to Oxford Economics. The 10-year bond yield could rise to 5.20% from 4.53%, debt will increase, inflation will be higher, and debt servicing costs could jump to 180 billion crowns from 100 billion, Oxford Economics said. Other economists also see high costs. Daniel Munich of the economic institute CERGE-EI estimated tax cuts could leave an up to 82 billion crown hole in the budget, about 1% of GDP. ANO's pension and welfare promises would initially cost up to 35 billion crowns but longer-term that could soar to 239 billion crowns with changes like re-capping retirement at age 65, he said. Moody's ratings agency said in a July review that a reversal of reforms like in pensions "would be highly credit-negative." LAGGING WAGES ANO's ambitions may be pre-election posturing and might still be tempered by legislation on budget responsibility or EU rules. At the same time, a fiscal prudence message is harder now than before. Real household gross disposable income in the Czech Republic has grown by less than 1% since end-2019, according to Oxford Economics and Haver Analytics data. In neighbours Slovakia, Hungary and Poland, the rise is 8-12%. ANO calls the budget a "tool, not a goal". Babis rejects claims his promises are too expensive, arguing they will come over time and money can be found in the informal economy and better state functioning. "It is realistic," Babis said in a September 23 Facebook post to voters. "We are not promising you anything we wouldn't fulfil." ** Click here , opens new tab for an interactive graphic: ($1 = 20.7220 Czech crowns) https://www.reuters.com/markets/europe/populist-czech-vote-frontrunner-babiss-lavish-spending-plans-could-jolt-budget-2025-09-29/

2025-09-29 13:20

Sept 29 (Reuters) - Brazil Finance Minister Fernando Haddad does not believe the country can put its public finances in order without also addressing the need for economic growth, he said on Monday. "This should not be confused with any leniency toward inflation," he added during remarks at an event hosted by Itau BBA in Sao Paulo. Sign up here. Haddad said it was important to be cautious when discussing fiscal adjustment, "not because it isn't crucial for debt sustainability, but because it needs to be fair and intelligent." According to the minister, public spending in Latin America's largest economy averaged around 19.5% of gross domestic product over the last decade, excluding the pandemic, and is currently below 19%. He said this reduction was a result of trimming non-essential expenditures under the administration of leftist President Luiz Inacio Lula da Silva and was not from cuts to health and education. Regarding the 50% tariffs imposed by the U.S. since August on many Brazilian goods, the minister said: "I want to believe that, at some point, a rational debate with the United States will begin." Last week, U.S. President Donald Trump said he planned to meet Lula after months of sparring between the two leaders over what the White House has called a "witch hunt" in Brazil against former President Jair Bolsonaro, a Trump ally. Bolsonaro was sentenced to 27 years in prison after being convicted of plotting a coup to remain in power after losing the 2022 election. https://www.reuters.com/world/americas/brazils-finance-minister-says-public-finances-cannot-be-fixed-without-economic-2025-09-29/

2025-09-29 13:01

Sept 29 (Reuters) - Goldman Sachs on Monday upgraded its stance on global equities to "overweight" from "neutral" over the three-month horizon, citing improving economic momentum across regions, attractive valuations and growing support from monetary and fiscal policy. "We think that good earnings growth, Fed easing without a recession and global fiscal policy easing will continue to support equities," Goldman analysts said in a note. Sign up here. The analysts held their rating at "overweight" for the next 12 months. Global equities have surged to record highs recently, driven by optimism that the U.S. Federal Reserve has begun cutting interest rates early enough to stave off a recession. The MSCI World Index (.MIWO00000PUS) , opens new tab, which is dominated by U.S. stocks, has climbed roughly 35% since its April lows, rebounding from a selloff sparked by recession fears following President Donald Trump's 'Liberation Day' tariffs. Resilient corporate earnings and a more dovish Fed have prompted several brokerages to raise their year-end targets for the U.S. benchmark S&P 500 (.SPX) , opens new tab, with Goldman last week lifting its forecast to 6,800. Goldman notes that equities tend to perform well during late-cycle slowdowns when recession risks remain low and policy support is strong, as seen in historical rallies during the late 1990s and mid-1960s. However, the Wall Street brokerage downgraded its outlook on global credit to "underweight" from "neutral" for the next three months, citing late-cycle dynamics and stretched valuations as key headwinds. Goldman also downgraded cash to "underweight" over the 12-month horizon, warning that continued Fed easing is likely to push returns on cash even lower into next year. https://www.reuters.com/business/goldman-sachs-upgrades-global-equities-growth-optimism-policy-support-2025-09-29/

2025-09-29 12:44

ZURICH, Sept 29 (Reuters) - The Swiss National Bank, the Swiss Finance Ministry and the U.S. Treasury Department have reconfirmed that they do not target exchange rates for competitive purposes. In a joint statement, Switzerland and the U.S. both said they did not use exchange rates to win an unfair advantage or prevent adjustments to their balance of payments. Sign up here. A joint statement "confirms that foreign exchange market interventions are an important monetary policy instrument for the SNB in ensuring appropriate monetary conditions and thus meeting its statutory mandate with respect to price stability," the SNB said on Monday. The SNB has regularly denied being a currency manipulator after the United States added Switzerland to a list of countries being monitored for unfair currency and trade practice in June. UBS economist Maxime Botteron said the SNB had not intervened significantly in forex markets in May to July, after the franc remained steady against the euro. Although the dollar weakened considerably against the franc this year, this was part of a broader sell-off of the U.S currency, which was not considered undervalued and was a less important factor for Swiss inflation. SNB Chairman Martin Schlegel said last week that the central bank has held "intensive" consultations with U.S. authorities, stressing the bank was focused on its inflation target. "We never intervene in order to prevent adjustments in the current account balance or to give Swiss companies an unfair advantage," Schlegel told reporters. https://www.reuters.com/world/europe/swiss-national-bank-reconfirms-with-us-it-doesnt-seek-competitive-edge-via-forex-2025-09-29/

2025-09-29 12:32

BP's Tiber-Guadalupe project to produce 80,000 boed by 2030 US will account for just under half of BP output by 2030 TotalEnergies buys US onshore gas asset stake from Continental HOUSTON/LONDON, Sept 29 (Reuters) - European oil and gas majors BP (BP.L) , opens new tab and TotalEnergies (TTEF.PA) , opens new tab on Monday deepened their commitments to the United States, with BP approving a $5 billion offshore oil field and TotalEnergies buying into an onshore gas field. Higher investment in U.S. oil and gas production aligns with U.S. President Donald Trump's goal to capitalise on the country's hydrocarbon resources. Sign up here. BP, which currently produces around 2.3 million barrels of oil equivalent per day, is becoming increasingly reliant on the United States to shore up its oil and gas business following a strategic revamp announced in February to shift spending from renewables to hydrocarbons. INCREASING US EXPOSURE BP has vowed to increase its U.S. production to just over 1 million boed by the end of the decade, or just under half of its global target of 2.3 million to 2.5 million boed in that timeframe. Its $5 billion Tiber-Guadalupe project in the Gulf of Mexico, expected to begin production in 2030, will include a floating 80,000 boed platform to tap into an estimated 350 million boe in recoverable resources, BP said. BP is considering selling minority stakes in Tiber as well as another fully BP-owned Gulf of Mexico project, Kaskida, sources have told Reuters. French rival TotalEnergies said on Monday it would buy a 49% stake in Continental Resources' onshore gas fields in the U.S. state of Oklahoma, for an undisclosed sum. The assets will net it around 150 million standard cubic feet per day of gas by 2030, or about 26,000 boed, helping to secure access to low-cost upstream gas as the company signs deals to deliver the fuel via ship to mostly Asian clients. TotalEnergies is the largest buyer of U.S. liquefied natural gas, purchasing 10 million metric tons per year, but its own output in the United States is much smaller. Its U.S. upstream assets last year produced 93,000 boed, or about 3.8% of Total's global production, far behind its assets in Africa, Europe, the Middle East, Asia and Latin America. This is set to change as Total seeks to balance its U.S. LNG purchases with increasing its own gas production in the country. https://www.reuters.com/business/energy/wrapup-bp-total-deepen-commitments-us-with-major-projects-2025-09-29/

2025-09-29 12:22

Sept 29 (Reuters) - Barrick Mining (ABX.TO) , opens new tab appointed veteran executive Mark Hill as interim president and CEO on Monday following the sudden resignation of Mark Bristow, who led the Canadian miner for nearly seven years after its merger with Randgold Resources. Bristow, who became CEO in 2019 when Barrick acquired Randgold, oversaw integration of the two companies and steered the miner through a period of significant portfolio reshaping and debt reduction. Sign up here. "Disappointed to see him leave, he has been a fine leader," said Peter Letko, of the Letko Brosseau investment fund, one of Barrick's shareholders. Speaking in May, Bristow said the company had indicated he would stay in his current role until 2028, but added there was a succession program in place overseen by the board. Shares in Barrick, which owns 13 mining assets across Africa, Asia, Latin America, and North America, have lagged some rivals, rising by 37% since 2020 compared to a 110% climb in shares of fellow Canadian miner Agnico Eagle with gold prices also hitting record highs. Hill, who will also serve as group chief operating officer, takes charge immediately as the board begins a global search for a permanent chief executive with the help of an external firm. Known for his mercurial leadership style, Bristow's tenure at Barrick was focused on integrating tough assets that Barrick owned in some of the volatile regions of the world. But his biggest test came this year when Barrick's gold mine in Mali was taken over by the military government over alleged non-payment of taxes. Barrick had to write off $1 billion from its books over Mali. U.S.-listed shares of Barrick were down marginally at $34.36 in premarket trading on Monday. https://www.reuters.com/sustainability/boards-policy-regulation/barrick-names-mark-hill-interim-ceo-after-bristow-exit-2025-09-29/