2025-09-24 22:18

Holtec International is decommissioning Indian Point Lawsuit challenged limit on radioactive water disposal Judge says federal law preempts New York limit NEW YORK, Sept 24 (Reuters) - A federal judge ruled in favor of the company dismantling the Indian Point nuclear power plant in New York on Wednesday, saying a state law designed to limit potential contamination of the Hudson River was preempted by federal law. U.S. District Judge Kenneth Karas in White Plains, New York said the state law could not stand because it significantly constrained Holtec International's decisionmaking in how to dispose of radioactive materials safely. Sign up here. Holtec sued to block a 2023 law signed by Governor Kathy Hochul that made it illegal to discharge radioactive materials into the Hudson in connection with the decommissioning, after environmental advocates raised safety concerns. The company, which has offices in Camden, New Jersey, said its plan to dispose of millions of gallons of tritiated water, a radioactive form of water, complied with Nuclear Regulatory Commission licenses and regulations. It has also said the New York law could delay Indian Point's planned decommissioning until 2041. The office of New York Attorney General Letitia James, which defended the state law, did not immediately respond to requests for comment. Before closing in 2021, Indian Point drew sustained opposition from nuclear power opponents, in part because of its proximity to New York City. The complex is located in Buchanan, New York, about 45 miles (72 km) north of Midtown Manhattan. JUDGE: NEW YORK CAN'T BAN WHAT FEDERAL LAW ALLOWS In his 32-page decision, Karas said the law "categorically precludes Holtec from utilizing a federally accepted method of disposal. "By requiring Holtec to change the method by which it disposes of tritiated water," he added, "the statute directly and substantially affects decisions concerning radiological safety levels." Karas also rejected New York's argument that Holtec should have offered alternative means to comply with the discharge law. Holtec said it was pleased with the decision, and believes the federal government and NRC should regulate radiological water discharge. "We will continue to decommission the Indian Point site in an environmentally responsible manner working with local, state and federal stakeholders," Holtec added. Earlier this month, Politico reported that Holtec floated possibly restarting Indian Point at an estimated $10 billion cost, provided that the administrations of Hochul and U.S. President Donald Trump back the idea. The case is Holtec International et al v New York, U.S. District Court, Southern District of New York, No. 24-02929. https://www.reuters.com/legal/litigation/new-york-law-curbing-radioactive-indian-point-discharges-voided-by-us-judge-2025-09-24/

2025-09-24 21:54

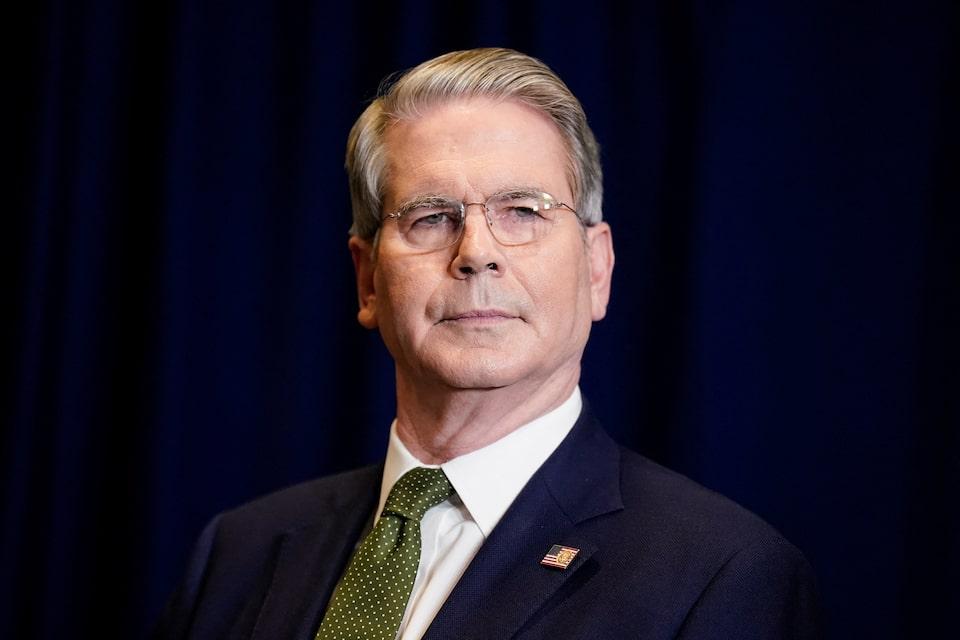

US also ready to buy government debt, Treasury chief says Bessent says markets looking backward, but this time is different US firms eyeing investments in Argentina under right conditions, Bessent says Argentine assets up sharply this week WASHINGTON, Sept 24 (Reuters) - The U.S. is currently in negotiations for a $20 billion swap line with Argentina's central bank and stands ready to do what is needed to support the South American country, U.S. Treasury Secretary Scott Bessent said on Wednesday in a post on X. Bessent said the U.S. is prepared to purchase Argentina’s U.S. dollar-denominated bonds and will do so as conditions warrant. The U.S. is also set to deliver significant standby credit via the Exchange Stabilization Fund, he said. Sign up here. "Argentina has the tools to defeat speculators, including those who seek to destabilize Argentina's markets for political objectives," he said. "I will be watching developments closely and the Treasury remains fully prepared to do what is necessary." Bessent, a former hedge fund executive, also said the U.S. is ready to purchase secondary or primary government debt and is working with the Argentine government to end the tax holiday for commodity producers converting foreign exchange. He said numerous U.S. companies had told him they intended to "make substantial foreign direct investments" in multiple Argentine sectors "in the event of a positive election outcome," but gave no details. Argentina votes on October 26 for legislative midterm elections, in which President Javier Milei's right-wing party aims to gain seats to strengthen its minority position. Argentine assets rose sharply on Wednesday after Bessent provided details on his previous pledge to support Latin America's third-largest economy and Milei, a close ally of President Donald Trump. The country's embattled peso currency has strengthened this week in a sharp reversal from last week, when the Argentine central bank burned through more than $1 billion of reserves to defend its currency. Markets grew panicked after Milei's party suffered a larger-than-expected loss in a local election in Buenos Aires, reflecting growing frustration with austerity measures and triggering concern over the future of Milei's reform agenda. Trump on Tuesday said he would support Argentina but did not think it needed a bailout. The head of the International Monetary Fund, Kristalina Georgieva, said after meeting Milei on Wednesday in New York that it is very important for Argentina to stay the course on economic reforms. She said support like the one offered from Treasury "strengthens the program" between the IMF and the grains exporter. Argentina is due to pay the IMF $4.8 billion next year. "The United States needs to be careful not to raise expectations they can't fulfill," said Martin Muehleisen, former strategy chief of the IMF and now a senior fellow at the Atlantic Council. "Argentina still needs to deliver on difficult underlying reforms for which there is currently no indication because of a lack of bipartisan support." The economic recovery stalled this year according to Goldman Sachs, pointing to three consecutive months of activity contraction through July. BESSENT: THIS TIME IS DIFFERENT In an interview on Fox Business Network on Wednesday, Bessent underscored U.S. support for Argentina and Milei, adding that he did not think the market had lost confidence in the Argentine leader, but was remembering earlier crises. "We are not going to let a disequilibrium in the market ... cause a backup in his substantial economic reforms," Bessent told the network's "Mornings with Maria" program. "I think the market is looking in the rear-view mirror and is looking at decades, if not a century, of terrible Argentinian mismanagement," he said. "People are skittish. It's very hard to believe that it is different this time, but I believe with President Milei it is." Milei, who met with Trump and Bessent on Tuesday, thanked the U.S. for its support. "Thank you President Donald Trump and Mr. Secretary Scott Bessent for your firm support and confidence in the Argentine people," he said in response on X. "We value deeply our friendship with the United States and your commitment to strengthen our partnership on the basis of shared values. Together we will build a path of stability, prosperity, and freedom. MAGA!" Argentina's government bond prices rallied after Bessent announced details of support, with the country's 2030 issue up more than three cents. "Well, what more can be added than thank you Secretary Scott Bessent," Argentina's Economy Minister Luis Caputo wrote on X. "Let's all work together to make our country great again!" https://www.reuters.com/world/americas/us-ready-support-argentina-needed-bessent-says-2025-09-24/

2025-09-24 21:13

2026 budget growth limited compared to previous years, Grau states Grau confident in Codelco's strategy despite past production challenges Unemployment rate remains a priority for Chile's finance minister SANTIAGO, Sept 24 (Reuters) - Chile will have a "responsible" 2026 budget with a limited increase while state-run Codelco, the world's largest copper miner, seeks to recover from recent production problems, the country's new finance minister told Reuters on Wednesday. In an interview at his office in Santiago, Nicolas Grau, appointed in August by his close ally President Gabriel Boric, said the 2026 budget due in Congress would have a more "limited" spending increase than in recent years. Sign up here. The specific amount will be announced by Boric, but the budget increase has been on a downward trend since 2023 when it grew 4.2%. Grau said that with this budget, the average annual increase would be about 2%. "What we're going to do is define a responsible budget with Congress that addresses the country's needs, and provides sufficient flexibility to the next administration," he said. Chile is facing a presidential election in November and Boric, who will serve until March, is not allowed to run for consecutive re-election. CODELCO'S COPPER RECOVERY Chile produces about a third of the world's copper, its main source of income. State-owned Codelco has been struggling to boost output for years. In August, it cut its annual production target due to a fatal accident at its flagship El Teniente mine. Grau emphasized his confidence in Codelco's strategy to close production gaps in previous years, and highlighted initiatives like its partnership with Anglo American (AAL.L) , opens new tab to exploit two neighboring deposits. "(Codelco) is creating these public-private partnerships that allow it to maintain its leadership in the copper sector," Grau said. SPEEDING UP PERMITTING TO BOOST INVESTMENT Grau said he was confident the economy would grow 2.5% this year, boosted by an investment increase of more than 5% for carbon-neutral projects like clean energy and digital infrastructure. Rising unemployment has also been one of Grau's priorities for the final months of the administration. The country's former labor minister, Jeannette Jara, is the leftist government's coalition candidate in the upcoming election. "Although the unemployment rate has dropped somewhat in the latest data, 8.7% is a challenging unemployment rate. We believe that rate must be reduced," Grau said. He added that policies like pension reform and improved permitting - a key demand from large miners like BHP (BHP.AX) , opens new tab and renewable energy companies like TotalEnergies (TTEF.PA) , opens new tab - have allowed for greater economic growth. Still, he acknowledged that less progress has been made in reforming environmental permitting, a sector that takes the longest compared to other categories. He argued that the executive branch had made "significant efforts" to move the reform forward but could not predict whether it would be approved during this administration. https://www.reuters.com/world/americas/chile-curb-budget-growth-codelco-ramps-up-recovery-minister-says-2025-09-24/

2025-09-24 21:03

ORLANDO, Florida, Sept 24 (Reuters) - Wall Street fell on Wednesday as record high prices and lofty valuations gnawed away at sentiment, while the dollar rose as investors continued to digest Federal Reserve Chair Jerome Powell's cautious comments , opens new tab this week on further rate cuts. In my column today I look at whether the apparent politicization of the Federal Reserve and growing concern about its independence will extend to dollar swap lines, its liquidity lifeline to other central banks in times of crisis. Sign up here. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Today's Talking Points: * Always take the Tether with you El Salvador-based crypto giant Tether is in talks to raise as much as $20 billion in a private placement that could value the firm at $500 billion, according to Bloomberg News. These are big sums, and raise big questions. A valuation that size could be a game-changer for many crypto skeptics, forcing them to finally invest in the rapidly growing market. But if Tether is so profitable, why does it need that much fresh funding? And is it really worth the same as Goldman Sachs and Morgan Stanley combined? * Signs of life in the dollar? The dollar rose to a two-week high on Wednesday, clocking its biggest rise in three weeks. It is welcome respite for the battered currency, which last week traded at its weakest level against a basket of major currencies since February 2022. But the dollar is hardly out of the woods. Its short-term technical outlook is dim, and a lightening of short positions in recent weeks suggests traders have scope to get bearish again. Bulls' best hope may be the number of implied Fed rate cuts this year in the rates futures curve falling to one from two. * Slick oil Oil prices leaped as much as 3% on Wednesday, their best day since July, as a surprise drop in U.S. crude inventories added to a sense in the market of tightening supplies amid export issues in Iraq, Venezuela and Russia. Brent crude is now nudging $70 a barrel instead of looking to break below $60, as had seemed more likely a few weeks ago. The disinflationary effect of oil prices is fading. Prices are now only 6% down from a year ago, compared with almost 30% in April. Fed independence spotlight shines on dollar swap lines Debate around politicization of the Federal Reserve has mostly centered on its interest rate-setting independence. But another part of the central bank's toolkit, with perhaps even greater significance for global financial stability, is back in the spotlight: dollar swap lines. These are the pipelines of dollar liquidity to central banks that the Fed opens in times of crisis, like 2008 and 2020, to keep the dollar-based global financial system from seizing up. Ultimately, when the world needs scarce dollars, the Fed assumes its role as lender of last resort and provides them. That's the assumption. Or the hope. The Fed has standing dollar swap lines with five major central banks - the European Central Bank, Bank of Japan, Bank of England, Swiss National Bank, and Bank of Canada. It has since retired the temporary lines opened in the 2008 and 2020 crises with central banks in nine other countries that included Brazil, Australia, and Mexico. The use of this instrument seemed fairly uncontroversial. It is a critical tool in preventing severe tightening of financial conditions, disorderly dollar strength, and broader market turmoil in times of global stress. But as with many aspects of the economic status quo since President Donald Trump's return to the White House, that can no longer be taken for granted. It may increasingly be used as a political tool as much as a financial and economic one. 'A HIGH-LEVEL POLITICAL MATTER' Will a Trump-influenced Fed automatically lend dollars to foreign central banks in a crisis? It might lend to some without hesitation, but not all. Current events with the U.S. vis-a-vis South Korea and Argentina shine a light on the politics at play. Seoul reached a preliminary trade deal with Washington in July but has not yet signed it due to the foreign exchange implications of a $350 billion investment package included in the deal. "My personal opinion is that the FX swap is a high-level political matter, not an economic one," Bank of Korea board member Hwang Kun-il said on Tuesday. A day earlier, President Lee Jae Myung told Reuters that the economy could fall into a crisis rivaling its 1997 meltdown if it accepts Washington's demands without safeguards, such as a currency swap. Meanwhile, U.S. Treasury Scott Bessent on Monday said "all options", including a currency swap line, are on the table to stabilize Argentina's markets, which are once again suffering a severe crisis of confidence. Bessent stressed that Washington's support for right-wing President Javier Milei, Trump's biggest ally in Latin America, will be "large and forceful". Of course, a dollar swap line may be offered to South Korea, the sixth-largest U.S. goods trading partner last year and which boasted a $66 billion surplus. And Treasury can operate its own swap lines under its Exchange Stabilization Fund. But the administration's approach to the two countries is clearly different. This is not just an emerging market issue either. The Bank of England and European Central Bank have asked lenders to assess their need for dollars in times of stress, and weigh up their options if they're unable to rely on the Fed backstop. POLITICAL ALIGNMENT AT PLAY As Bank of America analysts noted in a report last month, only the Federal Open Market Committee or Congress can make changes to FX swap lines, which are managed by the New York Fed under authorization of the Fed itself. "The executive branch has no direct authority to make any changes," they wrote. But pressure on the Fed from the administration, often from Trump himself, is intensifying and taking many forms. Not only has the White House demanded that interest rates be slashed, it is attempting to fire Fed governor Lisa Cook , opens new tab, and has got current White House adviser Stephen Miran onto the Fed board. So while the president doesn't have direct authority over the Fed's dollar swap lines, it's another area where the administration could exert its influence "via moral suasion as well as the appointment of the Fed governing board," as Deutsche Bank analysts wrote in a report in March. Perhaps this was always the case. John Michael Cassetta, author of a working paper "The Geopolitics of Swap Lines" , opens new tab published in 2022 by the Kennedy Business School, posited that although it was never explicitly stated, politics influenced the Fed's choice of who got swap lines in 2008 and 2020. "The empirical evidence suggests that, controlling for other potential factors, political alignment with the U.S. played a role in determining a country's likelihood of receiving a swap line and where it placed in the hierarchy," Cassetta argued. There is also evidence to suggest that political pressure on the Fed has increased significantly since then. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/global-markets-trading-day-graphic-2025-09-24/

2025-09-24 20:55

COPENHAGEN, Sept 24 (Reuters) - Denmark's Orsted (ORSTED.CO) , opens new tab said on Wednesday it had resumed work on a U.S. offshore wind project after a federal judge on Monday ruled it could restart construction , opens new tab while the Trump administration's legal case to fully halt the project continues. The U.S. Bureau of Ocean Energy Management issued a stop-work order on August 22 for Revolution Wind, marking the latest development in President Donald Trump's broader campaign to dismantle the renewable energy sector. Sign up here. Revolution Wind, located 15 miles (24 km) off the coast of Rhode Island, was 80% complete with all offshore foundations in place and 45 of 65 wind turbines installed at the time. Once completed, Revolution Wind is expected to produce enough electricity to power 350,000 homes in Rhode Island and Connecticut. Orsted and joint venture partner Skyborn Renewables have already spent or committed about $5 billion to the project, according to U.S. court filings by the companies. They would incur over $1 billion in breakaway costs if it were to be cancelled. https://www.reuters.com/sustainability/climate-energy/orsted-resumes-work-us-offshore-wind-farm-after-stop-work-order-lifted-2025-09-24/

2025-09-24 20:52

China announces plans for first-ever emissions cuts, targeting 7-10% by 2035 Xi rebukes climate retreat by "some countries" in veiled reference to United States New country pledges still fall short for holding global warming in check Sept 24 (Reuters) - China led several countries in announcing new climate plans on Wednesday and offered a veiled rebuke of the U.S. president's anti-climate rhetoric a day earlier at the U.N. General Assembly. Addressing a climate leaders’ summit hosted by U.N. Secretary-General Antonio Guterres, Chinese President Xi Jinping said in a live video message from Beijing that by 2035 his country would cut its greenhouse gas emissions by 7%-10% from its peak. Sign up here. In addition, Xi said China planned to increase its wind and solar power capacity by six times from its 2020 levels within the next 10 years – helping to boost its share of non-fossil fuels in domestic energy consumption to over 30%. China's reduction target marked the first time the world's biggest emitter pledged a cut in emissions, rather than just limiting their growth, though the reduction was less than many observers had expected. Xi urged stronger climate action from the world's developed countries. He referred, though not by name, to the United States for moving away from the goals of the Paris Agreement on climate change. "Green and low-carbon transformation is the trend of our times. Despite some countries going against the trend, the international community should stay on the right track, maintain unwavering confidence, unwavering action, and undiminished efforts," Xi said. On Tuesday, U.S. President Donald Trump used his U.N. General Assembly speech to blast climate change as a "con job", to call scientists “stupid” and to criticize EU member states and China for embracing clean energy technologies. Trump ordered a second withdrawal by Washington from the 10-year-old Paris treaty, which aimed to prevent global temperatures from rising beyond 1.5 degrees Celsius through national climate plans. The U.S. is the world's biggest historical greenhouse gas emitter and second biggest current emitter behind China. Ian Bremmer, a political scientist with the Belfer Center, said Trump's climate denial speech had effectively ceded the market for post-carbon energy to the Chinese. "Trump wants fossil fuels and the United States is indeed a powerful petro-state,” Bremmer said. “But letting China become the world’s sole powerful electro-state is the opposite of making America great again … at least if you care about the future.” Observers had been hoping that China would seize on the U.S. retreat as a moment to announce a reduction target of at least 30% to stay in line with its past goal of net-zero emissions by 2060. Li Shuo, director of the China Climate Hub at the Asia Society, said China's announcement was underwhelming in light of its rapid production of renewable energy and electric vehicles. "Beijing's commitment represents a cautious move that extends a long-standing political tradition of prioritizing steady, predictable decision-making but also hides a more significant economic reality," he said. Li noted, however, that China's dominance in green technology and Washington's retreat could push China toward a more proactive role on the global stage. WORLD IS STILL SHORT ON AMBITION Despite pressure for significant new climate commitments ahead of this year’s COP30 summit in Brazil, Wednesday’s announcements failed to impress. Environmental groups and observers said pledges by some of the world's biggest economies fell well short of where they should be in emissions reductions, given the rapidly worsening impacts of climate change. Brazilian President Luis Inacio Lula da Silva warned that countries’ commitments made ahead of the U.N. climate summit in November would show the world "whether or not we believe in what the science is showing us." Brazil has committed to reducing emissions by 59%-67% by 2035 and to stepping up efforts to combat deforestation. "Society is going to stop believing its leaders," Lula said. "And all of us will lose because denialism may actually win." Guterres, who hosted the summit on the sidelines of the U.N. General Assembly, assured that the world was making progress in the energy transition, even if it was slow. "The Paris Agreement has made a difference," Guterres said in prepared remarks, noting that actions taken under the 2015 treaty had lowered the projected rise in the average global temperature to from 4 degrees C to 2.6 degrees C. That’s still far from the treaty’s stated goal of holding to 1.5 degrees C. Already the world has warmed more than 1.2 degrees C from the preindustrial average. "Now, we need new plans for 2035 that go much further, much faster," Guterres said. The European Union has not yet reached agreement on its new U.N.-mandated climate target, instead drafting plans to submit a temporary goal, which could change. EU President Ursula Van der Leyen told the summit the EU was on track to reach its 2030 target of slashing emissions 55% by 2030, and the bloc’s 2035 reduction goal would range between 66% and 72%. Australia, which plans to host a 2026 UN climate summit, announced a pledge that by 2035, it would slash greenhouse gas to between 62% and 70% below 2005 levels. "We want to bring the world with us on climate change, not by asking any nation to forgo the jobs or security that its people deserve, but by working with every nation to seize and share those opportunities," Australia Prime Minister Anthony Albanese said. The South Pacific island nation of Palau, representing the 39-member Alliance of Small Island States, announced its own goal of slashing emissions to 44% of 2015 levels by 2035. Palau’s President Surangel Whipps reminded leaders of the advisory opinion issued by the International Court of Justice earlier this year affirming an "obligation grounded in international law" for countries to take stronger measures to curb their emissions. "Those with the greatest responsibility and the greatest capacity to act must do far more," he said, in reference to the world’s industrialized nations. https://www.reuters.com/sustainability/cop/un-chief-tells-countries-new-climate-targets-must-go-futher-faster-2025-09-24/