2025-09-24 17:37

US Treasury backs Argentina with $20 billion currency swap and bond purchases offer Local stocks pare sharp gains to rise 1.5%; peso up 10% so far this week Analysts say US backing boosts Milei's political and economic position NEW YORK/LONDON, Sept 24 (Reuters) - Argentina's financial assets rallied for a third straight day on Wednesday after U.S. Treasury Secretary Scott Bessent detailed massive support for Argentine President Javier Milei's right-wing government and the country's markets. Bessent said , opens new tab the U.S. was in negotiations over a $20 billion currency swap line with Argentina's central bank, and said it was prepared to purchase Argentina's dollar-denominated bonds in the secondary market. Sign up here. The South American country has tools to fight "those who seek to destabilize Argentina's markets for political objectives," Bessent said, reaffirming the political connection to the U.S. support. On Monday, he said the administration was seeing a shift to the right in Latin American politics when he teased the U.S. backing of Milei's project. Numerous U.S. companies would invest in Argentina "in the event of a positive election outcome," Bessent said. Argentina goes to the polls on October 26 for legislative midterm elections, in which Milei's party aims to gain seats to strengthen its minority position. In early September, the party suffered a bruising defeat in local elections in the populous Buenos Aires Province amid accusations of corruption inside Milei's circle, including his sister and close confidant Karina Milei. "This degree of U.S. support for Argentina was beyond what any analyst could have imagined just a few weeks ago," said Alejo Czerwonko, chief investment officer for emerging markets in the Americas at UBS. "It stands among the strongest examples of U.S. Treasury backing in the history of emerging markets." Argentina's 2030 bond rose 3.5 cents in price to trade at 74.78 cents on the dollar, while the Global X Argentina stocks ETF added 2%, with bank stocks leading the gains. The local stock benchmark (.MERV) , opens new tab rose 1.5% after rising as much as 6.6% earlier. The peso shaved some of the day's gains to strengthen near 2%, taking the weekly gains versus the U.S. dollar to 10%. "We would like to see a policy shift that allows for the central bank to accumulate international reserves aggressively," said Alexis Roach, emerging markets sovereign analyst at Payden & Rygel. "This should translate into changing the monetary framework to allow for more currency flexibility." Bonds had fallen as much as 20% for the year as of last week and the local peso was hitting against the weaker limit of a band set in place in April, in connection with a $20 billion program approved by the International Monetary Fund. The central bank had to burn over $1 billion last week in defence of the currency. Aberdeen fund manager Kevin Daly said this week's sharp rebound in bond prices meant there was now "limited upside" going into the midterms, with the focus being on how Milei's party fares and how far and fast the peso will be allowed to fall after the vote. "This U.S. (support) is coming to the rescue but that alone won't save Argentina. It has to take steps too," Daly said. MARKET BOUNCE BACK The market has rebounded dramatically after Bessent said on Monday the U.S. would do whatever it takes to support Milei and Argentina's reforms. "It's hard to know if this will influence the midterm results but certainly it improves Milei's negotiating power with governors and offers the country more firepower to defend itself in the case of an adverse outcome," said Aaron Gifford, senior EM sovereign analyst at T. Rowe Price. He said Argentina's macroeconomic fundamentals are not concerning despite a dip in overall growth, while foreign exchange reserves accumulation, a main concern, should be covered by the U.S. support. "Tail risks have been significantly reduced, and the rally should continue at least in the near term," he said. https://www.reuters.com/world/americas/argentine-assets-rally-bessent-details-strong-us-support-2025-09-24/

2025-09-24 16:45

MEXICO CITY, Sept 24 (Reuters) - Mexico's headline inflation sped up in the first half of September, broadly in line with market expectations, heading closer to the upper limit of the central bank's target. Banxico, as the central bank is known, is expected to further cut its benchmark interest rate 25 basis points later this week, but persistent inflation casts doubts on its path moving forward. Sign up here. "Headline inflation close to expectations and core inflation slightly sticky — keeps Thursday's monetary policy decision in play, but calls for a measured tone in future guidance," said Felipe Barragan, research strategist at Pepperstone. Consumer prices were up 3.74% in the 12 months through mid-September, statistics agency INEGI said on Wednesday, speeding from a prior figure of 3.49%. Analysts polled by Reuters had forecast an annual rate of 3.77%. The closely watched core price index, which strips out some volatile food and energy prices, kept picking up with a 4.26% annual increase in early September, from the prior figure of 4.21%, and landed slightly above expectations of a 4.24% increase. While the market expects inflation in Latin America's second-largest economy to reach 3.9% by the end of the year, Banxico targets an inflation rate of 3%, plus or minus a percentage point. Despite inflation's speed-up, "Banxico anticipates a further deepening of conditions that allow for slack (weakness in economic activity), which going forward would reduce inflationary pressures," analysts at brokerage Monex said. Month-on-month Mexican consumer prices rose 0.18% during the first half of September, also accelerating from a prior decrease of 0.02%, and compared with a 0.19% rise expected by economists in the poll. The core price index (MXCPIH=ECI) , opens new tab kept picking up with a 0.22% monthly increase from the prior figure of 0.09%. https://www.reuters.com/world/americas/mexicos-inflation-speeds-up-early-september-2025-09-24/

2025-09-24 16:17

Sept 24 (Reuters) - Argentina's embattled bonds, stocks and peso currency gained for a third day on Wednesday after more details were shared on U.S. support for the reform push by the South American government under President Javier Milei. Below are comments from analysts on the latest developments: Sign up here. KIMBERLEY SPERRFECHTER, EMERGING MARKETS ECONOMIST, CAPITAL ECONOMICS "U.S. Treasury Secretary Scott Bessent’s renewed pledge to 'do what is needed' to support Argentina in a post on X earlier today, including purchases of Argentinian sovereign U.S. dollar bonds and a potential $20 billion credit line, should give Argentina’s government breathing space ahead of the midterm elections in October. Crucially, though, it doesn’t solve the country’s underlying issues, in particular the misaligned exchange rate." "The latest developments suggest that the Trump administration is willing to go a long way in supporting its allies while taking the opposite approach towards countries that it deems aren’t." THOMAS HAUGAARD, PORTFOLIO MANAGER EM DEBT, JANUS HENDERSON "There are several angles to this, but the $20 billion itself is a high number. So people are definitely more comfortable with the U.S. support, and that number is enough for it to be a meaningful circuit breaker in terms of the kind of vicious spiral that you were seeing, where you had the FX pressure, a bond selloff and FX reserves going down." "Concern about a repayment capacity, default risk and depleting reserves - definitely the worst-case scenario there - is taken off the table, and that's why you've seen bonds rally." EDUARDO ORDONEZ BUESO, EMERGING MARKETS DEBT PORTFOLIO MANAGER, BANKINVEST "This is part of the alliances being built between the U.S. and Argentina, because Argentina has a lot of natural resources and Argentina has a nice remote position for military bases. Argentina has a dynamic economy as part of the Western world and it's a good place to push China out of the continent. China has made a lot of progress in the country and they have a military base and a lot of trade." "So the Argentine officials, knowing that what they sell is a game of expectations, that what they do is try to simulate animal spirits and provide a confidence shock and then hope that the shock is self-fulfilling." ALEJO CZERWONKO, CIO FOR EMERGING MARKETS IN THE AMERICAS, UBS "This degree of U.S. support for Argentina was beyond what any analyst could have imagined just a few weeks ago. It stands among the strongest examples of U.S. Treasury backing in the history of emerging markets." AARON GIFFORD, SENIOR EM SOVEREIGN ANALYST, T. ROWE PRICE "It’s hard to know if this will influence the midterm results but certainly it improves Milei’s negotiating power with governors and offers the country more firepower to defend itself in the case of an adverse outcome. As a result, tail risks have been significantly reduced, and the rally should continue at least in the near term." https://www.reuters.com/world/americas/view-us-support-boosts-argentina-stocks-bonds-peso-2025-09-24/

2025-09-24 13:46

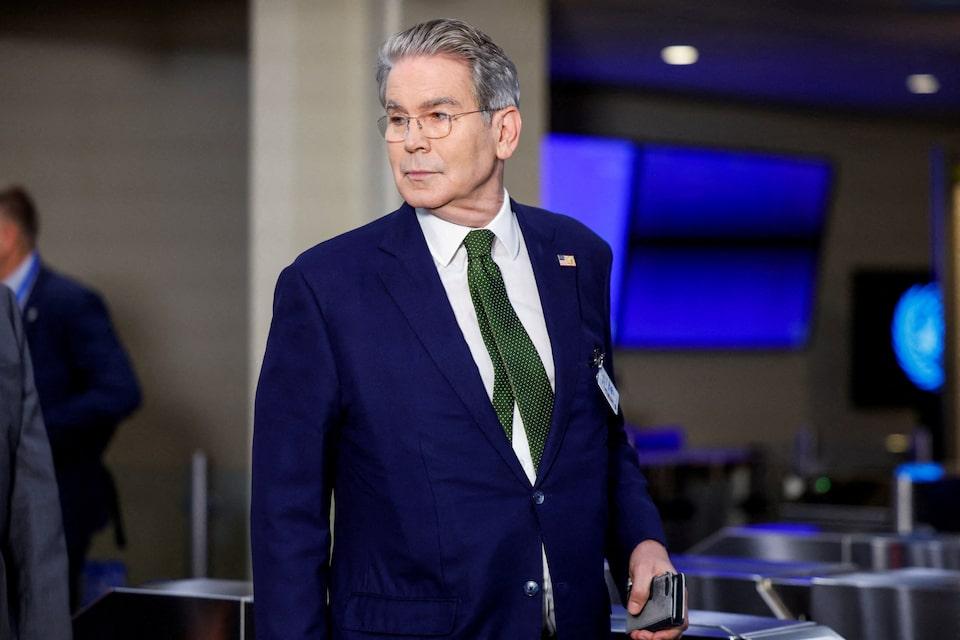

Bessent says surprised by strength of some candidates Seeking candidates who are looking forward, Bessent says Jobs revisions show 'something wrong,' Treasury chief says Not as concerned about recession, Bessent says WASHINGTON, Sept 24 (Reuters) - U.S. Treasury Secretary Scott Bessent on Wednesday said he would interview a lot of candidates next week to replace Jerome Powell as chair of the Federal Reserve, with an eye to completing the first round of interviews by the first week of October. Bessent told Fox Business Network's "Mornings with Maria" that he was surprised by the strength of some candidates, but declined to name them. Sign up here. He said he was looking for someone with an open mind to lead the U.S. central bank, doubling down on criticism of Powell for not lowering interest rates sooner. Bessent noted that Stephen Miran, a recent addition to the Fed board chosen by U.S. President Donald Trump, had pressed for a 50-basis-point cut in rates, larger than the 25-basis-point cut agreed. He said he was surprised that the Fed had not sketched out a target for lowering rates by the end of the year by 100 or 150 basis points, given recent downward revisions in jobs data. Powell said on Tuesday the central bank needed to continue balancing the competing risks of high inflation and a weakening job market in coming interest rate decisions as his colleagues staked out arguments on both sides of the policy divide. The central bank last week cut its benchmark rate a quarter of a percentage point. Powell said the Fed was not on "a preset course" for further rate cuts. "These meetings are supposed to be a discussion. You're supposed to go into them with an open mind," Bessent said. "Not unlike the U.N., we've seen a lot of mistakes, a lot of rigidities, and it's good to get some new blood in that." He said he planned a second round of interviews before presenting Trump with a list of three or four very strong candidates. "Everyone asks me what am I looking for when I interview potential Federal Reserve chairs, and it's just someone with an open mind, who's not looking in the rearview mirror, who's looking forward," Bessent said. Recent revisions in employment data were concerning, Bessent said, adding, "With these revisions, we know that something was wrong beneath the hood." That said, Bessent said he was less concerned about the economy tipping into a recession than the distributional aspects that left poorer Americans getting hit hardest. https://www.reuters.com/world/us/treasurys-bessent-says-hes-looking-someone-with-an-open-mind-fed-chair-2025-09-24/

2025-09-24 12:48

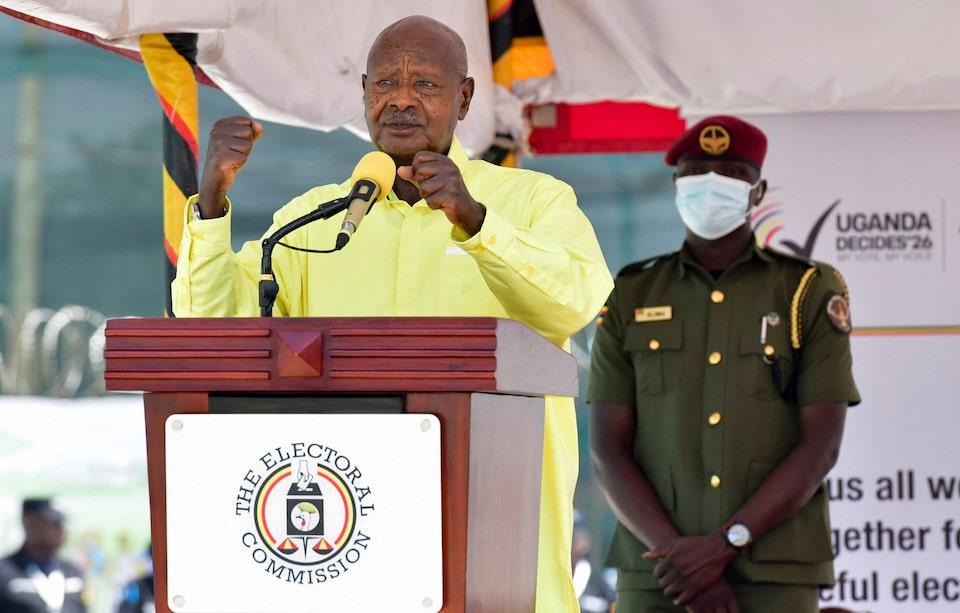

Museveni is among Africa's longest-serving leaders Seized power in 1986 Expected to face opposition leader Bobi Wine in polls next year KAMPALA, Sept 23 (Reuters) - Uganda's Electoral Commission on Tuesday cleared octogenarian President Yoweri Museveni to seek reelection in polls due to be held early next year, which could extend his rule in the East African nation to nearly half a century. A former rebel, Museveni has been credited with stabilising Uganda, promoting economic growth, and combating HIV/AIDS. But critics denounce his government's suppression of political opponents, human rights abuses and corruption scandals. Sign up here. After seizing power in 1986, Museveni said the problem facing Africa was not its people but "leaders who want to overstay in power". Now Africa's fourth longest-ruling leader, Museveni and his government have amended the constitution twice to remove age and term limits, allowing him to remain in office. EXPECTED TO FACE OFF AGAINST OPPOSITION LEADER WINE The 2026 election is expected to once again pit the 81-year-old incumbent against his chief rival Bobi Wine, 43, a singer who has leveraged his pop stardom to galvanise a large support base among young voters. Museveni defeated Wine, whose real name is Robert Kyagulanyi, in 2021 by a wide margin, though Wine said his victory was stolen through ballot stuffing, intimidation by security forces and other irregularities. Museveni's was the first candidacy to be cleared by the elections body, which is charged with evaluating whether those seeking office meet legal requirements. It is expected to assess Wine's candidacy on Wednesday. At a press conference on Tuesday, Museveni said another five-year term in office would allow him to prioritise restoring public safety, fixing transportation infrastructure, and expanding health care and free education. "There's a bit of crime and impunity," he said, referring to public concerns about a wave of crime in urban areas. His governing National Resistance Movement party would also work on "getting rid of corruption," he said. Museveni's government is eyeing an economic boom when the country begins shipping crude oil next year, with growth seen leaping to double digits next financial year. The president's opponents have long accused him of using state patronage and the military to maintain his grip on power, and of using kidnappings and torture against adversaries, claims he denies. In May, Uganda's military chief Muhoozi Kainerugaba, who is also Museveni's son, admitted to holding a missing opposition activist in his basement while threatening that Wine would be next. https://www.reuters.com/world/africa/ugandas-museveni-cleared-seek-reelection-eyes-near-half-century-rule-2025-09-23/

2025-09-24 12:47

MOSCOW, Sept 24 (Reuters) - A Ukrainian drone strike on the southern Russian port city of Novorossiisk killed two people and wounded six on Wednesday, regional authorities said on Telegram. The city's top official said a state of emergency had been declared in Novorossiisk, which is Russia's major sea port on the Black Sea and contains major oil and grain export terminals. Sign up here. The emergency services ministry declared a danger of drone attacks across the whole of the Krasnodar region. The Caspian Pipeline Consortium (CPC)'s office in the city was struck in the attack, with two employees injured, CPC said. However, a CPC spokesperson said the consortium's terminal at Yuzhnaya Ozereyevka, located around the bay from the city of Novorossiisk, was still operating. The terminal loads Caspian CPC Blend crude oil for export to international markets. Ukraine has been heavily targeting energy and port facilities that support Russia's war economy and generate revenues for its state budget. Regional authorities in Krasnodar, southern Russia, said there was a threat of attacks on the Black Sea port of Tuapse from Ukrainian naval drones, and instructed residents and guests to leave the coastal strip. https://www.reuters.com/world/europe/ukrainian-drone-attack-russian-port-novorossiisk-kills-two-prompts-state-2025-09-24/