2025-09-24 06:39

KOLKATA, Sept 24 (Reuters) - At least 12 people died as heavy rain lashed the eastern Indian city of Kolkata and surrounding areas ahead of a major festival, flooding streets, disrupting transport and leaving residents stranded for hours, officials said on Wednesday. Most of the rain, as much as 251.6 mm (9.9 inches) in 24 hours, fell during the early hours of Tuesday and was the heaviest witnessed in the city since 1988, said HR Biswas, the regional head of India Meteorological Department (IMD) in Kolkata. Sign up here. Police said nine people died in Kolkata, with most of the deaths due to electrocution. Two people drowned, they added. The rains brought the state capital to a standstill, seriously hampering preparations for the upcoming Durga Puja - the biggest annual festival of Hindus in West Bengal state. Many pandals, temporary structures built with bamboo and other material for the festival, and clay idols of the deities also suffered damage across the city. Roads were submerged under waist-deep water in some areas, stranding vehicles and forcing commuters to wade through flooded streets. Road, train, and air traffic were severely disrupted, with several flights and trains cancelled or delayed. Power outages affected multiple areas for hours, compounding residents' difficulties. "I got stranded in my hotel as my flight got cancelled and the roads were all waterlogged," said Ranjan Panda, a water and climate expert. Authorities said they have deployed water pumps to clear streets and railway tracks, with relief measures, including food distribution and emergency services, underway. The IMD predicted more rain in the state and eastern India over the next few days due to the formation of a low-pressure area over Bay of Bengal. The state government declared schools and other educational institutions closed on Wednesday and Thursday before the holidays for the festival take effect from Friday. Officials said conditions will normalize by Wednesday evening while urging residents to remain cautious as water levels gradually recede in low-lying areas. "This should not have happened after four hours of rain. West Bengal is not in a good condition," Sandip Ghosh, a local resident in Kolkata, told Indian news agency ANI, in which Reuters has a minority stake. https://www.reuters.com/business/environment/least-12-dead-record-rain-floods-indias-kolkata-2025-09-24/

2025-09-24 06:37

Proposal would raise VAT to 22% from 20% Additional revenues estimated at $14.3 billion Putin signalled last week he was open to raising certain taxes Trump says Russia in 'big economic trouble' in Truth Social post MOSCOW, Sept 24 (Reuters) - Russia's finance ministry proposed raising the rate of value-added tax on Wednesday to 22% from 20% in 2026 to fund military spending and help curb a swelling budget deficit, in what would be the fifth year of the war in Ukraine. The proposal comes as U.S. President Donald Trump called Russia a "paper tiger" for "fighting aimlessly for three-and-a-half years" and said that Russia was in "big economic trouble". Sign up here. President Vladimir Putin signalled last week that he was open to raising certain taxes during the war, noting that the U.S. had raised taxes on wealthy people during the Vietnam and Korean wars. The government on Wednesday approved a new draft budget for 2026, called by some Kremlin officials a "wartime budget", and announced updated figures for 2025, with economic growth expected to plummet to 1% from 4.3% last year. National defence spending will fall to 12.6 trillion roubles ($150.5 billion) in 2026 from a post-Soviet high of 13.5 trillion in 2025, finance ministry documents showed. In 2025, the deficit is seen at 2.6% of national output, the highest since the start of the war, according to the documents reviewed by Reuters, exceeding the previous target by 53%. TAX HIKE PRIMARILY TO FUND 'DEFENCE AND SECURITY' The proposal is in line with a Reuters report last week. VAT, a consumption tax seen as easy to administer, accounted for 37% of budget revenues in 2024. Alexander Shokhin, head of a major business lobby, called the hike "unpleasant". The ministry estimated that the increase would generate about 1.2 trillion roubles ($14.33 billion) in additional revenue in 2026. The government also plans to increase borrowing by 46% in 2025. The finance ministry said the tax hikes would be "aimed primarily at financing defence and security". It proposed other tax increases, including on gambling businesses, and the elimination of tax breaks on small businesses. The proposal will spur inflation, which has been receding in recent months, and make more key rate cuts more difficult for the central bank, which said it will take into account the effects of the VAT increase on inflation expectations. A two percentage point 2019 VAT hike contributed 0.6 percentage points to inflation that year, according to the central bank, which has pledged to halve it from current levels and return it to its 4% target in 2026. T-Bank analyst Sofya Donets estimated that in 2026 the tax hike would boost inflation by 1.5 percentage points, making the central bank's job more difficult as it navigates between worsening inflation and a further economic slowdown. The rouble was little changed at 83.75 to the U.S. dollar on Wednesday, with analysts saying that a slower pace of key rate cuts supported the Russian currency. The average rouble rate is seen at 92.2 to the dollar in 2026 in the new forecast, about 8% stronger than in the previous one. After meeting Ukrainian President Volodymyr Zelenskiy on the sidelines of the U.N. General Assembly in New York, Trump posted on his Truth Social platform: "Putin and Russia are in BIG Economic trouble, and this is the time for Ukraine to act." Trump's tone was in stark contrast to his red-carpet treatment for Putin at a summit in Alaska last month, part of an ostensible push to expedite an end to the war. 'NO SUCH THING AS A PAPER BEAR' Kremlin spokesman Dmitry Peskov told RBC radio on Wednesday the Russian economy had adapted to the conflict in Ukraine. Brushing off Trump's "paper tiger" comment, Peskov said Russia was a bear, not a tiger, and "there is no such thing as a paper bear", while adding Putin valued Trump's efforts to resolve the conflict. The finance ministry said the draft 2026 budget was "balanced and sustainable" while providing "financial support for the country's defence and security needs". "The resources planned in the budget will make it possible to equip the armed forces with the necessary weapons and military equipment, pay salaries to military personnel and support their families, and modernise defence industry enterprises," it said in a statement. ($1 = 83.7500 roubles) ($1 = 83.7455 roubles) https://www.reuters.com/markets/currencies/russian-finance-ministry-proposes-raising-vat-help-finance-war-ukraine-2025-09-24/

2025-09-24 06:37

Fed's Powell treads tightrope on future rate cuts Trump says Ukraine can recover all lost territory Silver hovers near 14-year highs Sept 24 (Reuters) - Gold prices steadied on Wednesday, trading near the record high hit the day before, as expectations of further U.S. interest rate cuts and geopolitical uncertainty boosted demand for the safe-haven metal. Spot gold was steady at $3,762.73 per ounce, as of 1103 GMT, after hitting a record high of $3,790.82 on Tuesday. Sign up here. U.S. gold futures for December delivery edged down 0.5% to $3,795.80. The dollar index (.DXY) , opens new tab, which measures the greenback against a basket of major currencies, rose about 0.5%, making dollar-priced bullion more expensive for other currency holders. "The rally is being fuelled by lower U.S. funding costs alongside a cocktail of investor concerns spanning overvalued equities, Fed independence, and mounting geopolitical risks," said Ole Hansen, head of commodity strategy at Saxo Bank. Powell said that the Fed would continue to balance concerns over labour market weakness with worries about inflation, while central bank officials took stances on both sides of the monetary policy path divide. Investors are now looking ahead to the U.S. Personal Consumption Expenditures index, the Fed's preferred inflation gauge, on Friday for further cues on potential rate cuts. Market participants are pricing in two more 25-basis-point cuts this year, one each in October and December, with 94% and 77% probability, respectively, the CME FedWatch tool , opens new tab shows. Gold, considered a safe-haven asset during times of uncertainty, tends to perform well in a low interest rate environment. Elsewhere, NATO warned Russia on Tuesday that it would use "all necessary military and non-military tools" to defend itself, as U.S. President Donald Trump shifted rhetoric by asserting that Ukraine could recover all territory occupied by Russia. "With geopolitical turbulence and economic uncertainty driving safe-haven demand, alongside growing expectations of a dovish Fed, gold (should) consolidate above $3,750 in the short term, with the prospect of a new resistance around $3,900," said Ricardo Evangelista, senior analyst at ActivTrades. Spot silver fell 0.3% to $44.89 per ounce. Platinum fell 0.7% to $1,467.39 and palladium lost 0.1% to $1,218.61. https://www.reuters.com/world/india/gold-eases-record-high-investors-book-profits-weigh-powells-comments-2025-09-24/

2025-09-24 06:29

NEW DELHI, Sept 24 (Reuters) - India's Oil and Natural Gas Corp (ONGC.NS) , opens new tab hopes to acquire 2.5-3 gigawatt renewable energy projects by 2030, Executive Director Satyan Kumar said on Wednesday. The company already has about 2.5 GW of renewable energy capacity, Kumar told reporters. Sign up here. ONGC is looking to import 3 million ton per year of liquefied natural gas under long-term deals and expects some contracts to be finalised in 12 months, he added. https://www.reuters.com/sustainability/climate-energy/indias-ongc-eyes-acquisition-25-3-gw-renewable-energy-projects-exec-says-2025-09-24/

2025-09-24 06:21

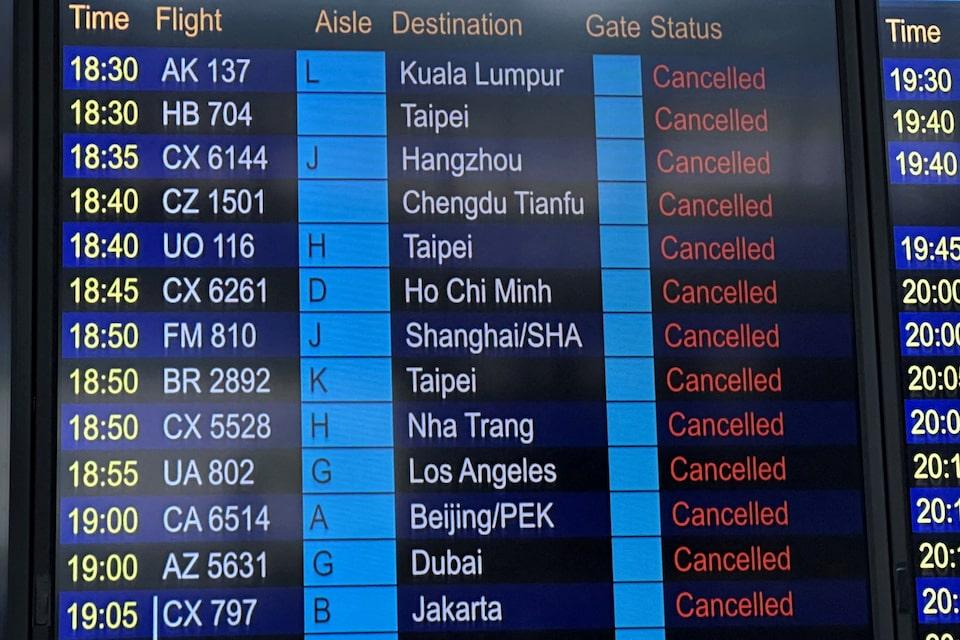

About 80% of planes belonging to city's airlines sent elsewhere - tracking data Majority of private jets also moved out-Hong Kong Business Aviation Centre Planes are at airports in Japan, China, Cambodia, Europe, Australia Cathay Pacific cancelled more than 500 flights Sept 24 (Reuters) - As Typhoon Ragasa, the world's most powerful tropical cyclone this year, approached Hong Kong this week, mass flight cancellations and lost revenue were not the only headache for airlines based at one of the world's busiest airports. Ahead of the arrival of hurricane-force winds and torrential rain on Wednesday, about 80% of the aircraft belonging to the four main airlines based in the city had been relocated to or grounded at airports in Japan, China, Cambodia, Europe, Australia and other locations, Flightradar24 tracking data showed. Sign up here. The majority of Hong Kong's business jet fleet also moved out of the territory ahead of the storm, the Hong Kong Business Aviation Centre said. All landings and departures at Hong Kong, the world's busiest cargo airport and the ninth busiest for international passenger traffic, were cancelled for 36 hours starting on Tuesday evening. Hong Kong's largest airline, Cathay Pacific Airways (0293.HK) , opens new tab, said on Monday the typhoon was going to have "a significant impact" on its operations and it would cancel more than 500 long-haul and regional flights. "We are positioning some of our aircraft away from Hong Kong and expect a staggered and gradual resumption to our schedule throughout Thursday into Friday," said the airline, which has a fleet of 179 passenger and freighter planes. Hong Kong issued typhoon signal 10, its highest warning, early on Wednesday, which urges businesses and transport services to shut down. It is standard industry practice for airlines to move aircraft abroad during major weather events or as conflict risk rises to avoid potential damage, often to comply with insurance obligations. At least 14 Cathay Pacific jets flew from Hong Kong to Cambodia's Phnom Penh Techo airport on Tuesday to wait out the storm, according to tracking data and Techo airport. Airlines can also preemptively send aircraft away from their main base so they are ready to operate return flights when a storm subsides. In high winds, airlines can store aircraft in hangars, or add extra fuel to weigh them down. Smaller aircraft can be tied down. Hong Kong-based Greater Bay Airlines, a small carrier with seven aircraft, said it had parked all its planes away from Hong Kong as a safety precaution. Its Boeing (BA.N) , opens new tab 737s flew to airports in Japan and China on Tuesday, tracking data shows. Hong Kong Airlines similarly appeared to have kept all but one of its 28 aircraft out of Hong Kong. Cathay and its low-cost subsidiary HK Express kept more of their planes in Hong Kong, tracking data showed. Cathay and HK Express did not respond to requests for comment about how they were storing their planes. In a 2017 internal publication, Cathay said it had stored some of its planes in hangars at Hong Kong airport during past cyclones, while others had been sent to other destinations. https://www.reuters.com/world/china/hong-kongs-airlines-evacuate-planes-they-wait-out-typhoon-ragasa-2025-09-24/

2025-09-24 06:16

MUMBAI, Sept 24 (Reuters) - The Indian rupee hovered near its record low on Wednesday, staying flat, as worries about the impact of steep U.S. tariffs and shifts in visa policies kept up the pressure, with intervention by the Reserve Bank of India offering some support. The rupee was last nearly flat at 88.7425 against the U.S. dollar, but is in touching distance of its all-time low of 88.7975 hit on Monday. Sign up here. While the local currency appeared on course to open weaker around 88.85, likely intervention by the central bank in the non-deliverable forwards and onshore spot market helped it find its footing, traders said. There are persistent dollar bids from importers and foreign banks so the direction of travel for the rupee appears to be lower, a trader at a state-run bank said, adding that the extent will depend on what RBI allows. India's benchmark equity indexes, BSE Sensex (.BSESN) , opens new tab and Nifty 50 (.NSEI) , opens new tab were down about 0.4% each on the day. A gauge of IT stocks (.NIFTYIT) , opens new tab was down nearly 1%, as investors fretted over how a steep rise in fees for U.S. H1-B visas could impact their business models. Foreign investors have sold $1 billion worth of Indian stocks on a net basis so far in September, taking the year-to-date outflow tally to nearly $16 billion. The central bank had likely intervened in the market on Monday as well to support the rupee, according to traders. On the day, modest strength in the dollar was a pain point for the rupee. Asian currencies were down slightly. "Despite brief dips in the dollar's strength, persistent market pressures have kept the local currency under strain, reflecting a challenging mix of global developments," said Amit Pabari, managing director at FX advisory firm CR Forex. https://www.reuters.com/world/india/rupee-pinned-near-record-low-holds-ground-central-bank-support-2025-09-24/