2025-09-23 20:40

Tail-risk hedge fund Universa sees stocks surging further before 1929-like crash Delayed effects of rate hikes will cause downturn but process may take time NEW YORK, Sept 23 (Reuters) - Market euphoria could carry U.S. stocks another 20% higher before giving way to a collapse on the scale of the 1929 crash that ushered in a global recession, according to tail-risk hedge fund Universa Investments. The benchmark S&P 500 has gained about 13% this year, hitting a fresh record high on Monday after the Federal Reserve last week cut interest rates for the first time since December. Sign up here. The central bank has indicated more cuts are likely as it tries to counterbalance a weakening labor market, which could add to and broaden Wall Street's rally. For Mark Spitznagel, chief investment officer and founder of Universa, stocks may rise roughly another 20% from current levels, driving the S&P 500 index (.SPX) , opens new tab - which was last at about 6,653 points - to over 8,000 points. However, he warns that this ascent is likely to be followed by a historic crash as the U.S. economy is expected to buckle under the burden of still high borrowing costs. "I do expect an 80% crash ... but only after a massive, euphoric, historic blow off rally," said Spitznagel in an interview. "I would argue we're in the middle of that (rally) right now, not at the end of it." Miami-headquartered Universa is a $20 billion hedge fund that specializes in protecting against “black swan” shocks - rare, high-impact events that jolt markets - using financial instruments such as credit default swaps, stock options, and other derivatives that gain value during extreme market dislocations. Its average return on capital since its founding in 2007 is over 100%. Investors use such tail-risk funds as insurance, as they carry small costs that drag on performance until disaster hits and the payoff is massive. Universa proved the point in 2020, emerging as one of the big winners amid the market chaos unleashed by the COVID-19 pandemic. "Universa is the most bearish expression of the market there is, and clients use us to be longer the market ... which is paradoxical," said Spitznagel, adding he remains bullish for the time being. Spitznagel had said last year investors should seize the “goldilocks” moment for markets caused by expectations that the Fed could tame inflation without hurting the economy, and predicted that euphoria would build further before giving way to a crash. He also said in a separate interview later last year, when the Fed started easing monetary policy, that a U.S. recession was imminent. While the economy has held up well since then, Spitznagel argues it is still propped up by the excesses of ultra-loose monetary policy since 2008, and that the full impact of sharply higher rates that followed the pandemic has yet to be felt. "We're going to see the consequences of that ... it takes time," he said. https://www.reuters.com/markets/wealth/us-stocks-may-surge-another-20-before-historic-crash-says-black-swan-fund-2025-09-23/

2025-09-23 20:39

Sept 23 (Reuters) - Crypto giant Tether is in talks to raise as much as $20 billion in a private placement that could value the El Salvador-based firm at about $500 billion, Bloomberg News reported on Tuesday. The company is seeking $15 billion to $20 billion for roughly a 3% stake, the report said, citing people familiar with the matter. Sign up here. Still, the figures were top-end targets and eventual numbers could end up significantly lower, with the valuation of the company depending on the stake offered, the report added. Tether's chief executive, Paolo Ardoino, said in a post on X that the company is evaluating a raise from a selected group of high-profile key investors, without disclosing any further details. Tether's USDT stablecoin, which is pegged to the U.S. dollar, has a market capitalization of about $173 billion, according to data from CoinGecko. Tether has solidified its position as a dominant player in the stablecoin market, offering cryptocurrencies pegged to traditional currencies to minimize price volatility and enable seamless transactions between digital assets. In August, the firm appointed former White House crypto policy executive Bo Hines as a strategic adviser to bolster its expansion in the United States, where crypto companies have benefited from President Donald Trump's favorable stance on digital currencies. The company recently unveiled plans to launch a U.S.-based stablecoin, called USAT, designed for U.S. residents. Rival stablecoin firm Circle (CRCL.N) , opens new tab went public in the United States through a blockbuster IPO in June. https://www.reuters.com/business/crypto-firm-tether-eyes-500-billion-valuation-major-raise-round-bloomberg-news-2025-09-23/

2025-09-23 20:37

WASHINGTON, Sept 23 (Reuters) - U.S. Senator Edward Markey sent a letter to President Donald Trump on Tuesday saying he is concerned U.S. Energy Secretary Chris Wright is working in the interest of nuclear power company Oklo (OKLO.N) , opens new tab, of which he used to be a board member. Markey, a Democrat, noted that the administration is moving ahead with plans to allow Oklo to build a nuclear waste reprocessing plant and transfer government-held plutonium from nuclear weapons to use as fuel in planned reactor projects. Sign up here. "Oklo stands to benefit financially and Secretary Wright is acting in his former company's interest," Markey said. The White House referred a request for comment to the Energy Department, which said Wright, who resigned from Oklo's board when he became energy secretary, is compliant with all ethics and financial disclosure requirements. Wright has never owned Oklo stock, it said. Oklo had no comment. Oklo said this month it plans to build and operate a plant in Tennessee to reprocess nuclear waste as the first phase of a nuclear fuel center costing up to $1.68 billion. Reuters reported in August the government plans to make available 20 metric tons of plutonium to nuclear companies. Oklo has not said it wants to use the plutonium and the department has not announced plans on the material. But an Energy Department source said Oklo has been in touch with the agency about using the radioactive metal and that top energy officials were having conversations with the company about it. Markey asked Trump questions about Wright's connection to decision-making and the Republican secretary's financial interest in Oklo. Trump in May ordered the government to halt much of its existing program to dispose of plutonium, and instead provide it as a fuel for reactors. The idea of using surplus plutonium as fuel and extracting it from nuclear waste has concerned nuclear safety experts who say it could increase risks of proliferation and make it hard for the U.S. to tell other countries not to pursue similar technologies. https://www.reuters.com/business/energy/us-senator-says-he-is-concerned-energy-secretary-acting-nuclear-firms-interest-2025-09-23/

2025-09-23 20:27

Chevron's ventures paying royalties, taxes with oil in kind in recent months PDVSA using its portion of barrels for refining and to ship to other destinations Pace of debt repayment to Chevron has slowed HOUSTON, Sept 23 (Reuters) - U.S. oil major Chevron (CVX.N) , opens new tab is only able to export about half the crude its joint ventures produce in Venezuela with the latest rules laid out by Washington, three sources close to the matter said. The Treasury Department in late July issued a restricted authorization allowing Chevron to operate in the sanctioned country and export oil to the U.S., but it banned payments in any currency to the government of President Nicolas Maduro. Sign up here. To comply with the permit, the joint ventures where the Houston-based company participates have been paying royalties and taxes with oil in kind, effectively reducing what Chevron can export to about 50% of the 240,000 barrels per day of crude the projects produce, the sources said. Chevron's partner, state oil company PDVSA, is in control of the barrels delivered to comply with the in-kind payments, using them either for domestic refining or export, they added. The latest rules - which have not been made public - represent a significant departure from a previous license granted to Chevron under former President Joe Biden in 2022, which allowed the company to export all of its output from the country and pay taxes and royalties to Venezuela with cash. On a practical level, the new authorization means that less of the heavy, high-sulfur crude produced in Venezuela will reach the U.S. Gulf Coast, the sources added. PDVSA and Venezuela's oil ministry did not reply to requests for comment. Senior U.S. officials have said in recent months Washington would not allow Maduro's government to profit from the sale of oil. Chevron said it conducts its business globally in compliance with applicable laws and regulations, as well as the U.S. sanctions frameworks, including in Venezuela. The previous payment structure had allowed Chevron to see a substantial reduction in the debt Venezuela owes the company from more than $3 billion in 2022, according to separate sources at both companies. With a limited volume of oil for exports under the new arrangement, the pace of repayment has slowed. The company is also dealing with restrictions affecting its joint ventures' operational and capital expenses, the people added. In August, Chevron resumed exports of Venezuelan oil to the U.S. after a 4-month pause, shipping some 60,000 bpd that month. So far in September, it has exported an average of 102,000 bpd, according to vessel monitoring data. Chevron CEO Mike Wirth said last month that exportable volume under the new terms would be limited, but did not disclose figures. https://www.reuters.com/business/energy/chevron-exports-venezuelan-oil-halved-under-new-us-authorization-sources-say-2025-09-23/

2025-09-23 20:24

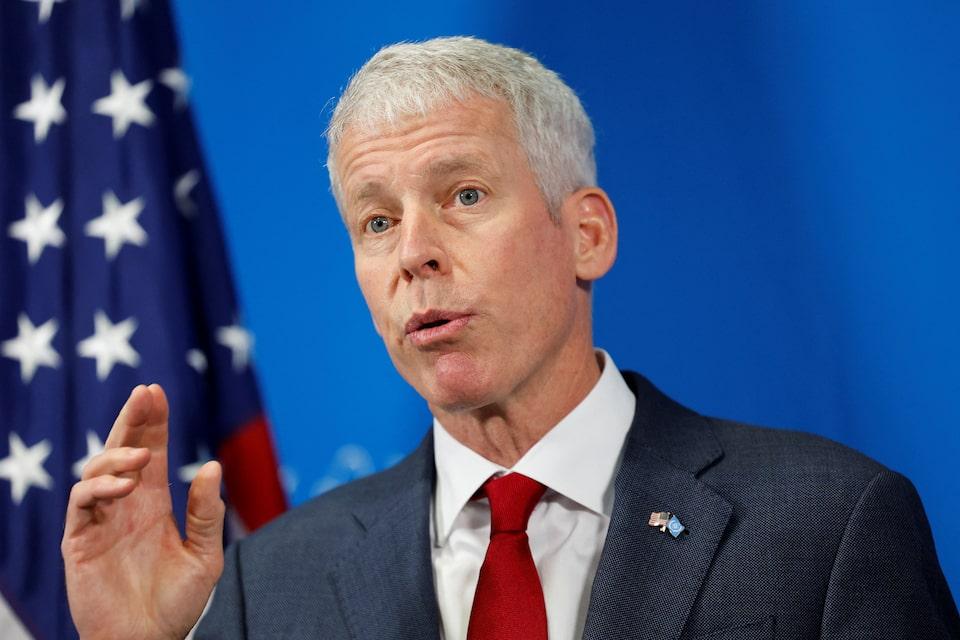

Exelon aims to own regulated power supplies in Mid-Atlantic amid rising bills CEO Butler advocates for legislative changes to allow regulated power generation Independent power companies oppose regulated generation NEW YORK, Sept 23 (Reuters) - Major U.S. electric utility Exelon (EXC.O) , opens new tab plans to step up its push to own power plants in its Mid-Atlantic service area next year, where electricity bills are spiking in the face of rising demand and new supplies are slow to be added, CEO Calvin Butler told Reuters this week. Exelon's effort comes as PJM Interconnection, the country's largest grid providing electricity to over 65 million people in the Midwest to the Mid-Atlantic, faces supply shortfalls amid surging demand from data centers and the electrification of industries like transportation. Sign up here. Chicago-based Exelon said in July that it was considering its options for building and owning regulated power generation, which electric utilities are legally barred from in about half of U.S. states. In those states, regulated utilities generally own power lines, while independent power producers own and operate power plants to diversify market power, which can help prevent anti-competitive behavior. Butler said allowing electric utilities like Exelon to build new regulated power supplies, which is currently barred by state laws in much of PJM's territory, would ease the grid's power crunch and bring down prices. Regulated power generation in the region where Exelon operates would require a series of changes to state law, which Butler said his company is laying the groundwork for by talking to lawmakers and governors ahead of next year's lawmaking meetings. "I believe the 2026 legislative sessions are going to be an opportunity for us," Butler told Reuters at a meeting in New York on Monday. "We're going to be advocating for it." About half of U.S. states are considered deregulated, generally, meaning that electric utilities that own transmission and distribution lines cannot also own regulated power generation. The deregulation effort began in the 1990s in response to rising electricity costs. As power bills rise again, some of the 13 states in PJM, like Maryland and New Jersey, have considered amending their laws to allow regulated power generation. "I'm one of the staunchest supporters for competitive markets when they work, but we are seeing that the competitive marketplace in PJM is not working," Butler said. U.S. power demand is forecast to hit record highs this year and next, according to the U.S. Energy Information Administration. FIGHTING RISING BILLS If allowed by the states, Butler said he would seek to build community solar in low-to-moderate income neighborhoods, which he said would reduce power bills. Some 80% of recent household electricity bill increases are power supply costs, Butler said, as opposed to utility charges. With nearly 11 million customers, Exelon is one of the biggest power utilities in the country and covers some of the most impoverished urban communities, including those in Philadelphia, Baltimore and Atlantic City. Some of those cities have also seen the biggest power bill increases over the summer. Independent power companies have argued against the idea of regulated power generation in deregulated states, saying utilities would pass the cost down to customers and further raise bills. Butler said regulated utilities can often build power supplies with a lower impact on bills. They have lower borrowing costs and cost of capital and a speedier permitting process because utilities like Exelon already own substantial land and easements to develop new power generation, he said. Exelon's overall return on its assets is about 9.5%, or roughly half of what he said independent power producers earn. https://www.reuters.com/sustainability/boards-policy-regulation/exelon-intensify-push-own-mid-atlantic-power-plants-ceo-says-2025-09-23/

2025-09-23 20:08

HOUSTON, Sept 23 (Reuters) - Gas flow into the largest U.S. liquefied natural gas (LNG) plant fell nearly 600 million cubic feet on Tuesday from Monday, short of peak demand by 1.4 billion cubic feet (bcf), according to preliminary data from financial firm LSEG. Cheniere Energy's (LNG.N) , opens new tab Sabine Pass plant in Texas, which can pull over 5 bcf a day of natural gas to convert into LNG, was down to 3.8 bcf from 4.4 bcf on Monday, suggesting at least one of its processing plants, which are called trains, could be offline, LSEG data showed. Sign up here. The company did not immediately respond to a request for comment. Cheniere is the largest exporter of the superchilled gas in the U.S. and played a key role in making the country the world's largest LNG exporter. https://www.reuters.com/business/energy/chenieres-biggest-lng-plant-pulling-less-gas-tuesday-lseg-data-shows-2025-09-23/