2025-09-17 10:55

Concerns over potential Russian supply disruption support prices Markets eye Fed meeting for clues on economy US crude stockpiles fell last week, industry data shows LONDON, Sept 17 (Reuters) - Oil prices eased on Wednesday, after rising more than 1% in the previous session, though ongoing geopolitical jitters provided a floor for the market, with traders eyeing an expected interest rate cut from the U.S. Federal Reserve later in the day. Brent crude futures were down 62 cents, or 0.9%, to $67.85 a barrel at 1042 GMT, while U.S. West Texas Intermediate crude futures were down 63 cents, or around 1%, to $63.89 a barrel. Sign up here. The benchmarks settled more than 1% higher in the last trading session due to concerns that Russian supplies may be disrupted by Ukrainian attacks. Reuters reported on Tuesday that three industry sources said Russia's oil pipeline monopoly Transneft (TRNF_p.MM) , opens new tab had warned producers they might have to cut output following Ukraine's drone attacks on critical export ports and refineries. "If the drone damage (to Russian energy infrastructure) proves to be short-lived, the recent range of say, $5 per barrel, will resume," said PVM Oil Associates analyst John Evans. "Given the impasse in sanctions and the arrival of more OPEC barrels, the only hope for an oil rally has been through the lack of distillate stock as we approach winter." PESKOV SAYS EU PLANS WILL NOT AFFECT RUSSIA Kremlin spokesperson Dmitry Peskov on Wednesday said the European Union's plans to phase out Russian energy and commodities more quickly will not affect Russia. Despite sanctions already in place, the EU still imports billions of euros worth of Russian energy and commodities, ranging from liquefied natural gas to enriched uranium, though its imports of Russian oil and gas have plummeted. Investors are also awaiting the outcome of the Federal Reserve's September 16–17 meeting, with a new governor, Stephen Miran, on leave from the Trump administration, joining the deliberations. While markets have largely priced in a 25 basis-point Fed rate cut, which could ease borrowing costs and boost fuel demand, traders will be watching for remarks from Fed Chair Jerome Powell. Market sources citing American Petroleum Institute figures said that U.S. crude and gasoline stocks fell last week, while distillate stocks rose. The market is also awaiting stockpile data from the U.S. Energy Information Administration - a Reuters poll of nine analysts estimated crude inventories fell while distillate and gasoline stockpiles rose. "It looks like a make or break moment for the latest bounce in oil prices - reports of large funds piling in with bearish bets show that glut fears remain, something that could make gains hard to sustain," said Chris Beauchamp, chief market analyst at IG Group. "While Russia has continued to test NATO's resolve, it seems that tensions will remain contained, providing a further negative impulse and making a test of recent lows more likely." https://www.reuters.com/business/energy/oil-retreats-geopolitical-jitters-limit-declines-2025-09-17/

2025-09-17 10:50

EU to speed up Russia's fossil fuel exit Kremlin: EU phase-out plans won't impact Russia MOSCOW, Sept 17 (Reuters) - The European Union's plans to phase out Russian energy and commodities more quickly will not affect Russia and will not force it to change its position, Kremlin spokesman Dmitry Peskov said on Wednesday. The head of the EU's executive, Ursula von der Leyen, said on Tuesday after a call with U.S. President Donald Trump that the European Commission would propose a faster phase-out of Russian fossil fuel imports. Sign up here. "They (European countries) mistakenly believe that the continuation of the sanctions policy is capable of somehow influencing the position of the Russian Federation," Peskov told a daily conference call with reporters. "Russia, which defends its national interests, is certainly not affected by these sanctions. And the last three years have eloquently demonstrated this," he added. Russia's economy has shown resilience in the face of sanctions imposed by the West over the conflict in Ukraine, though it is also grappling with persistently high inflation and a rising budget deficit partly as a result of sharply increased military spending. Despite the sanctions, the EU still imports billions of euros worth of Russian energy and commodities, ranging from liquefied natural gas to enriched uranium, though its imports of Russian oil and gas have plummeted. https://www.reuters.com/business/energy/kremlin-shrugs-off-eu-plans-speed-up-phase-out-russias-energy-2025-09-17/

2025-09-17 10:43

2026 gold price seen at $4,000/oz on demand, Fed policy Risks include strong equities, seasonal gold weakness Sept 17 (Reuters) - Deutsche Bank (DBKGn.DE) , opens new tab raised its gold price forecast by $300 for next year to an average of $4,000 per ounce on Wednesday, due to strong central bank demand, potential U.S. dollar weakness and a resumed Federal Reserve rate-easing cycle. The bank raised its forecast from a previously expected $3,700/oz in April, citing factors including downside risks to the Federal Reserve's base case of holding rates steady in 2026 following three anticipated rate cuts in 2025. Sign up here. It flagged uncertainty stemming from changes in the Federal Open Market Committee's composition and ongoing challenges to Fed independence as being supportive for gold prices. The Fed is set to announce its policy decision later on Wednesday, amid challenges including a legal dispute over its leadership and U.S. President Donald Trump's efforts to exert greater control over rate policy and the bank’s broader role. Deutsche Bank pointed to official gold demand continuing at twice the pace of the 2011-2021 average, largely driven by China, and noted that recycled gold supply is running 4% below expected levels this year, easing limits on gold’s upside. However, the bank warned of risks, including strong equity market performance, seasonal weakness in gold prices during the fourth quarter based on 10-year and 20-year historical trends, and U.S. economic conditions that may prompt the Fed to hold rates steady in 2026. Deutsche Bank said that while positive developments in U.S. trade negotiations could reduce uncertainty for business investment, gold's sensitivity to such events was limited. Non-yielding bullion, often considered a safe-haven asset during times of uncertainty, tends to perform well in a low-interest-rate environment. It has risen about 40% year-to-date and hit a record high of $3,702.95 on Tuesday. The bank also raised its silver price forecast for 2026 to an average of $45 per ounce, up from $40. https://www.reuters.com/business/finance/deutsche-bank-raises-2026-gold-forecast-4000-bullion-hits-record-highs-2025-09-17/

2025-09-17 10:38

LONDON, Sept 17 (Reuters) - What matters in U.S. and global markets today By Mike Dolan , opens new tab, Editor-at-Large, Finance and Markets Sign up here. With a first Federal Reserve , opens new tab interest rate cut of 2025 now considered to be in the bag, world markets are hungry for signals on how much more comes after. This has allowed the dollar to stabilize at four-year lows against the euro ahead of today's decision. U.S. stocks also stalled on Tuesday and futures were flat ahead of today's bell, with Fed rate cut bets now gravitating to exactly 25 basis points after news of roaring 5% annual retail sales growth in August helped put the kibosh on thoughts of a bigger move this week. Gold backed off too. That didn't stop U.S. long bonds rallying , opens new tab further, however. Helped by brisk demand for 20-year debt at Tuesday's auction, the 30-year yield hit a 4-1/2 month low of 4.62% ahead of the Fed announcement. In today's column, I take a look at whether the Fed might soon start stimulating an already healthy economy and explore how challenging it is to determine exactly where "neutral" truly is. Today's Market Minute * President Donald Trump on Tuesday announced an agreement between the U.S. and China to keep TikTok operating in the United States, with three sources familiar with the matter saying the deal was similar to one discussed earlier this year. , opens new tab * Britain and the United States have agreed a technology pact to boost ties in AI, quantum computing and civil nuclear energy. The "Tech Prosperity Deal" is part of U.S. President Donald Trump's second state visit to Britain, which formally begins on Wednesday. * President Donald Trump's renewed push to nix quarterly corporate disclosures, a drive that went nowhere in his first administration, has a better chance this time as the White House takes more control of the Securities and Exchange Commission's agenda. * The Trump administration has made it clear that they think Chair Jay Powell’s team has done a poor job with inflation control. Eurizon SLJ asset management CEO Stephen Jen argues that the president may have a point. * The rush to hedge U.S. equity exposure this year was initially seen as part of a broad 'de-dollarization' process. But, writes ROI markets columnist Jamie McGeever, as the months go by and U.S. stocks roar to fresh tech-fueled highs, this theory seems to be crumbling. Chart of the day There may be many reasons why the Fed decides to resume policy easing with its first interest rate cut of the year on Wednesday - but the current pace of GDP growth, booming retail sales, the loosest financial conditions in more than three years and inflation still far above target are not among them. Today's events to watch * U.S. August housing starts/permits (8:30 AM EDT) * Bank of Canada policy decision (9:45 AM EDT) and press conference (10:30 AM EDT) * U.S. Federal Reserve's policy decision and updated economic and rate projections (2:00 PM EDT), press conference (2:30 PM EDT) * European Central Bank President Christine Lagarde speaks * U.S. President Donald Trump visits Britain * U.S. corporate earnings: General Mills, Progressive Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-09-17/

2025-09-17 10:32

After back-to-back cuts, markets had expected rate hold Benchmark rate, lending facility cut by 25 bps Deposit facility down 50 bps BI says liquidity ample, contradicting finance minister's comments Markets eyeing possible changes in BI mandate, economist says JAKARTA, Sept 17 (Reuters) - Indonesia's central bank delivered another surprise interest rate cut on Wednesday, aiming to bolster economic growth even as investors' concerns grow over the country's fiscal discipline. Bank Indonesia trimmed the benchmark 7-day reverse repurchase rate (IDCBRR=ECI) , opens new tab by 25 basis points to 4.75%, its sixth cut since it kicked off an easing cycle in September last year and taking borrowing costs to the lowest since late 2022. Sign up here. All 31 economists surveyed by Reuters had expected no change after a cut in July and an unexpected easing in August. Governor Perry Warjiyo said the central bank would continue to assess room for further cuts, underscoring economists' expectations for more monetary loosening. BI has had to balance the need to keep the rupiah currency stable while supporting economic growth during the easing cycle, Warjiyo said. "Our economic growth is still below the national capacity so demand needs to be pushed," Warjiyo told an online press conference, adding BI has been going "all out" to support economic growth while maintaining financial market stability. Indonesia's stock market (.JKSE) , opens new tab hit a record high after Wednesday's decision, while the rupiah firmed slightly. The rupiah is one of emerging Asia's worst performing currencies so far this year. It has dropped 2% against the U.S. dollar, with concerns over Indonesia's domestic finances and central bank independence offsetting broader global weakness in the greenback that has buoyed many other emerging market currencies. Financial markets also have been unsettled by two weeks of protests and unrest in many cities from late August, and by last week's abrupt sacking of respected finance minister Sri Mulyani Indrawati. There have been concerns about the central bank's independence following a "burden sharing" deal that will see BI help fund state programmes. Parliament is discussing changes to an existing bill that could strengthen the requirement of the central bank to support growth and also give it the power to recommend the removal of the bank's governor, lawmakers said on Tuesday. BI has now cut its main interest rate by a total of 150 basis points in this cycle, and has expanded liquidity through its open market operations and government bond purchases in the secondary market. The bank also cut its overnight deposit facility rate (IDCBID=ECI) , opens new tab by 50 bps and its lending facility (IDCBIL=ECI) , opens new tab rate by 25 bps to 3.75% and 5.50%, respectively. SIGNS OF SLOWDOWN Southeast Asia's largest economy grew 5.1% in the second quarter from a year earlier, the fastest pace in two years, but new Finance Minister Purbaya Yudhi Sadewa has said there were signs of slowing in the third quarter. Purbaya has criticised BI for keeping banking liquidity "dry", which has restricted bank lending, as he moved more than $12 billion of government funds from the central bank to commercial banks to be used for loans. In an apparent response, Warjiyo said liquidity was ample but demand for credit has been weak as businesses were in a wait-and-see mode. Banks have approved lending commitments worth 2,372 trillion rupiah ($144.41 billion) that have not been utilised, he said. Warjiyo also urged commercial banks to follow BI's lead in cutting rates, highlighting that their lending rates have fallen only 7 bps so far this year, a small fraction of the cuts in the central bank's major rates. However, Warjiyo said he welcomed Purbaya's decision to move government funds and the new $1 billion stimulus package for the fourth quarter, which he said could help bolster domestic demand. "Policymakers likely bet on a re-widening in the ID-U.S. rate differential after the U.S. Federal Reserve's anticipated cut this week, providing more headroom to lower domestic rates in the fourth quarter," DBS economist Radhika Rao said, adding markets were monitoring potential changes to BI's mandate. Gareth Leather, an economist with consultancy Capital Economics, said the surprise cut was likely to heighten concerns about BI's independence, while Warjiyo's dovish tone suggests further easing is coming. "That said, the government and central bank's clear pivot towards growth-supportive measures risks undermining confidence in policymaking," Leather said, warning any resulting adverse market reaction could force BI to reconsider its dovish stance. Local lender Bank Permata revised its forecast for the end-2025 benchmark rate to 4.50%, from 4.75% before, with more cuts expected in 2026, its economist Faisal Rachman said. The governor did not respond to questions on parliament's bill affecting BI. ($1 = 16,425.0000 rupiah) https://www.reuters.com/world/asia-pacific/indonesia-central-bank-makes-another-surprise-rate-cut-independence-concerns-2025-09-17/

2025-09-17 10:25

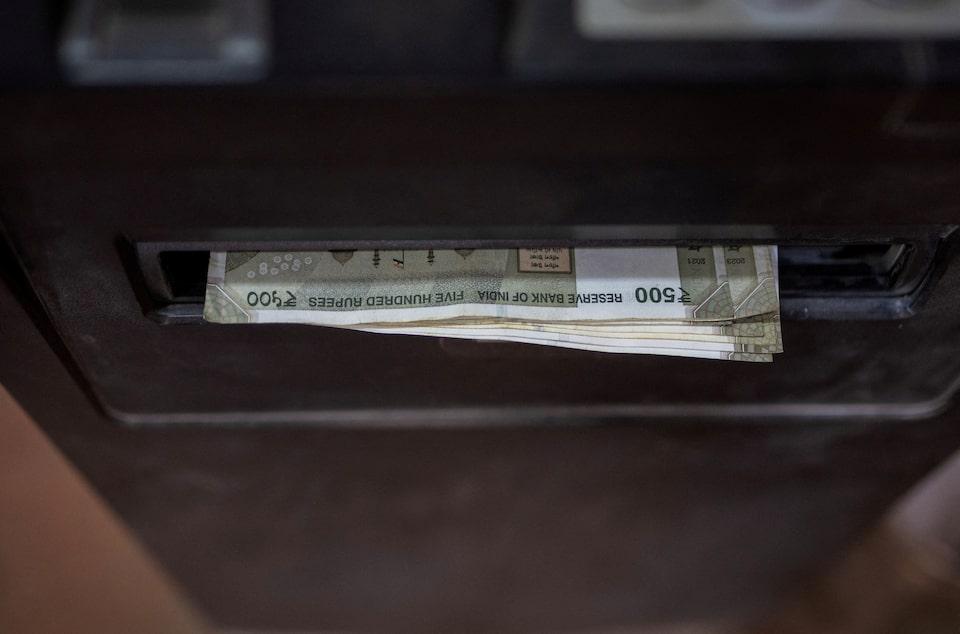

MUMBAI, Sept 17 (Reuters) - The Indian rupee rose on Wednesday, supported by a weaker dollar ahead of an expected U.S. Federal Reserve rate cut and upbeat sentiment from trade talks with Washington. The rupee rose to an intra-day peak of 87.73 during the session before ending at 87.8150, up 0.27% on the day, its best one-day gain since August 19. Sign up here. The rupee sank to a record low of 88.4550 last week on worries over steep U.S. tariffs but has since gained 0.2% this week, aided by upbeat U.S.-India trade talks and expectations of imminent Fed easing. "The negative bias on the rupee has eased slightly but it's quite likely that dollar demand related to importer hedging will limit gains near 87.50 in the near-term," an FX salesperson at a foreign bank said. Trade discussions between Indian and U.S. officials on Tuesday were "positive" and "forward-looking", New Delhi said on Tuesday. Meanwhile, money markets are fully pricing in a 25 basis point cut by the Fed later in the day with focus on remarks from Fed Chair Jerome Powell and policymakers' updated economic and interest rate projections. "While the near-term bias for the rupee is tilted towards further appreciation, we caution that any hawkish tilt from the Fed or adverse developments on the trade policy front could temper gains and reintroduce volatility," said Abhishek Goenka, founder & CEO of FX advisory firm IFA Global. Market participants will also watch whether policymakers considered a larger 50-basis-points cut as President Donald Trump pushes ahead with plans to overhaul a pillar of the U.S. economy and casts a shadow on the central bank's independence. https://www.reuters.com/world/india/rupee-posts-best-day-month-investors-gear-up-fed-outcome-2025-09-17/