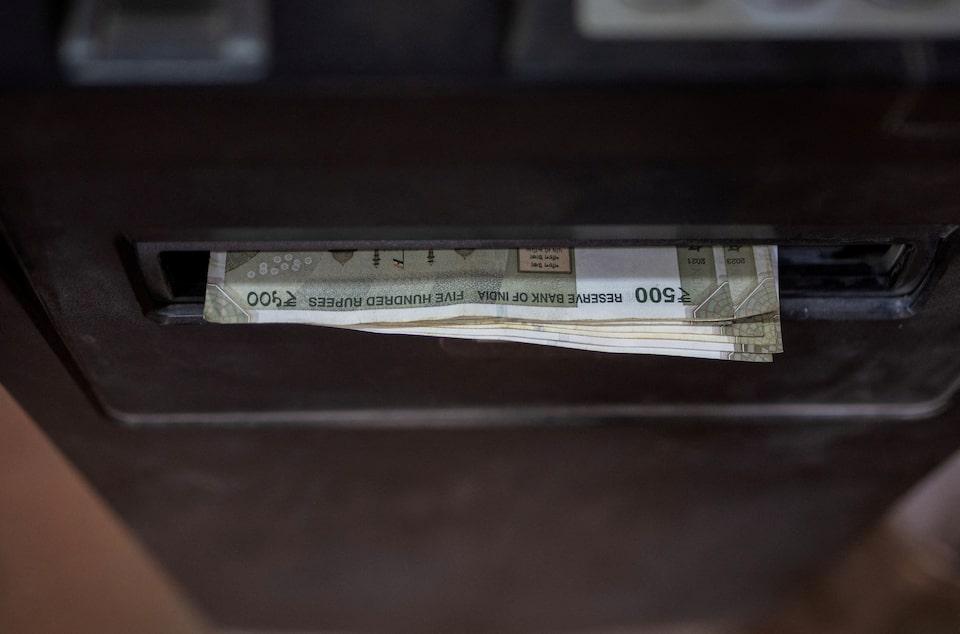

2025-09-17 05:39

MUMBAI, Sept 17 (Reuters) - The Indian rupee touched a more than two-week high on Wednesday, boosted by a slump in the U.S. dollar ahead of an expected rate cut by the U.S. Federal Reserve and optimism over U.S.-India trade talks. The rupee touched a peak of 87.73 against the U.S. dollar, its strongest since August 29, in early trading and was last up 0.3% at 87.7525 as of 10:50 a.m. IST. Sign up here. The euro had surged to a four-year peak against the dollar in the previous session as investors positioned for an expected 25-basis-point rate cut by the Fed later in the day. Against a basket of peers, the dollar was last at 96.69, pinned near its lowest level since early July after slumping 0.7% in the previous session. The rupee's move on Wednesday has been largely tracking weakness in the dollar and positive sentiment on account of trade talks between India and the U.S., a senior trader at a Mumbai-based bank said. The spotlight on the day will also be on whether policymakers considered a bigger 50 bp cut and their updated summary of economic and interest rate projections. Money markets are currently pricing in a 4% chance of an outsized rate cut. "Unless the Fed surprises with a hawkish cut, the outlook for the USD remains weak, with profit-taking providing an opportunity to re-establish shorts," analysts at DBS said in a note. Meanwhile, dollar-rupee far forward premiums continued to nudge higher on the back of a decline in near-tenor U.S. Treasury yields. The 1-year dollar-rupee implied yield was last up 2 bps at 2.36%. The 1-year U.S. Treasury yield was at 3.62% after declining 2 bps in the previous session. https://www.reuters.com/world/india/rupee-rises-ahead-fed-decision-us-india-trade-talks-lift-sentiment-2025-09-17/

2025-09-17 05:35

Euro near 4-year high before expected Fed rate cut Bank of Canada also set to cut rates due to weak labour market Gold reaches new highs as investors seek safe haven TOKYO, Sept 17 (Reuters) - The dollar was on the defensive, shares edged up and gold scaled new heights on Wednesday as global markets counted down to an anticipated rate cut by the Federal Reserve later in the day and waited on signals around the extent of future easing. The euro surged to a four-year high against the greenback in the prior session on the Fed easing bets, while oil remained firm following Ukrainian drone attacks on Russian refineries and ports. Asian equity indexes were led by Hong Kong shares, which surged to a four-year high. Sign up here. The Fed is expected to cut its benchmark interest rate by a quarter of a percentage point to the 4.00%-4.25% range at the end of its monetary policy meeting later in the global day. The main focus beyond the rate decision will be on Fed Chair Jerome Powell's comments on the outlook for U.S. monetary policy. "Markets are effectively daring the Fed to over-deliver on the dovish side," said Dilin Wu, research strategist at Pepperstone. "The bigger question, though, is whether Powell can satisfy markets already leaning heavily on a dovish view, or whether conditions are ripe for a near-term shakeout in both USD and gold positioning." The dollar index , which tracks the greenback against a basket of currencies of other major trading partners, edged up 0.1% to 96.723 after a 0.7% slide on Tuesday to the lowest since early July. The euro was down 0.1% at $1.1855, after touching $1.1867 on Tuesday, its highest level since September 2021. The dollar was little changed at 146.43 yen following a 0.6% slide in the previous session. "If the (Fed) chair is more dovish than expected, of course, you would expect that to weigh on the dollar, but really, how much more bearish can you get from here?" Mahjabeen Zaman, head of foreign exchange research at ANZ, said on a podcast. "We've already got more than five cuts priced in for the cycle." Stephen Miran was sworn into his Fed position on Tuesday morning, after the U.S. Senate narrowly confirmed him to the central bank's Board of Governors ahead of its policy meeting. A U.S. appeals court separately declined to let President Donald Trump fire Fed Governor Lisa Cook. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab reversed early declines, rising 0.2% and on course for a ninth-straight gain. Japan's Nikkei stock index (.N225) , opens new tab slid 0.1% after a record high close on Tuesday. Hong Kong's benchmark Hang Seng Index (.HSI) , opens new tab jumped 1.4%, buoyed by signs of progress of a deal to allow the Chinese-owned social media platform TikTok to keep operating in the U.S. European and U.S. stock futures were firmer after a largely soft cash session overnight. The pan-region Euro Stoxx 50 futures were up 0.32%, German DAX futures gained 0.36%, and FTSE futures added 0.11%. U.S. stock futures, the S&P 500 e-minis , were flat. The Bank of Canada is also expected to cut rates on Wednesday to contend with a flagging labour market and trade frictions. Soft trade data from Japan showing exports fell for a fourth straight month in August highlighted the toll on major economies from the wide-ranging tariffs imposed by the Trump administration. U.S. crude dipped 0.1% to $64.45 a barrel after a three-day surge. Russia's oil pipeline monopoly Transneft has warned producers they may have to cut output following Ukraine's drone attacks on critical facilities, three industry sources said. Spot gold gained 0.2% to $3,683.29 per ounce, after the yellow metal crossed $3,700 for the first time in the previous session. In cryptocurrencies, bitcoin fell 0.2% to $116,687.18, while ether declined 0.18% to $4,490.76. https://www.reuters.com/world/china/global-markets-wrapup-2-2025-09-17/

2025-09-17 05:18

Powell's comments after near-certain rate cut in focus Fed policy meeting comes as independence under pressure Dollar wallows near multi-month lows against peers SINGAPORE, Sept 17 (Reuters) - The U.S. dollar loitered near four-year lows against the euro and a one-month trough against the yen on Wednesday, as traders geared up for a near-certain interest rate cut from the Federal Reserve later in the session. Traders have fully priced in a 25 basis point cut and the focus will be on comments from Chair Jerome Powell after the decision to gauge the pace of future easing. Markets are pricing in 67.9 bps of cuts by the end of the year. Sign up here. The spotlight will also be on whether policymakers considered a bigger 50 bps cut at a time when President Donald Trump pushes ahead with efforts to overhaul a pillar of the U.S. economy, stoking concerns about the central bank's independence. The currency market was fairly subdued in Asian hours as traders were reluctant to place major bets ahead of the meeting. The euro eased a touch to $1.1852, just below the four-year high of $1.18785 it hit on Tuesday. Sterling was steady at $1.3642, hovering near 2-1/2-month highs after weaker British jobs data on Tuesday did not shake investors' belief that the Bank of England would keep rates steady this week. The dollar index , which measures the U.S. unit against six others, was at 96.686, languishing near its lowest since early July. The index is down nearly 11% this year, with investors bracing for further losses after a recent pause. "The risk is that the Fed’s punchbowl for risk assets comes with a hangover," said Laura Cooper, senior macro strategist at Nuveen. "A cautious signal, or penciling in fewer cuts than markets are pricing, could shake the risk rally." "With six cuts priced over the next year, the real story is not the size of the move this week, but how Powell frames the path. A hawkish cut risks deflating the risk rally in the near-term." The Fed began a two-day meeting on Tuesday with a new governor on leave from the Trump administration joining the deliberations, and a second policymaker at the table still facing efforts by Trump to oust her. A federal appeals court on Monday blocked Fed Governor Lisa Cook's firing, paving the way for the Biden appointee to participate fully in the policy meeting this week. Data on Tuesday showed U.S. retail sales increased more than expected in August as consumers bought a range of goods and dined out, but a weakening labour market and rising prices because of tariffs pose a downside risk to continued strength in spending. Benoit Anne, managing director at MFS Investment Management, does not expect Powell to provide strong forward guidance at this juncture. "Being data dependent and providing forward guidance do not work that well together... the bar is really high to produce a dovish surprise, given how much easing has already been priced in by the rates market." The Swiss franc eased to 0.7869 per U.S. dollar in Asian hours, near the decade high it touched in the previous session. The Australian dollar hit a 11 month high and was last at $0.6675. The Japanese yen firmed in early trading to 146.22 per dollar, its strongest in a month ahead of the Bank of Japan policy meeting on Friday where the central bank is expected to stand pat on rates. It was last at 146.49. The spotlight is on an October 4 vote where the ruling Liberal Democratic Party will elect a new leader to replace outgoing Prime Minister Shigeru Ishiba. "It is unlikely BOJ will move ahead of the elections and considering the potential Fed cut to come this week," said Howe Chung Wan, head of Asian fixed income at Principal Asset Management. "Our base case is for the next hike to take place in early 2026 as markets may take time to see how the new leadership comes into place." https://www.reuters.com/world/middle-east/dollar-holds-soft-tone-rate-cut-expectations-powell-comments-2025-09-17/

2025-09-17 05:17

KAMPALA, Sept 16 (Reuters) - Uganda plans to borrow $358 million from regional and private lenders to finance various projects, including a power grid interconnection with neighbouring South Sudan, according to a finance ministry official. The credit will be sourced from the African Development Fund, an arm of the African Development Bank, the Arab Bank for Development in Africa, and Standard Chartered Bank (STAN.L) , opens new tab, junior finance minister, Henry Musasizi, said while presenting the plan in parliament late on Tuesday. Sign up here. Deputy House Speaker Thomas Tayebwa referred the request to a House committee, comprising of both ruling party and opposition lawmakers, that will study it and make a report before the full House debates and takes a vote on the request. Other projects to be financed by the loan include a road in the country's northwest linking Uganda to the Democratic Republic of Congo and the expansion of clean water access. Uganda, which now produces surplus power after commissioning a $1.7 billion Chinese-funded hydropower dam last year, has been planning to start exporting some of its excess electricity to energy-starved South Sudan. The east African country has already been in talks with the Chinese firm Sinohydro [RIC:RIC:SINOH.UL] to develop the project, which will involve construction of a 138-km (85.75 miles) high-voltage transmission line, expansion of two substations, and construction of one new one. https://www.reuters.com/sustainability/boards-policy-regulation/uganda-borrow-358-million-power-line-south-sudan-other-projects-2025-09-17/

2025-09-17 05:12

BANGKOK, Sept 17 (Reuters) - Thailand's industrial sentiment index fell to its lowest level in three years in August on worries about domestic political uncertainty, a strong baht currency and U.S. tariffs, the Federation of Thai Industries said on Wednesday. After falling for the past six months, the FTI said sentiment may pick up on the formation of a new government after a period of political chaos. Sign up here. The FTI said its industrial sentiment index dropped to 86.4 in August from 86.6 in July, the lowest reading in 37 months. The survey was conducted before parliament elected as prime minister earlier this month. "The good point we believe is that this cabinet has a short tenure, which will make the government focus on working diligently," FTI Vice Chairman Nava Chantanasurakon, told a news conference. "If it can prioritise and implement the private sector's proposals effectively, the index should be better than in August." Anutin has said he wants to boost the struggling economy, and on Monday said he would tackle the baht's appreciation. The baht's rise to a four-year high against the dollar has raised concerns about competitiveness among businesses, including rice exporters. The baht is up 8% against the dollar this year, the second-largest rise amongst Asian currencies. The central bank has said it is considering measures, including a tax on gold trading, to counter the gains. The state planning agency has forecast Southeast Asia's second-largest economy will grow by 1.8% to 2.3% this year, below last year's 2.5% growth which lagged regional peers. The United States a 19% tariff on goods imported from Thailand, and there are still uncertainties relating to tariffs on transshipments via Thailand from third countries. A special task force will be set up in October to manage millions of certificates of origin expected to be required under new trade rules. https://www.reuters.com/markets/asia/thai-industrial-sentiment-hits-3-year-low-august-politics-strong-baht-2025-09-17/

2025-09-17 04:32

A look at the day ahead in European and global markets from Rocky Swift After weeks of market gyration and agonising over every speck of U.S. data, the day is finally upon us when the Federal Reserve delivers its appraisal of how much stimulus the world's biggest economy needs to keep humming along. Sign up here. Markets have priced in a near certainty the Fed will cut its key interest rate by a quarter of a percentage point to the 4.00%-4.25% range today. But they also anticipate the U.S. central bank will go further with nearly 150 basis points of easing through the end of next year. So all eyes will be on Fed Chair Jerome Powell's comments as well as the central bank's "dot plot" of economic projections, all due after markets close in the United States. Expectations of a dovish take from the Fed, fuelled also by threats from President Donald Trump, have driven global shares and gold to unprecedented highs at the cost of U.S. Treasuries and the dollar, languishing at a four-year low against the euro. The Fed deck isn't stacked quite as Trump had hoped. Stephen Miran, head of the White House's Council of Economic Advisers, was sworn into his Fed position on Tuesday morning, while an appeals court separately declined to let Trump fire Fed Governor Lisa Cook. The president will take in the Fed's decision from London, where he arrived late on Tuesday to seal investment deals and bask in the royal glow of King Charles at Windsor Castle. Also on the docket is the Bank of Canada, which is expected to cut rates as trade frictions roil labour markets on both sides of the American border. Meanwhile, data from Japan showed a fourth consecutive monthly decline in exports in August, highlighting the toll on major economies from the wide-ranging tariffs imposed by the Trump administration. In Asian markets, stocks started out subdued before turning up, led higher by Hong Kong's Hang Seng Index (.HSI) , opens new tab, which surged 1.4%. Equity futures indicated positive openings in Europe, while U.S. stock futures were flat. Key developments that could influence markets on Wednesday: - Fed, Bank of Canada policy meetings - U.S. housing starts for August - British consumer price index (CPI) for August - Euro zone consumer price data for August, final - Germany's reopening of 23-year and 31-year government debt auctions - Meta opens its annual Connect conference at its Menlo Park, California-based headquarters - StubHub, WaterBridge Infrastructure go public in New York https://www.reuters.com/world/china/global-markets-view-europe-2025-09-17/