2025-09-16 05:08

European shares dragged down by banks and insurance stocks Investors bet on further Fed cuts, no more from ECB Gold at new record high, dollar weaker SINGAPORE/LONDON, Sept 16 (Reuters) - Global shares held near record highs on Tuesday as investors bought U.S. assets on the premise that the Federal Reserve is likely to cut rates, while selling equities in Europe, where borrowing costs look unlikely to fall much further. MSCI's all-country index (.MIWD00000PUS) , opens new tab edged up 0.46% to new record highs. The pan-European STOXX 600 (.STOXX) , opens new tab dropped 0.19%, led by declines in rate-sensitive banks (.SX7E) , opens new tab and insurers (.SXIP) , opens new tab, which stand to lose out if the European Central Bank does not cut euro zone rates much more. Sign up here. "Markets are probably realising that there will be no further cuts by the ECB and this is offsetting expectations of Fed resuming its easing path," said James Rossiter, head of global macro strategy at TD Securities in London. Money markets are pricing in just a 40% chance of the ECB cutting by 25 bps by June 2026 from around 50% last week. STOCKS SCALE NEW HEIGHTS The markets' mood has been buoyant over the past few sessions and stocks scaled new highs on Wall Street on expectations of imminent Fed rate cuts. S&P 500 futures and Nasdaq futures were up 0.2%, pointing to another rally at the opening bell, after both indexes scaled all-time highs in Monday's trading session. Futures already have over 127 bps worth of Fed cuts priced in by July 2026, meaning the bar could be high for policymakers to keep investors optimistic. "There do seem to be quite a few rate cuts priced in now. On balance, maybe that suggests that the bar for a hawkish surprise is a little lower than that for a dovish one," said Thomas Mathews, head of markets for Asia Pacific at Capital Economics. "It's likely though that the Fed will stick with its cautious communication approach and not give much away." With so much focus on the Fed decision, markets hardly reacted to news that the U.S. Senate narrowly confirmed Stephen Miran to the central bank's Board of Governors, and a U.S. appeals court separately declined to let President Donald Trump fire Fed Governor Lisa Cook. Neither move was seen as likely to shift the needle for the Fed's decision on Wednesday, where a 25-basis-point cut is fully priced in. The Bank of Canada is also expected to cut rates by a quarter point this week, and the Bank of Japan and the Bank of England are both expected to hold rates steady. Elsewhere, U.S. and Chinese officials said on Monday they had reached a framework agreement to switch short-video app TikTok to U.S.-controlled ownership which will be confirmed in a Friday call between Trump and Chinese President Xi Jinping. PRESSURE ON THE DOLLAR The Fed cut bets have in turn kept pressure on the dollar, which on Tuesday fell to its lowest since July 4 against a basket of currencies . Euro traded near its highest since early July, which in turn was the highest since September 2021. It was up 0.4% at $1.1811. Sterling climbed to its highest in over two months at $1.3641. U.S. Treasury yields were little changed after falling in the previous session, with the two-year yield last at 3.5345%. The benchmark 10-year yield was almost flat at 4.0432%. Oil prices extended their rise from the previous session, as investors assessed the impact of Ukrainian drone attacks on Russian refineries. Brent crude futures were up 0.5% at $67.79 per barrel. U.S. crude futures rose 0.8% to $63.74 a barrel. Spot gold reached a new record high just below $3,700 an ounce, supported by a weaker dollar and expectations for a Fed rate cut. https://www.reuters.com/world/china/global-markets-wrapup-3-2025-09-16/

2025-09-16 04:31

A look at the day ahead in European and global markets from Rae Wee The U.S. Federal Reserve kicks off its two-day policy meeting later on Tuesday where an interest rate cut is all but priced in, at a time when the central bank faces unprecedented pressure from the White House over the direction of monetary policy. Sign up here. The U.S. Senate on Monday narrowly confirmed Stephen Miran to the Fed's Board of Governors, handing President Donald Trump's top economic adviser one of 12 interest rate-setting votes on the eve of the policy meeting. Miran will join the meeting pending completion of paperwork and his swearing-in. Also able to attend the meeting - absent a last-minute Supreme Court intervention - is Fed Governor Lisa Cook after a U.S. appeals court on Monday said Trump could not fire her. Markets hardly reacted to the news yet the developments were a reminder of how Trump is putting his stamp on the bank and reshaping its standing in the eyes of the public and peer institutions, and influencing policy and other decisions. Ahead of Wednesday's Fed outcome, markets were largely in wait-and-see mode, with stocks scaling fresh highs in Asia while the U.S. dollar struggled to make headway. Markets have fully priced in a 25 basis-point cut with some pricing in a slim chance of a 50 bp move, against a backdrop of Trump calling for the Fed to deliver a "bigger" cut. The Fed aside, investors will also have UK labour market data and U.S. retail sales figures to chew on later on Tuesday. Still-elevated wage growth in Britain continues to be a source of concern for the Bank of England, even as the broader labour market shows signs of cooling. Overall average weekly earnings, excluding bonuses, likely grew 4.8% over May-July, versus 5.0% for April-June, while the unemployment rate is forecast to have stayed steady at 4.7%. The BoE is widely expected to keep its benchmark interest rate on hold later this week as the rate of inflation creeps up, but is likely to cut once next quarter and again early next year, showed a Reuters poll of economists. Key developments that could influence markets on Tuesday: https://www.reuters.com/world/china/global-markets-view-europe-2025-09-16/

2025-09-16 03:04

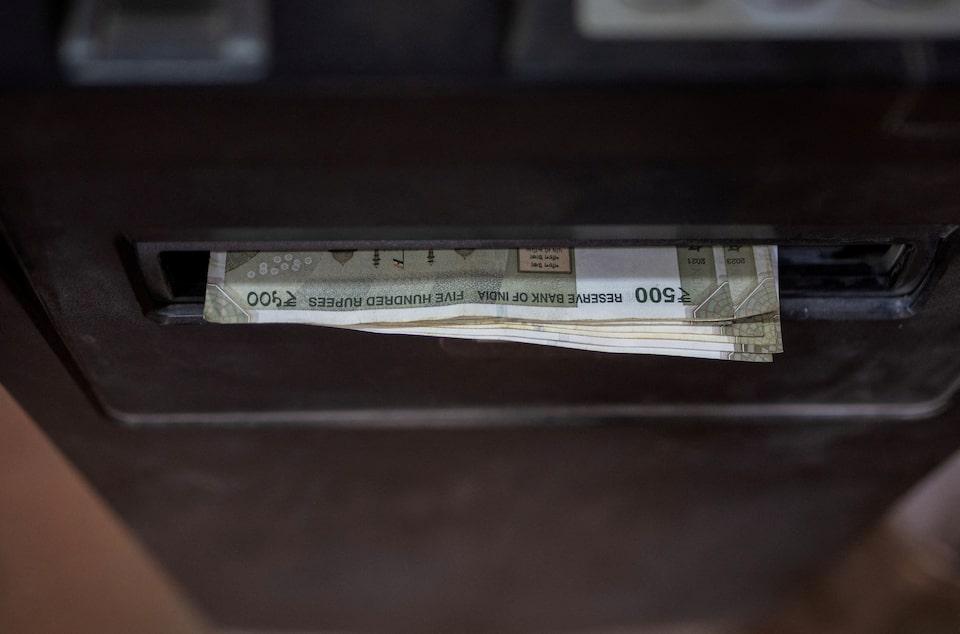

MUMBAI, Sept 16 (Reuters) - The Indian rupee is expected to open higher on Tuesday, buoyed by the dollar's struggles in the run-up to the U.S. Federal Reserve's policy decision, with traders watching out for potential hints on further rate cuts. The 1-month non-deliverable forward indicated the rupee will open in the 88.12-88.14 range versus the U.S. dollar, compared with Monday's level of 88.21. Sign up here. The rupee has managed to recover after sliding to a record low of 88.4550 on Friday. However, bankers did not cite any specific trigger for the recovery, noting instead that broader Asian currencies have been performing well and that risk appetite remains firm. They further suggested positioning adjustments may have played a role. Flows have turned "more two-way" after the lifetime low, and positioning possibly is lighter, a currency trader at a private sector bank said. "It's just a modest pullback (in dollar/rupee). However, the tide does look a bit better for the rupee, though it hasn't really turned in its favour yet," he said. If the Fed turns more dovish than the market is braced for, it could squeeze dollar longs and hand the rupee the needed tailwind, he added. Market participants downplayed the near-term impact of a Bloomberg report that JPMorgan will cut the weight of top bond issuers in its flagship EM index, noting that any reallocation of flows away from India and China toward smaller countries would be a slow process. POSITIVE ASIAN CUES Asian currencies and equities advanced on Tuesday and the dollar index slipped, with focus squarely on the Fed meeting. The central bank is widely expected to deliver a 25-basis-point rate cut on Wednesday, with investors watching closely for signals on the depth of future reductions. Investors are currently pricing in two additional rate cuts by the Fed following Wednesday’s decision, expected at the October and December meetings. KEY INDICATORS: ** One-month non-deliverable rupee forward at 88.28; onshore one-month forward premium at 12 paise ** Dollar index down at 97.26 ** Brent crude futures rise 0.2% to $67.6 per barrel ** Ten-year U.S. note yield at 4.04% ** As per NSDL data, foreign investors bought a net $115.8 mln worth of Indian shares on September 12 ** NSDL data shows foreign investors bought a net $198.9 mln worth of Indian bonds on September 12 https://www.reuters.com/world/india/rupee-push-higher-dollar-weakness-lead-up-fed-meeting-2025-09-16/

2025-09-16 02:56

TOKYO, Sept 16 (Reuters) - Japan's Finance Minister Katsunobu Kato said on Tuesday the government will carefully consider what measures would be most effective in pressuring Russia, while noting challenges in imposing higher tariffs on countries buying Russian oil. His comments come after the U.S. urged the Group of Seven nations on Friday to impose tariffs on buyers of Russian oil during a call with G7 finance ministers as they discussed further sanctions on Russia. Sign up here. "It's important that Japan thoroughly consider what measures would be most effective and coordinate with other G7 countries," Kato said in a regular press conference. However, Kato said it would be difficult to impose higher tariffs on specific countries just for their purchases of Russian oil, as long as they comply with the World Trade Organization rules. https://www.reuters.com/markets/currencies/japan-will-carefully-consider-measures-pressure-russia-finance-minister-says-2025-09-16/

2025-09-16 01:09

Ann Arbor finds no tax rule violations by Cook Trump administration accuses Cook of mortgage fraud Cook denies wrongdoing Sept 15 (Reuters) - The property tax authority in Ann Arbor, Michigan, said that Federal Reserve Governor Lisa Cook hasn’t broken rules for tax breaks on a home there that Cook declared her primary residence. The finding, which came in response to a Reuters request that the city review Cook’s property records, could boost Cook’s defense against efforts by the Trump administration to remove her from the Federal Reserve board. Sign up here. Ann Arbor has “no reason to believe” that Cook violated property tax rules, City Assessor Jerry Markey told Reuters. Cook has at times lived elsewhere and city records indicate she sought permission from Ann Arbor authorities to rent out the Michigan home on a short-term basis. Temporary absence from the home or renting it out short-term wouldn’t disqualify her from a tax exemption in Ann Arbor, the tax official said. “Living elsewhere temporarily does not necessarily make an owner ineligible for a principal residence exemption,” said Markey. The official’s remarks come as the administration of President Donald Trump is accusing the Fed governor of fraud related to mortgages on the Ann Arbor home and another she purchased in Atlanta. Bill Pulte, the director of the Federal Housing Finance Agency, has spearheaded the effort, denouncing Cook on social media and referring the matter to the Department of Justice, which launched an investigation. At issue is whether Cook, whom Trump has sought to fire from the Fed board, lied to her lenders when obtaining the two mortgages. The Trump administration, citing her mortgage contracts, has alleged that she improperly told both lenders that the loan was for a primary residence. By declaring a home as a primary residence, a homeowner can – but doesn’t always – secure a better interest rate on the loan and, separately, can receive discounts from local authorities on property taxes. A federal appeals court declined late Monday to allow Trump to fire Cook. The administration is expected to appeal immediately to the Supreme Court, adding a further complication to her status for the Fed's upcoming two-day gathering. Reuters last week reported that Cook, according to a loan estimate for the mortgage in Atlanta, had informed her lender that the property would be a “vacation home,” not a primary residence , opens new tab . In a social media post after the news agency’s story, Pulte wrote that a “vacation home” claim in the Atlanta mortgage paperwork could still be fraudulent if she eventually secured the loan by declaring otherwise. “That is extremely concerning,” Pulte wrote on X, “and in my opinion, evidences further intent to defraud.” The full extent of Cook's representations to her lenders remains unclear, including any paperwork that may have changed the “vacation home” characterization by the time the mortgage was settled. Local officials in Georgia told Reuters that Cook never declared the home as a primary residence for tax purposes there. Cook has repeatedly denied any wrongdoing. In a written statement on Monday, her attorneys said: “The attempt to remove Governor Cook is based on cherry-picked social media posts from the FHFA Director that collapse under basic scrutiny.” Since securing a mortgage for the Michigan home in 2021, local property records show she got approval from the city to rent it out on a short-term basis in October 2022 and again in April 2024. Some cities, like Ann Arbor, require home owners to obtain a license to rent out their home, even on a short-term basis. In April 2025, months before Pulte began publicly accusing her of fraud, Cook sought approval to list the home as a long-term rental, according to local records and city officials. In July, she told the city she had enlisted a rental firm to manage the property, the officials said. Cook now has until the end of the year to revoke the tax exemption on the home, said Markey, the Ann Arbor city assessor. The property tax records in both states, along with Cook’s “vacation home” disclosure in Atlanta, could be considered strong factors in her defense, real estate and legal experts said. For any conviction of mortgage fraud, which is rarely pursued as a criminal offense in the United States, they said prosecutors would have to show she deliberately sought to deceive her lenders. Paul Pelletier, a Washington-based former federal prosecutor who targeted bank fraud, said the Justice Department historically would only pursue cases in which a financial institution suffered significant loss. “This would never have crossed my desk, let alone be prosecuted,” he said, regarding the accusations against Cook so far. The rates on Cook’s two mortgages show Cook didn’t enjoy discounts compared with prevailing rates available to borrowers when she negotiated the loans in 2021. Her rate on the 15-year loan on the Michigan property was 2.875%, versus a prevailing national rate in that period ranging from 2.23% to 2.45%, according to Freddie Mac data. And her rate on the 30-year loan on her Atlanta property was 3.25%, versus a prevailing rate at the time ranging from 2.93% to 3.04%, according to Freddie Mac data. https://www.reuters.com/world/us/no-evidence-primary-residence-violation-by-fed-gov-lisa-cook-says-michigan-2025-09-16/

2025-09-16 00:57

Milei's budget aims for fiscal balance, 85% allocated to education, healthcare and pensions Argentina forecasts 5% GDP growth, inflation to slow to 10.1% by 2026 October's legislative vote poses challenges for Milei's agenda BUENOS AIRES, Sept 15 (Reuters) - Argentina's President Javier Milei presented on Monday the government's proposal for next year's budget, which he said would guarantee a fiscal balance, a cornerstone of his economic policy, while also hiking funds for healthcare, education and pensions. "There is no other way but that of fiscal balance," Milei said in a national address, ahead of a high-stakes legislative election in which Milei's libertarian party is aiming to secure enough seats to keep Congress from overriding his vetoes. Sign up here. The key vote comes after a local election in The populous Buenos Aires province dealt a blow to Milei's party, whose austerity measures have weighed on its popularity. Milei said the budget proposal would include a "rule of fiscal stability," which means that if costs exceed expectations the budget should be adjusted to maintain a fiscal balance. Next year should see Argentina log a fiscal surplus, or, "in the worst case scenario," a fiscal balance, he added. The draft budget document showed that the government expects a fiscal surplus of 1.5% of gross domestic product next year and a financial surplus - after debt payments - of 0.3% of GDP. Latin America's third-largest economy should post GDP growth of around 5% next year, according to the document, after expanding 5.4% in 2025. The government also forecasts a trade deficit of $5.751 billion next year, and for the local currency to hit 1,423 pesos per U.S. dollar. Annual inflation is expected to slow to 10.1% by end 2026 from the 24.5% estimated by the end of this year. HUMAN CAPITAL Milei said 85% of the proposed budget would be destined for education, healthcare and pensions, including a 17% increase in allocations for healthcare, 8% for education and 5% for pensions, on top of inflation. "This means that this government's priority, as we have always said, is human capital," Milei added. Milei's government has dramatically brought down yearly inflation from the triple digits it reached before he came into office. However, his government's popularity has been hit ahead of the key elections by a corruption scandal and the fallout of his austerity measures for disabled and pensioners, which have fueled regular protests in the capital, Buenos Aires. Local elections in Buenos Aires province earlier this month resulted in a solid victory for the opposition Peronists over the ruling party, raising doubts on the minority government's ability to gain more seats in Congress and secure its agenda. Milei will send the proposal to Congress later tonight, he said. https://www.reuters.com/world/americas/argentina-draft-2026-budget-spotlights-fiscal-balance-hikes-social-allocations-2025-09-16/