2025-09-15 21:02

CHICAGO, Sept 15 (Reuters) - Nebraska has detected its first case of bird flu in a dairy cattle herd, the U.S. Department of Agriculture said on Monday, showing the virus continues to spread in livestock after an outbreak began last year. Dairy cattle in 17 states have been infected since the start of the outbreak in March 2024, according to the USDA. California, Michigan, Nevada, Idaho, Arizona and Texas have also reported cases in dairy herds this year. Sign up here. The herd in Nebraska is located in the central part of the state and has been quarantined, according to the Nebraska Department of Agriculture. Infected dairy cows often suffer from reduced milk production. https://www.reuters.com/business/healthcare-pharmaceuticals/usda-reports-nebraskas-first-case-bird-flu-dairy-cattle-herd-2025-09-15/

2025-09-15 21:01

Delaware judge to select final winner after four-day hearing Hearing could extend to October if more evidence is needed Amber's bid includes $2.1 billion cash for PDVSA bondholders Gold Reserve, others prefer waiting for New York case resolution Citgo's valuation at the center of dispute HOUSTON, Sept 15 (Reuters) - A long-awaited sale hearing expected to complete a U.S. court-organized auction of shares in the parent of Venezuela-owned U.S. refiner Citgo Petroleum kicked off on Monday, with bidders and creditors locked in a bitter dispute over who should win. The Delaware court is hearing testimony from involved parties, witnesses and experts in the four-day showdown before Judge Leonard Stark selects a final winner. Sign up here. At stake is the future of the seventh largest U.S. refiner, whose parent was found liable for the South American nation's debt, as 15 companies with expropriated assets and holders of defaulted bonds pursue its assets. Judge Stark on Monday denied a motion to extend the hearing to consider a last-minute bid from Blue Water (BLUW.O) , opens new tab, and also denied Venezuela's request to suspend the proceeding over an alleged conflict of interest involving law firm Weil, Gotshal & Manges, which is advising the court. Another set of arguments could be presented in October if the court decides more time and evidence are needed. "This sale hearing represents a significant milestone in an 18-year litigation effort that ConocoPhillips (COP.N) , opens new tab has been engaged in since its assets were expropriated in 2007 by (Venezuelan) President Hugo Chavez," Amy Wolf, a lawyer representing the oil company, the largest creditor in the case with more than $11 billion in claims, said during the hearing. Blue Water representatives told Reuters the firm was granted access to Citgo's data room and expects the court to allow it to present supporting evidence at the end of the hearing. Weil, Gotshal & Manges did not immediately reply to a request for comment. RIVAL BIDS FOR CITGO CLASH IN COURT In July, a court officer overseeing the process selected a subsidiary of Toronto-listed miner Gold Reserve (GRZ.V) , opens new tab as the auction's frontrunner. But following a last-minute bidding war, officer Robert Pincus last month switched his recommendation to a $5.9 billion bid from Amber Energy, an affiliate of hedge fund Elliott Investment Management. The decision has unleashed objections and a motion to disqualify Amber's bid, which remains pending, amid a battle between expropriated companies and holders of the nation's defaulted bonds. Miner Crystallex, ConocoPhillips (COP.N) , opens new tab and an affiliate of bondholder Contrarian Funds told the court on Monday they support Amber's bid, while Venezuela, Gold Reserve and junior creditors objected to it. The hearing "will serve as the first stress test of whether the Amber bid can survive the full gauntlet of procedural, legal, and geopolitical risks," said lawyer Jose Ignacio Hernandez from consultancy Aurora Macro Strategies, in a report last week. By including a $2.1 billion cash payment to holders of PDVSA's 2020 bonds, Amber's bid creates an opportunity to resolve a long-pending claim that is being heard in a separate New York court. However, Venezuela and a handful of creditors prefer to wait for the resolution of the New York case, where the validity of the bonds is in dispute, before anything is paid to the holders. The court on Monday heard testimonies from experts about Citgo's valuation, following Venezuela's arguments that the assets should not be auctioned at a fraction of their value. The company was valued at some $13 billion by court advisors before the first bidding round last year, but a more recent valuation raised it to some $18 billion, one of the experts said. Bids have not surpassed $11 billion. https://www.reuters.com/business/energy/citgo-parent-auction-nears-final-stages-sale-hearing-kicks-off-2025-09-15/

2025-09-15 20:59

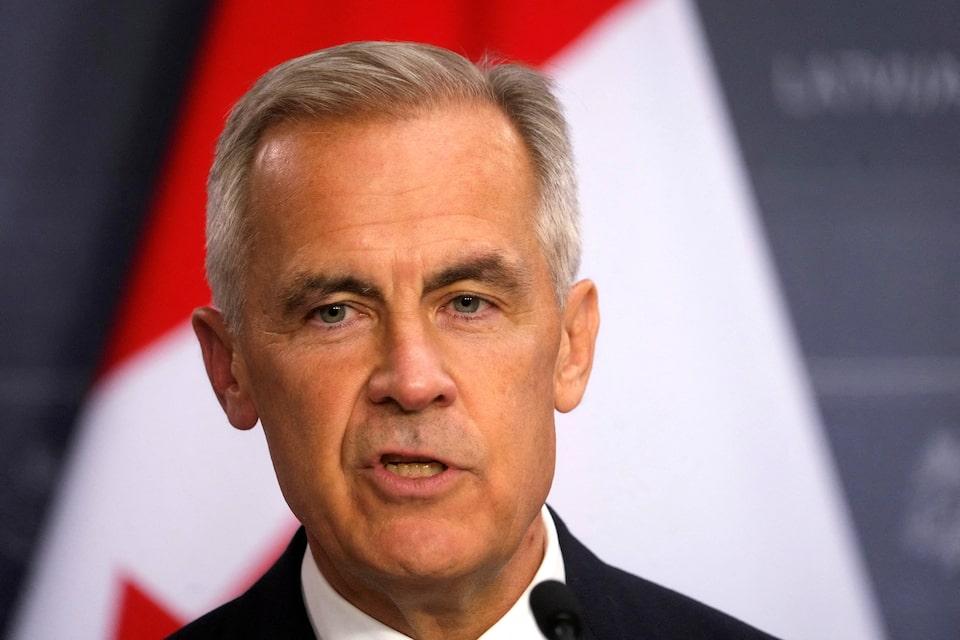

Sept 15 (Reuters) - Canadian Prime Minister Mark Carney told Anglo American (AAL.L) , opens new tab to move its headquarters to Canada or its proposed acquisition of Teck Resources (TECKb.TO) , opens new tab would not be allowed to proceed, the Globe and Mail reported on Monday, citing two sources familiar with the matter. London-based Anglo American and Canada's Teck last week announced a $53-billion planned merger, the sector's second-biggest M&A deal ever, and said the merged entity, Anglo Teck, would be headquartered in Canada and have a primary stock listing in London. Sign up here. In his conversations with Anglo American, Carney made it clear that shifting headquarters was a requirement that any prospective buyer for Teck would have to meet, the Globe and Mail report added. An Anglo American spokesperson declined to comment on the report, but pointed to CEO Duncan Wanblad's statement last week that Vancouver is the natural location for the merged company, given its operations and projects are largely based in the Americas. "Anglo American has also had its Americas exploration team based out of Vancouver for a long time, so we are very familiar with the setup," the spokesperson told Reuters in an emailed statement. Reuters could not immediately verify the report. PM Carney's office did not immediately respond to a Reuters request for comment, while Teck declined to comment on the report. https://www.reuters.com/markets/commodities/canada-pm-told-anglo-american-move-hq-canada-teck-deal-nod-globe-mail-reports-2025-09-15/

2025-09-15 20:50

S&P 500, Nasdaq hit fresh records Dollar drops against peers, Euro gains Rate cuts seen from Fed, BoC; steady for BoE, BOJ Benchmark 10-year yields fall NEW YORK/LONDON, Sept 15 (Reuters) - Global shares hit a fresh record high on Monday as markets positioned for the U.S. Federal Reserve to begin its monetary policy easing cycle this week. Gold prices hit a record high as the U.S. dollar weakened. Traders widely expect the Fed to deliver a 25 basis-point cut at the end of its policy meeting on Wednesday, with the probability of such a move near 100%, according to CME's FedWatch tool. Sign up here. MSCI's All-Country Index (.MIWD00000PUS) , opens new tab rose as high as 977.09, up 0.50%, topping last week's record high. On Wall Street, all three main indexes closed higher with the S&P 500 and Nasdaq hitting fresh intraday record highs. Communication services, consumer discretionary, and technology stocks were the biggest gainers while consumer staples, healthcare and materials equities drove losses. The Dow Jones Industrial Average (.DJI) , opens new tab rose 0.11% to 45,883.45, the S&P 500 (.SPX) , opens new tab rose 0.47% to 6,615.28 and the Nasdaq Composite (.IXIC) , opens new tab rose 0.94% to 22,348.75. Stocks in Europe (.STOXX) , opens new tab rose 0.42% on the day, finishing near a three-week high with luxury and defense stocks boosting the main index "Today it looks like we're still in a wait-and-see mode for the Fed meeting and announcement," said Wasif Latif, chief investment officer at Sarmaya Partners in New Jersey. "We've had a big run up in the market that continues to see new highs in anticipation of the Fed and today seems to be moving in the same direction." Key too will be Fed members' "dot plot" projections for rates and guidance from Fed Chair Jerome Powell on the extent and pace of any further easing. The yield on benchmark U.S. 10-year notes fell 2.4 basis points to 4.036%. Futures already have 125 basis points of cuts priced in by late 2026, so anything less than dovish will likely disappoint investors. "What's interesting is that we've already seen prices move significantly in anticipation of the cut, so the question is will the rate announcement itself turn into a sell-on-the-news today or not," Latif added. U.S. President Donald Trump continued his attacks on the central bank on Sunday, saying Powell was incompetent and hurting the housing market. The Bank of Canada is also expected to cut rates by a quarter point this week, while the Bank of Japan and the Bank of England are both seen holding rates steady. In currencies, the U.S. dollar dropped against its peers ahead of the Fed's expected rate cut. It was down 0.17% to 147.42 against the Japanese yen and was down 0.27% to 0.79420 against the Swiss franc . The dollar index fell 0.36% to 97.31. The euro shrugged off Fitch's downgrade of France late last week, rising 0.23% to $1.176075. It was a touch weaker against sterling, trading at 86.44 pence, down 0.1% on the day . The euro has been underpinned by a steady outlook for EU rates, with the European Central Bank signaling last week it was in a "good place" on policy. A host of ECB officials are due to speak this week, including President Christine Lagarde. The United States and China reached a framework agreement to switch short-video app TikTok to U.S.-controlled ownership, an arrangement that will be confirmed in a call between Trump and Chinese President Xi Jinping on Friday, U.S. officials said. Nvidia's (NVDA.O) , opens new tab finished flat, erasing earlier session losses, after China's market regulator said on Monday that a preliminary investigation had found that the company had violated the country's anti-monopoly law, marking the latest hit for the U.S. chip giant. Oil prices rose as investors assessed the impact of Ukrainian drone attacks on Russian refineries. Brent crude futures settled up 0.67% to $67.44 a barrel. U.S. West Texas Intermediate crude CLc1 settled at $63.30 a barrel, up 0.97%. Gold prices hit a new record high, underpinned by a softer dollar and lower Treasury yields. Spot gold rose 1.04% to $3,680.87 an ounce. It hit a record high of $3,685.39 earlier in the session. https://www.reuters.com/world/china/global-markets-wrapup-5-graphics-2025-09-15/

2025-09-15 20:47

S&P up 0.47%, Nasdaq up 0.94%, Dow up 0.11% Alphabet hits $3 trillion in market value for first time Nvidia slips after China's anti-monopoly investigation Tesla gains as CEO Musk buys shares worth $1 billion Sept 15 (Reuters) - The three major U.S. stock indexes closed higher on Monday with the S&P 500 and the Nasdaq notching intraday record high closes, as investors await the Federal Reserve's crucial policy meeting later this week. Tesla (TSLA.O) , opens new tab shares climbed 3.6% after regulatory filings revealed CEO Elon Musk had acquired nearly $1 billion worth of the electric vehicle maker's stock on Friday. And Google parent Alphabet (GOOGL.O) , opens new tab hit a record high and raced past $3 trillion in market capitalization. Sign up here. The Federal Open Market Committee meeting on September 16 and 17 looms large over sentiment this week with market participants widely expecting a 25-basis-point reduction following recent economic data signaling labor market weakness. “The market is counting on sort of a goldilocks scenario where the employment market is just weak enough to prompt the Federal Reserve to start a rate cutting series, not just one, without disrupting overall growth,” said Carol Schleif, Chief Investment Officer at BMO Family Office. “I think the markets will be disappointed if the Fed doesn’t give some hint that they intend to continue rate cuts.” Traders on Monday are pricing in a 96% chance of a 25-basis-point cut at this week's meeting. Tesla's gains boosted the S&P 500 consumer discretionary sector (.SPLRCD) , opens new tab 1.1% to its highest level in nearly nine months. Meanwhile, Alphabet helped lift the communication services sector (.SPLRCL) , opens new tab up 2.33%. Nvidia (NVDA.O) , opens new tab slipped 0.04% after China's market regulator said it will continue an investigation into the AI chip leader after preliminary findings showed it had violated the country's anti-monopoly law. The Dow Jones Industrial Average (.DJI) , opens new tab rose 49.23 points, or 0.11%, to 45,883.45, the S&P 500 (.SPX) , opens new tab gained 30.99 points, or 0.47%, to 6,615.28 and the Nasdaq Composite (.IXIC) , opens new tab gained 207.65 points, or 0.94%, to 22,348.75. Wall Street's three main indexes had logged weekly gains in the previous session, with the Nasdaq and the S&P 500 hitting intraday record highs on Friday as technology-linked stocks remained resilient. Declines in McDonald's (MCD.N) , opens new tab and Procter & Gamble Co (PG.N) , opens new tab weighed on the Dow. CoreWeave (CRWV.O) , opens new tab jumped 7.6% after the data center operator signed a deal with Nvidia that guarantees that the chipmaker will purchase any residual cloud capacity not sold to customers. The deal's initial value is $6.3 billion. Kerrisdale Capital disclosed a short position on CoreWeave. On the Nasdaq, advancing issues outnumbered decliners by a 1.2-to-1 ratio. Advancing issues outnumbered decliners by a 1.67-to-1 ratio on the NYSE. The S&P 500 posted 23 new 52-week highs and 11 new lows while the Nasdaq Composite recorded 117 new highs and 66 new lows. Volume on U.S. exchanges was 17.68 billion shares, compared with the 16.2 billion average for the full session over the last 20 trading days. https://www.reuters.com/business/wall-street-indexes-end-higher-ahead-fed-meeting-tesla-alphabet-rally-2025-09-15/

2025-09-15 20:46

TSX ends up 0.5% at 29,431.02 Surpasses Thursday's record closing high Energy rises 0.8% as oil settles 1.1% higher Cameco jumps 9.9% Sept 15 (Reuters) - Canada's main stock index rose to another record high on Monday as energy and technology shares notched gains, and ahead of expected moves this week by the Bank of Canada and the Federal Reserve to resume their easing campaigns. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) , opens new tab ended up 147.20 points, or 0.5%, at 29,431.02, eclipsing last Thursday's record closing high. Sign up here. Wall Street's three major indexes also closed up as investors awaited an expected interest rate cut by the Fed on Wednesday. The BoC is also expected to lower rates on Wednesday after leaving its benchmark rate on hold at 2.75% since March. "Recent soft economic numbers on both sides of the border have increased the pressure on central bankers to do something," Colin Cieszynski, chief market strategist at SIA Wealth Management, said in a note. The energy sector rose 0.8% as the price of oil settled 1.1% higher at $63.36 a barrel after Ukrainian drone attacks on Russian refineries. Uranium shares were among the biggest advancers, with Cameco Corp (CCO.TO) , opens new tab jumping 9.9%. Canadian oil sands producer MEG Energy (MEG.TO) , opens new tab urged shareholders to reject the sweetened takeover bid from its majority stakeholder Strathcona Resources (SCR.TO) , opens new tab and reaffirmed support for sale to Cenovus Energy (CVE.TO) , opens new tab. Cenvous rose 1.9%, while Strathcona was down 1.8% and MEG ended barely changed. Technology was up 0.8% and heavily weighted financials added 0.5%. Canadian home sales rose for a fifth straight month in August as increased activity in the regions of Montreal, Greater Vancouver and Ottawa offset a decline in the Greater Toronto Area, data from the Canadian Real Estate Association showed. https://www.reuters.com/markets/europe/uranium-producers-help-lift-tsx-another-record-high-2025-09-15/