2025-09-11 11:08

LONDON, Sept 11 (Reuters) - Britain’s largest electricity supplier Octopus Energy has signed a deal with Chinese wind turbine manufacturer Ming Yang Smart Energy (601615.SS) , opens new tab, which could see the first Chinese made turbines installed in Britain. Britain is seeking to scale up renewable power to help meet its climate targets but is also grappling with rising project costs and high electricity prices. Sign up here. The partnership, announced on Thursday, will see the companies explore opportunities to use Ming Yang Smart Energy’s technology as part of Octopus Energy's plans to develop up to 6 gigawatts of wind through its Winder initiative, which matches communities that would like wind farms with project developers. “By combining Octopus’s expertise in smart technology and software with outstanding wind turbines, we can optimise every kilowatt and cut energy costs for millions of bill payers,” Zoisa North-Bond, CEO of Octopus Energy Generation, said in a statement. Elsewhere in Europe, the European Commission last year launched a review into Chinese turbine manufactures in response to industry concerns that cheaper imports could threaten the competitiveness of European firms. Ming Yang Smart Energy was due to supply turbines for a 300-megawatt Waterkant wind farm in Germany under a deal announced last year, but Hamburg-based asset manager Luxcara said last month it had instead chosen Siemens Gamesa, a subsidiary of Germany's Siemens Energy as its supplier. Britain’s Energy Minister Ed Miliband visited China earlier this year to discuss climate and energy issues, and has said it would be negligent to not engage with China on climate issues. https://www.reuters.com/sustainability/boards-policy-regulation/britains-octopus-energy-partners-with-chinese-wind-turbine-maker-2025-09-11/

2025-09-11 11:00

LITTLETON, Colorado, Sept 11 (Reuters) - It's been said that there's little point in other countries cutting back on pollution while China keeps building new coal plants and lifts its own emissions ever higher. But so far in 2025 China's power sector has managed a rare decline in pollution from the use of fossil fuels, which bodes well for climate trackers hoping that China's mammoth pollution trends are close to peaking. Sign up here. The problem is, the cuts made in China have been more than offset by sharply higher discharge from power plants in the United States, where coal-fired electricity generation has jumped to three-year highs in 2025. The higher pollution load from the U.S. means that global power sector pollution will likely keep climbing this year even if China's power emissions fall. The U.S. pollution offset also clearly negates the argument that it is pointless to cut pollution while China's emissions expand, and reveals that the world could get closer to capping power sector discharge if other countries follow China's lead. COAL CUTS Between January and July, China's emissions of carbon dioxide from fossil fuel use in power generation dropped by 30 million metric tons compared to the same months in 2024, data from energy think tank Ember shows. That emissions cut marks a 1% fall from the year before and comes after two straight years of pollution growth during the January to July period in China. On a full-year basis, China's power emissions from fossil fuels have recorded nine straight years of growth, so even a modest pullback in power emissions in 2025 would mark a rare milestone in China's pollution reduction efforts. Total power emissions from fossil fuel use were 3.24 billion tons of CO2 during January to July, down from 3.27 billion tons during January to July of 2024. Key to the emissions drop has been the first cut in coal-fired power generation since 2022, which in turn has been facilitated by a 14% year-over-year rise in clean electricity output. Total clean electricity production during the January to July window was 2,445 terawatt hours (TWh), which is around 303 TWh more than was generated during the same months last year. Electricity generation from coal-fired power plants - which remains China's main power source - was 3,277 TWh during January to July, down around 30 TWh or 1% from the same months in 2024. Gas-fired electricity generation in China was also down by around 1% from a year ago. US POWERING UP As China's power sector has curbed coal use this year, U.S. power firms have raised it, with coal-fired electricity supplies jumping by 16% during the January to July window from the same months in 2024. Total U.S. coal-fired electricity supplies were 435 TWh during January to July, up from 375 TWh a year ago and the highest since 2022. The emissions toll from that spike in coal use was a 37 million ton increase in CO2 discharge compared to the same months last year. Total U.S. power sector emissions from fossil fuel use during January to July were 978 million tons of CO2, up from 941 million tons for the same period in 2024. U.S. power emissions were amplified by a rise in coal's share of the generation mix from just under 15% a year ago to nearly 17% so far in 2025. The main driver of that higher coal use was a climb in the price of natural gas during the opening months of the year. Natural gas-fired power plants remain the primary power source in the U.S., but power firms cut gas generation by 4% during January to July after gas prices averaged 65% more during the opening half of 2025 compared to the same period in 2024. To compensate for the lower gas-fired supplies, power firms burned cheaper but higher-emitting coal instead, triggering the swell in pollution. CLEANING UP Alongside higher coal-fired output, U.S. utilities also generated around 30% more solar-powered electricity during January to July compared to a year earlier, and 3% more wind and hydro-powered electricity. Total U.S. clean electricity generation during January to July rose by 6% to a record 1,155 TWh. Clean power's share of the U.S. electricity generation mix also climbed to a record 44% during January to July, up from just under 43% the year before. However, with total electricity demand rising at its fastest pace in decades, U.S. utilities continue to rely on fossil fuels for a majority of electricity production. And with thermal coal prices still roughly 20% cheaper than gas prices for power generation, many utilities are likely to sustain their high use of coal within the generation mix in order to keep overall costs in check. This suggests that further increases in U.S. emissions could be seen, which would drive global power pollution levels to new highs even if China manages to keep its own fossil fuel use in check through the rest of the year. The opinions expressed here are those of the author, a columnist for Reuters. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/markets/commodities/chinas-rare-cut-power-pollution-offset-by-higher-us-emissions-2025-09-11/

2025-09-11 10:54

LONDON, Sept 11 (Reuters) - What matters in U.S. and global markets today By Anna Szymanski, Editor-in-Charge, Reuters Open Interest Sign up here. Oracle’s skyrocketing share price lifted Asian equities on Thursday, as AI enthusiasm shows no signs of abating. Meanwhile, European markets remain in wait-and-see mode ahead of the European Central Bank’s rate decision later today. The focus will be less on what the ECB does – which is expected to be nothing – and more on what President Christine Lagarde says. Investor attention will then turn once again to U.S. inflation data, with a consumer price update due following a soft producer price report yesterday. This is one of the last major data releases before the Federal Reserve’s meeting next week, and the question now is not whether the central bank will cut but by how much. Mike is enjoying some well deserved time off, and will be back with the Morning Bid next week. Today's Market Minute * Police and federal agents mounted an intense manhunt on Thursday for the sniper believed to have fired the single gunshot that killed conservative activist Charlie Kirk as he was fielding questions about gun violence during a university appearance. * Protesters across France obstructed highways, burned barricades and clashed sporadically with police on Wednesday in a show of anger against President Emmanuel Macron, the political elite and planned spending cuts. * Klarna (KLAR.N) shares jumped 30% in their hotly anticipated New York debut, valuing the Swedish fintech at $19.65 billion, ending the company's years-long wait for a listing and underscoring a rebound in the broader U.S. IPO market. * The global crude oil market is facing two long-term fundamental shifts that will change how cargoes flow around the world and how they are priced, writes ROI columnist Clyde Russell. * The dollar has been beaten down this year amid rising expectations for Fed easing, but ROI markets columnist Jamie McGeever argues that even if lower nominal rates are already reflected in the greenback's price, lower 'real' rates may not be. Another day, another AI record Oracle (ORCL.N) shares skyrocketed around 40% on Wednesday, its biggest one-day percentage jump since 1992, after the company announced four multi-billion-dollar contracts on Tuesday. Oracle co-founder Larry Ellison saw his fortune rise by about $100 billion to around $392.6 billion, according to Forbes. The cloud service firm’s surge boosted Asian tech stocks on Thursday, pushing indices in Japan, Taiwan and South Korea to fresh highs. European shares edged up modestly early on Thursday , opens new tab, as with the STOXX 600 rising modestly as investors await the ECB’s decision. Most economists expect no change in policy, but ECB President Christine Lagarde’s remarks will be closely watched for signals about future easing amid the ongoing trade and geopolitical tensions. The ECB cut its key policy rate to 2% in the year through June but has been on hold ever since, arguing that the 20-country euro zone economy is in a "good place". Lagarde is likely to keep the door open for further rate cuts, especially since inflation is expected to temporarily dip below the ECB's 2% target next year, supporting market bets that a final "insurance" cut could come around the turn of the year. The dollar steadied during Asian trading and gold continued to hover near record highs after an unexpected drop in U.S. producer prices on Wednesday reinforced bets for a Fed rate cut next week. The U.S. Producer Price Index fell 0.1% during August, the Labor Department's Bureau of Labor Statistics said on Wednesday. This followed a 0.7% jump in July, which was revised downwards. Traders are essentially certain there will be at least a 25 basis point cut at the Fed meeting next week, with a slim chance for a 50 bps move. U.S. CPI data due later today is expected to show a 0.3% monthly rise and 2.9% annual increase. While a weaker print could fuel bets for a larger cut, the report would have to be very hot indeed to shake up easing expectations. Chart of the day Oracle (ORCL.N) shares surged more than 40% to hit a record high on Wednesday, putting the company on track to join the trillion-dollar club. The company unveiled four multi-billion-dollar contracts on Tuesday, amid an industry-wide shift to spend aggressively to stay ahead in the AI race. Today's events to watch Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website , opens new tab, and you can follow us on LinkedIn , opens new tab and X. , opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-09-11/

2025-09-11 10:52

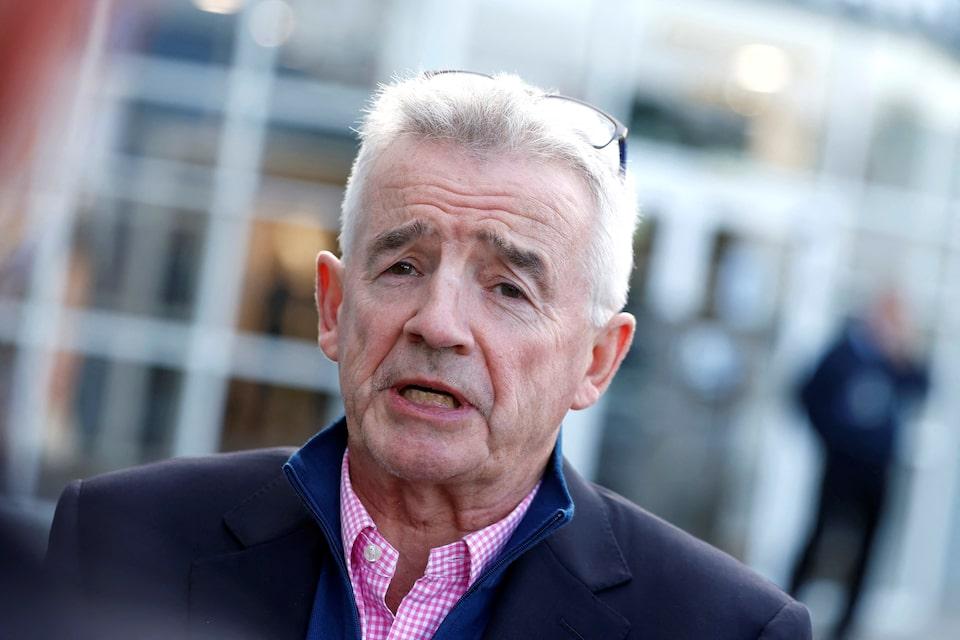

DUBLIN, Sept 11 (Reuters) - Ryanair boss Michael O'Leary warned on Thursday that the Russia-Ukraine war would be an ongoing issue for all European airlines for years to come, a day after Poland shot down suspected Russian drones in its airspace. Warsaw Chopin and Modlin airports, as well as Rzeszow and Lublin airports in the country's east, temporarily closed before resuming operations after Poland shot down the drones early on Wednesday. Sign up here. Air-traffic control services all over Europe were significantly impacted on Wednesday and only 60% of Ryanair's flights were on time, compared to a normal rate of around 90%, group CEO O'Leary said. Flights from Scandinavia and the Baltic states in particular were impacted. "This is going to be an ongoing issue for all airlines and all European citizens for the next number of years," he said in comments at the company's annual general meeting. Polish F-16 fighter jets, Dutch F-35s, Italian AWACS surveillance planes, and NATO mid-air refuelling aircraft scrambled in an operation to shoot down drones entering Polish airspace from Tuesday evening until morning, officials said. The impact of the incident, which marked the first time a member of NATO is known to have fired shots during the war, was discussed at a meeting of the company's board of directors on Wednesday. "I think we expect more disruptions, unless the European, the EU and the White House, take some firm stick, preferably in the form of sanctions, penal sanctions, on Russia," O'Leary told journalists after the AGM. "This kind of irritant ... Russia playing games with Europe - will continue," he said. https://www.reuters.com/business/aerospace-defense/ryanair-warns-years-long-impact-european-aviation-russia-ukraine-war-2025-09-11/

2025-09-11 10:52

Kashmir apple growers face losses of $68 million to $79 million Truckers stranded, produce rotting; packaging costs rise Indian railways offers relief, adding services from September 13 Sept 11 (Reuters) - Apple growers in Indian Kashmir are staring at huge losses this year as floods and highway closures disrupt the peak harvest season, enmeshing growers and truckers in uncertainty, farmers and industry officials say. Losses of between 6 billion rupees and 7 billion rupees ($68 million and $79 million) are estimated as landslides shut the national highway linking Jammu and Srinagar, a vital artery carrying apples out of the region, since August 26. Sign up here. Besides the snaking queues of trucks left to idle for days, heavy rains brought sudden floods that killed dozens of people by mid-August. "If this continues, the entire season will suffer, and our sector will collapse," said Bashir Ahmad Basheer, chairman of the Kashmir Valley Fruit Growers and Dealers Union, adding that the traffic disruptions drove up costs, worsening the crisis. Packaging costs have risen to 200 rupees for a carton of apples, from 40 rupees earlier, for example. India’s apple production is concentrated in the mountainous regions of Kashmir and Himachal Pradesh, with most of the fruit consumed domestically. Less than 2% is exported, mainly to Bangladesh and Nepal. In South Kashmir, swollen rivers broke their banks, flooding orchards and leaving behind uprooted trees and rotting fruit. Mughal Road, now the sole operational corridor for traffic with Kashmir and a back-up route for the national highway has also been rendered unreliable, say people living there. On Thursday, the Indian Railways offered some respite for growers, with plans to launch from September 13 a daily service for parcels from Badgam in the Kashmir Valley to Adarsh Nagar station in Delhi, with two carriages dedicated for apples. Despair is mounting among truck drivers stranded on the highway as their produce deteriorates. "I don’t know what to do with these apples and who to blame," said Abid Ahmad Lone, stuck for 12 days, adding that his truckload of apples had rotted, causing an estimated loss of 1 million rupees. Other truck drivers, some stuck on the highway for nearly two weeks, echoed the sentiment, while growers who managed to dispatch their produce are still anxious. "My family is solely dependent on apple orchards, but the recent floods have devastated everything," said Shahid Ahmad, as he stood among trees spattered with mud and bruised fruit scattered in his orchard at the town of Pulwama. "We used to sell a box of apples for around 1,600 rupees to 1,700 rupees," he said. "Now nobody is willing to buy them, even at low prices." ($1=88.0890 Indian rupees) https://www.reuters.com/business/environment/apple-growers-indian-kashmir-face-crippling-losses-floods-road-closures-2025-09-11/

2025-09-11 10:25

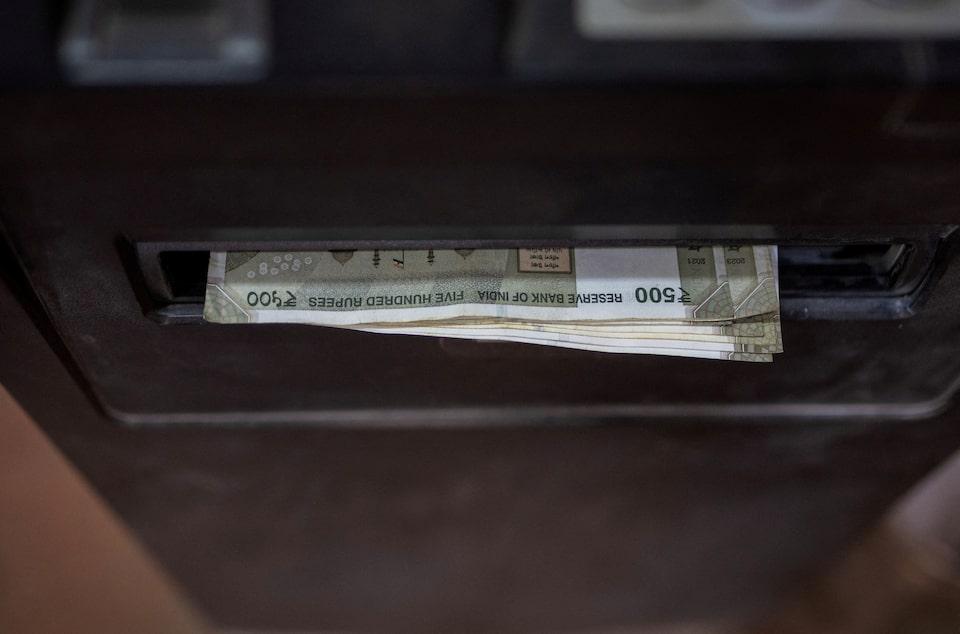

MUMBAI, Sept 11 (Reuters) - The Indian rupee dropped to an all-time low against the U.S. dollar on Thursday, in a slide that reflects the mounting strain of U.S. tariffs on Asia's third largest economy. The rupee closed 0.39% lower at 88.4425 against its previous close of 88.1000. The currency had hit its previous record low of 88.36 last Friday. Sign up here. Punitive U.S. tariffs on Indian goods, which kicked in last month, are denting investor confidence, making the rupee one of the most vulnerable Asian currencies. Foreign investors have withdrawn a net of $11.7 billion from India's debt and equity markets so far this year. Washington's steep tariffs have hurt India's growth and trade outlook and clouded the path for currency. To curb the impact of the levies, Indian Prime Minister Narendra Modi has rolled out consumption tax cuts. Both U.S. and India are also looking at resuming negotiations to address the trade barriers. For now, Indian exporters face uncertainty over order flows, while importers are forced to hedge their forex exposure more aggressively, distorting the demand-supply balance in the currency market. "While importer dollar demand is persistent, exporter flows, and foreign portfolio flows seem to be muted, which is leading to pressure on the rupee," said Dilip Parmar, a foreign exchange research analyst at HDFC Securities. The USD/INR pair is likely to continue following a pattern of consolidation for a few days before breaking higher, Parmar said. The Reserve Bank of India has stepped in frequently to temper the pace of the rupee’s decline. Market participants say the central bank has been selling dollars to prevent large swings. The interventions are not aimed at defending any particular level, bankers say, but are intended to keep the slide "measured" and to prevent unease among companies and investors. The rupee’s weakness is in contrast to its regional peers, most of which have been buoyed by expectations of a Federal Reserve rate cut next week. Weakness in the rupee is likely to persist in the near term considering the impact of the U.S. tariffs on labour-intensive sectors, Abhishek Goenka, founder & CEO of IFA Global, said. Most Asian currencies fell on Thursday while the dollar index inched higher, as investors awaited U.S. inflation data due later in the day. https://www.reuters.com/world/india/india-rupee-sinks-record-low-us-tariffs-keep-outlook-fragile-2025-09-11/