2025-09-11 10:23

Sept 11 (Reuters) - The pound fell against a broadly stronger dollar on Thursday as markets focused on impending U.S. core consumer inflation data at 1230 GMT and a European Central Bank policy meeting, as well as next week's Federal Reserve and Bank of England meetings. Sterling was down 0.2% at $1.3505 at around 1000 GMT. The pound was 0.1% lower against the euro at 86.545 . Sign up here. Sterling has come back from a one-month low hit in early September after a sell-off in long-dated government bonds pushed yields to their highest since the late 1990s amid jitters over the UK's public finances. It is part of a broader storm hitting the long-dated government debt of G7 major world economies. Pressure is mounting on finance minister Rachel Reeves to keep Britain's deficit in check with the next budget announcement due at the end of November. "Rising government borrowing costs, in the form of higher yields on its bonds, or gilts, mean Rachel Reeves will want to put together a tax-and-spending plan that appeases bond vigilantes," Russ Mould, AJ Bell investment director, said in a note. Reeves said on Thursday she would look at reforming business property taxes to make it easier for smaller firms to expand, as she seeks to boost growth. The Bank of England's monetary policy committee convenes next Thursday to deliver its next rate decision. Money markets are betting it will hold rates steady at 4%. Elsewhere, British house prices in August experienced the most widespread falls in more than a year-and-a-half, a survey showed. https://www.reuters.com/world/uk/sterling-slips-traders-await-us-inflation-print-ecb-meeting-2025-09-11/

2025-09-11 10:05

Dollar still pressured by concerns over trade and twin deficits Bears also worry aggressive Fed rate cuts could sink dollar Another worry: global investors rebalancing away from US assets NEW YORK, Sept 11 (Reuters) - The U.S. dollar has steadied since a record slide earlier this year, but many currency market players still view the greenback as locked in a bearish trend and are bracing themselves for further losses. The dollar index (.DXY) , opens new tab fell about 11% in the six months through June in one of its steepest declines on record. Sign up here. The greenback has steadied in recent weeks along with a sharp pullback in bearish futures bets. As of last week, speculators’ net short dollar position was at $5.7 billion, near the smallest since mid-April. That was down sharply from about $21 billion in late June, CFTC data show. Many investors view this as a pause in the selling rather than a reversal. Worries include twin U.S. fiscal and trade deficits, chances that a slow job market may prompt more aggressive rate cuts from the Federal Reserve and the view that global fund managers may be in the process of rethinking their FX hedging practices as they look to reduce their exposure to the U.S. dollar. "The dollar is in the process of declining, and there's more to go," Francesca Fornasari, head of currency solutions at Insight Investment said. "It's messy and it's probably going to be pretty noisy," Fornasari said. Many of the forces that drove the dollar’s slide remain in place. These include a rethink of U.S. exceptionalism, worries about economic growth due to U.S. President Donald Trump's protectionist trade stance, and persistent twin-deficit concerns. Soft jobs data give the Fed scope to cut rates more aggressively. This would erode the yield advantage for the greenback. "The markets are now starting to think about the degree to which the U.S. economy is going to weaken ...how weak will the labor market get going forward and what does that mean for Fed monetary policy," said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi, the biggest European asset manager. The Fed will likely resume cutting short-term rates next week and continue on for the rest of the year. Upadhyaya, who started the year bearish on the greenback and has been adding to short dollar positions, sees little reason to change course now. GLOBAL INVESTORS FACE HEDGING HEADACHE Years of U.S. outperformance have left global investors heavily exposed to American assets. April’s tariff turbulence prompted some to trim positions and reassess hedges, but the repositioning is far from complete, investors said. With foreign holdings of U.S. assets in the trillions, according to banks including Deutsche Bank, any paring of exposure could weigh on the dollar, a move that has yet to materialize in a big way, analysts said. "The next big drop in the dollar could be if foreign investors decide they want to now start reducing their U.S. allocation," Amundi's Upadhyaya said. The dollar's dismal first-half performance has already prompted a pick-up in hedging activity by asset managers. Slower-acting market participants could join the fray over the next three to six months, Insight Investment's Fornasari said. Hedging flows typically involve selling dollars via forwards or swaps, adding supply that can pressure the greenback. Lower U.S. interest rates relative to overseas rates reduce the cost of popular hedging instruments and can make hedging more attractive. "It is stating the obvious that additional Fed cuts from here would increase incentives to hedge dollar assets by foreign investors," George Saravelos, Global Head of FX Research at Deutsche Bank, said in a note on Monday. Dollar bulls are unlikely to find support from the Trump administration, investors said, as the “America First” agenda and plans to revive U.S. manufacturing work against a stronger currency. The administration has occasionally said it is committed to protecting the strength and power of the U.S. dollar. "They still believe in a strong dollar, king dollar, but a little bit weaker than the very elevated level (at the start of the year,)" Thanos Bardas, managing director and co-head of global investment-grade fixed income at Neuberger Berman, said. "There is no way they can bring manufacturing back to the U.S. with the dollar index at 110," said Bardas, who expects the index to linger in the 95 to 100 range in the near term. On Wednesday the index was at 97.72. "I don't think the U.S. wants to necessarily signal its desire for a weaker dollar, but it's not going to stand in the way of a weaker dollar," said Shaun Osborne, chief FX strategist at Scotiabank. Osborne sees the dollar falling another 5% to 7% over the next year or so against major peers. MANY SAY DOLLAR IS STILL OVERVALUED There is still some chance that the dollar finds some support, given how much it has already fallen this year and the extent of Fed easing already priced in by the market. One risk to the weaker-dollar view is an unexpected brightening in the U.S. economic growth outlook, Neuberger Berman’s Bardas said. The economy expanded faster than first estimated in the second quarter, helped by business investment in intellectual property such as artificial intelligence, though import tariffs kept the outlook cloudy. Still, the dollar remains expensive relative to many currencies, investors said, discouraging potential buyers in FX markets, known for prolonged periods where currencies overshoot in both directions. "We're just barely getting to what I would consider neutral levels for the dollar," Amundi's Upadhyaya said, noting that the dollar is far from undervalued. "We have more of the dollar bear market still to come." https://www.reuters.com/business/finance/us-dollar-bears-think-record-slide-may-resume-after-recent-pause-2025-09-11/

2025-09-11 09:23

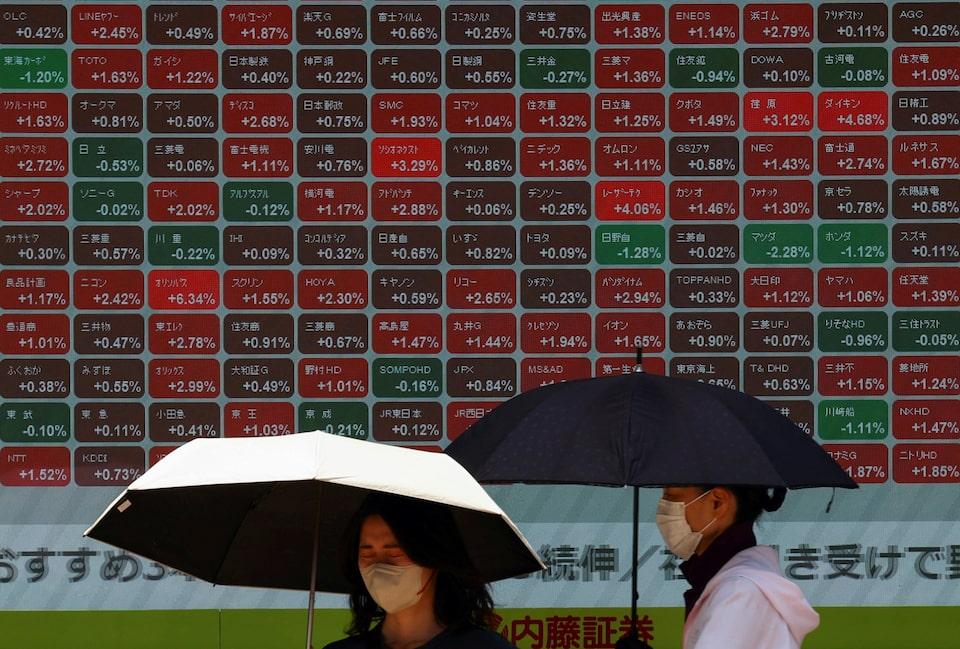

ECB expected to hold rates at 2% US inflation data to feed Fed rate cut expectations Oil edges lower after two days of conflict-linked rises LONDON, Sept 11 (Reuters) - World stocks consolidated near all-time highs while the dollar crept up on Thursday, as traders readied for the European Central Bank's latest interest rate decision as well as new U.S. inflation data later. High-flying tech shares lifted Japan, Taiwan and South Korea's bourses to record peaks overnight and Europe was having a steady morning ahead of what is set to be a second hold in a row in the euro zone's 2% rates from the ECB after lunch. Sign up here. With that and closely watched U.S. consumer price inflation data coming, most traders were keeping their powder dry. The euro hovered at $1.1690 having soared nearly 13% versus the dollar this year, while the bond vigilantes hadn't yet managed to decisively push politically strained France's borrowing costs above Italy's. ABN AMRO strategist Benoit Begoc said with the ECB widely expected to hold rates, the focus is on whether it keeps the door ajar for further cuts and its new set of economic forecasts this meeting. "I think the question will be why are you not cutting rates more?" Begoc said. "We know we have some deflationary pressures and there is no big rise in consumer confidence, so what is the rationale behind that?" Ahead of the 1215 GMT ECB decision and 1245 GMT press conference, the pan-European STOXX 600 (.STOXX) , opens new tab edged up 0.3% while Germany's 10-year bond yield eased to 2.65% having touched 2.80% - its highest since March - just last week. GVD-EUR In the commodity markets, oil prices also dipped after gaining more than 1% on Wednesday when Poland's downing of suspected Russian drones triggered fresh talk of sanctions a day after Israel attacked Hamas leadership in Qatar. Safe-haven gold edged away from its recent record highs and bellwether metal copper took a breather from its more than 20% rally since U.S. President Donald Trump's trade tariffs shook global markets back in April. /GOL TRADERS BET ON TRIO OF FED CUTS Wall Street futures pointed to more gains there later after a stunning 36% leap in the shares in data services giant Oracle (ORCL.N) , opens new tab had fuelled the latest records for the S&P 500 (.SPX) , opens new tab and Nasdaq (.NDX) , opens new tab. A benign reading on U.S. producer prices had also helped as the money markets priced in more of a chance of three interest rate cuts from the Federal Reserve this year. Investors have fully priced in a quarter-point move from the Fed at next week's meeting, with an 8% chance of a 50 basis-point cut. August's consumer price index data is due later. A Reuters poll expects headline CPI to rise 2.9% from a year earlier, the biggest increase since January, while the core measure likely held at 3.1%. "Unless CPI delivers a significant upside shock, investors are likely to maintain their dovish outlook," said Julien Lafargue, chief market strategist at Barclays Private Bank. "This shift in inflation dynamics could prove pivotal for the U.S. Fed, which now faces fewer constraints in pursuing a more aggressive rate-cutting cycle." Overnight in Asia, Japan's Nikkei (.N225) , opens new tab gained 1.2% to hit a record as tech, energy and utilities firms jumped. South Korean shares (.KS11) , opens new tab rose 0.9%. In Tokyo. SoftBank (9984.T) , opens new tab rose almost 10% after the roaring gains for its Stargate Project partner Oracle (ORCL.N) , opens new tab. That 36% leap had been the biggest one-day gain since 1992 for the 48-year-old tech giant. In foreign exchange, movement was largely muted, with the U.S. dollar struggling for direction and the main six currency dollar index (.DXY) , opens new tab a touch above a seven-week trough. Ten-year Treasury yields edged up 2 basis points to 4.0531%, having fallen 4 basis points on Wednesday after the PPI data and as a solid 10-year note auction alleviated some concern about investor appetite for long-term U.S. debt. An even more telling gauge will be the Treasury's $22 billion sale of 30-year bonds on Thursday. The 30-year yield rose 2 bps to 4.7028%, having come down more than 30 basis points since it briefly topped 5% a week ago. https://www.reuters.com/world/china/global-markets-wrapup-3-pix-2025-09-11/

2025-09-11 09:07

Euro steady, ECB rate decision due at 1215 GMT Markets await US CPI data later on Thursday Australian dollar nears strongest level since November SINGAPORE/LONDON, Sept 11 (Reuters) - The dollar held onto small gains on Thursday as traders awaited key U.S. consumer price data for a steer on the Federal Reserve's rate cutting path, while the euro was unchanged ahead of a European Central Bank meeting. "The main event is the U.S. CPI... The market is looking for reasons to reprice the Fed lower and push the USD down," said Michalis Rousakis, G10 FX strategist at Bank of America. Sign up here. "The question is whether the Fed can be re-priced lower, given that a cut or a little more is priced for September, and almost three cuts are priced by year-end," he said. Bank of America's house view is for two more Fed rate cuts this year. The dollar index nudged up 0.2% to 97.97, with the dollar largely steady against major currencies. Elsewhere, an unexpected drop in U.S. factory-gate prices on Wednesday has bolstered expectations that the Federal Reserve will cut rates next week. The data followed Tuesday's revision to U.S. employment growth figures, with the U.S. having created 911,000 fewer jobs in the 12 months through March than previously estimated. Meanwhile, the European Central Bank was expected to hold rates steady when it meets later in the day. The euro was unchanged at $1.1686 ahead of the rate decision. Analysts said policymakers may strike a more dovish tone to counter a fraught trade and political outlook across the continent. The common currency is stabilising after a two-day streak of declines as geopolitical tensions continue on the EU's eastern flank. Poland said it shot down suspected Russian drones in its airspace on Wednesday with the backing of aircraft from its NATO allies, the first time a member of the Western military alliance is known to have fired shots during Russia's war in Ukraine. Commerzbank analysts said in a note that hopes of the ECB meeting being a catalyst for greater movement in EUR/USD are likely to be dashed, given no new information is likely to be forthcoming. "If anything, hopes may lie with ECB President Christine Lagarde. After all, she sounded surprisingly hawkish at the last two press conferences," they wrote. Given that a rate cut is not expected until next June, they added, Lagarde is unlikely to reveal her hand so far in advance. FED FIRMLY IN FOCUS Attention remains on the Fed's likely rate cut trajectory. Markets are trading on expectations that the prospect of the Fed easing is a certainty and the only remaining question is by how much. Traders are pricing in an 8.9% chance of a jumbo 50 basis points (bps) rate cut at the central bank's September 16-17 meeting, while a cut of at least 25 bps is viewed as a done deal, according to the CME Group's FedWatch tool. Appointments to the Fed's rate-setting panel remained in focus, as President Donald Trump's administration on Wednesday moved to appeal a federal judge's ruling temporarily blocking Trump from taking the unprecedented step of firing Federal Reserve Governor Lisa Cook. The White House is seeking to remove her before next week's Fed meeting. Stephen Miran also moved closer to becoming a Federal Reserve governor, furthering Trump's effort to exert more direct control over interest rate policy. The Senate Banking Committee voted to advance Miran's nomination, though lawmakers involved said it is far from certain if the process can be completed in time for him to participate in the coming meeting. Against the yen, the dollar was trading 0.3% higher at 147.96 yen , after data showed Japanese wholesale prices rose 2.7% in the year to August, accelerating from the previous month in a sign of sticky inflationary pressure in the world's fourth-largest economy. The Australian dollar slipped 0.1% to $0.6605 , retreating after hitting the highest levels since November on Wednesday, as commodities including crude oil and gold gave up recent gains. The offshore yuan traded at 7.1232 yuan per dollar , strengthening 0.06%. The kiwi slipped 0.3% to $0.59260 . Sterling traded down 0.2% to $1.35105 . https://www.reuters.com/world/africa/dollar-steady-traders-await-us-inflation-data-ecb-meeting-2025-09-11/

2025-09-11 08:37

LONDON, Sept 11 (Reuters) - Britain's finance minister Rachel Reeves said on Thursday she would look at reforming business property taxes to make it easier for smaller firms to expand, as she seeks to step up efforts to boost growth. As her annual budget on November 26 approaches, speculation about tax increases and worries over inflation are already weighing confidence among some businesses and households. Sign up here. Many economists think Reeves will need to find tens of billions of pounds more in revenue due to higher borrowing costs, a less certain growth outlook and a failure to pass welfare cuts through parliament. "Our economy isn't broken, but it does feel stuck," Reeves said alongside a finance ministry report into business property taxation, known as rates. The report proposed smoothing out big jumps in property taxes faced by small businesses when they expand. "Tax reforms such as tackling cliff-edges in business rates and making reliefs fairer are vital to driving growth," she said in a statement. Also under consideration are changing how the tax is calculated and enhancing tax reliefs when the value of a property is increased through improvements. Further details would be published in the budget, it added. Helen Dickinson, chief executive of the British Retail Consortium, welcomed the plans but said it was more important for the government to confirm a details of a promised reduction in rates for retail, hospitality and leisure businesses. "Until we get clarity on these changes, which isn’t expected until the budget, many local investments in jobs and stores are being held back," she said. https://www.reuters.com/world/uk/uk-finance-minister-eyes-tax-reform-help-small-business-expansion-2025-09-11/

2025-09-11 07:52

Mexico to raise China auto tariffs to maximum level New tariffs affect $52 billion in imports from countries without trade deals Minister says measure will protect local jobs Move seen as response to U.S. pressure MEXICO CITY, Sept 10 (Reuters) - Mexico said on Wednesday it will raise tariffs on automobiles from China and other Asian countries to 50%, in a broad overhaul of import levies the government said would protect jobs and analysts said was aimed at placating the United States. The Economy Ministry said the moves, which will increase tariffs to varying degrees on goods across multiple sectors including textiles, steel and automotive, would impact $52 billion of imports. Sign up here. "They already have tariffs," Economy Minister Marcelo Ebrard told reporters when asked about the import levies on Chinese cars, which are currently 20%. "What we will do is raise them to the maximum level allowed. "Without a certain level of protection, you almost can't compete," he added. Ebrard said the measures, which come just within limits imposed by the World Trade Organization, were intended to protect jobs in Mexico as Chinese cars were entering the local market "below what we call reference prices." China firmly opposes to being coerced by others, and restrictions imposed under "various pretexts", its foreign ministry said on Thursday, adding that the Asian nation hopes that Mexico will instead work with it towards global economic recovery and trade development. "We will resolutely safeguard our own rights and interests in accordance with the actual situation," ministry spokesperson Lin Jian told reporters at a regular news briefing. The plan still needs to be approved by Congress, where the government holds a significant majority. The tariffs will impact countries that do not have trade deals with Mexico, especially China, South Korea, India, Indonesia, Russia, Thailand and Turkey, the Economy Ministry said in a document. The plan will impact 8.6% of all imports, the document said, and will protect 325,000 industrial and manufacturing jobs that were at risk. The measures also include a 35% tariff on steel, toys and motorcycles. Textiles will see levies between 10% and 50%. The move comes as the United States pushes countries in Latin America to limit their economic ties with China, with which it competes for influence in the region. "The U.S. is not going to allow China to use Mexico as a backdoor," said Mariana Campero of the CSIS Americas Program, adding that Mexico has doubled its trade deficit with China in the last decade, hitting $120 billion last year. Ebrard had earlier this year spoken against tariff measures, saying they were at odds with economic growth and keeping inflation down. RESPONDING TO U.S. PRESSURE Banco BASE analyst Gabriela Siller said the tariffs would likely boost demand for Chinese vehicles in the very short-term. "Tariffs on countries with which Mexico does not have trade agreements have two objectives," she said on social media. "First, more revenue and second, to look good to Trump." John Price, managing director at Americas Market Intelligence, said that Mexico, which exports many of its own vehicles to the United States, is responding to U.S. pressure while trying to protect its economy. "The Mexicans are trying to placate the Americans, but protect their industrial policy that's worked so well for them over the last 30 years," he said after the government announced it was looking to raise an additional $3.76 billion in tariff measures next year. The United States and Mexico, which share a free trade agreement along with Canada, are each other's top trade partners. The agreement, which has spared Mexico the brunt of much of the tariffs from U.S. President Donald Trump's administration, is set for review next year. https://www.reuters.com/business/autos-transportation/mexico-raise-tariffs-cars-china-50-major-overhaul-2025-09-10/